Global Fish Powder Market Size

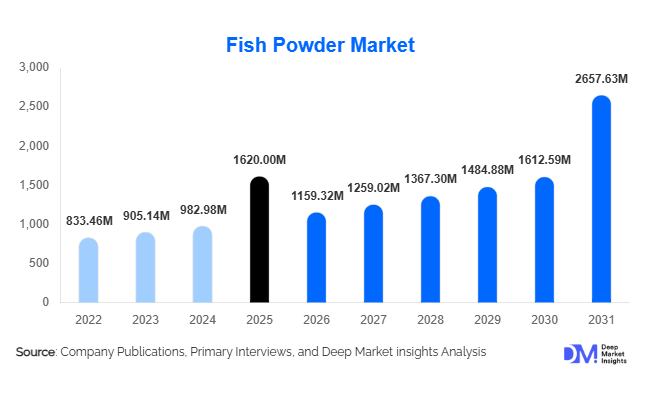

According to Deep Market Insights, the global fish powder market size was valued at USD 1,620 million in 2025 and is projected to grow from USD 1,159.32 million in 2026 to reach USD 2,657.63 million by 2031, expanding at a CAGR of 8.6% during the forecast period (2026–2031). The fish powder market growth is primarily driven by rising global protein demand, expansion of aquaculture and animal feed industries, and the increasing adoption of fish powder in nutraceutical and functional food applications worldwide.

Key Market Insights

- Marine fish-based fish powder dominates the market, accounting for a majority share due to higher protein content and well-established processing infrastructure, making it the preferred choice for both feed and human consumption.

- Spray-dried fish powder is the leading processing method, offering superior solubility, lower microbial load, and consistent quality for food, feed, and nutraceutical applications.

- Animal feed applications remain the largest segment, driven by aquaculture and livestock industries, which continue to demand protein-rich, digestible feed ingredients.

- Feed-grade fish powder holds the highest share among product grades, reflecting its widespread use in poultry, livestock, and aquaculture feed formulations.

- Direct B2B sales dominate distribution, as bulk buyers such as feed mills, food processors, and nutraceutical manufacturers prefer long-term supply contracts and consistent quality.

- Technological advancements in drying and deodorization are enabling broader human food applications, enhancing flavor, shelf life, and nutritional retention in processed and functional foods.

What are the latest trends in the fish powder market?

Rising Use in Human Nutrition and Functional Foods

While traditionally used in animal feed, fish powder is increasingly incorporated into protein-fortified foods, soups, snacks, and medical nutrition. Improved processing techniques, such as enzymatic hydrolysis and microencapsulation, are reducing odor and enhancing palatability, enabling higher adoption in human consumption. Health-conscious consumers are driving demand for omega-3 enriched foods and dietary supplements containing fish powder, particularly in North America and Europe. Functional foods targeting cognitive development, cardiovascular health, and bone nutrition are emerging as key applications, expanding revenue streams for producers.

Integration of Advanced Processing Technologies

Emerging spray-drying, freeze-drying, and low-temperature drying technologies are enhancing the quality, solubility, and nutrient retention of fish powder. These technologies allow manufacturers to offer food-grade and pharmaceutical-grade products that meet strict regulatory standards. Companies adopting microencapsulation, odor-reduction, and standardized protein profiling are able to tap into high-margin nutraceutical, medical, and human food markets. Such innovations are enabling product differentiation and supporting premium pricing, while also addressing sustainability and efficiency concerns.

What are the key drivers in the fish powder market?

Growing Global Protein Demand

The rising global population and increasing awareness of protein-rich diets are driving consistent demand for fish powder. In regions with limited access to high-quality protein, such as Africa and parts of Asia-Pacific, fish powder provides an affordable, nutrient-dense alternative. Livestock and aquaculture industries also rely heavily on protein-rich ingredients to optimize feed efficiency, further supporting market growth.

Expansion of Aquaculture and Feed Industries

Aquaculture output continues to grow faster than capture fisheries, increasing the need for high-quality feed. Fish powder is widely used to enhance feed conversion ratios and larval survival rates, particularly in shrimp and finfish hatcheries. Asia-Pacific countries like China, India, and Vietnam are witnessing rapid adoption, fueling long-term market growth. The increasing demand for sustainable feed inputs is encouraging manufacturers to develop traceable, high-quality fish powder for industrial feed applications.

Health and Nutraceutical Applications

Rising consumer awareness about the health benefits of omega-3 fatty acids, minerals, and essential amino acids is driving demand for fish powder in dietary supplements and functional foods. Aging populations in Europe, Japan, and North America are seeking convenient, nutrient-dense solutions, providing opportunities for human-grade fish powder. Manufacturers focusing on food-grade and pharmaceutical-grade products can leverage these trends to tap into high-margin segments.

What are the restraints for the global market?

Raw Material Price Volatility

Fish powder production depends heavily on seasonal fish catch and fluctuating fishmeal prices, which directly impact costs. Overfishing regulations, fishing quotas, and climate-induced changes in fish availability further exacerbate supply risks. These factors create price instability, particularly for small and medium-sized manufacturers, affecting overall market growth.

Regulatory Compliance Challenges

Food-grade and pharmaceutical-grade fish powder products must adhere to strict safety, contaminant, and traceability standards. Compliance costs, certification requirements, and lengthy approval timelines can limit entry for smaller players, slow innovation, and increase the cost of finished products for consumers.

What are the key opportunities in the fish powder industry?

Government Nutrition and Food Security Programs

Governments in Asia-Pacific and Africa are incorporating fish powder into school meal schemes, maternal nutrition programs, and humanitarian food aid due to its high protein content. Companies aligning with public procurement frameworks can secure long-term supply contracts, ensuring stable revenue and high-volume demand. This presents opportunities for both domestic producers and exporters targeting emerging markets.

Aquaculture Feed Expansion

With global aquaculture production rising, feed manufacturers are increasingly adopting fish powder to improve palatability, growth performance, and feed conversion ratios. Investments in consistent protein profiling and digestibility improvements provide an edge to producers supplying high-quality feed-grade fish powder. This segment is expected to grow steadily, driven by large-scale hatcheries and intensification of shrimp and finfish farming in Asia-Pacific.

High-Value Human Food and Nutraceutical Applications

Advancements in processing technologies have made food-grade and pharmaceutical-grade fish powder more appealing for functional foods, protein-fortified snacks, and dietary supplements. Enzymatic hydrolysis, deodorization, and microencapsulation allow manufacturers to enter premium markets. Companies investing in R&D, certifications, and product innovation can capture high-margin human consumption and nutraceutical segments.

Product Type Insights

Marine fish-based fish powder dominates the market, accounting for approximately 68% of the total market in 2025. This dominance is driven by its superior protein content, high digestibility, and well-established supply chains that ensure consistent quality. Among processing methods, spray-dried fish powder leads with a 42% share, due to its excellent solubility, uniform consistency, and enhanced microbial safety. Regarding product grades, feed-grade fish powder holds 55% of the market, primarily driven by demand from aquaculture and livestock feed industries. In contrast, food-grade fish powder is the fastest-growing segment, propelled by rising human nutrition awareness, functional foods, and nutraceutical applications, including omega-3 enriched products and protein-fortified supplements.

Application Insights

The animal feed segment remains the largest application, contributing approximately 38% of the market in 2025. Within this segment, aquaculture feed is experiencing rapid growth due to the intensification of fish farming practices and rising global seafood demand. Human food and nutraceutical applications are expanding at a CAGR of 10%, driven by increased consumption of protein-rich diets, clinical nutrition, and functional supplements. Emerging applications in pet food and pharmaceutical sectors are creating new revenue streams, fueled by trends in premium pet nutrition and health-conscious consumer behavior.

Distribution Channel Insights

Direct B2B sales dominate with a 60% share, as bulk buyers such as feed manufacturers and food processors prefer stable supply contracts. Retail and wholesale channels are gaining importance, particularly for human-grade and nutraceutical fish powder. Online sales are also becoming a key channel for specialty dietary products, with consumers seeking convenience, transparency, and traceable sourcing. Across all channels, distribution strategies are increasingly focusing on sustainability, traceability, and certifications to meet growing consumer expectations in premium segments.

| By Source Type | By Processing Method | By Application | By Product Grade | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest regional market, holding 46% share in 2025. Key countries include China (18%), India (9%), Vietnam, and Indonesia. Growth is fueled by:

- Rapid expansion of aquaculture and commercial fish farming.

- Well-developed fish processing infrastructure supporting large-scale production.

- Government initiatives promoting nutrition and food security.

- Urbanization and rising middle-class incomes boosting domestic consumption.

- Strong export potential driven by abundant marine resources and regional trade agreements.

Europe

Europe accounts for 21% of the global fish powder market. Leading countries include Norway, Spain, Denmark, and the U.K. Market growth is supported by:

- High demand for nutraceuticals, functional foods, and premium pet nutrition.

- Stringent regulatory and sustainability standards driving adoption of high-grade fish powder.

- Growing health-conscious population prioritizing omega-3 and protein-enriched products.

- Technological advancements in processing methods, ensuring product quality and consistency.

North America

North America holds 17% of the market, led by the U.S. Key drivers include:

- Increasing adoption of dietary supplements and functional foods.

- Rising demand for traceable, clean-label, and sustainably sourced products.

- Growth in premium pet nutrition supporting feed-grade and food-grade fish powder consumption.

- Strong research and innovation ecosystem promoting novel applications in human nutrition.

Latin America

Latin America represents 9% of the global market, with Chile and Peru as key exporters. Growth is fueled by:

- Abundant marine resources supporting both domestic and export-driven production.

- Increasing demand for animal feed in aquaculture and livestock sectors.

- Government incentives and trade policies promoting fish-based protein exports.

- Emerging nutraceutical and functional food markets in urban centers.

Middle East & Africa

This region holds 7% of the global market but is the fastest-growing globally, with a CAGR exceeding 9.5%. Key growth drivers include:

- Government nutrition and food security programs enhancing fish powder adoption.

- Rising aquaculture adoption in countries such as Nigeria, Egypt, and Saudi Arabia.

- Growing awareness of protein-rich diets and animal feed requirements.

- Investment in processing infrastructure and cold chain logistics to improve product availability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fish Powder Market

- Pelagia AS

- Austral Group

- Siam Industries International

- Oceana Group

- TASA (Tecnológica de Alimentos)

- Nissui Corporation

- Copeinca

- Pesquera Exalmar

- Kodiak Fishmeal

- TripleNine Group

- FF Skagen

- Welcon Fishmeal

- Scoular Company

- GC Rieber VivoMega

- Olvea Fish Oils