Pet Dietary Supplements Market Size

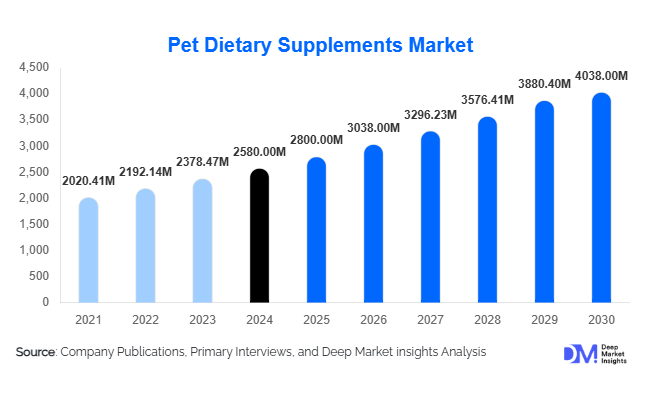

According to Deep Market Insights, the global pet dietary supplements market size was valued at USD 2,580 million in 2024 and is projected to grow from USD 2,800 million in 2025 to reach USD 4,038 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The pet dietary supplements market growth is primarily driven by increasing pet ownership, rising humanization of companion animals, growing demand for preventive pet health solutions, and the expansion of functional and premium supplement offerings across global markets.

Key Market Insights

- Dogs dominate the market, accounting for nearly 46% of the global share in 2024, due to high adoption rates and a wide variety of breed-specific health needs.

- Soft chews and treat-style supplements are leading the product formats, representing around 39% of the market, thanks to palatability, ease of dosing, and high consumer acceptance.

- North America is the largest market, with approximately 48% share in 2024, driven by mature pet care infrastructure, high disposable income, and established veterinary channels.

- Asia-Pacific is the fastest-growing region, fueled by rising pet adoption in China, India, and Southeast Asia, combined with increasing premiumization trends.

- Multivitamins and joint health supplements are the most sought-after categories, with multivitamins holding 29% and hip & joint health supplements capturing 31% of the market in 2024.

- Online direct-to-consumer (D2C) channels are rapidly expanding, allowing manufacturers to deliver personalized and subscription-based supplement solutions directly to pet owners.

Latest Market Trends

Premiumization and Functional Ingredients Driving Growth

Pet owners are increasingly seeking premium, functional supplements that address specific health concerns such as joint mobility, digestive wellness, skin and coat health, and cognitive support for senior pets. Ingredients such as probiotics, omega-3 fatty acids, glucosamine, chondroitin, collagen, and CBD/hemp derivatives are gaining traction. The trend toward clean-label, natural, and veterinary-endorsed products is also shaping consumer preferences, particularly in North America and Europe.

Rise of Online and Subscription-Based Channels

E-commerce platforms and subscription services are reshaping the pet supplement market. Consumers value convenience, recurring delivery, and personalized formulations, which have driven growth in D2C models. Digital marketing, social media engagement, and health-tracking apps for pets have enabled brands to strengthen loyalty and offer tailored products to specific breeds, life stages, or health conditions. Subscription-based models are particularly appealing in high-income urban regions and emerging markets seeking premium offerings.

Pet Dietary Supplements Market Drivers

Increasing Pet Ownership and Humanization

The global rise in pet adoption, coupled with the trend of humanizing pets, has boosted demand for dietary supplements. Owners increasingly view pets as family members and are willing to invest in products that enhance health, longevity, and overall well-being. Dogs, in particular, require breed-specific and life-stage-targeted supplements, while the growing cat population is also contributing to market growth.

Focus on Preventive Pet Health

Pet owners are shifting from reactive veterinary care to proactive wellness. Preventive health supplements, including multivitamins, joint care, digestive support, and calming formulations, are becoming mainstream. This focus on preventive health is driving premiumization, with higher spend per pet on functional, multi-benefit products.

Innovation and E-Commerce Expansion

Technological adoption in formulation, packaging, and distribution is accelerating market growth. Manufacturers are introducing chewable treats, liquid drops, powders, and subscription-based products to enhance palatability and convenience. E-commerce channels, including marketplaces and D2C subscriptions, are expanding access, particularly in Asia-Pacific and Latin America, while allowing manufacturers to gather data for product personalization.

Market Restraints

Regulatory Complexity

Varying regulatory frameworks for pet supplements across regions, including ingredient approvals, labeling requirements, and claim restrictions, pose challenges for global manufacturers. Compliance costs and delayed product launches can slow growth and limit innovation, particularly in emerging markets with evolving regulations.

Consumer Trust and Price Sensitivity

Many pet owners are skeptical about supplement efficacy, particularly in markets flooded with low-cost or unverified products. High price points for premium formulations may limit adoption among price-sensitive consumers, making it essential for brands to provide clinical evidence, veterinary endorsements, and transparent ingredient sourcing.

Pet Dietary Supplements Market Opportunities

Personalized Nutrition and Subscription Models

Personalized supplement solutions, tailored to breed, life stage, health condition, and lifestyle, are emerging as high-growth opportunities. Subscription-based delivery models enhance customer retention and provide convenience, while allowing brands to leverage data analytics to optimize formulations and marketing strategies. Direct-to-consumer channels enable brands to engage customers more effectively and drive premiumization.

Expansion in Emerging Geographies

Asia-Pacific, Latin America, and the Middle East present significant growth potential due to rising pet ownership, growing disposable incomes, and increased awareness of pet wellness. Localized product offerings, educational campaigns, and strategic partnerships with veterinary clinics can help brands capture market share in these fast-growing regions.

Ingredient Innovation and Functional Claims

The shift from basic multivitamins to functional supplements, such as joint support, probiotics, calming, and CBD/hemp-based products, represents a major opportunity. Clinical validation, veterinary endorsements, and clean-label positioning differentiate brands and allow premium pricing, particularly in North America, Europe, and high-income APAC markets.

Product Type Insights

Soft chews and treat-style supplements continue to dominate the pet dietary supplements market, capturing approximately 39% of the global market in 2024. Their popularity is largely driven by high palatability, ease of administration, and convenience for pet owners, making them the preferred choice for dogs and cats alike. Tablets, capsules, powders, and liquids also maintain significant market shares, with ongoing innovation in chewable, flavored, and functional formats enhancing adoption across all pet types. Multivitamins and joint support supplements lead the ingredient category, providing comprehensive health benefits such as improved mobility, immune support, and enhanced vitality. Additionally, novel functional ingredients, including CBD, collagen, botanicals, and omega-3 fatty acids, are gaining traction in premium segments due to rising consumer awareness of their anti-inflammatory, cognitive, and skin & coat health benefits.

Application Insights

Hip and joint health supplements are the leading application segment, representing 31% of the market in 2024. The growth of this segment is primarily driven by the increasing prevalence of joint issues in aging dogs and cats, as well as preventive care awareness among pet owners. Digestive health supplements, supported by probiotics and prebiotics, are also experiencing strong demand, driven by recognition of gut health as a critical component of overall well-being. Skin & coat, immune support, calming, and cognitive support supplements are emerging as high-growth applications, particularly for senior pets and breed-specific formulations. The trend toward personalized nutrition, reflecting life stage and health needs, is shaping product development and consumption patterns globally.

Distribution Channel Insights

Specialty pet retail stores currently hold the largest market share at 42%, supported by product expertise, veterinary recommendations, and premium brand availability. Traditional offline channels remain dominant as consumers often prefer in-store shopping for immediate product access and personalized advice. However, online channels are expanding rapidly, driven by subscription services, direct-to-consumer (D2C) models, and e-commerce platforms that provide convenience, home delivery, and personalized product recommendations. Veterinary clinics continue to influence demand for prescription-adjacent and functional supplements, while supermarkets and hypermarkets cater to mass-market wellness products, balancing accessibility and affordability for pet owners.

End-Use Insights

Dogs account for the largest end-use segment due to high adoption rates, common health concerns such as joint and digestive issues, and breed-specific dietary needs. Cats represent the fastest-growing segment, propelled by increasing awareness of feline-specific health challenges such as urinary tract issues, hairball management, and age-related conditions. Senior pets are emerging as a key driver of demand across multiple supplement categories, while breed-specific and life-stage formulations are encouraging higher consumption and premiumization. Export-driven demand from Asia-Pacific and Latin America is further boosting the global market, with premium imports from North America and Europe playing a significant role in supporting product diversity and quality standards.

| By Product Type | By Application | By End-Use Pet Type | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market, contributing approximately 48% of the global share in 2024. High pet ownership rates, a strong focus on pet health and wellness, and a well-established veterinary infrastructure are key growth drivers. Consumers in the U.S. and Canada increasingly invest in preventive healthcare, functional supplements, and premium formulations, particularly for joint, digestive, and multivitamin applications. The region also benefits from advanced distribution networks, high e-commerce penetration, and a growing preference for subscription-based delivery models, which make it easier for pet owners to access specialized products. Rising awareness of veterinary-endorsed supplements and humanization of pets continue to drive growth in both dogs and cats.

Europe

Europe holds a significant share, with Germany, the U.K., and France leading demand. The market is driven by a combination of stringent regulations on pet food quality, growing emphasis on preventive pet healthcare, and a strong focus on clean-label and functional supplements. Consumers in this region show high adoption of premium products for joint, skin & coat, digestive, and cognitive health applications. Veterinary guidance and professional recommendations play a central role in product selection, while the trend toward natural and organic ingredients encourages innovation. The region’s moderate growth is supported by stable pet adoption, rising disposable incomes, and well-developed retail and e-commerce channels.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rapid urbanization, increasing disposable incomes, and rising pet adoption in countries such as China, India, Japan, and Australia. The region shows strong demand for multivitamins, joint health supplements, and premium functional products. Growing awareness of pet health, expanding e-commerce infrastructure, and the rising influence of social media on pet care trends are accelerating consumption. China leads in joint and functional supplements, while India demonstrates strong growth in multivitamins and online subscription models. Urban pet owners increasingly prioritize preventive care and functional nutrition, creating opportunities for personalized and breed-specific formulations.

Latin America

Latin America is emerging as a high-potential market, with Brazil, Argentina, and Mexico leading adoption. Growth is driven by rising affluence, increased pet ownership, and awareness of functional and premium supplements. Dogs dominate the market due to high adoption and health concerns, while cats are gaining importance as urban households diversify pet ownership. Limited but growing e-commerce channels and specialty retail networks facilitate product distribution. Premium imports from North America and Europe are enhancing product availability and supporting the trend toward functional nutrition in urban centers.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, represents a niche premium market for pet dietary supplements, supported by high disposable incomes and growing demand for imported, functional products. Africa, particularly South Africa, is witnessing gradual growth driven by increasing urban pet adoption and awareness of pet wellness. Veterinary guidance and the introduction of functional products such as joint, skin, and digestive supplements are gaining traction. Rising expatriate populations and increased access to online retail platforms are expected to further drive regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Dietary Supplements Market

- Nestlé S.A.

- Mars Incorporated

- Elanco Animal Health

- Virbac

- Vetoquinol

- Nutramax Laboratories

- Hill’s Pet Nutrition

- Swedencare AB

- H&H Group

- Bayer Animal Health

- Zoetis Inc.

- NOW Foods (Pet lines)

- Kemin Industries

- PetHonesty

- Ark Naturals

Recent Developments

- In May 2025, Nestlé Purina launched a new line of breed-specific joint health chews in North America, focusing on senior dogs.

- In April 2025, Elanco expanded its CBD-based calming supplements portfolio across Asia-Pacific, catering to growing pet anxiety concerns.

- In February 2025, Mars Petcare introduced subscription-based personalized multivitamins for cats and dogs in Europe and the U.S., integrating online health tracking tools.