Global Cryo-Stable Texture Agents Market Size

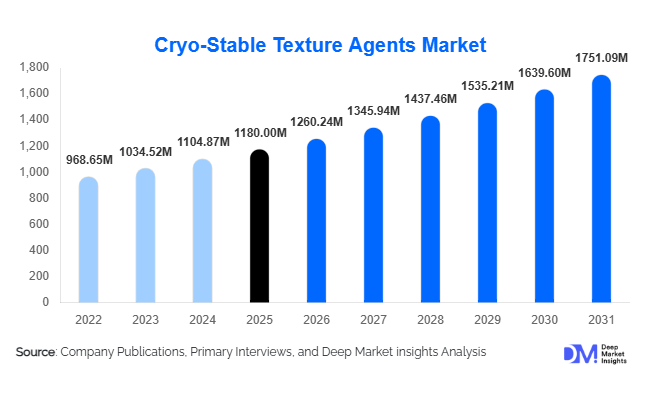

According to Deep Market Insights, the global cryo-stable texture agents market size was valued at USD 1,180 million in 2025 and is projected to grow from USD 1,260.24 million in 2026 to reach USD 1,751.09 million by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The market growth is primarily driven by the rising demand for high-quality frozen and chilled foods that retain texture and sensory appeal, increasing adoption of clean-label and natural stabilizers, and the expansion of frozen food consumption in emerging markets across Asia-Pacific and Latin America.

Key Market Insights

- Hydrocolloids dominate product adoption, including carrageenan, xanthan gum, and agar, due to superior cryo-stable performance across frozen desserts, dairy, and ready-to-eat meals.

- Powdered forms remain the preferred format, offering ease of handling, longer shelf-life, and precise dosing for industrial applications.

- Frozen desserts lead applications, particularly ice cream, frozen yogurt, and sorbets, requiring texture stability during freeze-thaw cycles.

- Food & beverage industry represents the largest end-use segment, accounting for ~75% of the market, driven by convenience foods and growing global frozen food consumption.

- Asia-Pacific is the fastest-growing region, with China and India driving demand due to urbanization, rising disposable income, and westernized dietary habits.

- Technological adoption in formulation and R&D, including multifunctional protein-based and hydrocolloid-based cryo-stable agents, is enhancing product performance and expanding clean-label offerings.

What are the latest trends in the cryo-stable texture agents market?

Shift Toward Clean-Label and Natural Ingredients

Manufacturers are increasingly formulating cryo-stable agents with natural hydrocolloids, plant-based proteins, and modified starches to meet growing consumer demand for clean-label foods. Products emphasizing plant-based, non-GMO, and allergen-free ingredients are gaining popularity across frozen desserts, ready-to-eat meals, and dairy applications. Innovation in hydrocolloid blends and protein-stabilized cryoprotectants ensures improved functionality while maintaining nutritional and sensory quality.

Technological Advancements in Functional Formulations

Emerging technologies allow development of multifunctional cryo-stable agents that enhance texture, maintain moisture, and reduce ice crystal formation. R&D efforts are focused on improving thermal and freeze-thaw stability while incorporating health-oriented benefits such as protein fortification. Adoption of advanced manufacturing techniques ensures consistent quality, optimized solubility, and compatibility across diverse food matrices, which is particularly important in high-volume industrial applications.

What are the key drivers in the cryo-stable texture agents market?

Rising Global Frozen Food Consumption

Urban lifestyles and the increasing demand for convenience foods are driving growth in frozen and ready-to-eat meals. Cryo-stable texture agents are essential for preserving creaminess, smoothness, and uniform mouthfeel in ice cream, frozen desserts, and processed dairy products. North America and Europe remain the largest consumers due to mature markets, while APAC and LATAM show rapid growth fueled by modern retail expansion and rising disposable incomes.

Growing Consumer Focus on Product Quality and Sensory Experience

Consumers increasingly value texture, stability, and taste in frozen products. Cryo-stable agents help maintain product integrity during storage and transportation, preventing phase separation, ice crystal growth, and structural breakdown. This has become a critical factor in brand differentiation, particularly in premium frozen desserts and dairy products, influencing purchasing decisions globally.

Innovation in Protein- and Hydrocolloid-Based Ingredients

Innovation in functional ingredients, such as protein-based cryoprotectants and multifunctional hydrocolloid blends, enables manufacturers to meet clean-label, plant-based, and health-conscious product trends. These agents not only stabilize texture but also support nutritional enhancement, creating added value and catering to evolving consumer preferences.

What are the restraints for the global market?

High Cost of Specialty Cryo-Stable Agents

Advanced cryo-stable agents, especially protein-based or natural hydrocolloids, are costlier than traditional stabilizers. Small and medium-sized manufacturers face challenges in adopting these ingredients due to higher procurement costs, which may limit market expansion in price-sensitive regions.

Regulatory Compliance Challenges

Strict food additive regulations across different regions require manufacturers to meet specific safety and labeling standards. Navigating varying global regulatory requirements, including FDA, EFSA, and FSSAI guidelines, can be challenging and may slow market entry and expansion for new participants.

What are the key opportunities in the cryo-stable texture agents market?

Expansion in Emerging Markets

APAC and LATAM present significant growth potential due to urbanization, increasing disposable incomes, and rising adoption of frozen and processed foods. Local manufacturers can leverage regional dietary trends to introduce tailored cryo-stable agents that maintain product quality and meet local taste preferences. Rapid expansion of retail and cold-chain infrastructure is further supporting market penetration.

Integration of Clean-Label Ingredients

The growing global preference for natural and clean-label products offers opportunities for hydrocolloid- and protein-based cryo-stable agents. Companies investing in R&D for sustainable, multifunctional, and label-friendly ingredients can differentiate themselves and secure premium pricing, enhancing both domestic and export market share.

Technological Advancements and Product Innovation

Investment in R&D allows for the development of multifunctional cryo-stable agents that enhance texture, flavor retention, and nutritional properties. Manufacturers can develop solutions for emerging product categories, including plant-based frozen desserts and nutraceutical applications, thus expanding market reach and catering to premium consumer segments.

Product Type Insights

Hydrocolloids dominate the global cryo-stable agents market, accounting for approximately 40% of the 2025 market share. Their versatility across applications, including frozen desserts, dairy products, and ready-to-eat meals, drives their widespread adoption. Protein-based agents are gaining momentum in high-value applications such as plant-based and functional foods due to their natural composition and ability to enhance texture. Starch-based agents remain widely used in bakery products and ready-to-eat frozen meals, offering cost-effective cryo-stability. The ongoing trend toward clean-label and multifunctional ingredients is further propelling the demand for hydrocolloid and protein-based products globally, as manufacturers respond to consumer preference for natural, multifunctional, and sustainable ingredients.

Application Insights

Frozen desserts lead application demand, representing around 35% of the global market. Ice cream, frozen yogurt, and sorbets require agents that prevent ice crystal formation and maintain creaminess, making hydrocolloids the preferred choice. Ready-to-eat meals and frozen bakery products are witnessing rapid growth, especially in APAC and LATAM, fueled by rising consumer demand for convenient, ready-made meals. Dairy products, including yogurts and cream-based desserts, show strong demand in North America and Europe due to premiumization trends and increasing interest in functional dairy offerings. Emerging applications such as plant-based frozen desserts and nutraceuticals are poised to create significant growth opportunities, driven by health-conscious and flexitarian consumers.

Distribution Channel Insights

Direct B2B sales to industrial manufacturers dominate the market, supported by specialized ingredient distributors in North America, Europe, and APAC. Online ingredient sourcing platforms are gaining traction, particularly among smaller manufacturers and R&D laboratories seeking flexibility and convenience. Manufacturers are increasingly adopting global distribution networks to serve multinational frozen food companies efficiently. Strategic partnerships with frozen dessert, dairy, and ready-to-eat meal producers ensure steady demand, long-term contracts, and mitigation of market volatility.

End-Use Insights

The food & beverage industry represents roughly 75% of the market demand, driven by frozen desserts, bakery products, and ready-to-eat meals. Fastest-growing segments include plant-based frozen desserts and functional dairy products, propelled by health and wellness trends. Emerging nutraceutical and cosmetic applications present niche opportunities for high-performance cryo-stable agents. Export-driven demand from the USA, Germany, and China further supports global expansion and innovation in the sector.

| By Product Type | By Form | By Application | By Function | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds around 32% of the global market share in 2025, with the USA as the dominant contributor. Market growth is driven by a mature frozen food industry, high consumer awareness of clean-label ingredients, and strong adoption of natural stabilizers. Canada demonstrates steady growth due to increasing demand for premium frozen desserts and ready-to-eat meals. Key drivers include technological advancements in food processing, stringent food safety regulations, and rising demand for plant-based and functional frozen foods.

Europe

Europe accounts for approximately 28% of the global market in 2025, with Germany, France, and the UK leading adoption. Growth is fueled by advanced food & beverage infrastructure, high consumer preference for clean-label frozen products, and stringent EU regulations on food safety and labeling. Sustainable and multifunctional ingredient trends, coupled with increasing frozen dessert consumption in urban populations, are significant growth drivers. Manufacturers are investing in localized production and R&D to meet rising demand for natural and high-performance cryo-stable agents.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to register a CAGR of 8% between 2026 and 2031. China and India are key growth drivers due to rapid urbanization, increasing disposable income, and adoption of westernized diets. Expansion of modern retail chains, increasing popularity of frozen desserts, and rising demand for convenient, ready-to-eat meals further fuel growth. Japan, South Korea, and Australia contribute through high-value segments such as premium frozen desserts and functional foods. Regional growth is also supported by government initiatives promoting food processing modernization and local ingredient sourcing.

Latin America

Brazil and Mexico are the leading markets in Latin America, with growth driven by rising urbanization, increasing middle-class income, and growing adoption of frozen meals and desserts. Expansion of organized retail, export-oriented food manufacturing, and partnerships with multinational frozen food companies support market penetration. Consumer preference for affordable, convenient, and clean-label frozen products is a significant driver of segment growth, particularly for hydrocolloid-based agents.

Middle East & Africa

The MEA region represents approximately 7% of the market in 2025. GCC countries show strong demand for imported premium frozen desserts, driven by high disposable incomes and lifestyle changes. Africa serves both as a supplier and consumer of cryo-stable agents, particularly for export-ready food products. Key growth drivers include increasing urbanization, expansion of modern retail chains, and government initiatives to support local food processing industries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cryo-Stable Texture Agents Market

- Cargill, Inc.

- Ingredion Incorporated

- CP Kelco

- DuPont de Nemours, Inc.

- Kerry Group

- Ashland Global Holdings Inc.

- Tate & Lyle PLC

- FMC Corporation

- Archer Daniels Midland Company

- DSM Food Specialties

- BASF SE

- Roquette Frères

- Lubrizol Corporation

- Ingredion Asia Pacific Limited

- E. I. du Pont de Nemours and Company