Couscous Market Size

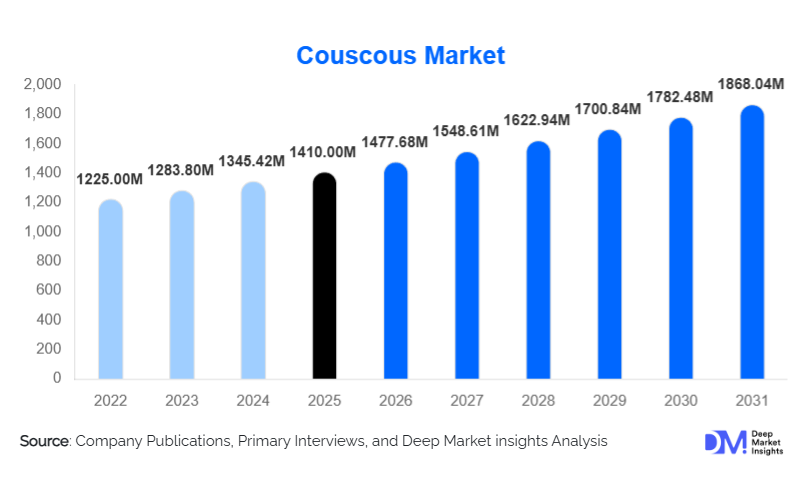

According to Deep Market Insights, the global couscous market size was valued at USD 1,410.00 million in 2025 and is projected to grow from USD 1,477.68 million in 2026 to reach USD 1,868.04 million by 2031, expanding at a CAGR of 4.8% during the forecast period (2026–2031). The couscous market growth is driven by increasing global adoption of Mediterranean and Middle Eastern cuisines, rising preference for healthier carbohydrate alternatives, and growing demand for convenient, shelf-stable grain-based foods across both retail and foodservice channels.

Key Market Insights

- Traditional wheat-based couscous continues to dominate global consumption due to cultural familiarity, affordability, and wide availability.

- Gluten-free and whole-grain couscous variants are gaining rapid traction, supported by health-conscious consumers and plant-based diet adoption.

- Europe remains the largest regional market, driven by strong consumption in France, Italy, and Spain.

- North America represents the fastest-growing developed market, with couscous increasingly positioned as a rice and pasta alternative.

- Asia-Pacific is emerging as a high-growth region, fueled by urbanization, expanding foodservice demand, and exposure to global cuisines.

- Modern retail and online distribution channels are reshaping market accessibility and private-label penetration.

What are the latest trends in the couscous market?

Rising Demand for Gluten-Free and Functional Couscous

One of the most prominent trends shaping the couscous market is the shift toward gluten-free and functional food products. Manufacturers are increasingly introducing couscous made from corn, rice, lentils, and chickpeas to cater to consumers with gluten intolerance and those seeking higher protein and fiber content. These products are often fortified with vitamins and minerals, positioning couscous as a nutritionally enhanced staple rather than a traditional carbohydrate. This trend is particularly strong in North America and Europe, where health-focused labeling and clean ingredient lists strongly influence purchasing decisions.

Growth of Instant and Ready-to-Eat Couscous

Convenience-oriented consumption patterns are accelerating the adoption of instant and ready-to-eat couscous formats. These products require minimal preparation time and are well-suited to busy urban lifestyles, making them popular among working professionals and younger consumers. Ready-to-eat couscous meals with pre-seasoned flavors and vegetables are gaining shelf space in supermarkets and online platforms. Foodservice operators are also increasingly adopting instant couscous due to its fast cooking time and operational efficiency.

What are the key drivers in the couscous market?

Shift Toward Healthier Staple Foods

Consumers globally are becoming more conscious of their carbohydrate intake, driving demand for alternatives to refined rice and pasta. Couscous, particularly whole-wheat variants, is perceived as a lighter and healthier option with better digestibility and nutritional value. This shift is supporting steady growth across both developed and emerging markets, especially among health-aware urban populations.

Globalization of Ethnic and Mediterranean Cuisines

The increasing popularity of Mediterranean, North African, and Middle Eastern cuisines has significantly expanded couscous consumption beyond its traditional regions. Restaurants, meal-kit providers, and home cooks are incorporating couscous into a wide range of recipes, enhancing its mainstream appeal. International travel, migration, and food media exposure continue to reinforce this driver.

What are the restraints for the global market?

Volatility in Durum Wheat Prices

Traditional couscous production relies heavily on durum wheat, making the market vulnerable to fluctuations in raw material prices caused by climate conditions, trade disruptions, and geopolitical factors. Rising wheat prices can pressure profit margins and lead to higher consumer prices, potentially slowing demand growth.

Competition from Substitute Staples

Couscous faces intense competition from established staples such as rice, pasta, quinoa, and bulgur. In many regions, these alternatives benefit from stronger cultural familiarity or established supply chains, requiring couscous manufacturers to invest heavily in marketing and product differentiation.

What are the key opportunities in the couscous industry?

Expansion in Asia-Pacific and Emerging Markets

Asia-Pacific represents a major growth opportunity for couscous manufacturers. Rapid urbanization, rising disposable incomes, and growing exposure to international cuisines are driving demand in countries such as China, Australia, Japan, and South Korea. Localized flavors, smaller pack sizes, and foodservice partnerships can help accelerate market penetration in these regions.

Foodservice and Institutional Catering Growth

The expanding global foodservice industry presents strong opportunities for couscous adoption. Quick-service restaurants, airline caterers, and institutional kitchens increasingly favor couscous for its versatility, short cooking time, and ability to absorb flavors. Long-term supply contracts with foodservice operators provide stable volume growth for manufacturers.

Product Type Insights

Traditional durum wheat couscous dominates the global market, accounting for approximately 62% of total market value in 2025, driven by widespread consumption in Europe, North Africa, and the Middle East. Whole-wheat couscous is gaining popularity due to its perceived health benefits, while gluten-free couscous represents the fastest-growing product category, expanding at a rate significantly above the market average. Flavored and seasoned couscous products are also gaining traction, particularly in developed markets, where consumers seek convenient meal solutions.

Form Insights

Dry couscous remains the most widely consumed form, holding nearly 78% of the global market share in 2025 due to its long shelf life, ease of storage, and suitability for international trade. Ready-to-eat and instant couscous products, while smaller in volume, are experiencing faster growth as convenience becomes a key purchasing criterion.

Distribution Channel Insights

Modern retail channels, including supermarkets and hypermarkets, account for the largest share of couscous sales globally, representing approximately 46% of total revenue. Online retail and direct-to-consumer platforms are expanding rapidly, driven by broader product availability and premium offerings. Foodservice distribution is the fastest-growing channel, supported by rising restaurant and catering demand.

End-Use Insights

Household consumption remains the dominant end-use segment, contributing around 58% of global demand in 2025. Foodservice applications are growing at the fastest pace, supported by restaurants, cafés, and catering services integrating couscous into diverse menus. Industrial and institutional consumption, including airline catering and public food programs, is steadily increasing, providing consistent bulk demand.

| By Product Type | By Form | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe holds the largest share of the global couscous market, accounting for approximately 34% of total revenue in 2025. France is the single largest consumer and importer of couscous, followed by Italy and Spain. Strong cultural acceptance, large North African diaspora populations, and well-established retail distribution support sustained demand.

North America

North America represents around 21% of the global market, with the United States accounting for the majority of regional demand. Rising health awareness, ethnic food adoption, and foodservice innovation are key growth drivers. The region is also a major importer of premium and organic couscous products.

Asia-Pacific

Asia-Pacific accounts for approximately 12% of global demand and is the fastest-growing regional market, expanding at over 7% CAGR. Growth is driven by urban consumers in China, Japan, Australia, and South Korea, supported by foodservice adoption and increasing retail availability.

Middle East & Africa

The Middle East and Africa collectively represent about 27% of the global market. North African countries such as Morocco, Algeria, and Tunisia serve as both major consumers and producers, while Gulf countries are key import markets driven by high per-capita food expenditure.

Latin America

Latin America holds a smaller but growing share of around 6%, with Brazil and Mexico emerging as key demand centers due to expanding middle-class populations and increasing exposure to global cuisines.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Couscous Market

- Barilla Group

- Ebro Foods

- Dari Couspate

- Tipiak Group

- Al Ghurair Foods

- Roland Foods

- Bionaturae

- Kassab Group

- Riso Scotti

- SunRice