Corn Modified Starch Market Size

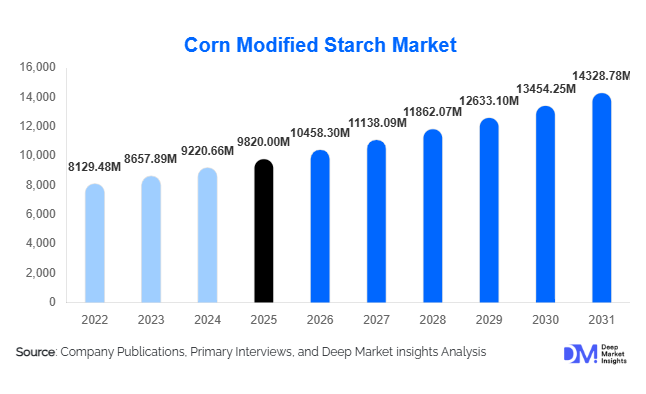

According to Deep Market Insights,the global corn modified starch market size was valued at USD 9,820 million in 2025 and is projected to grow from USD 10,458.30 million in 2026 to reach USD 14,328.78 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The corn modified starch market growth is primarily driven by rising demand from processed food manufacturing, expanding paper and packaging production, and increasing adoption of specialty starches in pharmaceuticals, adhesives, and sustainable material applications.

Key Market Insights

- Food & beverage applications dominate global demand, accounting for the largest revenue share due to extensive use as thickeners, stabilizers, and texture enhancers.

- Asia-Pacific leads global consumption, supported by strong industrialization, expanding food processing capacity, and rising pharmaceutical production.

- Cationic and chemically modified starches remain the most widely used product types, particularly in paper manufacturing and industrial applications.

- Sustainability-driven demand is accelerating, with growing use of corn modified starch in biodegradable packaging and bio-based materials.

- Enzyme-modified starches are gaining traction as clean-label alternatives in food and personal care applications.

- Moderate market consolidation exists, with the top five players collectively accounting for around 42% of global revenue.

What are the latest trends in the corn modified starch market?

Rising Adoption of Enzyme-Modified and Clean-Label Starches

One of the most prominent trends in the corn modified starch market is the growing adoption of enzyme-modified starches, particularly within food, pharmaceutical, and personal care applications. These starches provide improved functional performance while reducing chemical processing, aligning with clean-label requirements and evolving regulatory standards. Food manufacturers are increasingly reformulating products to eliminate chemically intensive ingredients, driving demand for enzymatic solutions that deliver similar viscosity, stability, and binding properties. This trend is particularly strong in North America and Europe, where regulatory scrutiny and consumer awareness are high.

Integration into Sustainable Packaging and Bioplastics

Corn modified starch is increasingly being integrated into biodegradable films, compostable packaging, and bio-based polymers. As governments enforce stricter regulations on single-use plastics, manufacturers are shifting toward starch-based alternatives. Modified corn starch serves as a cost-effective and scalable feedstock for bioplastics, particularly in flexible packaging, food service ware, and agricultural films. This trend is accelerating investments in specialty starch R&D and capacity expansion across Asia-Pacific and Europe.

What are the key drivers in the corn modified starch market?

Growth of Processed and Convenience Foods

The rapid expansion of the global processed food industry is a major driver for the corn modified starch market. Modified starches are widely used in sauces, soups, bakery products, dairy formulations, and ready-to-eat meals due to their superior thickening, stabilizing, and moisture-retention properties. Urbanization, rising disposable incomes, and changing dietary habits continue to fuel demand, particularly in emerging economies across Asia-Pacific and Latin America.

Rising Demand from Paper and Packaging Manufacturing

The paper and pulp industry relies heavily on corn modified starch for surface sizing, fiber bonding, and printability enhancement. Increasing e-commerce activity, growth in corrugated packaging, and higher recycled paper usage are supporting consistent demand. Cationic corn starch remains essential in paper strength improvement, making this sector a stable growth pillar for the market.

Expansion of Pharmaceutical and Healthcare Manufacturing

Modified corn starch is extensively used as a binder, disintegrant, and filler in tablet and capsule formulations. The expansion of generic drug manufacturing, nutraceutical production, and healthcare access in developing regions is driving steady growth. Asia-Pacific, particularly India and China, has emerged as a global hub for pharmaceutical production, significantly boosting starch consumption.

What are the restraints for the global market?

Volatility in Corn Raw Material Prices

Fluctuating corn prices, driven by climate variability, biofuel demand, and geopolitical factors, pose a challenge for starch manufacturers. Raw material price volatility impacts production costs and compresses margins, particularly for producers operating in price-sensitive markets.

Competition from Alternative Starch Sources

Potato, tapioca, and wheat starches offer comparable functionality in certain applications, limiting the pricing power of corn modified starch in cost-driven segments. In regions with abundant alternative feedstocks, substitution remains a persistent restraint.

What are the key opportunities in the corn modified starch industry?

Bioplastics and Bio-Based Material Development

The transition toward sustainable materials presents a major growth opportunity. Corn modified starch is increasingly used in biodegradable packaging, molded materials, and polymer blends. Manufacturers investing in starch-polymer integration technologies can capture high-growth opportunities as sustainability regulations tighten globally.

Emerging Market Industrialization

Rapid industrial growth across India, Southeast Asia, Latin America, and parts of Africa is driving new demand for modified starch in food processing, textiles, adhesives, and construction materials. Establishing regional manufacturing hubs and strategic partnerships enables companies to tap into export-driven demand while reducing logistics costs.

Product Type Insights

Cationic corn starch dominates the global market, accounting for approximately 28% of total market revenue in 2025. Its leadership is primarily driven by its superior binding strength, charge density, and retention properties, making it indispensable in the paper and packaging industry for surface sizing, coating, and wet-end applications. Rising demand for lightweight, recyclable, and high-strength packaging materials further reinforces the dominance of cationic starch.Oxidized and esterified corn starches hold a substantial share due to their enhanced viscosity control, improved film-forming ability, and stability under varying processing conditions. These starches are widely used in food processing applications such as sauces, bakery fillings, and dairy products, where texture consistency and shelf-life stability are critical.

Enzymatically modified corn starches currently represent a smaller portion of total revenue but constitute the fastest-growing product segment. Growth is fueled by increasing clean-label and non-GMO preferences, particularly in food and beverage applications where enzymatic modification is perceived as more natural compared to chemical alternatives.Dual-modified corn starches are gaining strong adoption in high-performance industrial and food applications that require enhanced resistance to heat, shear, and acidic conditions. These products are increasingly used in ready-to-eat meals, frozen foods, and specialty industrial formulations, supporting premium pricing and margin expansion.

Application Insights

The food and beverage processing segment represents the largest application area, contributing nearly 38% of global revenue. Its dominance is driven by the widespread use of modified corn starch as a thickener, stabilizer, emulsifier, and texture enhancer across processed foods, beverages, confectionery, and convenience foods. Rapid urbanization, changing dietary habits, and growth in ready-to-eat and frozen food categories continue to propel demand.

Paper and pulp applications account for a significant share of global consumption, supported by rising demand for packaging materials, corrugated boxes, and paper-based alternatives to plastic. Growth in e-commerce logistics and recycling activities further increases starch usage in paper strength enhancement and coating applications.Pharmaceuticals, adhesives, textiles, and emerging bioplastic applications are expanding steadily. In pharmaceuticals, modified corn starch is widely used as a binder, disintegrant, and filler in solid dosage forms. Adhesives and textile applications benefit from improved bonding strength and surface finish, while bioplastics leverage starch as a biodegradable and renewable raw material.

End-Use Industry Insights

Processed food manufacturers remain the primary end users of modified corn starch, driven by large-scale production volumes and continuous product innovation. Packaging and paper producers represent the second-largest end-use segment, benefiting from sustainability-driven shifts toward fiber-based packaging solutions.

Pharmaceutical and nutraceutical companies are among the fastest-growing end-use industries, supported by expanding healthcare manufacturing capacity, rising generic drug production, and increased demand for excipients with consistent performance.New applications in biodegradable materials, construction additives, and industrial binders are creating additional demand streams. These applications are particularly prominent in sustainability-focused markets, where regulatory pressure and corporate environmental commitments are accelerating the adoption of bio-based materials.

| Cargill, Incorporated | Archer Daniels Midland Company (ADM) | Ingredion Incorporated | Tate & Lyle PLC | Roquette Frères | Grain Processing Corporation | Tereos Group | Südzucker AG | Avebe Group | Manildra Group |

|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global corn modified starch market with approximately 38% share in 2025. Regional growth is driven by rapid industrialization, expanding food processing capacity, and strong demand from paper and pharmaceutical industries. China leads regional consumption due to its large-scale manufacturing base, high packaged food output, and extensive paper production infrastructure.

India is the fastest-growing market in the region, expanding at over 8% CAGR. Growth is supported by rising consumption of processed foods, increasing pharmaceutical production, and government initiatives such as Make in India that encourage domestic manufacturing and food processing investments. Southeast Asian countries, including Indonesia, Thailand, and Vietnam, are also contributing to growth through expanding export-oriented food and packaging industries.

North America

North America accounts for around 27% of global demand, led by the United States. The region benefits from strong processed food consumption, advanced pharmaceutical manufacturing, and high adoption of value-added and clean-label starch products. Continuous innovation in food formulations and growing demand for sustainable packaging solutions support stable long-term growth.Additionally, stringent quality standards and well-established supply chains enable manufacturers to focus on high-margin specialty and enzymatically modified starch products.

Europe

Europe represents approximately 22% of the global market, with Germany, France, and the UK as key contributors. Growth in the region is driven by strict sustainability regulations, rising adoption of recyclable and biodegradable packaging, and strong demand for clean-label food ingredients.

The region also benefits from advanced research and development capabilities, enabling the commercialization of specialty and dual-modified starches for food, pharmaceutical, and industrial applications.

Latin America

Latin America is an emerging market for corn modified starch, led by Brazil and Mexico. Regional growth is supported by expanding food processing industries, rising exports of processed food products, and increasing investments in packaging and paper manufacturing.

Abundant availability of corn as a raw material and improving industrial infrastructure are further enhancing the region’s attractiveness for starch producers.

Middle East & Africa

The Middle East & Africa region is experiencing gradual but steady growth. Demand is primarily supported by rising food imports, expanding packaging requirements, and increasing industrialization in countries such as Saudi Arabia, the UAE, and South Africa.

Growth opportunities are emerging from investments in food security, local food processing facilities, and infrastructure development, which are expected to drive long-term demand for modified corn starch across multiple applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Corn Modified Starch Market

- Cargill

- ADM

- Ingredion

- Tate & Lyle

- Roquette

- Grain Processing Corporation

- Tereos

- Südzucker

- Avebe

- Emsland Group

- Manildra Group

- AGRANA

- PT Budi Starch & Sweetener

- Samyang Corporation

- Gulshan Polyols