Corn Starch Market Size

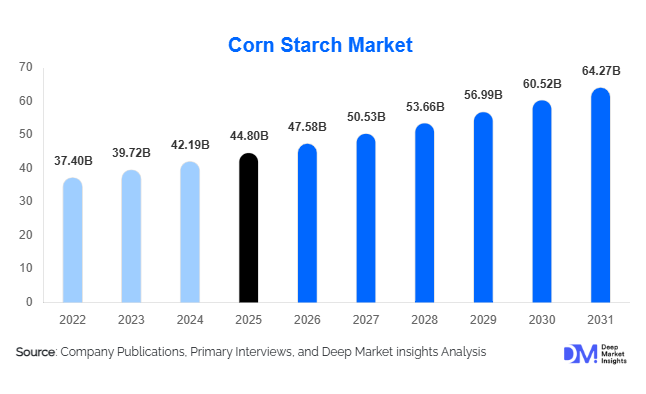

According to Deep Market Insights,the global corn starch market size was valued at USD 44.8 billion in 2025 and is projected to grow from USD 47.58 billion in 2026 to reach USD 64.27 billion by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The corn starch market growth is primarily driven by rising demand from the processed food and beverage industry, expanding industrial applications in paper, textiles, and packaging, and increasing adoption of bio-based and specialty starches across global manufacturing sectors.

Key Market Insights

- Modified corn starch dominates global demand due to its superior functional properties across food, pharmaceutical, and industrial applications.

- Food and beverage applications account for the largest market share, supported by global growth in processed and convenience food consumption.

- Asia-Pacific is the fastest-growing regional market, driven by rapid industrialization, expanding food processing capacity, and rising domestic starch production.

- North America remains the largest market, supported by abundant corn availability and a highly integrated wet milling industry.

- Specialty and clean-label starches are gaining traction, reflecting shifting consumer preferences toward health-focused and sustainable ingredients.

- Technological advancements in enzymatic modification are enabling manufacturers to deliver customized starch solutions for high-value end uses.

What are the latest trends in the corn starch market?

Rising Adoption of Specialty and Functional Corn Starches

Manufacturers are increasingly focusing on specialty corn starches such as resistant starch, non-GMO starch, and organic variants to address evolving consumer preferences for health, wellness, and clean-label products. Resistant corn starch is gaining popularity for its digestive health benefits and application in low-glycemic foods, while non-GMO and organic starches are being adopted by premium food brands. These products command higher margins compared to native starch and are helping producers diversify revenue streams beyond commodity-grade starch.

Expansion of Industrial and Bio-Based Applications

Corn starch is increasingly being utilized as a renewable feedstock in bioplastics, adhesives, coatings, and fermentation-based chemicals. Growing environmental regulations and sustainability commitments are accelerating the shift toward starch-based biodegradable materials, particularly in packaging and disposable consumer products. This trend is strengthening long-term demand stability for corn starch outside the food sector.

What are the key drivers in the corn starch market?

Growing Processed Food and Beverage Consumption

The global rise in urbanization and changing dietary habits has led to increased consumption of processed foods, bakery products, sauces, confectionery, and dairy alternatives, all of which rely heavily on corn starch as a thickener, stabilizer, and texture enhancer. Modified corn starch, in particular, is widely used due to its ability to withstand heat, acidity, and mechanical stress during food processing.

Industrial Demand from Paper, Textile, and Packaging Sectors

Corn starch plays a critical role in paper sizing, textile finishing, and corrugated packaging production. The growth of e-commerce and sustainable packaging has significantly boosted starch consumption in paper-based packaging solutions. Textile manufacturers continue to use starch for yarn sizing and finishing processes, especially in Asia-Pacific.

Technological Advancements in Starch Processing

Advances in enzymatic and physical modification technologies are enabling producers to create customized starch solutions tailored to specific industry requirements. These innovations are improving product performance, reducing waste, and enhancing production efficiency, thereby supporting market growth.

What are the restraints for the global market?

Volatility in Corn Prices

Corn accounts for a significant portion of production costs in starch manufacturing. Fluctuations in corn prices due to weather conditions, biofuel demand, and trade policies can compress margins and create supply uncertainties for manufacturers.

Regulatory and Health Concerns Around Corn-Based Sweeteners

High-fructose corn syrup and other sweeteners face regulatory scrutiny and negative consumer perception in several markets. These concerns can limit growth in the sweetener derivatives segment and require producers to shift focus toward non-sweetener starch applications.

What are the key opportunities in the corn starch industry?

Growth in Clean-Label and Health-Focused Food Products

The increasing demand for clean-label, gluten-free, and health-oriented food products presents strong opportunities for corn starch manufacturers. Reformulation trends in bakery, snacks, and functional foods are driving demand for specialty starches that offer improved nutritional profiles without compromising functionality.

Emerging Market Capacity Expansion

Countries such as India, Vietnam, Brazil, and Indonesia are investing in domestic corn processing capacity to support food security and industrial growth. These markets offer opportunities for new entrants, joint ventures, and technology partnerships, supported by favorable government policies and lower production costs.

Product Type Insights

Modified corn starch represents the largest product segment, accounting for approximately 52% of the global market share in 2025. Its dominance is driven by superior functional properties such as enhanced viscosity control, thermal and shear stability, improved shelf-life, and resistance to acidic and high-temperature processing conditions. These characteristics make modified corn starch a preferred ingredient across food processing, pharmaceuticals, and industrial applications where consistency and performance reliability are critical.

Native corn starch continues to be widely used in traditional food formulations and basic industrial applications due to its cost-effectiveness and broad availability. Meanwhile, specialty starches, including clean-label, non-GMO, and functional blends, are witnessing faster growth. This growth is supported by premium positioning, rising health-conscious consumption, and expanding use in pharmaceutical excipients, nutraceuticals, and specialized food products.

Application Insights

Food and beverage applications account for nearly 46% of total market demand, making it the largest application segment. Growth is primarily driven by increasing consumption of processed and convenience foods, where corn starch is extensively used as a thickener, stabilizer, texturizer, and binding agent in bakery products, confectionery, sauces, soups, and dairy alternatives.

Industrial applications, including paper, textiles, adhesives, and corrugated packaging, collectively represent a substantial share of demand. Expansion in e-commerce, rising packaging needs, and increased use of starch-based adhesives and coatings are key drivers supporting industrial consumption. Pharmaceutical and personal care applications, although smaller in volume, generate higher margins and are expanding steadily due to growing demand for bio-based excipients, binders, disintegrants, and skin-friendly formulation ingredients.

Distribution Channel Insights

Direct sales dominate the corn starch market, accounting for around 60% of total transactions. Large food processors, pharmaceutical manufacturers, and industrial users prefer direct procurement through long-term supply agreements to ensure consistent quality, pricing stability, and reliable supply chains.

Distributors and wholesalers play a critical role in serving small and medium-sized enterprises, particularly in emerging markets where localized sourcing and flexible order sizes are essential. Online platforms and specialty ingredient marketplaces are emerging as niche channels, especially for specialty, clean-label, and customized starch solutions, supported by digitalization of B2B procurement.

End-Use Industry Insights

The food processing industry remains the largest end-use segment, driven by continuous innovation in processed foods, ready-to-eat meals, and plant-based alternatives. Corn starch plays a vital role in enhancing texture, mouthfeel, and product stability across diverse food formulations.

The paper and packaging industry is the fastest-growing end-use segment, supported by sustainability-driven shifts toward recyclable, biodegradable, and paper-based packaging materials. Increasing demand for starch-based coatings and adhesives in corrugated boxes and paperboard further accelerates growth. Pharmaceutical and personal care industries are emerging as high-value end users due to rising adoption of corn starch as a safe, bio-based excipient and functional ingredient.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global corn starch market share in 2025, with the United States leading regional consumption and production. Abundant corn availability, advanced wet milling infrastructure, and a well-established food processing sector support market dominance.

Regional growth is further driven by increasing demand for clean-label and functional starches, expanding pharmaceutical manufacturing, and rising use of bio-based materials in packaging and industrial applications.

Europe

Europe represents around 21% of global demand, driven by strong adoption of specialty and bio-based starch products. Key markets such as Germany, France, and the Netherlands benefit from advanced food processing capabilities and robust industrial demand.

Stringent sustainability regulations, emphasis on biodegradable materials, and rising demand for non-GMO and clean-label ingredients are major drivers supporting regional growth.

Asia-Pacific

Asia-Pacific holds nearly 29% of the global market and is the fastest-growing region, expanding at a CAGR of over 7%. China and India dominate regional demand due to large populations, rising disposable incomes, and rapid expansion of food processing and manufacturing industries.

Government support for agro-industrial development, increasing investments in starch processing capacity, and growing pharmaceutical and textile industries are key factors accelerating regional market growth.

Latin America

Latin America accounts for approximately 11% of global demand, with Brazil and Mexico serving as major growth centers. The region benefits from favorable climatic conditions for corn cultivation and improving processing infrastructure.

Growth is driven by expanding food processing industries, rising animal feed demand, and increasing exports of starch and starch derivatives to North America and Europe.

Middle East & Africa

The Middle East & Africa region holds about 7% of the global corn starch market. Demand is largely supported by rising imports, particularly in Gulf Cooperation Council countries and South Africa.

Key growth drivers include expansion of food processing capacity, increasing urbanization, growing demand for packaged foods, and gradual adoption of starch-based solutions in industrial and personal care applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Corn Starch Market

- Cargill

- Archer Daniels Midland (ADM)

- Ingredion Incorporated

- Tate & Lyle

- Roquette Frères

- COFCO Biochemical

- Grain Processing Corporation

- Tereos Group

- AGRANA Group

- Gulshan Polyols

- Angel Starch & Food

- Samyang Corporation

- Global Bio-Chem Technology

- Zhucheng Xingmao Corn Processing

- Henan Jindan Lactic Acid