Clear Whey Isolate Market Size

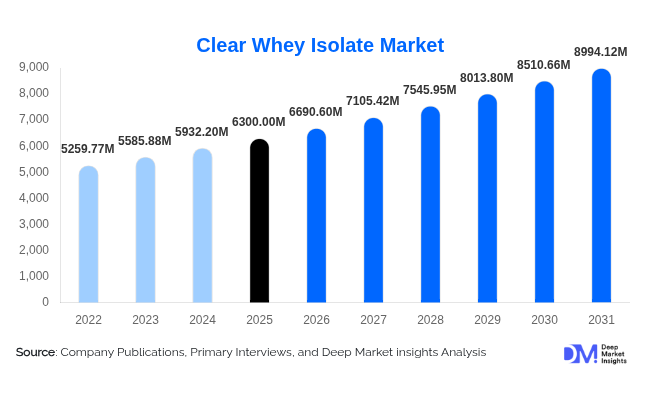

According to Deep Market Insights, the global clear whey isolate market size was valued at USD 6,300.00 million in 2025 and is projected to grow from USD 6,690.60 million in 2026 to reach USD 8,994.12 million by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The clear whey isolate market growth is primarily driven by rising consumer preference for low-calorie, high-protein nutrition, increasing adoption of functional and ready-to-drink protein beverages, and advancements in dairy filtration and flavor-masking technologies.

Key Market Insights

- Clear whey isolate is transitioning from a niche sports nutrition product to a mainstream lifestyle nutrition option, driven by demand for refreshing, juice-like protein beverages.

- Flavored clear whey isolate dominates product demand, accounting for over 60% of total market revenue due to improved taste profiles.

- North America leads global consumption, supported by a mature sports nutrition industry and high protein intake per capita.

- The Asia-Pacific region is the fastest-growing, driven by the expansion of the fitness culture, urbanization, and the adoption of premium nutrition.

- Microfiltration-based processing is the preferred technology, ensuring protein purity, clarity, and bioavailability.

- Direct-to-consumer and online channels are reshaping distribution, enabling brand-led pricing and subscription models.

What are the latest trends in the clear whey isolate market?

Rise of Functional and Ready-to-Drink Protein Beverages

Clear whey isolate is increasingly being incorporated into functional and ready-to-drink (RTD) beverage formats, including protein waters, recovery drinks, and hydration-protein hybrids. Consumers are seeking alternatives to thick, milk-based shakes, favoring lighter formulations that support muscle recovery, weight management, and metabolic health. Beverage manufacturers are leveraging clear whey isolate to develop low-sugar, clean-label products with improved shelf stability. This trend is accelerating partnerships between dairy ingredient suppliers and beverage brands, particularly in North America and Europe.

Flavor Innovation and Clean-Label Positioning

Advancements in flavor masking and natural sweetening have significantly enhanced consumer acceptance of clear whey isolate. Fruit-based and exotic flavors such as citrus, berry, tropical blends, and botanical infusions are gaining traction. Clean-label positioning, including non-GMO, low-lactose, and minimal ingredient claims, is becoming a key differentiator. Brands are also reducing artificial additives to align with wellness-focused consumer expectations.

What are the key drivers in the clear whey isolate market?

Growing Demand for High-Protein, Low-Calorie Nutrition

Global consumers are increasingly prioritizing protein intake for muscle maintenance, weight management, and active lifestyles. Clear whey isolate offers high protein concentration with minimal fat, lactose, and carbohydrates, making it attractive to fitness enthusiasts and health-conscious consumers. This shift is particularly evident among younger demographics and working professionals seeking convenient nutrition solutions.

Expansion of Sports and Active Lifestyle Culture

The rapid growth of gyms, fitness studios, endurance sports, and recreational athletics has expanded the consumer base for sports nutrition products. Clear whey isolate is widely adopted for post-workout recovery due to its fast absorption and refreshing taste. Social media-driven fitness trends and influencer marketing are further amplifying product awareness and adoption.

What are the restraints for the global market?

Higher Cost Compared to Conventional Whey Protein

Clear whey isolate requires advanced processing technologies such as microfiltration and ultrafiltration, resulting in production costs that are 20–35% higher than standard whey protein isolates. This price premium can limit adoption in cost-sensitive markets and among entry-level consumers.

Volatility in Dairy Raw Material Prices

Fluctuations in milk supply, feed costs, and global dairy prices directly impact input costs for clear whey isolate manufacturers. Price volatility can compress margins and create challenges in maintaining stable pricing for long-term supply contracts.

What are the key opportunities in the clear whey isolate industry?

Medical and Aging Nutrition Applications

Clear whey isolate’s high digestibility and low lactose content make it suitable for medical nutrition, elderly care, and post-surgical recovery products. Aging populations in Europe, Japan, and China are driving demand for protein-enriched clinical beverages, presenting high-margin opportunities for ingredient suppliers.

Emerging Market Expansion and Localization

Asia-Pacific, Latin America, and the Middle East offer significant untapped potential. Localized manufacturing, halal-certified formulations, and region-specific flavors can improve affordability and accelerate adoption. Government initiatives supporting domestic nutrition manufacturing further strengthen growth prospects in these regions.

Product Type Insights

Flavored clear whey isolate dominates the global market, accounting for approximately 62% of total revenue in 2025. The leadership of this segment is primarily driven by rapid consumer adoption of fruit-based, beverage-inspired, and functional flavor profiles that deliver a refreshing, juice-like experience rather than a traditional dairy taste. Innovations in natural flavor masking, low-calorie sweeteners, and acid-stable protein formulations have significantly improved palatability, enabling flavored clear whey isolate to appeal to both sports nutrition users and mainstream lifestyle consumers.

Additionally, flavored variants are increasingly being positioned as ready-to-mix and RTD-compatible ingredients, supporting their integration into protein waters, hydration drinks, and recovery beverages. In contrast, unflavored clear whey isolate plays a strategically important role in B2B applications, particularly among food and beverage manufacturers that require high formulation flexibility, neutral taste profiles, and compatibility with customized flavor systems. Although smaller in volume, unflavored variants are critical for product innovation pipelines and private-label manufacturing.

Application Insights

Sports and performance nutrition remains the largest application segment, contributing nearly 45% of total market demand in 2025. This dominance is driven by the segment’s need for fast-absorbing, high-protein formulations that support muscle recovery, lean mass development, and post-workout hydration. Clear whey isolate’s low lactose content and superior digestibility have positioned it as a preferred alternative to conventional whey proteins among endurance athletes and gym-focused consumers.

Functional beverages represent the fastest-growing application segment, expanding at a CAGR exceeding 15%. Growth is supported by rising consumer demand for protein-enriched waters, metabolic health drinks, and low-sugar nutritional beverages. Meanwhile, medical and clinical nutrition is gaining traction as aging populations and post-surgical care programs increasingly incorporate high-quality protein supplementation. Hospitals and healthcare nutrition brands are adopting clear whey isolate due to its ease of digestion and compatibility with liquid nutrition formats.

Distribution Channel Insights

Direct-to-consumer (DTC) and online channels account for approximately 38% of global sales, making them the largest distribution segment in the clear whey isolate market. Growth in this channel is driven by brand-owned e-commerce platforms, digital fitness communities, influencer-led marketing, and subscription-based protein nutrition models. These channels enable manufacturers to maintain pricing control, gather consumer insights, and rapidly launch new product variants.

Specialty nutrition stores and pharmacies continue to play a critical role in premium and clinical-grade product distribution, particularly in North America and Europe, where professional recommendations influence purchasing decisions. Additionally, B2B ingredient supply remains a stable and high-volume channel, supporting large-scale production of functional beverages, RTD protein drinks, and private-label nutrition products.

End-Use Insights

Athletes and fitness consumers represent the largest end-user segment, accounting for nearly 56% of total market demand. This segment’s leadership is driven by increasing participation in organized fitness activities, bodybuilding, endurance sports, and recreational training programs. Clear whey isolate is favored for its rapid absorption, light texture, and post-workout hydration benefits.

Lifestyle and wellness consumers are the fastest-growing end-user group, supported by rising awareness of preventive health, weight management, and daily protein intake requirements. Medical patients and elderly consumers form a smaller but high-value segment, where demand is driven by clinical nutrition protocols and aging-related muscle loss prevention. Meanwhile, food and beverage manufacturers contribute consistent B2B demand as they integrate clear whey isolate into fortified drinks and nutritional formulations.

| By Product Type | By Application | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global clear whey isolate market with approximately 38% market share in 2025. The United States dominates regional demand due to high per-capita protein consumption, a well-established sports nutrition ecosystem, and a strong presence of global dairy ingredient manufacturers. Growth is further supported by rapid innovation in functional and RTD beverages, widespread adoption of DTC nutrition brands, and consumer willingness to pay premium prices for clean-label, performance-oriented products.

Europe

Europe accounts for around 28% of global demand, led by Germany, the United Kingdom, and France. Regional growth is driven by a strong consumer focus on clean-label nutrition, sustainable dairy sourcing, and regulatory-backed quality standards. Europe also benefits from advanced dairy processing infrastructure and the increasing adoption of clear whey isolate in medical nutrition and weight management programs, particularly among aging populations.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of over 16%. China, Japan, India, and Australia are key contributors, driven by rising disposable incomes, expanding urban middle-class populations, and rapidly growing fitness and wellness culture. Increased penetration of Western-style sports nutrition products, coupled with localized flavor innovation and growing e-commerce adoption, is accelerating market expansion across the region.

Latin America

Latin America holds approximately 6% market share, with Brazil and Mexico leading demand. Growth is supported by increasing gym memberships, rising awareness of protein supplementation, and improving access to international nutrition brands. Although price sensitivity remains a challenge, mid-range clear whey isolate products and online retail channels are improving market penetration.

Middle East & Africa

The Middle East & Africa accounts for around 5% of global demand, with the Gulf countries, particularly the UAE and Saudi Arabia, emerging as key growth markets. High disposable incomes, expanding fitness infrastructure, and strong demand for premium, halal-certified nutrition products are driving adoption. In Africa, demand is gradually increasing in South Africa and select urban centers, supported by rising health awareness and sports participation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Clear Whey Isolate Market

- Glanbia plc

- Arla Foods Ingredients

- Lactalis Ingredients

- FrieslandCampina Ingredients

- Fonterra Co-operative Group

- Kerry Group

- Hilmar Cheese Company

- Saputo Inc.

- Royal DSM

- Carbery Group

- Armor Protéines

- Milk Specialties Global

- Davisco Foods

- Volac International

- Leprino Foods