Whey Protein Market Size

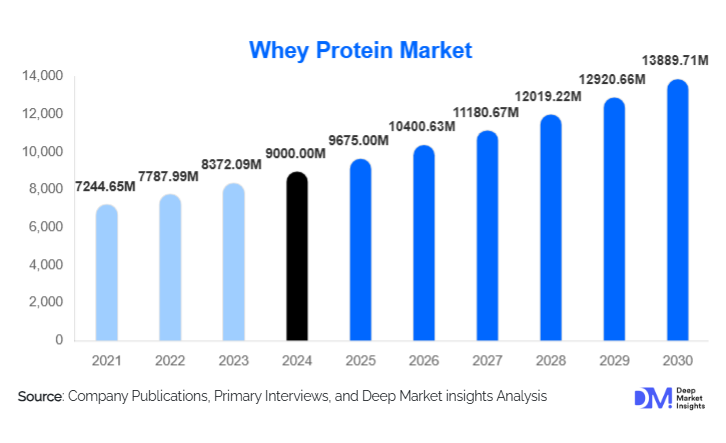

According to Deep Market Insights, the global whey protein market size was valued at approximately USD 9,000 million in 2024 and is projected to grow to around USD 9,675.00 million in 2025 and reach USD 13,889.71 million by 2030, expanding at a CAGR of roughly 7.5% during the forecast period (2025–2030). This growth is driven by rising health and fitness awareness, increasing demand for high-protein diets, and broader incorporation of whey proteins into functional foods, medical nutrition, and ready-to-drink applications.

Key Market Insights

- Whey Protein Concentrate (WPC) remains dominant as a cost-effective option, favoured in both sports nutrition and food-ingredient applications.

- Sports nutrition is a leading application segment, fueled by gym culture, muscle-recovery needs, and performance-oriented consumers.

- Conventional whey protein (non-organic) continues to account for the majority of volume globally due to its widespread supply chain and lower cost.

- Mass retail channels such as supermarkets and hypermarkets dominate distribution for lower-cost whey powders, while online retail is gaining traction for premium and niche variants.

- Athletes and fitness enthusiasts remain core consumers, but lifestyle and wellness-focused users are growing rapidly, broadening the customer base.

- North America leads regionally in 2024, leveraging a mature supplement ecosystem, but Asia-Pacific is the fastest-growing region due to rising middle-class health consciousness and fitness uptake.

What are the Latest Trends in the Whey Protein Market?

Premium & Clean-Label Whey Gaining Ground

There is a strong shift toward premium, clean-label whey protein options. Products such as organic whey, grass-fed whey, and non-GMO isolates are increasingly popular. Consumers are more discerning about the source and processing of their proteins, demanding transparency in sourcing, minimal processing, and sustainable production. This trend is encouraging companies to invest in advanced filtration, fractionation technologies, and traceability systems to produce high-purity whey variants that command a price premium.

Functional Foods & RTD Integration

Whey protein is increasingly being embedded into functional food and beverage formats beyond just powder supplements. Ready-to-drink (RTD) protein shakes, protein-enriched bars, meal replacements, and even bakery applications are expanding rapidly. Ingredient suppliers are forming partnerships with food and beverage brands, enabling whey to penetrate mass consumer segments and reach non-traditional users who want convenient, high-protein nutrition.

What Are the Key Drivers in the Whey Protein Market?

Growing Fitness & Health Awareness

The surge in global health consciousness, driven by social media, increasing gym memberships, and widespread education about nutrition, is a foundational driver. Both athletes and everyday wellness-seekers are incorporating whey protein into their routines for muscle recovery, weight management, and general nutrition support.

High-Protein Diet Trends

Dietary patterns such as high-protein weight loss, keto, and intermittent fasting emphasize increased protein intake. Whey protein, with its rich essential amino acid profile and high bioavailability, is ideally suited to meet these needs. Consumers are turning to whey to ensure that their protein requirements are met conveniently.

Ingredient Demand from Food & Beverage Manufacturers

Manufacturers in the food and beverage industry are increasingly using whey as a functional ingredient, in bars, beverages, meal replacements, and fortified foods, because of its techno-functional properties (solubility, emulsification, foaming). This B2B demand is broadening the commercial base beyond supplement users.

What Are the Restraints for the Global Whey Protein Market?

Lactose Intolerance & Allergen Constraints

A significant portion of the population is sensitive to lactose or dairy proteins, limiting demand for some whey forms. Lower-purity whey proteins (like some concentrates) may contain residual lactose, pushing these consumers toward isolates, hydrolysates, or plant-based alternatives.

Raw Material Price Volatility

Since whey is a by-product of cheese production, its supply and cost are intimately tied to dairy market dynamics. Fluctuations in milk prices, changes in cheese demand, and seasonal dairy production can create cost instability for whey producers, which compresses profitability or forces margin compromises, especially for commodity-grade whey.

What Are the Key Opportunities in the Whey Protein Industry?

Premium Whey Differentiation

The demand for premium, high-quality whey (organic, grass-fed, low-lactose, isolate, hydrolysate) is rising. Companies can differentiate through clean-label claims, sourcing transparency, and advanced processing. By building trust through traceability and sustainability, they can command higher ASPs and cater to affluent or health-conscious consumers.

Expansion into Emerging Markets

Emerging economies in Asia-Pacific (especially India and China), Latin America, and the Middle East present significant growth potential. As disposable incomes rise and fitness culture spreads, the penetration of whey-based nutritional products is expected to climb. Companies can invest in local production, partnerships, or targeted supply chain strategies to tap these markets.

Growth in Clinical & Functional Nutrition

Whey protein has strong potential in clinical nutrition, for recovering patients, elderly care, pediatric nutrition, and enteral feeding. Healthcare providers are increasingly recognising whey’s benefits for recovery and lean mass maintenance. Simultaneously, food companies can develop high-protein functional foods for everyday nutrition, preventive health, and wellness segments.

Product Type Insights

Whey Protein Concentrate (WPC) continues to dominate the global market, accounting for the largest product share due to its cost-effectiveness, versatility, and widespread availability. Its strong presence across both consumer nutrition products and food-ingredient applications is driven by its balanced composition of protein, lactose, and bioactive compounds, making it ideal for mass-market consumption. The segment's leadership is further reinforced by high adoption among athletes and mainstream wellness consumers, as well as its compatibility with bakery, confectionery, and ready-to-drink formulations.

Whey Protein Isolate (WPI), while smaller in volume, is rapidly expanding owing to its superior purity levels (90%+ protein), low lactose profile, and appeal among premium buyers, especially those seeking clinical-grade or weight management solutions. Additionally, the rise of clean-label and high-performance nutrition trends supports WPI’s growth trajectory. Hydrolysed Whey Protein (WPH) remains niche but crucial in specialised domains such as infant nutrition, medical nutrition, and digestive-sensitive consumer groups, providing enhanced bioavailability and faster absorption.

Application Insights

Sports nutrition remains the leading application segment, supported by the global surge in fitness culture, increased gym memberships, and the influence of social media-driven body transformation trends. Whey protein’s rapid absorption rate and complete amino acid profile make it the preferred choice for muscle repair and performance enhancement. Beyond traditional powders, the integration of whey into RTD shakes, performance bars, and protein gummies is accelerating adoption.

The dietary supplements category is also expanding, driven by consumers using whey protein for weight management, immunity support, and general wellness. Functional food manufacturers increasingly incorporate whey for its solubility, emulsification, and texture-enhancing properties, enabling innovation in high-protein snacks, beverages, and meal replacements. Clinical and medical nutrition is another fast-growing application, especially for elderly nutrition, post-operative recovery, and malnutrition interventions, where high-quality protein is essential.

Distribution Channel Insights

Supermarkets and hypermarkets maintain dominance in volume sales, largely driven by mass-market WPC products and the rising availability of private-label nutrition supplements. Their strong shelf-space visibility and promotional campaigns help reinforce whey protein’s mainstream accessibility.

However, online retail is the fastest-growing channel, fueled by the surge in e-commerce penetration, demand for premium products, and subscription-based D2C protein brands offering personalised nutrition. Supplement and speciality nutrition stores continue to thrive among athletes and performance-driven consumers who seek expert guidance. For industrial buyers, direct B2B distribution remains critical as whey ingredient manufacturers supply bulk proteins to food, beverage, and pharmaceutical companies.

End-User Insights

Athletes and fitness enthusiasts remain the core demand drivers, valuing whey protein for its superior biological value, muscle recovery benefits, and compatibility with high-performance training regimens. The segment’s expansion is supported by growing participation in sports events, bodybuilding, and CrossFit-style fitness cultures.

A rapidly growing end-user category consists of wellness-driven consumers who incorporate whey into daily diets for weight control, improved metabolism, and general nutrition. Clinical end users, including elderly populations and recovering patients, are increasingly adopting whey-based formulations due to their proven benefits in muscle retention, immune support, and healing. The rise of preventive healthcare and physician-recommended nutritional interventions further accelerates segment growth.

Age Group Insights

The 25–45 age group leads overall demand, balancing disposable income with a strong interest in fitness, lifestyle enhancement, and preventive health. This demographic is the primary consumer of RTD shakes, isolates, and protein-enriched functional snacks.

Young adults aged 18–25 represent the fastest-growing segment, influenced heavily by social media, fitness influencers, and the popularity of aesthetically driven health goals. They prefer flavoured powders, energy-protein hybrids, and convenient whey-based beverages. Meanwhile, consumers over 45 are increasingly adopting whey for muscle preservation, bone health, and age-related nutritional needs, making them an important emerging demographic.

| By Product Type | By Application | By Distribution Channel | By End User | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the global market leader, commanding approximately 36–38% of global whey protein demand in 2024. The region's growth is underpinned by high gym penetration, a well-developed supplement ecosystem, and widespread consumer education about protein benefits. The U.S., in particular, benefits from advanced dairy processing facilities, strong R&D investments, and a robust sports nutrition culture. Additional drivers include rising trends in clean-label protein, high adoption of keto and high-protein diets, and significant penetration of RTD protein beverages. Canada’s demand is supported by growing fitness participation and government-backed health awareness programs.

Europe

Europe is a mature yet steadily growing market, particularly in Western European countries such as Germany, the U.K., and France. Growth is driven by strong consumer preference for clean-label, organic, and sustainably sourced whey products. Strict regulations supporting transparency, traceability, and quality assurance have accelerated the adoption of premium whey protein isolates and hydrolysates. Furthermore, Europe’s thriving functional foods market and increasing adoption of high-protein bakery and dairy products contribute meaningfully to regional expansion.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional market, valued at approximately USD 1.46 billion in 2024 and expanding rapidly. China and India serve as the primary growth engines, supported by rising disposable incomes, rapid urbanisation, and heightened awareness of protein deficiencies. Fitness culture, including gym memberships and home-based workouts, has grown exponentially in these countries. Government-backed nutrition programs in nations like China, Japan, and Australia also promote high-protein diets, stimulating demand for whey-based foods. The region additionally benefits from the expansion of local manufacturing units, reducing import dependency and improving product accessibility.

Latin America

Latin America’s whey protein market is growing steadily, led by Brazil and Mexico. Increasing gym culture, sports participation, and rising consumption of fortified foods are central drivers. Brazil’s expanding middle class and higher awareness of protein-rich diets strengthen the region’s demand. Import-friendly regulations for sports nutrition products in many Latin American countries also facilitate the entry of international whey brands. The growth of whey use in confectionery and RTD beverages within urban populations further contributes to market expansion.

Middle East & Africa

The Middle East & Africa region shows strong emerging potential, particularly in the Gulf Cooperation Council (GCC) countries such as the UAE, Saudi Arabia, and Qatar. Regional growth is driven by rising disposable incomes, rapid adoption of Western fitness habits, and strong demand for premium nutritional supplements. Government campaigns promoting active lifestyles, combined with increased investment in fitness centres and sports infrastructure, are fueling whey protein adoption. In Sub-Saharan Africa, urbanisation, nutritional awareness, and the emergence of local supplement distributors are gradually increasing market penetration despite infrastructural challenges. Partnerships between global whey manufacturers and regional dairy cooperatives are further enhancing supply availability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Whey Protein Market

- Glanbia plc

- Fonterra Co-operative Group Ltd

- Arla Foods

- Hilmar Cheese Company

- Lactalis Ingredients

- FrieslandCampina

- Saputo Inc.

- Olam International (dairy-ingredient business)

- Agropur

- Agri-Mark

- Carbery Group

- Danone

- Kerry Group

- Savencia Fromage & Dairy

- Milk Specialities Group