Clean Label Emulsifiers Market Size

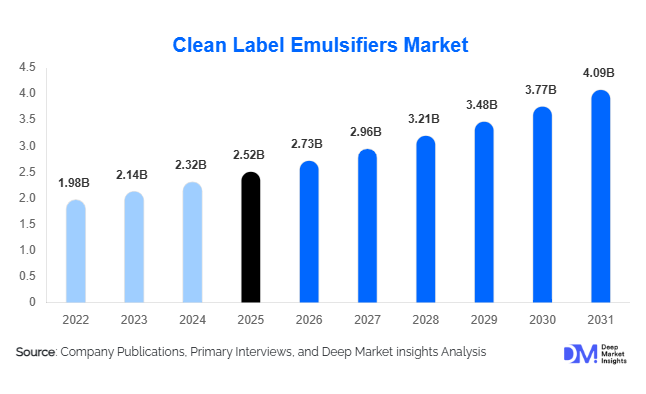

According to Deep Market Insights, the global clean-label emulsifiers market was valued at USD 2.52 billion in 2025 and is projected to grow from USD 2.73 billion in 2026 to approximately USD 4.09 billion by 2031, expanding at a CAGR of 8.4% during the forecast period (2026–2031). The clean label emulsifiers market growth is primarily driven by increasing consumer demand for transparent ingredient labeling, rising regulatory pressure to eliminate synthetic additives, and strong reformulation activity across food, beverage, and adjacent industries.

Key Market Insights

- Plant-based emulsifiers dominate the market, driven by vegan, non-GMO, and allergen-free positioning, particularly sunflower and starch-based variants.

- Bakery and confectionery applications account for the largest share of demand, as manufacturers replace synthetic emulsifiers without compromising texture or shelf life.

- Europe leads global consumption, supported by stringent clean-label regulations and strong consumer awareness.

- Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, growth in packaged foods, and expanding middle-class consumption.

- Food and beverage manufacturers account for over three-fourths of total demand, reflecting widespread reformulation initiatives.

- Technological advances in enzyme modification and fermentation are enabling multifunctional clean-label emulsifiers with improved performance.

What are the latest trends in the clean-label emulsifiers market?

Shift Toward Plant-Based and Fermentation-Derived Emulsifiers

One of the most prominent trends in the clean-label emulsifiers market is the accelerated shift toward plant-based and fermentation-derived solutions. Food manufacturers are increasingly replacing soy-based emulsifiers with sunflower, rapeseed, and starch-derived alternatives to address allergen concerns and non-GMO preferences. Fermentation-derived emulsifiers and biosurfactants are also gaining traction, as they offer enhanced functionality while maintaining clean label compliance. This trend is especially strong in Europe and North America, where consumers actively scrutinize ingredient lists and favor recognizable, minimally processed inputs.

Reformulation of Core Packaged Food Products

Major food brands are reformulating flagship products to eliminate artificial emulsifiers such as DATEM and polysorbates. Clean-label emulsifiers are being adopted across bread, cakes, sauces, dairy alternatives, and ready-to-eat meals. The trend is not limited to premium products; mainstream and private-label brands are also adopting clean label positioning to maintain competitiveness. This reformulation wave is driving sustained demand growth and encouraging long-term supply agreements between ingredient manufacturers and food processors.

What are the key drivers in the clean-label emulsifiers market?

Rising Consumer Demand for Transparency and Natural Ingredients

Consumers across developed and emerging markets are increasingly prioritizing food transparency, ingredient simplicity, and perceived health benefits. Clean-label emulsifiers align closely with these preferences, as they are sourced from familiar plant or animal origins and avoid chemical-sounding names. This behavioral shift has become a foundational growth driver, influencing purchasing decisions across bakery, dairy, and convenience foods.

Regulatory Pressure on Synthetic Food Additives

Stricter food labeling regulations, particularly in Europe and North America, are accelerating the replacement of synthetic emulsifiers. Regulatory authorities are tightening permissible additive lists and encouraging clear labeling, forcing manufacturers to proactively reformulate. Compliance-driven demand has transformed clean-label emulsifiers from optional ingredients into strategic necessities for food producers operating in regulated markets.

What are the restraints for the global market?

Higher Cost Compared to Synthetic Alternatives

Clean-label emulsifiers typically carry higher production and sourcing costs than conventional synthetic emulsifiers. They often require higher dosages or specialized processing, which increases formulation costs for manufacturers. This cost differential can slow adoption in price-sensitive markets and among small- and mid-sized food processors.

Performance Limitations in Complex Applications

While functionality has improved significantly, clean-label emulsifiers may still underperform in high-fat, extreme pH, or long-shelf-life applications compared to synthetic counterparts. Ensuring consistent texture, stability, and shelf life across diverse formulations remains a technical challenge that can delay adoption in certain product categories.

What are the key opportunities in the clean-label emulsifiers industry?

Expansion of Plant-Based and Dairy Alternative Markets

The rapid growth of plant-based dairy, meat analogs, and vegan bakery products presents a major opportunity for clean-label emulsifier suppliers. These products require advanced emulsification systems to replicate traditional textures and mouthfeel. As global plant-based food sales continue to rise at double-digit growth rates, demand for clean-label emulsifiers tailored to alternative proteins is expected to expand substantially.

Emerging Demand from Personal Care and Nutraceuticals

Beyond food applications, clean-label emulsifiers are gaining traction in personal care, cosmetics, and nutraceutical formulations. Consumers increasingly prefer “edible-grade” or food-derived ingredients in skincare and supplements. This cross-industry adoption creates new revenue streams and reduces dependence on traditional food applications.

Source Insights

Plant-based emulsifiers represent the largest source segment in the clean-label emulsifiers market, accounting for approximately 62% of global market value in 2025. Their dominance is primarily driven by strong alignment with consumer demand for vegan, allergen-free, non-GMO, and sustainably sourced ingredients. Sunflower lecithin, starch-based emulsifiers, and gum-derived solutions have gained widespread adoption due to their label-friendly perception, stable supply chains, and versatility across bakery, dairy alternatives, and processed food formulations.

The leading growth driver for plant-based emulsifiers is the global shift toward plant-forward diets and clean eating lifestyles, coupled with regulatory pressure to reduce chemically synthesized additives. Food manufacturers increasingly favor plant-based emulsifiers as they enable reformulation without compromising functionality while supporting premium and mainstream clean label positioning. Animal-based emulsifiers, such as egg yolk lecithin and milk-protein-derived emulsifiers, continue to retain relevance in select applications, particularly in traditional bakery, confectionery, and specialty dairy products where their natural emulsification efficiency and sensory performance remain difficult to replicate. However, growth in this segment is comparatively moderate due to allergen labeling concerns and limited suitability for vegan formulations.

Functionality Insights

Emulsification remains the leading functionality segment, representing approximately 44% of total market demand in 2025. This dominance is driven by the fundamental role emulsifiers play in stabilizing oil–water systems across bakery, dairy, beverages, and convenience foods. Clean-label emulsifiers are increasingly used to replace traditional synthetic emulsifiers while maintaining required product consistency, appearance, and mouthfeel. The primary driver supporting emulsification functionality is the continued expansion of processed and packaged food consumption globally, where product stability and uniformity are non-negotiable. Manufacturers are prioritizing emulsifiers that can deliver core emulsification performance using recognizable, minimally processed ingredients.

Stabilization and texture enhancement functionalities follow closely, supported by growing demand for consistent crumb structure in bakery products, smooth textures in dairy alternatives, and viscosity control in sauces and dressings. Shelf-life extension and fat replacement functionalities are gaining importance as manufacturers seek to reduce total ingredient counts and reformulate products with lower fat content without sacrificing sensory quality. These multifunctional demands are accelerating innovation in next-generation clean-label emulsifier systems.

Application Insights

Bakery and confectionery applications dominate global clean-label emulsifier demand, accounting for nearly 31% of total market value. This segment leads due to high emulsifier inclusion rates in bread, cakes, pastries, and chocolate products, where emulsifiers are essential for dough conditioning, aeration, and moisture retention. The leading growth driver in this segment is the large-scale reformulation of everyday bakery staples to eliminate artificial additives while maintaining volume, softness, and shelf stability.

Dairy and dairy alternatives represent the fastest-growing application segment. Growth is fueled by the rapid expansion of plant-based milk, yogurt, cheese, and ice cream categories, all of which require advanced emulsification systems to replicate the mouthfeel and stability of conventional dairy. Clean-label emulsifiers are becoming indispensable in this segment due to consumer expectations for short, natural ingredient lists. Sauces, dressings, and processed foods continue to provide steady demand, driven by the need for phase stability, pourability, and extended shelf life in clean-label formulations. Ready-to-eat meals and convenience foods are also contributing to incremental growth as manufacturers balance clean labeling with functional performance.

End-Use Industry Insights

Food and beverage manufacturing accounts for over 78% of total clean-label emulsifier demand, with a 2025 market value of approximately USD 1.96 billion. This dominance reflects widespread reformulation initiatives across multinational and regional food producers responding to evolving consumer preferences and regulatory expectations. The leading growth driver for this end-use segment is the strategic repositioning of mass-market food products toward clean label compliance.

Personal care and cosmetics represent a fast-growing end-use segment, expanding at over 9% CAGR. Growth is driven by increasing consumer preference for food-grade, naturally derived ingredients in skincare, haircare, and cosmetic formulations. Clean-label emulsifiers enhance product safety perception and align with “edible beauty” and minimal formulation trends. Nutraceuticals and functional foods are also gaining momentum as emulsifiers improve the bioavailability of fat-soluble vitamins, omega fatty acids, and botanical extracts. Clean label compatibility is becoming a critical purchase criterion in these health-oriented categories.

| By Source | By Functionality | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe holds the largest share of the clean label emulsifiers market, accounting for approximately 34% of global demand in 2025, led by Germany, France, the U.K., and Italy. Regional dominance is driven by stringent food additive regulations, mandatory labeling standards, and high consumer awareness of ingredient transparency. European consumers actively scrutinize ingredient lists, compelling manufacturers to adopt clean-label emulsifiers across both premium and private-label products. Early regulatory adoption and strong sustainability mandates continue to reinforce Europe’s leadership.

North America

North America represents around 29% of global market demand, with the United States as the largest single-country contributor. Growth in this region is driven by strong clean eating movements, widespread reformulation by multinational food companies, and high penetration of organic and natural food categories. The presence of leading food ingredient manufacturers and advanced R&D capabilities further accelerates the adoption of innovative clean-label emulsifier solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at over 10% CAGR. China, India, Japan, and South Korea are key contributors, supported by rapid urbanization, rising disposable incomes, and increasing consumption of packaged and convenience foods. Growth is further driven by export-oriented food manufacturing, as regional producers align with global clean label standards to access European and North American markets.

Latin America

Latin America accounts for approximately 7% of the global market share, led by Brazil and Mexico. Regional growth is supported by expanding processed food exports, increasing investments in food manufacturing infrastructure, and the gradual adoption of clean label positioning by regional brands. Multinational food companies operating in Latin America are also transferring clean-label reformulation strategies to local production facilities.

Middle East & Africa

The Middle East & Africa market remains relatively nascent but is steadily expanding. Growth is driven by increasing imports of clean-label food products, rising health awareness among urban consumers, and expanding food processing industries in the UAE, Saudi Arabia, and South Africa. Premium food segments and international foodservice chains are acting as early adopters, laying the foundation for broader market penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Clean Label Emulsifiers Market

- Cargill

- ADM

- DuPont

- Kerry Group

- BASF

- Corbion

- Ingredion

- DSM-Firmenich

- Tate & Lyle

- Palsgaard

- Novozymes

- AAK

- Ashland

- Puratos

- Givaudan