Cheese Market Size

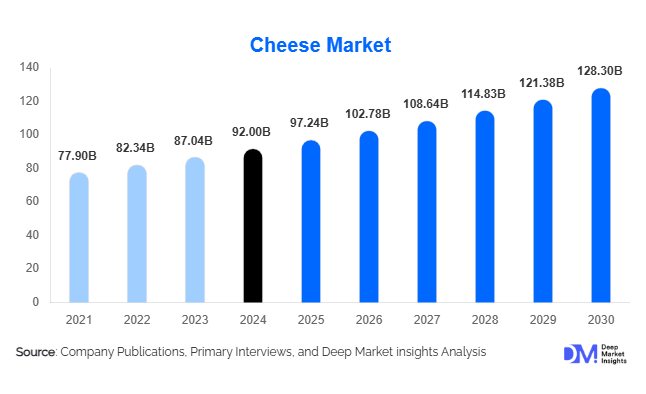

According to Deep Market Insights, the global cheese market size was valued at USD 92.0 billion in 2024 and is projected to grow from USD 97.24 billion in 2025 to reach USD 128.30 billion by 2030, expanding at a CAGR of 5.7% during the forecast period (2025–2030). The cheese market growth is driven by rising global consumption of dairy-based convenience foods, expanding foodservice and quick-service restaurant (QSR) networks, and increasing penetration of cheese in emerging economies across Asia-Pacific, Latin America, and the Middle East.

Key Market Insights

- Natural cheese dominates global consumption, supported by premiumization, clean-label preferences, and strong cultural integration in Europe and North America.

- Mozzarella and cheddar remain the highest-volume varieties, driven by pizza, burgers, and ready-to-eat food demand.

- Foodservice accounts for nearly one-third of global cheese demand, growing faster than household consumption due to urban dining trends.

- Asia-Pacific is the fastest-growing region, led by China, India, and Southeast Asia, from a low consumption base.

- Reduced-fat, organic, and functional cheeses are gaining traction among health-conscious consumers.

- Advancements in packaging and cold-chain logistics are extending shelf life and supporting export growth.

What are the latest trends in the cheese market?

Premium and Artisanal Cheese Gaining Momentum

Premium and artisanal cheeses are increasingly shaping value growth in the global cheese market. Consumers in developed economies are shifting toward specialty cheeses such as aged cheddar, parmesan, blue cheese, and region-specific European varieties, driven by interest in authenticity, taste differentiation, and provenance. Artisanal production methods, organic certification, and grass-fed milk sourcing are becoming key purchase drivers. This trend is particularly pronounced in Europe and North America, where premium cheese commands price premiums of 30–50% over mass-market processed cheese, significantly improving manufacturer margins.

Convenience-Driven Formats and Packaging Innovation

Demand for shredded, sliced, and individually portioned cheese continues to rise, supported by busy lifestyles and home cooking trends. Packaging innovations such as resealable pouches, modified atmosphere packaging, and single-serve formats are extending shelf life and improving usability. These formats are especially popular in retail and foodservice channels, enabling portion control, reduced waste, and faster meal preparation. Convenience-oriented formats now represent over one-third of global cheese sales by value.

What are the key drivers in the cheese market?

Expansion of Foodservice and Quick-Service Restaurants

The rapid expansion of global quick service restraunts (QSR) chains and casual dining outlets has emerged as a major growth driver for cheese demand. Cheese is a core ingredient in pizzas, burgers, sandwiches, and baked products, making it indispensable for standardized foodservice menus. Foodservice demand is growing at over 6% annually, particularly in emerging urban centers across Asia-Pacific and the Middle East, driving large-volume procurement of mozzarella, cheddar, and processed cheese.

Rising Disposable Income and Dietary Westernization

Increasing disposable income and changing dietary preferences in developing economies are accelerating cheese adoption. As consumers transition toward Western-style diets and convenience foods, cheese consumption is rising across households, bakeries, and food processors. Countries such as China, India, Brazil, and Indonesia are witnessing double-digit growth in cheese volumes, supported by urbanization and expanding modern retail infrastructure.

What are the restraints for the global market?

Volatility in Raw Milk Prices

Fluctuating raw milk prices remain a key restraint for cheese manufacturers. Variability in feed costs, climate conditions, and dairy farming regulations directly impacts milk supply and pricing, creating margin pressure. Producers operating in price-sensitive markets often struggle to pass cost increases on to consumers, leading to profitability challenges during inflationary cycles.

Health Concerns Related to Fat and Sodium Content

Cheese is often perceived as high in saturated fats and sodium, which can limit consumption among health-conscious consumers. Although reduced-fat and low-sodium variants are gaining acceptance, traditional full-fat cheese continues to dominate volumes. Regulatory scrutiny and evolving dietary guidelines may further restrain consumption growth unless reformulation and education efforts accelerate.

What are the key opportunities in the cheese industry?

Emerging Market Penetration

Emerging markets represent the largest untapped opportunity for the cheese industry. Per capita consumption in Asia-Pacific and Africa remains significantly lower than in Europe and North America, providing substantial headroom for growth. Localization of flavors, affordable processed cheese formats, and expansion of cold-chain infrastructure are enabling deeper market penetration. Government support for dairy modernization further enhances long-term growth prospects.

Functional and Health-Oriented Cheese Products

The growing focus on health and wellness is opening opportunities for functional cheese products enriched with protein, probiotics, and calcium. Lactose-free, reduced-fat, and organic cheeses are gaining traction among aging populations and fitness-oriented consumers. These products typically command higher margins and strengthen brand differentiation, particularly in developed markets.

Product Type Insights

Natural cheese leads the global market, accounting for approximately 62% of total market value in 2024, driven by strong demand for authentic taste and premium positioning. Processed cheese continues to play a critical role in foodservice and mass retail due to its affordability, consistent quality, and longer shelf life. Mozzarella and cheddar dominate volumes, while specialty cheeses contribute disproportionately to value growth.

Source Insights

Cow milk cheese accounts for nearly 78% of global production, owing to widespread availability, cost efficiency, and suitability for large-scale manufacturing. Goat and sheep milk cheeses, while smaller in volume, are gaining popularity in premium and specialty segments due to distinctive flavor profiles and perceived health benefits.

Distribution Channel Insights

Supermarkets and hypermarkets dominate cheese distribution, accounting for approximately 45% of global sales in 2024, supported by extensive assortments and private-label offerings. Foodservice channels represent the fastest-growing segment, while online retail is expanding rapidly, particularly for specialty and premium cheeses in urban markets.

End-Use Insights

Household consumption remains the largest end-use segment, driven by daily dietary use and home cooking. However, foodservice is the fastest-growing end-use, supported by QSR expansion and rising dining-out frequency. The food processing industry is also emerging as a key demand center, particularly for ready meals, frozen foods, and bakery applications.

| By Product Type | By Source | By Form | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe remains the largest cheese market globally, accounting for approximately 38% of total consumption in 2024. Demand is led by Germany, France, Italy, the United Kingdom, and the Netherlands, where cheese is deeply embedded in daily diets and culinary traditions. The region benefits from high per capita consumption, well-established dairy supply chains, and a wide range of protected and standardized cheese varieties. Strong domestic production, cross-border trade within the European Union, and consistent retail demand support market stability across both mass-market and premium segments.

North America

North America represents around 27% of the global cheese market, with the United States contributing nearly 22% of total market value. Consumption is driven by high usage of cheese in fast food, ready-to-eat meals, and foodservice applications such as pizza, burgers, and casual dining. Large-scale industrial production, strong brand penetration, and consistent demand from institutional buyers underpin regional growth. Canada also contributes steadily through retail and foodservice channels, supported by regulated dairy production systems.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 7%. Growth is concentrated in China, India, Japan, and South Korea, where rising urban populations and increasing exposure to Western-style diets are reshaping consumption patterns. Cheese demand is expanding rapidly across quick-service restaurants, bakery products, and packaged foods. Local production capacity is increasing, supported by multinational dairy companies investing in regional manufacturing and supply chains to meet rising demand.

Latin America

Latin America is experiencing steady growth, led by Brazil and Mexico, which account for the majority of regional consumption. Cheese is increasingly used in processed foods, bakery products, and foodservice menus, supporting volume growth. Urbanization, rising disposable incomes, and expanding retail penetration continue to improve accessibility across both traditional and modern trade channels. Domestic producers play a central role, complemented by imports in premium and specialty categories.

Middle East & Africa

The Middle East & Africa market is characterized by a high reliance on cheese imports, with Saudi Arabia, the United Arab Emirates, and South Africa serving as major demand centers. Consumption is concentrated in urban areas, driven by strong hospitality, tourism, and foodservice activity. High per capita intake in Gulf countries, coupled with a growing preference for Western-style foods, supports demand for both processed and specialty cheese varieties across retail and institutional channels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Cheese Market

- Lactalis Group

- Nestlé

- Danone

- Arla Foods

- FrieslandCampina

- Kraft Heinz

- Fonterra

- Saputo

- Bel Group

- Savencia Fromage & Dairy

- Glanbia

- DMK Group

- Emmi Group

- Yili Group

- Meiji Holdings

Recent Developments

- In March 2025, Arla Foods announced a major expansion of its cream cheese production capacity in Denmark to support growing demand across Europe, North America, and selected Asian export markets.

- In January 2025, Lactalis USA opened a new Culinary & Sensory Institute in Buffalo, New York, aimed at accelerating cheese innovation, recipe development, and foodservice collaboration across its Galbani and Président brands.

- In February 2025, Bel Group confirmed an expansion of its Mini Babybel manufacturing facility in South Dakota, increasing output to meet sustained demand in the U.S. snacking and children’s nutrition segments.

- In April 2025, Saputo Inc. announced capacity optimization initiatives across its North American cheese plants, focusing on higher-margin mozzarella and specialty cheese lines for foodservice and quick-service restaurants.