Quick Service Restaurants Market Summary

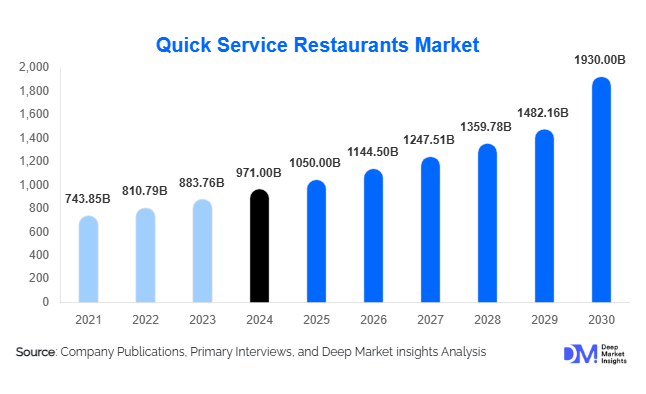

According to Deep Market Insights, the global Quick Service Restaurants (QSR) market size was valued at USD 971 billion in 2024 and is projected to grow from USD 1,058.39 billion in 2025 to reach USD 1,628.46 billion by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). The QSR market growth is primarily driven by rising urbanization, evolving consumer preferences for convenience, increasing disposable incomes, and the rapid adoption of digital ordering and delivery platforms.

Key Market Insights

- Drive-thru and online ordering services are increasingly driving revenue growth, as consumers prioritize speed, convenience, and contactless ordering options.

- Health-conscious menu innovations, such as plant-based and low-calorie options, are expanding customer reach and brand differentiation.

- North America dominates the QSR market, led by the U.S., where established chains and high consumer demand contribute to strong market performance.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, rising disposable incomes, and increasing penetration of international QSR chains in countries like China and India.

- Europe remains steady in growth, with the U.K. and Germany leading demand for diverse cuisines and modern QSR offerings.

- Technological integration, including AI-driven ordering systems, mobile apps, and delivery partnerships, is transforming customer experience and operational efficiency.

What are the latest trends in the quick-service restaurants market?

Digital Ordering and Delivery Services

QSR operators are increasingly leveraging mobile applications, third-party delivery platforms, and self-service kiosks to meet consumer demand for speed and convenience. Digital transformation enables seamless order placement, reduces wait times, and improves customer engagement. The trend of contactless delivery, accelerated by pandemic-driven preferences, has created new revenue channels and expanded market reach. Many QSRs are integrating loyalty programs and real-time order tracking into their digital platforms to improve retention and personalize customer experiences.

Health-Conscious and Sustainable Offerings

Health-focused menus and sustainable practices are gaining traction globally. Consumers increasingly seek plant-based options, low-calorie meals, and allergen-friendly alternatives. QSRs adopting environmentally friendly packaging, reducing food waste, and sourcing ingredients responsibly are attracting eco-conscious customers and enhancing brand loyalty. Chain operators are also introducing transparency in nutritional content to meet regulatory compliance and consumer expectations, positioning themselves as socially responsible brands.

What are the key drivers in the quick-service restaurants market?

Urbanization and Busy Lifestyles

Rapid urbanization and growing working populations have led to increased demand for fast, convenient meals. QSRs cater to this need with quick service models, drive-thru options, and delivery platforms. Urban dwellers and dual-income households increasingly prefer ready-to-eat meals over traditional dine-in options, boosting sales across both developed and emerging markets.

Technological Adoption

The integration of AI-driven ordering, self-service kiosks, mobile apps, and analytics has improved operational efficiency, inventory management, and customer engagement. Digital ordering and automated service options allow QSRs to meet consumer expectations for speed, personalization, and convenience, driving higher revenue growth.

Franchise Expansion

Franchising continues to fuel global QSR growth. Established brands are leveraging franchise models to enter new regions with consistent service and brand standards. This approach reduces capital requirements for operators while accelerating penetration in emerging markets, further increasing the QSR footprint worldwide.

What are the restraints for the quick-service restaurants market?

Intense Market Competition

The QSR sector is highly competitive, with numerous global and local players offering similar products. Price wars, aggressive promotional campaigns, and brand loyalty challenges create pressure on profit margins. Smaller operators may struggle to compete with established chains, potentially limiting market growth in saturated regions.

Regulatory and Compliance Challenges

QSRs must navigate diverse regulations regarding food safety, labor, environmental compliance, and nutritional labeling across multiple countries. Non-compliance can result in fines, reputational damage, and operational disruption, posing a significant restraint for multinational QSR chains expanding globally.

What are the key opportunities in the quick-service restaurants market?

Expansion in Emerging Markets

Emerging economies, particularly in the Asia-Pacific and Latin America, present untapped potential for QSR growth. Rising middle-class populations, urbanization, and increasing disposable incomes create demand for affordable, convenient meals. International QSR chains are rapidly entering these markets to capitalize on growing consumer demand.

Integration of Technology and AI

Adopting technology-driven innovations such as AI for predictive demand planning, personalized recommendations, and delivery route optimization presents a significant opportunity. QSRs using advanced analytics can reduce costs, improve efficiency, and offer enhanced customer experiences, strengthening competitive positioning.

Health & Sustainability Trends

Offering plant-based menu items, allergen-friendly meals, and eco-friendly packaging allows QSRs to appeal to health-conscious and environmentally aware consumers. This strategy not only drives revenue but also strengthens brand perception, aligning with evolving global trends for healthier and sustainable eating.

Product Type Insights

Burgers remain the leading product category, accounting for approximately 28% of the 2024 QSR market. Their affordability, customizability, and global appeal drive continuous growth. Chains are introducing innovative alternatives like plant-based and gourmet burgers to capture niche segments, maintaining their dominance over other product types such as pizza, fried chicken, and sandwiches.

Application Insights

Urban populations constitute the largest end-use segment, contributing nearly 40% of the 2024 market revenue. Fast-paced city lifestyles and increasing dual-income households drive high QSR demand. Emerging applications include corporate meal partnerships, online delivery platforms, and catering for special events, further expanding end-use opportunities.

Distribution Channel Insights

Drive-thru, dine-in, takeaway, and online delivery are the primary channels. Online platforms and mobile apps are rapidly gaining share due to consumer preference for convenience and contactless service. Partnerships with third-party delivery platforms have further enhanced market reach, especially in urban centers.

| By Product Type | By Service Type | By End-Use / Consumer Segment |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the global QSR market with nearly 35% market share in 2024. The U.S. leads due to high disposable incomes, mature urban infrastructure, and the presence of established global chains. Consumer preference for fast, convenient meals continues to drive growth.

Europe

Europe holds approximately 25% market share in 2024, with the U.K. and Germany as major contributors. Urbanization, demand for diverse cuisines, and growing delivery services are supporting steady expansion. Health-conscious menus are particularly popular in this region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by urbanization and rising middle-class incomes. China and India are key markets for international chain expansion. Online food delivery and mobile ordering apps are fueling rapid adoption, creating immense opportunities for new entrants.

Latin America

Brazil and Mexico are leading markets, with moderate growth driven by urbanization and expanding disposable income. Consumers are increasingly embracing QSR convenience, particularly in metro areas.

Middle East & Africa

Urban centers in the UAE, Saudi Arabia, and South Africa are witnessing gradual adoption. High-income populations, combined with international chain expansions, are creating growth potential for premium QSR offerings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Quick Service Restaurants Market

- McDonald's

- KFC

- Subway

- Starbucks

- Domino's Pizza

- Burger King

- Pizza Hut

- Taco Bell

- Dunkin'

- Wendy's

- Popeyes

- Chipotle Mexican Grill

- Five Guys

- Shake Shack

- Carl's Jr.

Recent Developments

- In March 2025, McDonald's expanded its digital ordering and delivery partnerships across Asia-Pacific, introducing AI-driven predictive ordering features.

- In January 2025, KFC launched a plant-based menu in Europe and North America, targeting health-conscious consumers.

- In November 2024, Domino’s upgraded its global supply chain technology, reducing delivery times and improving order accuracy across major markets.