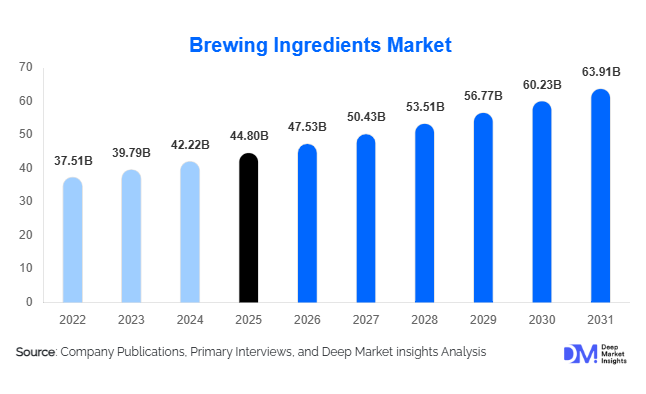

Brewing Ingredients Market Size

According to Deep Market Insights,the global brewing ingredients market size was valued at USD 44.8 billion in 2025 and is projected to grow from USD 47.53 billion in 2026 to reach USD 63.91 billion by 2031, expanding at a CAGR of 6.1% during the forecast period (2026–2031). The brewing ingredients market growth is driven by steady global beer consumption, rapid expansion of craft and specialty breweries, increasing demand for premium and differentiated beer styles, and rising adoption of advanced fermentation and enzyme technologies to improve brewing efficiency and consistency.

Key Market Insights

- Malts remain the dominant ingredient category, accounting for over two-fifths of global market value due to their essential role in fermentation and flavor development.

- Specialty hops and yeast are witnessing accelerated growth, supported by craft beer innovation and demand for unique aroma and flavor profiles.

- Europe leads global demand, supported by strong brewing traditions in Germany, the U.K., Belgium, and the Czech Republic.

- Asia-Pacific is the fastest-growing regional market, driven by rising beer consumption in China, India, and Southeast Asia.

- Low-alcohol and non-alcoholic beer production is reshaping ingredient demand, increasing usage of enzymes, fermentation modifiers, and specialty adjuncts.

- Technological advancements in yeast genetics and precision malting are enabling suppliers to move toward value-added, performance-based ingredient solutions.

What are the latest trends in the brewing ingredients market?

Rising Demand for Specialty and Craft-Oriented Ingredients

The global expansion of craft and regional breweries has significantly altered ingredient demand patterns. Brewers are increasingly seeking specialty malts, aroma and dual-purpose hops, and customized yeast strains to create differentiated beer profiles. This trend has shifted part of the market away from commoditized bulk ingredients toward higher-margin specialty inputs. Suppliers are responding by expanding small-batch malting capabilities, developing proprietary hop varieties, and offering yeast strains tailored to specific beer styles such as IPAs, sour beers, and barrel-aged brews. As a result, specialty ingredients are growing faster than the overall market, particularly in North America and Europe.

Technology-Driven Brewing Efficiency and Consistency

Technological innovation is reshaping brewing ingredient usage, especially through enzyme integration and advanced fermentation solutions. Enzymes are increasingly used to optimize starch conversion, improve yield from alternative grains, and support low-alcohol beer production. Yeast innovation, including strain optimization and genetic mapping, is enabling more predictable fermentation outcomes and consistent flavor delivery. Digital fermentation monitoring and AI-enabled process optimization are also influencing ingredient formulation decisions, strengthening long-term demand for high-performance brewing inputs.

What are the key drivers in the brewing ingredients market?

Steady Growth in Global Beer Consumption

Global beer consumption continues to grow steadily, particularly in emerging economies across Asia-Pacific and Latin America. Urbanization, rising disposable incomes, and expanding middle-class populations are driving increased demand for both mass-market and premium beer products. This directly supports higher consumption of malts, hops, yeast, and adjuncts, ensuring volume stability for ingredient suppliers.

Premiumization and Flavor Innovation

Consumer preferences are shifting toward premium, craft, and specialty beers with distinctive taste profiles. Brewers are investing in high-quality raw materials to differentiate products and command premium pricing. This trend is accelerating demand for specialty malts, aroma hops, and advanced yeast solutions, supporting higher revenue growth per unit of ingredient sold.

What are the restraints for the global market?

Raw Material Price Volatility

Volatility in agricultural raw material prices, particularly barley and hops, remains a key restraint. Climate variability, water availability issues, and supply-chain disruptions can significantly impact crop yields and pricing, affecting ingredient manufacturers’ cost structures and margins.

Regulatory Pressure on Alcohol Consumption

Increasing regulatory scrutiny on alcohol consumption in mature markets poses indirect risks to the brewing ingredients market. Higher excise duties, advertising restrictions, and public health campaigns can moderate beer production volumes, potentially slowing ingredient demand growth in certain regions.

What are the key opportunities in the brewing ingredients industry?

Low-Alcohol and Non-Alcoholic Beer Innovation

The rapid growth of low-alcohol and non-alcoholic beer presents a major opportunity for ingredient suppliers. Producing these beers requires specialized enzymes, fermentation control agents, and sugar alternatives, enabling suppliers to offer high-value, technology-driven solutions. Demand for such products is expanding rapidly in Europe and urban Asia-Pacific markets.

Emerging Market Capacity Expansion

Emerging economies such as India, Vietnam, Brazil, and Mexico are investing in domestic brewing capacity to meet rising consumption and export demand. Ingredient suppliers that localize production, invest in regional malt houses, and establish long-term supply partnerships stand to gain significant market share in these high-growth regions.

Ingredient Type Insights

Malts dominate the global brewing ingredients market, accounting for approximately 42% of total market value in 2025. This leadership is driven by malt’s indispensable role in beer production, influencing flavor, color, alcohol content, and mouthfeel across nearly all beer styles. Demand is further supported by rising production of premium and specialty malts tailored for craft and specialty beers.

Hops represent a smaller but rapidly evolving product segment. Dual-purpose hops continue to lead demand due to their versatility in providing both bitterness and aroma, making them cost-effective for breweries seeking formulation flexibility. Innovation in hop varieties, including aroma-intensive and region-specific cultivars, is expanding their application in premium and craft beer production.

Beer Type Application Insights

Lager beer remains the dominant application segment, accounting for over 70% of total brewing ingredient consumption globally. The segment’s leadership is driven by high-volume production, mass-market appeal, and consistent ingredient demand from macro and industrial breweries.

Specialty and craft beers represent the fastest-growing application segment, expanding at a significantly higher rate than lagers. This growth is fueled by shifting consumer preferences toward differentiated flavors, premium positioning, and experimental beer styles, which require higher-value ingredients such as specialty malts, aroma hops, and customized yeast strains.Stouts, porters, wheat beers, sour beers, and non-traditional styles are contributing to incremental growth in demand for specialty ingredients, particularly in mature beer markets and urban consumption centers where experimentation and limited releases are increasingly popular.

Distribution Channel Insights

Direct manufacturer supply dominates the brewing ingredients distribution landscape, particularly among large industrial breweries that prioritize long-term supply contracts, pricing stability, and consistent quality standards. This channel benefits from economies of scale and integrated supply agreements.

Ingredient distributors play a vital role in serving craft, micro, and regional breweries by offering flexible order volumes, access to diverse product portfolios, and value-added technical support. Their importance continues to grow alongside the expansion of small and mid-sized breweries.Brewing cooperatives are gaining traction in emerging and cost-sensitive markets by aggregating demand, improving bargaining power, and enhancing procurement efficiency for smaller breweries that lack direct supplier access.

End-Use Insights

Macro and industrial breweries account for approximately 65% of global brewing ingredient demand, driven by large-scale production volumes and standardized beer portfolios. Their demand is heavily weighted toward base malts, adjuncts, and process efficiency-enhancing additives.

Craft and microbreweries, while smaller in absolute volume, represent the fastest-growing end-use segment. Growth is driven by innovation-led brewing practices, frequent product launches, and higher per-unit consumption of specialty malts, hops, and yeast.Export-oriented breweries further amplify ingredient demand, particularly in key exporting countries such as Germany, Mexico, and the Netherlands, where international beer shipments require consistent quality and scalable ingredient supply.

| By Ingredient Type | By Ingredient Form | By Brewing Process Stage | By Beer Type Application | By Production Scale | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global brewing ingredients market, accounting for approximately 34% of total market share in 2025. Germany remains the largest national market, supported by its extensive brewery base, strong beer consumption culture, and high malt usage per unit of beer. The U.K., Belgium, and the Czech Republic also contribute significantly, driven by well-established craft, specialty, and traditional beer segments.Key Growth Drivers: strong brewing heritage, high per capita beer consumption, premium and craft beer expansion, innovation in specialty malts and hops, and robust export-oriented brewing activity.

Asia-Pacific

Asia-Pacific accounts for approximately 31% of global brewing ingredient demand and represents the fastest-growing regional market. China is the world’s largest beer producer by volume, driving substantial demand for base malts and adjuncts. India and Southeast Asian countries are experiencing rapid growth fueled by rising disposable incomes, urbanization, and premiumization trends.Key Growth Drivers: expanding brewery capacity, growing middle-class consumption, premium and imported beer demand, increasing acceptance of craft beer, and investments by multinational brewers in local production facilities.

North America

North America holds around 23% of global market share, with the United States dominating regional demand. The region is characterized by a highly developed craft beer ecosystem, driving elevated consumption of specialty hops, advanced yeast strains, and customized malt profiles.Key Growth Drivers: strong craft and independent brewery presence, continuous product innovation, consumer preference for premium and experimental beer styles, and advanced brewing technology adoption.

Latin America

Latin America accounts for roughly 7% of the global brewing ingredients market, led by Brazil and Mexico. Mexico’s role as a major beer exporter significantly supports ingredient demand, while rising domestic consumption across the region underpins steady growth.Key Growth Drivers: export-driven beer production, population growth, expanding middle-class consumption, modernization of brewery infrastructure, and increased availability of premium beer offerings.

Middle East & Africa

The Middle East & Africa region represents approximately 5% of global brewing ingredient demand. South Africa and Nigeria are the primary markets, supported by established brewing industries and growing urban populations. While alcohol regulations constrain growth in some countries, tourism-driven consumption and premium imports sustain niche demand.Key Growth Drivers: tourism and hospitality expansion, premium and imported beer consumption, gradual regulatory easing in select markets, and increasing demand for non-traditional and low-alcohol beer formats.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Brewing Ingredients Market

- Malteurop Group

- Soufflet Group

- Boortmalt

- BarthHaas

- Chr. Hansen

- Lallemand

- Kerry Group

- Cargill

- ADM

- Yakima Chief Hops

- Royal DSM

- Angel Yeast

- AB Mauri

- Muntons

- GrainCorp