Anime Streaming Services Market Size

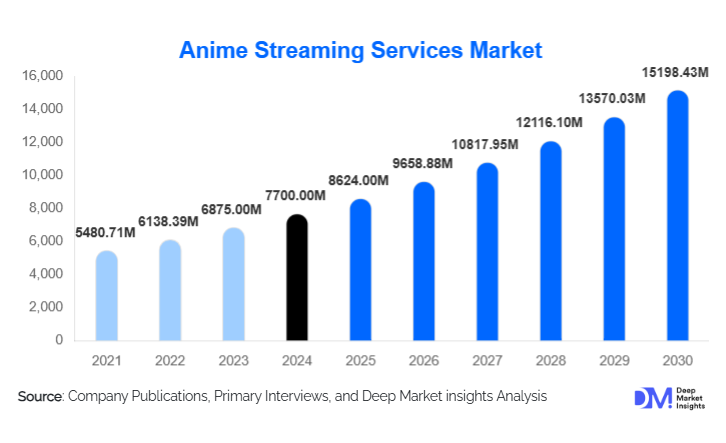

According to Deep Market Insights, the global anime streaming services market size was valued at USD 7,700.00 million in 2024 and is projected to grow from USD 8,624.00 million in 2025 to reach USD 15,198.43 million by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). This market’s rapid expansion is driven by the rising global popularity of anime, the proliferation of digital streaming platforms, and increasing investments in original anime productions and simulcast releases.

Key Market Insights

- Anime is becoming a mainstream entertainment category worldwide, driven by younger demographics, global fandom communities, and cross-cultural appeal.

- SVOD dominates the market as premium and ad-free subscription tiers attract long-term, high-value viewers seeking uninterrupted anime content.

- APAC leads global consumption, supported by Japan’s production ecosystem and strong demand in China, India, and Southeast Asia.

- North America is the fastest-growing premium subscription market, fueled by enthusiastic fan communities and localised dubbing.

- Original anime productions and co-productions by OTT giants are redefining competitive differentiation and long-term monetisation.

- AI-powered dubbing, recommendation engines, and localisation technologies are accelerating global adoption and reducing production timelines.

What are the latest trends in the anime streaming services market?

Localisation and Multi-Language Dubbing Surge

Platforms are investing heavily in localised dubbing, Spanish, French, Hindi, Portuguese, Bahasa, and Arabic, to make anime more accessible to global audiences. Localisation significantly increases watch-time and reduces drop-off rates for non-English-speaking markets. AI-driven dubbing and automated subtitle generation are accelerating turnaround times for new releases, enabling global simulcasts. This trend has made anime more culturally inclusive, allowing platforms to penetrate regions previously limited by language barriers.

Technology-Enhanced Streaming and Fan Engagement

Anime platforms are leveraging advanced technological tools such as AI-based content recommendations, predictive analytics for viewer behaviour, and machine-learning-assisted personalisation. Fan engagement features, digital collectables, anime community forums, livestream events, and gamification are now embedded directly within platforms. Some studios are experimenting with VR anime worlds and AR character interactions. Streaming apps increasingly include manga integration, real-time chat, character databases, and exclusive behind-the-scenes content to deepen user immersion.

What are the key drivers in the anime streaming services market?

Rising Global Anime Consumption

Anime has shifted from niche entertainment to a global cultural phenomenon. International viewership expanded by more than 22% in 2024, driven by widespread streaming availability and rising fan communities. Popular franchises and manga adaptations continue to fuel subscriber growth for major platforms, with increasing acceptance across Western and Asian audiences.

Expansion of Mobile and Affordable Digital Streaming

Over 65% of anime content in emerging markets is consumed via mobile devices. Affordable mobile broadband in India, Indonesia, the Philippines, Brazil, and Africa is accelerating the adoption of both AVOD and freemium models, enabling anime platforms to reach mass-market audiences.

Growth of Original Anime Content and Simulcasts

OTT platforms are investing in exclusive anime productions to attract and retain subscribers. Original anime titles typically deliver stronger lifetime value due to exclusivity and global fan engagement. Simulcast releases, broadcasting new episodes internationally within hours, reduce piracy and strengthen community-driven viewership.

What are the restraints for the global market?

Rising Licensing and Production Costs

The competitive rush for exclusive anime titles has driven licensing costs up by more than 20% over the past three years, pushing smaller platforms out of premium content acquisition. This cost inflation affects profitability and limits the content diversity of smaller or regional operators.

High Piracy Levels

Piracy remains a major barrier in emerging markets, where illegal anime streaming websites and apps attract large user bases. Piracy levels above 30% in some regions directly impact subscriber conversions and advertiser interest, making monetisation more challenging for legitimate platforms.

What are the key opportunities in the anime streaming industry?

Localised Content Expansion

The largest opportunity lies in linguistic and cultural localisation. Platforms investing in dubbed content for Europe, LATAM, and South Asia can unlock tens of millions of new viewers. Localisation enhances user comfort and improves retention, particularly for younger viewers and casual anime audiences.

Co-Productions and Global Anime Originals

Co-production partnerships between Japanese animation studios and global OTT platforms offer high-return opportunities. These collaborations produce exclusive titles, strengthen global anime ecosystems, and diversify storytelling across genres and cultures. Original anime content yields 2–3× higher engagement compared to licensed titles.

Immersive Fan Ecosystems and Gamified Communities

Fan-driven digital ecosystems, virtual meetups, collectable digital art, anime-themed NFTs, and AR/VR experiences create new revenue streams beyond streaming. These immersive platforms increase brand loyalty and reduce churn, positioning companies to generate premium subscription upgrades.

Product Type Insights

Subscription Video-on-Demand (SVOD) dominates the market, representing 48% of total revenue in 2024. Its appeal stems from uninterrupted viewing, premium simulcast access, and exclusive original anime series. AVOD serves price-sensitive markets, while TVOD remains relevant for select blockbuster releases. Co-production and licensing revenues continue rising as OTT platforms deepen their collaborations with Japanese studios.

Application Insights

Anime series account for the largest share (56%) due to long story arcs and strong binge-watching appeal. Anime films and OVAs serve as supplementary formats. Simulcasts have become critical for global fan engagement, while platform-exclusive originals are essential for differentiation. Anime applications extend into educational content, virtual fan festivals, gaming crossovers, and transmedia storytelling.

Distribution Channel Insights

Owned digital platforms dominate distribution with 62% market share in 2024, owing to superior user experience, data analytics, and full control over monetisation. Third-party aggregators like Amazon Channels expand reach, while telecom bundling enhances affordability in emerging markets. Smart TV app stores and gaming consoles continue to widen device penetration.

Traveller Type Insights

Although not a travel market, demographic insights show that the 18–34 age group represents 49% of all anime streaming consumption. This tech-savvy segment drives demand for mobile streaming, dubbed content, and premium subscriptions. Users aged 35 prefer dubbed content and long-form series.

Age Group Insights

The 18–34 demographic commands the largest consumption share, aligning with high digital adoption and fandom culture. The 35–54 segment contributes to premium tier growth, particularly for family-oriented anime content and nostalgia-driven series. The under-18 group is increasingly influential due to rising anime penetration in schools, streaming education platforms, and mobile-first consumption patterns.

| By Revenue Model | By Content Type | By Device Type | By User Demographics | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents 27% of the global market, with the U.S. holding the majority share. High disposable income, localised dubbing, and strong fandom conventions fuel growth. Premium subscription adoption is significantly higher than in other regions.

Europe

Europe holds a 16% share, with strong anime communities in France, Germany, and the U.K. Demand for localised dubbing and simulcasts continues to surge. Europe is one of the fastest-growing regional markets due to cultural acceptance and established streaming infrastructure.

Asia-Pacific

APAC is the largest region with 43% market share. Japan remains the content creation hub, while China and India drive large-scale consumption. Southeast Asia is experiencing explosive growth due to affordable mobile data and regional anime platforms.

Latin America

LATAM accounts for 7% of the market, with Brazil and Mexico leading adoption. Anime is deeply embedded in youth culture, making LATAM one of the fastest-growing AVOD-driven regions.

Middle East & Africa

MEA captures 7% of the global share. Growth is driven by rising youth populations and improving internet access. The UAE and Saudi Arabia lead premium subscriptions, while Africa shows strong potential for ad-supported models.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Anime Streaming Services Market

- Crunchyroll

- Netflix

- Disney+

- Bilibili

- Tencent Video

- Amazon Prime Video

- Hulu

- Ani-One Asia

- Muse Asia

- IQIYI

- HIDIVE

- Wakanim

- TrueID

- U-Next

- Rakuten Viki

Recent Developments

- In March 2025, Crunchyroll expanded its AI-driven dubbing capabilities, reducing localisation timelines by 30% for new anime titles.

- In February 2025, Netflix announced five new global anime co-productions with Japanese studios, strengthening its original anime slate.

- In January 2025, Bilibili launched a new anime production fund aimed at supporting emerging creators and global collaborations.