Subscription Video on Demand Market Size

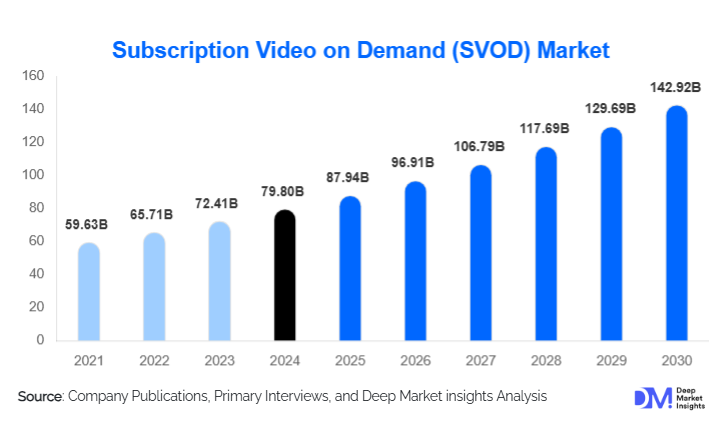

According to Deep Market Insights, the global subscription video on demand market size was valued at USD 79.8 billion in 2024 and is projected to grow from USD 87.94 billion in 2025 to reach USD 142.92 billion by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The SVOD market growth is primarily driven by rapid internet penetration, rising global consumption of on-demand digital content, and increasing investments in original and localized programming. Changing consumer behavior, migration from linear TV, and the rapid adoption of smartphones and smart TVs are accelerating the expansion of SVOD platforms across both mature and emerging regions.

Key Market Insights

- Movies remain the leading content category, representing the single largest share of global SVOD consumption due to their universal appeal and strong library-driven subscriber retention.

- Smartphones dominate as the primary streaming device, especially across Asia-Pacific, Africa, and Latin America, where mobile-first video consumption drives subscriber growth.

- North America accounts for approximately 44% of global SVOD revenue, driven by a mature streaming ecosystem and a high willingness to pay for premium content.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class spending, affordable subscription tiers, and unprecedented mobile broadband expansion.

- Localized content is becoming a critical differentiator, with platforms investing heavily in regional-language originals to attract non-English-speaking audiences.

- Technology integration, AI recommendations, multi-device ecosystems, and cloud-based streaming infrastructure are enhancing user experience and reducing churn rates.

What are the latest trends in the subscription video on demand market?

Localized & Original Content Becoming a Primary Growth Engine

SVOD platforms are increasingly prioritizing original and regional-language content to differentiate themselves from competitors and build long-term subscriber loyalty. Investing in culturally relevant stories, local actors, and region-specific production teams allows platforms to penetrate new demographics. Localization extends beyond dubbed content; platforms are producing originals tailored to individual markets such as India, Korea, Southeast Asia, Latin America, and the Middle East. This shift strengthens brand affinity and reduces dependency on licensed international content. Furthermore, global distribution of non-English originals, popularized by Korean dramas, Spanish thrillers, and Indian series, has transformed regional content into international hits, expanding monetization potential across borders.

Hybrid Subscription Models & Tiered Pricing Strategies

To address market saturation and rising price sensitivity, SVOD providers are adopting hybrid revenue models, including ad-supported plans, mobile-only tiers, and telecom-bundled subscriptions. Affordable mobile tiers have proven especially successful in emerging markets where disposable incomes remain limited, but smartphone penetration is high. Ad-supported SVOD is rapidly gaining traction, enabling platforms to attract cost-sensitive users while generating incremental advertising revenues. Telecom partnerships, where SVOD is offered within broadband or mobile data bundles, are becoming an essential growth strategy that reduces customer acquisition cost and expands rural and semi-urban subscriber bases.

What are the key drivers in the SVOD market?

Global Shift Toward On-Demand Digital Consumption

Consumers worldwide are transitioning from linear broadcast TV to flexible, on-demand content consumption. SVOD services provide ad-free viewing, binge-watching, personalized content recommendations, and multi-device access, features that align perfectly with modern digital lifestyles. The rise of connected TV ecosystems, accelerated by smart TV affordability, is further supporting on-demand viewing. Younger demographics, in particular, expect instant access to diverse genres, languages, and global titles, reinforcing SVOD’s position as the dominant entertainment medium of the future.

Proliferation of High-Speed Internet & Smart Devices

Widespread adoption of 4G/5G networks, fiber broadband, and affordable smartphones is a major catalyst for SVOD growth. Emerging regions with traditionally low adoption of pay-TV services are experiencing a direct leap into digital streaming. As internet quality improves, SVOD platforms can deliver HD and 4K content with minimal buffering, enhancing the viewing experience. Smart TVs, streaming sticks, and gaming consoles have expanded household access points, enabling multi-device streaming and strengthening family subscription plans.

Expansion of Premium & Local Content Libraries

Large-scale investments in blockbuster originals, local-language series, documentaries, sports content (in hybrid SVOD models), and kids’ programming continue to differentiate platforms. Exclusive premieres, global rights licensing, and development of franchise-driven content have become standard strategies to attract and retain subscribers. Localized content particularly boosts engagement in non-English-speaking markets and significantly reduces churn by creating cultural relevance.

What are the restraints for the global market?

Rising Content Production Costs & Market Saturation

Producing premium originals, especially high-budget series and films, requires substantial investment, and competition has intensified bidding for top creative talent. In mature markets such as the U.S. and Western Europe, subscription fatigue is rising as users manage multiple streaming accounts. High customer churn increases acquisition costs, while consumers increasingly switch platforms based on exclusive shows or seasonal pricing, tightening profitability margins.

Regulatory Challenges & Localization Barriers

SVOD platforms must comply with complex content regulations, censorship norms, and data localization mandates across regions. Producing local-language content requires investment in regional talent, studios, and distribution ecosystems. Additionally, political sensitivities or restrictions in certain markets may limit content availability, impacting subscriber acquisition and engagement. Copyright laws, cross-border licensing, and taxation complexities further hinder seamless global expansion.

What are the key opportunities in the SVOD industry?

Deep Penetration Into Emerging Markets

Africa, Southeast Asia, South Asia, and rural Latin America represent vast untapped markets where rising internet access and falling data prices are unlocking millions of new potential subscribers. Platforms offering mobile-only plans, offline viewing, and local-language dubbing/subtitles can scale quickly in these markets. Telecom bundling partnerships and micro-subscription models (weekly/monthly packs) create an accessible entry point for budget-conscious consumers.

Advanced Platform Personalization & AI-Driven Engagement

AI recommendation engines, user behavior analytics, and personalized watchlists increase viewing time and reduce churn. Future opportunities include AI-enhanced dubbing, automated localization workflows, and predictive viewing trends. Multi-profile family accounts and child-safe interfaces strengthen household adoption. Integration with smart home ecosystems, voice assistants, and connected devices further enhances user convenience, creating a competitive advantage for technologically advanced platforms.

Product Type Insights

Movies dominate SVOD content consumption, accounting for approximately 44% of the 2024 global market. Their widespread appeal, cross-cultural relevance, and evergreen library value make them essential for attracting and retaining subscribers. TV series remain the second-largest segment, driven by binge-watching behavior and high engagement rates. Documentaries, kids’ content, and niche genres are growing rapidly as platforms diversify their offerings. Sports-related SVOD formats are emerging in hybrid streaming models, expanding appeal beyond entertainment into live-event viewership.

Application Insights

Household consumption is the largest application segment, reflecting family-based subscription models, multi-profile accounts, and smart TV adoption. Mobile-only consumption is the fastest-growing application, especially across APAC and Africa, where smartphones serve as primary entertainment devices. Educational content, lifestyle programming, fitness streaming, and regional-language storytelling represent emerging application areas that broaden SVOD’s utility beyond entertainment alone.

Distribution Channel Insights

Direct-to-consumer (D2C) apps remain the predominant distribution channel, enabling personalized engagement and direct billing relationships. Telecom/ISP bundles are rapidly expanding, particularly in developing markets where subscription affordability is crucial. Smart TV app stores, connected devices, and streaming boxes such as Roku and Fire TV create additional distribution touchpoints. Social media-driven promotions, creator collaborations, and influencer-based marketing significantly shape subscription decisions among younger audiences.

End-User Insights

Individual households are the core end-user segment, driving the majority of global subscriptions. Families increasingly adopt multi-user premium tiers for simultaneous streaming. Students and young adults contribute significantly to mobile-only plans. Corporate and hospitality sectors represent emerging end-user groups adopting SVOD for customer entertainment, for example, hotels integrating SVOD apps into guest rooms. Diaspora communities continue to boost demand for regional-language content, strengthening global content circulation.

Age Group Insights

Adults aged 25–44 account for the largest share of SVOD subscriptions, driven by digital-first lifestyles, stable incomes, and multi-device usage. Young adults aged 18–24 represent the fastest-growing demographic, relying heavily on mobile devices and student-tier pricing. Older adults (45–65+) are increasingly adopting SVOD as smart TVs become household staples, with preferences leaning toward documentaries, news-based content, and international films.

| By Content Type | By Device / Platform Type | By Subscription Model | By End-User Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest SVOD region, contributing around 44% of global revenue in 2024. High disposable incomes, early adoption of streaming technologies, and a strong content creation ecosystem fuel growth. The U.S. dominates with multiple global streaming giants headquartered locally, while Canada shows strong uptake supported by national broadband initiatives. Premium subscription tiers, ad-supported models, and exclusive originals sustain market maturity.

Europe

Europe represents a stable and diversified market with strong demand for regional-language content across the U.K., Germany, France, and Nordic countries. The region benefits from high broadband penetration and a strong interest in international and local productions. Regulatory frameworks promoting cultural preservation drive investments in European originals. Hybrid monetization models and bundled offers are increasingly popular across Western and Central Europe.

Asia-Pacific

APAC is the fastest-growing SVOD region globally, driven by India, China, South Korea, Japan, and Southeast Asia. Affordable smartphones, mobile-first content strategies, and cultural affinity for serialized entertainment propel adoption. India shows exceptional growth due to low-cost subscriptions and extensive regional-language libraries. Japan and South Korea remain premium markets with high-quality domestic content fueling global cultural influence.

Latin America

Latin America is witnessing rising SVOD adoption supported by expanding fiber networks, growing smartphone use, and rising middle-class incomes. Brazil and Mexico dominate consumption, with strong engagement in local-language films and telenovela-style series. Despite economic fluctuations, low-cost mobile plans and telecom partnerships drive sustained growth.

Middle East & Africa

ME&A is an emerging high-potential region, supported by expanding digital infrastructure and a youthful population. The Middle East, especially the UAE, Saudi Arabia, and Qatar, shows strong premium-tier adoption. Africa’s growth is mobile-first, with Nigeria, Kenya, and South Africa leading demand. Local-language content and telecom bundles are essential strategies for success in these markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Subscription Video on Demand (SVOD) Market

- Netflix

- Amazon Prime Video (Amazon)

- The Walt Disney Company (Disney+)

- Warner Bros. Discovery (Max)

- Apple TV+

- Paramount Global (Paramount+)

- Comcast (Peacock)

- Sony Entertainment

- Roku Channel

- Hulu (within Disney structure)

- Tencent Video

- iQIYI

- VIU

- Hotstar (Disney-owned brand in India)

- BBC iPlayer