Amusement Machine Market Size

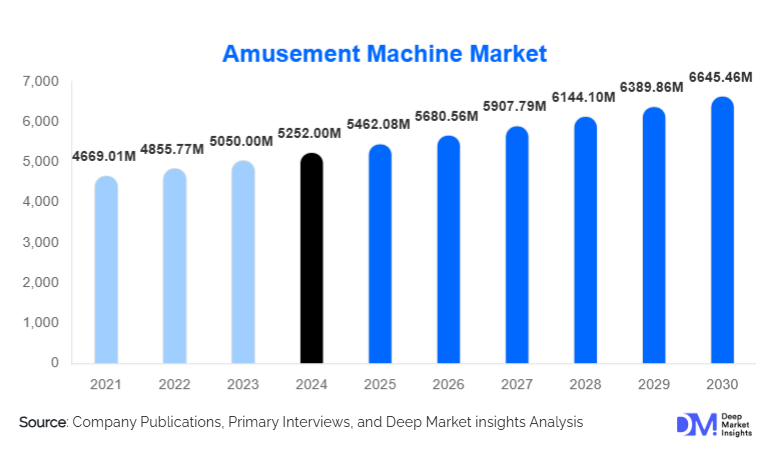

According to Deep Market Insights, the global amusement machine market size was valued at USD 5252.00 million in 2024 and is projected to grow from USD 5462.08 million in 2025 to reach USD 6645.46 million by 2030, expanding at a CAGR of 4.00% during the forecast period (2025–2030). The strong growth trajectory is driven by rising investments in family entertainment centers (FECs), rapid integration of VR/AR technologies in gaming machines, and increasing consumer demand for immersive, interactive entertainment experiences across commercial and hospitality venues worldwide.

Key Market Insights

- Arcade and video-based amusement machines remain the leading product segment, supported by high repeat usage and strong profitability for operators.

- Hardware dominates the component landscape, accounting for more than half of total market revenue in 2024 due to high-value cabinet and display technologies.

- North America is the largest regional market, driven by mature entertainment ecosystems and consistent reinvestment cycles in arcades and FECs.

- Asia-Pacific is the fastest-growing market, fueled by urbanization, rising disposable income, and the expansion of theme parks and indoor amusement venues.

- VR/AR-enabled simulators and connected gaming ecosystems are reshaping user engagement, enabling loyalty integrations, leaderboards, and data-driven performance optimization.

- Commercial installations contribute nearly 70% of global demand, with hospitality, resorts, and cinemas increasingly deploying interactive amusement units to enhance customer engagement.

What are the latest trends in the amusement machine market?

Immersive & Technology-Driven Amusement Experiences

The industry is rapidly shifting toward advanced technologies that elevate consumer engagement. VR simulators, AI-supported gaming environments, and motion-tracking systems are becoming central features in amusement machines, enabling highly immersive experiences. Operators are leveraging cloud-connected leaderboards, touchless payment systems, and recurring digital content updates to enhance replay value and drive higher lifetime machine revenues. Many manufacturers are introducing modular machines that allow software refreshes without full hardware replacement, improving ROI for operators and supporting ongoing innovation cycles.

Growth of Location-Based Entertainment (LBE) Ecosystems

Family entertainment centers, mixed-use retail complexes, and hospitality venues are increasingly integrating amusement machines into broader entertainment ecosystems. The trend toward multi-attraction entertainment hubs, combining arcades, VR arenas, bowling, and dining, has created sustained demand for versatile, durable, and high-engagement amusement systems. Operators prioritize machines that boost dwell time and offer hybrid monetization models, such as digital credits, membership tie-ins, and subscription-based access. This trend is reshaping how consumers interact with amusement content while increasing recurring revenues for machine manufacturers.

What are the key drivers in the amusement machine market?

Rising Consumer Demand for Interactive Entertainment

Modern consumers increasingly seek entertainment formats that are social, immersive, and skill-based. This behavioral shift is driving heightened demand for amusement machines that integrate digital storytelling, high-definition displays, and multi-player functionality. As younger demographics prioritize experience-driven recreation, operators are investing in next-generation machines to capture engagement and stimulate repeat visits.

Expansion of Family Entertainment Centers (FECs)

The global demand for family entertainment centers (FECs) is a major growth catalyst. Entertainment operators are expanding into tier-2 and tier-3 urban centers, while malls, cinemas, and leisure complexes integrate arcades to offset declining footfall in traditional retail. FECs rely heavily on amusement machines as core revenue drivers, prompting continuous investment in new machine categories and updates to existing fleets.

Continuous Innovation & Upgrade Cycles

Machine manufacturers frequently introduce refreshed product lines featuring improved graphics, enhanced motion systems, and expanded software ecosystems. These innovations shorten replacement cycles and support ongoing capital spending from operators seeking to maintain competitive attraction portfolios. The emergence of VR/AR simulators has also created new revenue opportunities and expanded the addressable market.

What are the restraints for the global market?

High Capital Expenditure for Advanced Machines

Premium amusement machines, particularly VR simulators and large-format interactive units, carry high upfront costs, making adoption challenging for smaller operators and limiting penetration in budget-constrained regions. Maintenance costs and periodic upgrades further elevate total ownership expense, slowing market expansion among smaller venues.

Regulatory, Safety, and Compliance Requirements

Strict safety certifications, electrical compliance standards, and government regulations in major regions increase production costs and lengthen development cycles. Variations in regional compliance frameworks create complexities for cross-border distribution. These regulatory hurdles can delay product launches and slow market adoption of new technologies.

What are the key opportunities in the amusement machine industry?

Integration of VR/AR and AI-Powered Experiences

Immersive machines using VR, AR, haptics, and AI are emerging as the next frontier for amusement venues. These technologies enable ultra-realistic simulations and data-driven personalization, attracting tech-driven consumers and allowing operators to command a higher price-per-play. Manufacturers integrating motion rigs, sensory effects, and cloud content updates stand to capitalize significantly on this evolving demand.

Growth in Emerging Markets & Entertainment Infrastructure

Countries across Asia-Pacific, the Middle East, and Latin America are investing heavily in malls, theme parks, tourism zones, and indoor amusement facilities. Rising disposable incomes and a younger demographic profile make these markets highly attractive for new machine installations. Favorable government incentives and relaxed import restrictions further accelerate adoption, creating substantial opportunities for global OEMs.

Product Type Insights

Arcade and video amusement machines dominate the market, contributing nearly 35–40% of total revenue in 2024. Their popularity is driven by high replayability, versatile content updates, and wide demographic appeal. Redemption games continue to grow in popularity among younger audiences, while VR simulators are the fastest-growing sub-segment due to heightened appetite for immersive play experiences. Prize vending machines and claw units remain staples in commercial venues, benefiting from high throughput and strong impulse-play characteristics.

Application Insights

Commercial venues, including amusement parks, FECs, arcades, cinemas, and hospitality centers, account for over 70% of market demand. These environments depend on amusement machines to drive foot traffic, increase dwell time, and generate per-capita revenue. Residential adoption is expanding gradually, fueled by demand for home game rooms and enthusiast collectors, but it remains a smaller segment. Educational and corporate applications are emerging, with gamified simulators being used for training, team-building, and interactive learning experiences.

Distribution Channel Insights

Offline distribution channels dominate with around 60% of total market sales, driven by the need for product demonstrations, physical inspections, and long-term service agreements. Online channels, however, are rapidly expanding as OEMs enhance digital storefronts and operators become more comfortable procuring high-value equipment online. Dedicated B2B marketplaces and OEM direct platforms are accelerating this shift, enabling transparent pricing, product comparisons, and digital support ecosystems.

End-User Insights

The amusement machine market is heavily driven by commercial customers, including arcades, entertainment centers, resorts, and casinos. These segments exhibit high machine utilization rates and frequent refresh cycles. Hospitality venues are increasingly adopting small-format and premium interactive machines to enhance guest experience. Meanwhile, the rise of home-based recreational spaces has introduced new revenue streams for compact, plug-and-play amusement units targeted at residential customers. The expansion of eSports lounges and VR arenas is creating additional niche demand across urban markets.

Age Group Insights

Consumers aged 18–35 represent the most engaged demographic for interactive amusement machines, driven by a strong interest in immersive digital gaming and social entertainment. Families with children also form a critical customer base, fueling demand for redemption games, interactive learning machines, and group-friendly formats. Older adults (45+) are increasingly drawn to nostalgic arcade games and classic pinball machines, supporting steady replacement demand for retro-themed equipment.

| By Product Type | By Component | By Installation Type | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, contributing 30–35% of global revenue. The U.S. leads adoption with strong FEC penetration, established arcade culture, and frequent upgrade cycles. Canada contributes additional demand through tourism-driven entertainment clusters and resort destinations. High disposable income and advanced retail infrastructure further support long-term growth.

Europe

Europe holds approximately 20% market share, with strong demand in the U.K., Germany, France, and Italy. The region benefits from a mix of traditional arcades, modern entertainment complexes, and seasonal outdoor amusement venues. Regulatory clarity and strong consumer spending continue to support sustained investment in new machine formats.

Asia-Pacific

APAC is the fastest-growing region, driven by rising middle-class populations, growth of mega-malls, and extensive expansion of theme parks in China, Japan, South Korea, and India. Rapid urbanization and strong government support for tourism and entertainment development further accelerate market penetration.

Latin America

Latin America is experiencing steady growth, especially in Brazil and Mexico, where mall expansions and rising consumer interest in indoor entertainment are driving adoption. Although economic fluctuations create demand variability, long-term prospects remain positive.

Middle East & Africa

MEA is emerging as a high-potential market due to large-scale entertainment investments in the UAE, Saudi Arabia, and Qatar. Africa’s contribution is growing through tourism-driven entertainment facilities in South Africa, Kenya, and Egypt, though overall market share remains smaller relative to global totals.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Amusement Machine Market

- Bandai Namco

- SEGA Amusements

- Raw Thrills

- UNIS Technology

- Elaut Group

- ICE (Innovative Concepts in Entertainment)

- Bay Tek Entertainment

- Coastal Amusements

- Andamiro

- LAI Games

- Benchmark Games

- Play Mechanix

- Global VR

- Incredible Technologies

- Hanco Technologies

Recent Developments

- In March 2024, Raw Thrills introduced a new multiplayer VR shooter platform featuring cloud-enabled content updates and enhanced motion tracking.

- In July 2024, Bandai Namco expanded its arcade product line with modular cabinets designed for easier maintenance and software upgrades.

- In October 2024, SEGA Amusements announced strategic partnerships with FEC chains across Asia-Pacific to deploy next-generation interactive redemption machines.