Family Entertainment Center Market Size

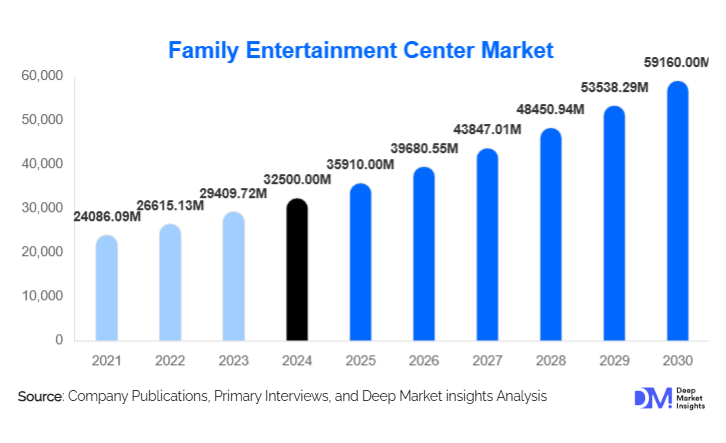

According to Deep Market Insights, the global family entertainment center market size was valued at USD 32500 million in 2024 and is projected to grow from USD 35910 million in 2025 to reach USD 59160 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The family entertainment center market growth is primarily driven by the rising preference for interactive, experience-led indoor entertainment, the expansion of mall-based leisure infrastructures, and increasing consumer spending on recreational activities across emerging and developed economies.

Key Market Insights

- Arcade studios remain the dominant attraction type, accounting for nearly 32% of global revenue in 2024 due to wide accessibility and strong teen engagement.

- Mixed-use retail and mall-integrated FECs continue to expand, leveraging high foot traffic and retail synergies to boost profitability.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, youth population expansion, and rising disposable incomes.

- Teenagers (13–19 years) represent the largest demographic segment, generating 30–35% of total FEC attendance and spending.

- VR/AR-based attractions are emerging as top capital investment areas, as operators modernize facilities to attract tech-driven consumer groups.

- Event hosting and party packages increasingly supplement revenue streams, supporting higher margins and repeat visitation.

Latest Market Trends

Immersive & Technology-Enabled Entertainment Gains Momentum

FEC operators worldwide are shifting from traditional arcade-only models to immersive, tech-enhanced entertainment ecosystems. VR zones, AR-based games, projection-mapped environments, and simulation rides are becoming central attractions that appeal to teens and young adults. Operators are also integrating AI-powered queuing systems, mobile app-based ticketing, and IoT-backed user analytics to personalize experiences and optimize crowd flow. Interactive digital attractions, such as motion gaming walls, e-sports arenas, and multiplayer VR bays, are reshaping how visitors engage with indoor entertainment, resulting in longer dwell times and higher per-capita spending.

Mall-Based Entertainment Anchors Driving FEC Expansion

As retail centers evolve into lifestyle destinations, FECs are increasingly being positioned as anchor tenants within malls. This trend allows real estate developers to boost footfall and diversify tenant mixes, while FEC operators benefit from shared infrastructure and built-in traffic. Many malls are replacing traditional department stores with large-scale indoor parks, trampoline arenas, bowling zones, and family play centers. With retail footfall becoming more experience-driven, mall-based FECs are expected to expand significantly through 2030, especially in Asia-Pacific, the Middle East, and Latin America.

Family Entertainment Center (FEC) Market Drivers

Rising Disposable Incomes and Urban Lifestyle Shifts

Growing middle-class income levels and increased spending on leisure activities continue to drive the FEC market worldwide. Urban families, especially in Asia-Pacific and Latin America, increasingly prefer accessible indoor entertainment options that offer safety, climatic comfort, and a variety of attractions under one roof. As dual-income households and youth demographics expand, FECs benefit from a steady rise in family outings, birthday celebrations, and after-school activities. This shift toward frequent, short-duration entertainment visits directly fuels market growth.

Shift Toward Experience-Led Recreation

Consumers are increasingly prioritizing experiences over material consumption, fueling demand for immersive entertainment formats. FECs combine interactive gaming, social experiences, and themed attractions, making them ideal for families and friend groups seeking memorable engagements. The rising popularity of edutainment zones, VR experiences, and e-sports arenas further amplifies demand for modern FEC environments. Operators are responding by investing in next-generation gaming equipment, simulation attractions, and multi-attraction layouts that encourage longer visits and repeat attendance.

Growth of Mixed-Use and Retail-Entertainment Complexes

Modern retail and hospitality developers increasingly incorporate large-scale FECs into master plans to differentiate their properties. In regions like the Middle East, Southeast Asia, and India, mega-malls and integrated townships treat FECs as essential footfall-generating assets. This real estate convergence has accelerated new FEC openings and upgrades of existing centers. The synergy between dining, shopping, and entertainment makes FECs central to consumer engagement strategies, helping operators scale faster with reduced marketing and infrastructure costs.

Market Restraints

High Initial Capital Expenditure

Developing a modern FEC requires substantial upfront investment in real estate, equipment, safety systems, and high-tech gaming attractions. VR and simulation-based experiences carry particularly high acquisition and maintenance costs. This capital intensity can restrict market entry for smaller operators, especially in high-rent urban zones. Additionally, constant technology refresh cycles can pressure profit margins and necessitate continual reinvestment.

Sensitivity to Economic Cycles and Discretionary Spending

FEC revenues are heavily dependent on consumer discretionary income. During economic slowdowns, families and young adults tend to reduce spending on entertainment activities, directly impacting footfall and ticket revenue. Inflationary pressures, rising cost of living, and geopolitical uncertainties may further curb consumer leisure spending. This cyclical vulnerability remains a key challenge for operators, particularly in regions with volatile economies.

Family Entertainment Center Market Opportunities

Expansion in Emerging Urban Markets

Rapid urbanization in countries across the Asia-Pacific, the Middle East, and Latin America is creating substantial opportunities for new FEC developments. Tier 2 and Tier 3 cities in India, Indonesia, Brazil, and the GCC region are witnessing increased mall construction and rising youth populations, creating ideal environments for FEC operators. These markets remain underpenetrated, enabling early movers to secure prime locations, strong brand visibility, and long-term loyalty.

Advanced Technology Integration (VR/AR, IoT, E-Sports)

Technological advancements present high-return investment opportunities for both established and new entrants. VR-based rides, AR-enhanced gaming zones, kinetic interactive walls, and immersive digital attractions significantly increase visitor engagement and spending. IoT-backed analytics solutions help optimize customer flows, personalize experiences, and drive loyalty. E-sports integrations, such as gaming tournaments and multiplayer lounges, are attracting teenage and young adult audiences, creating new monetization avenues beyond traditional arcades.

Diversification of Revenue Streams

Operators increasingly rely on multi-stream revenue models to enhance profitability. Beyond ticket sales, opportunities are rapidly expanding in party/event hosting, subscription memberships, F&B sales, merchandise, and corporate bookings. Birthday parties, school trips, and team-building events are becoming major revenue contributors. Partnerships with consumer brands for themed zones, sponsorships, and merchandise collaborations are creating additional high-margin revenue channels.

Product Type Insights

Arcade-based FECs remain the leading product category thanks to their universal appeal and lower operational complexity. Mixed-attraction FECs, including bowling, trampolines, VR zones, and soft play, are gaining traction due to their ability to cater to diverse age groups. Edutainment centers are expanding rapidly, particularly in regions with young family demographics. VR-focused FEC formats are emerging as premium offerings, drawing tech-savvy visitors and delivering higher per-visitor revenues.

Application Insights

Recreational and leisure-oriented visits dominate the FEC market, driven by family outings and teen social gatherings. Birthday parties and group events represent the fastest-growing application segment, supported by packaged offerings and dedicated party rooms. Corporate entertainment and team-building sessions are emerging as niche but growing applications in metropolitan markets. Skill-based gaming zones, e-sports lounges, and VR missions are expanding applications into competitive and interactive entertainment formats.

Distribution Channel Insights

Online channels, including direct websites, mobile apps, and third-party aggregators, constitute the dominant booking medium for FEC visits. Digital platforms enable dynamic pricing, loyalty rewards, and seamless ticket management. Offline walk-in bookings remain significant but are increasingly supplemented by digital pre-booking due to convenience and promotional offers. Social media marketing, influencer campaigns, and video-based promotions (TikTok, Instagram Reels) are major drivers of customer acquisition.

Demographic Insights

Teenagers (13–19 years) represent the largest customer demographic, contributing approximately 30–35% of global footfall due to strong interest in social, arcade, and gaming activities. Families with children aged 9–12 form the second-largest segment, driven by demand for safe, indoor, weather-independent entertainment. Young adults aged 20–25 years show growing engagement with VR-based attractions, e-sports arenas, and experience-led offerings. Multi-generational family visits are rising in markets such as the Middle East and Asia-Pacific, contributing to increased demand for versatile attraction mixes.

| By Activity / Attraction Type | By Facility Size | By Revenue Model | By Visitor Demographic |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest FEC market, contributing nearly 35–40% of global revenue in 2024. The U.S. leads regional growth with a dense network of mall-based FECs, upgraded arcade venues, bowling chains, and trampoline parks. High disposable incomes, a strong culture of out-of-home entertainment, and technological adoption support continuous expansion. Canada contributes a stable share, driven by family-oriented entertainment preferences and rapid mall modernization.

Europe

Europe is a mature FEC market with strong demand across Western and Northern Europe. Germany, the U.K., France, and the Netherlands exhibit notable traction for VR-based attractions and edutainment facilities. Cold climate regions reinforce demand for indoor entertainment year-round. Although growth rates are moderate compared to APAC, Europe continues to upgrade legacy FECs into modern, multi-attraction indoor parks.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 25–30% of global demand and demonstrating rapid expansion in China, India, Indonesia, Japan, and South Korea. Rising urban middle-class populations and mall proliferation are major growth drivers. India and Southeast Asia are experiencing significant investment in edutainment centers, trampoline parks, and VR arenas. China continues to scale large indoor theme parks and tech-enhanced attractions, driving the region’s dominant growth trajectory.

Latin America

Latin America is emerging as a growth-ready market with increasing investment in mall-based FECs across Brazil, Mexico, Chile, and Colombia. Economic improvements and rising youth populations are fueling demand for indoor entertainment. Mid-range and budget-friendly FEC formats are gaining traction as operators adapt offerings to local spending patterns.

Middle East & Africa

MEA is experiencing rapid expansion in modern FECs, particularly in the UAE, Saudi Arabia, Qatar, and South Africa. Mega-malls and mixed-use developments continue to integrate multi-attraction FECs as lifestyle anchors. GCC countries are heavily investing in futuristic indoor entertainment concepts, including VR theme parks, edutainment hubs, and augmented digital gaming zones. Africa’s FEC market is smaller but growing steadily through urban retail development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Family Entertainment Center Market

- Dave & Buster’s

- Bowlero Corporation

- KidZania

- Merlin Entertainments (LEGOLAND Discovery Center)

- Sky Zone

- Main Event Entertainment

- CEC Entertainment (Chuck E. Cheese)

- Timezone Group

- Scene75 Entertainment

- Round One Entertainment

- Kings Dining & Entertainment

- Urban Air Adventure Park

- Fun City

- Bogey’s Family Fun Center

- Adventure HQ

Recent Developments

- In 2025, Dave & Buster’s announced a multi-million-dollar upgrade initiative featuring VR arenas and immersive simulation rides across U.S. centers.

- In 2025, KidZania expanded its edutainment franchise footprint in India and Saudi Arabia with new city-based learning-themed FECs.

- In 2025, Sky Zone opened new trampoline and adventure park locations in Australia and Mexico, strengthening its global franchise network.