Allergen-Free Pulse Ingredient Market Size

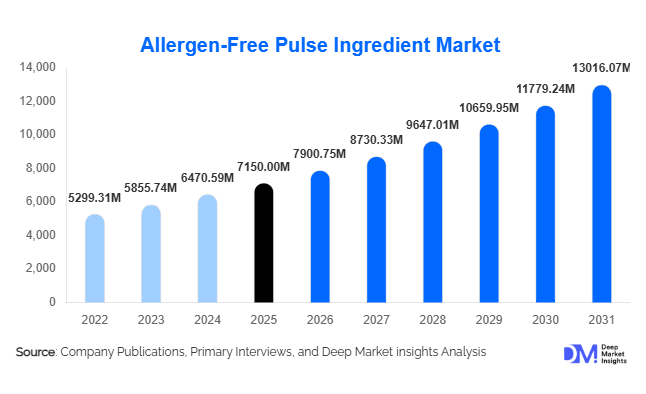

According to Deep Market Insights, the global allergen-free pulse ingredient market size was valued at USD 7,150 million in 2025 and is projected to grow from USD 7,900.75 million in 2026 to reach USD 13,016.07 million by 2031, expanding at a CAGR of 10.5% during the forecast period (2026–2031). The allergen-free pulse ingredient market growth is primarily driven by rising incidences of food allergies, increasing adoption of plant-based diets, regulatory emphasis on clean-label formulations, and expanding demand for soy- and gluten-free protein alternatives across food and beverage applications.

Key Market Insights

- Pea-based ingredients dominate the global market, accounting for nearly 42% of total revenue share in 2025 due to their neutral taste profile and high protein yield.

- Food & beverage applications represent over 74% of demand, led by dairy alternatives, meat substitutes, and protein-enriched bakery products.

- North America holds the largest market share (35%), supported by advanced plant-based product penetration and strict allergen-labeling regulations.

- Asia-Pacific is the fastest-growing region, expanding at nearly 12.8% CAGR due to rising middle-class consumption and expanding processing infrastructure.

- Wet extraction processing accounts for 55% of production, driven by demand for high-purity protein isolates used in premium applications.

- Top five companies control approximately 48% of global revenue, indicating moderate consolidation with strong technological differentiation.

What are the latest trends in the allergen-free pulse ingredient market?

Fermentation-Enhanced Pulse Proteins Gaining Commercial Adoption

Fermentation and enzymatic modification technologies are increasingly used to improve taste neutrality, digestibility, and functionality of pulse proteins. This addresses traditional challenges such as beany off-notes and limited solubility. Fermented pea and chickpea proteins are gaining traction in dairy-free beverages and high-moisture meat analogues. Companies are investing in precision fermentation to produce cleaner labels while maintaining superior emulsification and binding characteristics. This trend is enabling ingredient manufacturers to penetrate premium and clinical nutrition segments where sensory quality and digestibility are critical purchasing criteria.

Shift Toward Soy-Free and Gluten-Free Reformulation

Food manufacturers are actively reformulating products to eliminate top allergens such as soy and gluten. Pulses such as peas, lentils, chickpeas, and faba beans offer strong allergen-free positioning while maintaining protein density and functional stability. Regulatory emphasis on transparent allergen labeling in North America and Europe is accelerating this reformulation wave. Retailers are also pushing private-label brands to adopt allergen-controlled ingredients, further boosting pulse-based ingredient demand across bakery, snacks, and plant-based meat categories.

What are the key drivers in the allergen-free pulse ingredient market?

Rising Food Allergy Prevalence

The increasing incidence of lactose intolerance, gluten sensitivity, and soy allergies is significantly influencing ingredient sourcing strategies. Pediatric and adult allergy cases have risen globally, prompting manufacturers to adopt safer protein alternatives. Allergen-free pulse ingredients provide a viable solution with high protein density and minimal cross-reactivity risks. This driver is particularly strong in North America and Europe, where allergen transparency regulations are stringent.

Expansion of Plant-Based and Flexitarian Diets

Flexitarian and vegan lifestyles are expanding rapidly, supporting demand for alternative protein sources. Pulse-based proteins offer sustainability benefits, including lower water consumption and reduced nitrogen fertilizer requirements compared to animal proteins and soy. Food brands are launching high-protein snacks, dairy alternatives, and ready-to-eat meals fortified with pea and chickpea proteins, strengthening long-term demand.

Corporate Sustainability Commitments

Major multinational food manufacturers are committing to carbon-neutral sourcing and regenerative agriculture. Pulse crops enhance soil nitrogen fixation and support sustainable farming practices. This environmental advantage positions allergen-free pulse ingredients as preferred components in ESG-aligned procurement strategies.

What are the restraints for the global market?

Flavor and Texture Limitations

Despite technological improvements, certain pulse proteins still present off-flavors and texture limitations in complex formulations. High-moisture extrusion for meat analogues requires advanced processing, increasing production costs and limiting adoption among smaller manufacturers.

Raw Material Price Volatility

Pulse crop yields are sensitive to climate variability and global trade disruptions. Price fluctuations impact processing margins and long-term contract pricing. Weather-related production shortfalls in key exporting countries such as Canada and India can tighten supply chains and elevate ingredient costs.

What are the key opportunities in the allergen-free pulse ingredient industry?

Emerging Market Processing Infrastructure

Investments in pulse processing facilities across India, China, and Eastern Europe are creating export-oriented growth opportunities. Governments are encouraging local protein extraction industries to reduce reliance on imported soy. This regional expansion can significantly lower raw material costs while improving global supply resilience.

Clinical and Infant Nutrition Applications

Allergen-free protein isolates are increasingly used in specialized infant formulas and medical nutrition products. As hypoallergenic formulations gain regulatory approvals, demand for high-purity pulse protein isolates is expected to accelerate. This segment commands premium pricing and offers higher margins compared to conventional food applications.

Product Type Insights

Pea-based ingredients dominate the global allergen-free pulse ingredient market, accounting for approximately 42% of total revenue in 2025, supported by strong demand from plant-based dairy and meat manufacturers. The leading position of pea ingredients is primarily driven by the superior functional properties of pea protein isolates, including high solubility, emulsification stability, neutral flavor profile, and protein concentration levels exceeding 80%, making them highly suitable for clean-label and allergen-free formulations. In addition, the widespread cultivation infrastructure and established supply chains in major producing countries such as the United States and Canada ensure consistent raw material availability and competitive pricing.

Chickpea-based ingredients are gaining momentum in gluten-free bakery, snacks, and ready-to-eat products due to their natural binding functionality and high fiber content. Lentil and faba bean ingredients are increasingly utilized in protein fortification and fiber enhancement applications, particularly in fortified cereals, pasta alternatives, and nutritional blends. Wet-extracted isolates remain the leading product category, driven by premium food manufacturers seeking high-purity protein formats for performance-oriented applications. The continued shift toward allergen-free, soy-free, and dairy-free product innovation further strengthens demand across pulse-derived protein concentrates and isolates.

Application Insights

Food & beverage applications represent the largest segment, contributing nearly 74% of global revenue in 2025. The segment’s leadership is primarily driven by rapid expansion in dairy alternatives, plant-based meats, high-protein snacks, and gluten-free bakery products. Growing consumer awareness of food allergies, lactose intolerance, and soy sensitivities has significantly accelerated the integration of allergen-free pulse ingredients into mainstream packaged foods. Additionally, clean-label trends and demand for minimally processed, plant-derived proteins continue to reinforce adoption across global food manufacturers.

Nutraceutical and dietary supplement applications are expanding at a robust pace, supported by rising interest in high-protein, gut-friendly, and easily digestible plant-based formulations. Pulse proteins are increasingly incorporated into protein powders, meal replacements, and medical nutrition products due to their balanced amino acid profiles and lower allergenic risk compared to traditional dairy and soy proteins. Pet food and specialty allergen-controlled animal feed represent emerging niches, particularly in North America and Europe, where premiumization and demand for hypoallergenic formulations are strengthening growth prospects.

Processing Technology Insights

Wet extraction technology leads the market with approximately 55% share in 2025, driven by its capability to produce high-purity protein isolates suitable for premium and performance-oriented food applications. The technology enables improved protein functionality, enhanced texture, and superior solubility, which are critical for plant-based meat analogues and dairy alternatives. The strong demand for protein concentrations exceeding 80% continues to support investment in advanced wet-processing infrastructure.

Dry fractionation is gaining traction due to its lower water consumption, reduced energy usage, and improved sustainability profile. As environmental regulations and ESG commitments intensify globally, food manufacturers are increasingly exploring dry-processing solutions to reduce carbon footprints. Fermentation-enhanced processing represents an emerging technology segment, enabling taste improvement, enhanced digestibility, and reduction of off-flavors often associated with pulse proteins. This technology supports clean-label positioning while improving overall sensory acceptance in finished food products.

Distribution Channel Insights

Direct B2B supply accounts for approximately 61% of total market transactions, as large food and beverage manufacturers prefer long-term procurement contracts to ensure price stability, quality consistency, and secure supply chains. Vertical integration strategies among ingredient processors further strengthen direct supply relationships, particularly in developed markets.

Ingredient distributors play a crucial role in regions lacking localized processing infrastructure, enabling smaller manufacturers to access diversified pulse ingredient portfolios. These intermediaries provide warehousing, quality control, and regulatory compliance support, particularly in emerging markets. Online B2B ingredient platforms are gradually expanding, especially across Asia-Pacific, offering transparent pricing models, global sourcing access, and streamlined procurement processes. Digitalization of ingredient trading is expected to improve market efficiency and supply chain visibility over the forecast period.

| By Ingredient Type | By Application | By Processing Technology | By Form | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global allergen-free pulse ingredient market with approximately 35% share in 2025. The United States dominates regional demand due to its highly developed plant-based food industry, strong retail penetration of alternative proteins, and strict allergen labeling regulations that encourage soy- and dairy-free product reformulation. Rising consumer awareness regarding food allergies and lactose intolerance continues to drive innovation in pulse-derived protein applications.

Canada plays a strategic dual role as both a major producer and exporter of peas and processed protein isolates. Strong agricultural output, advanced processing facilities, and government-backed protein industry initiatives support the region’s competitive advantage. High investment in food technology startups and expansion of plant-based meat production capacity further strengthen regional growth momentum.

Europe

Europe accounts for nearly 29% of global market share, supported by strong sustainability policies and consumer preference for clean-label and non-GMO food products. Countries such as Germany, France, the United Kingdom, and the Netherlands lead regional demand due to rapid growth in plant-based dairy and meat alternatives. Increasing vegan and flexitarian populations significantly contribute to market expansion.

The European Union’s protein diversification strategies and agricultural policy reforms are encouraging regional pulse cultivation and processing investments, reducing dependency on imported soy. Stringent food safety standards and allergen transparency regulations further promote adoption of pulse-based, allergen-free ingredients across food and nutraceutical applications.

Asia-Pacific

Asia-Pacific represents approximately 24% of global demand and is the fastest-growing region with a projected CAGR of 12.8%. China and India serve as both major pulse producers and emerging consumers of allergen-free pulse ingredients. Rising disposable incomes, urbanization, and expanding middle-class populations are accelerating demand for protein-enriched and functional food products.

Japan demonstrates steady growth in functional foods and clinical nutrition applications, supported by an aging population and increased focus on digestive health. Rapid expansion of online ingredient procurement platforms, combined with increasing foreign investment in plant-based manufacturing facilities, further strengthens regional growth prospects.

Latin America

Latin America contributes approximately 6% of global revenue, with Brazil and Mexico emerging as key consumption hubs. Growing awareness of plant-based nutrition, expanding food processing industries, and gradual dietary shifts toward protein diversification are supporting market development. Increasing imports of processed pulse protein isolates are expected as regional manufacturers expand their allergen-free product portfolios.

Middle East & Africa

The Middle East & Africa region accounts for nearly 6% of global share, driven primarily by import-dependent markets such as the United Arab Emirates and Saudi Arabia. Expansion of premium retail chains, rising health-conscious consumer segments, and growth in specialty food sectors are encouraging demand for allergen-free and plant-based ingredient solutions. Government initiatives focused on food security and diversification of protein sources are expected to create long-term opportunities for pulse ingredient suppliers across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Allergen-Free Pulse Ingredient Market

- Roquette Frères

- Ingredion Incorporated

- AGT Food and Ingredients

- Cosucra Groupe Warcoing

- Puris

- Emsland Group

- Axiom Foods

- Burcon NutraScience

- Vestkorn Milling

- Nutri-Pea Limited

- The Scoular Company

- Shandong Jianyuan Group

- ET Chem

- Sotexpro

- Glanbia plc