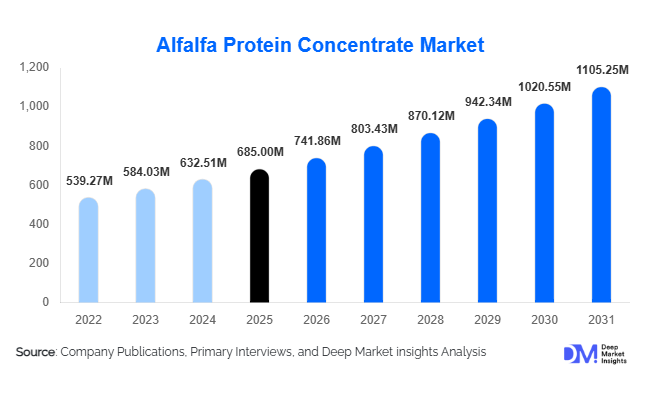

Global Alfalfa Protein Concentrate Market Size

According to Deep Market Insights, the global alfalfa protein concentrate (APC) market size was valued at USD 685 million in 2025 and is projected to grow from USD 741.86 million in 2026 to reach USD 1,105.25 million by 2031, expanding at a CAGR of 8.3% during the forecast period (2026–2031). The market growth is primarily driven by increasing demand for sustainable plant-based proteins in animal feed, growing adoption in human nutrition and functional foods, and technological advancements in green biorefinery processing that enhance protein extraction and yield efficiency.

Key Market Insights

- Animal feed remains the dominant application, particularly in dairy, poultry, and aquaculture, due to alfalfa protein’s high digestibility and amino acid profile.

- Human nutrition and dietary supplements are emerging applications, driven by the global plant-based protein trend and demand for clean-label, non-GMO ingredients.

- Europe currently leads global consumption, supported by strict sustainability mandates, advanced feed formulation technologies, and high consumer awareness of plant-based proteins.

- Asia-Pacific is the fastest-growing region, fueled by rising meat consumption, feed modernization, and increasing awareness of nutritional supplements in China and India.

- Technological adoption in extraction and processing, including mechanical fractionation and green biorefineries, is enhancing protein purity, reducing production costs, and improving scalability.

- Direct B2B contracts dominate distribution channels, reflecting bulk procurement patterns by feed manufacturers, pet food producers, and human nutrition supplement companies.

What are the latest trends in the alfalfa protein concentrate market?

Green Biorefinery and Integrated Processing

APC manufacturers are increasingly adopting green biorefinery techniques that allow the extraction of high-purity protein while generating value from co-products such as fibers and bioactive compounds. These integrated processes enhance profitability, reduce waste, and align with circular economy initiatives. The trend also supports government sustainability programs in the EU, China, and North America, attracting investments in energy-efficient processing infrastructure.

Plant-Based Protein Expansion in Human Nutrition

Rising consumer preference for plant-based diets is driving APC adoption in functional foods, protein powders, and dietary supplements. Flavor-masking techniques, high-protein formulations, and regulatory approvals for food-grade applications are enabling APC to penetrate new markets. Companies are focusing on marketing the nutritional benefits, including essential amino acids and micronutrients, positioning APC as an alternative to soy and whey protein.

What are the key drivers in the alfalfa protein concentrate market?

High Demand for Sustainable Animal Feed Proteins

Livestock producers are increasingly seeking protein-rich, non-GMO feed ingredients to enhance animal health, milk yield, and growth performance. APC’s digestibility and amino acid composition make it an attractive option, particularly in dairy and poultry industries. Rising global meat and dairy consumption, especially in Asia-Pacific, directly supports APC demand.

Technological Advancements in Extraction

Innovations in mechanical fractionation, thermal processing, and enzymatic extraction have improved protein yields and reduced operational costs. This has made APC commercially viable at scale, encouraging its adoption in both feed and human nutrition sectors.

Sustainability and Non-GMO Preference

Alfalfa’s nitrogen-fixing properties, water efficiency, and non-GMO status align with environmental policies and consumer preference for clean-label, eco-friendly products. Retailers and feed integrators in Europe and North America are increasingly prioritizing APC over conventional protein sources.

What are the restraints for the global market?

Higher Cost Compared to Conventional Proteins

APC remains 15–25% more expensive than soybean meal, limiting adoption in price-sensitive livestock feed markets. Cost competitiveness is a key challenge for new entrants and smaller producers.

Limited Awareness in Human Nutrition

Despite nutritional advantages, APC faces barriers in consumer acceptance for dietary supplements and functional foods due to taste, color, and regulatory familiarity. Education and formulation innovations are needed to accelerate adoption.

What are the key opportunities in the alfalfa protein concentrate industry?

Expansion in Human Plant-Based Nutrition

Increasing adoption of plant-based diets offers APC manufacturers a significant opportunity to enter functional foods and dietary supplements. Marketing APC’s high protein content, amino acid profile, and sustainability credentials can help capture growing health-conscious and environmentally aware consumer segments.

Green Biorefinery Technology Integration

Advanced extraction and biorefinery technologies allow producers to improve yields, reduce waste, and monetize co-products like fibers and bioactives. Government support and sustainability mandates further enhance opportunities for technology-driven expansion.

Rising Demand in Emerging Livestock Markets

Rapid livestock industrialization in Asia-Pacific, Latin America, and Africa is driving demand for high-efficiency protein feed. APC can serve as a sustainable alternative to soybean meal amid volatile pricing and import dependence, particularly in China, India, and Brazil.

Product Form Insights

Powdered APC dominates the market with an estimated 62% share in 2025, primarily due to its ease of blending in feed and supplement formulations, ensuring uniform nutrient distribution. Pelletized APC is gaining traction in ruminant feed, offering controlled intake and enhanced durability during transport, which reduces wastage and improves feed efficiency. Liquid APC remains niche but is emerging in high-value applications such as aquaculture and functional beverages, where precise dosing and rapid solubility are critical.

Application Insights

Animal feed remains the leading application, accounting for 71% of global demand, with dairy and poultry sectors driving growth due to the need for high-protein, nutrient-rich diets. Human nutrition, valued at USD 115 million in 2025, is growing at a robust 12% CAGR, fueled by increasing consumer interest in dietary supplements, functional foods, and plant-based protein alternatives. Pet food is emerging, especially in North America and Europe, as premiumization trends push demand for high-quality, protein-enriched formulations. Industrial applications including cosmetics and bio-based ingredients are niche but expanding as sustainability and natural product trends gain traction.

Distribution Channel Insights

Direct B2B contracts dominate global distribution, representing ~60% of sales, reflecting bulk procurement by feed, pet food, and supplement manufacturers. Complementary channels include agro-input distributors and specialty online ingredient platforms, which enhance access for small- and medium-scale buyers. Digital adoption, including online marketplaces for specialty proteins, is accelerating market reach, improving transparency, and enabling faster supply chain response.

End-Use Insights

Animal feed continues to be the largest end-use segment, valued at USD 485 million in 2025, with dairy and poultry driving primary growth. Human nutrition and pet food represent the fastest-growing segments, benefiting from rising consumer awareness of functional foods, nutraceuticals, and premium pet diets. Export-driven demand is increasing from Europe and North America to Asia-Pacific and Latin America, further supporting global market expansion and regional diversification.

| By Product Form | By Protein Concentration | By Application | By Processing Method | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America, accounting for 28% of market share, is a mature and high-value market. The U.S. leads livestock feed adoption due to large-scale dairy and poultry industries. Key growth drivers include strong sustainability mandates, premium feed demand, and technological adoption in feed processing and nutrient optimization. Rising interest in plant-based and alternative proteins in human nutrition and functional foods further supports segment expansion.

Europe

Europe holds 34% of the market share and leads in consumption due to regulatory support for sustainable proteins, advanced feed formulations, and high consumer awareness of plant-based nutrition. Germany, France, and the Netherlands are major importers and processors. Growth is driven by stringent environmental regulations, increasing demand for high-quality feed, and premium human nutrition products, particularly dietary supplements and functional foods.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with an estimated CAGR of 10.5%, led by China, India, and Vietnam. Growth is fueled by rising meat consumption, modernization of feed infrastructure, and increasing health-conscious consumer behavior. Key drivers include expanding livestock production, government initiatives supporting feed quality standards, and rising demand for human nutrition products, particularly functional foods and dietary supplements.

Latin America

Brazil and Argentina are the primary growth engines, particularly in the livestock feed sector. The region benefits from favorable export-import balances, government support for sustainable feed ingredients, and rising demand for high-protein animal feed. Additional growth drivers include expanding aquaculture activities and increased adoption of feed additives that enhance livestock productivity.

Middle East & Africa

Africa hosts key APC production hubs, while GCC countries represent high-value markets for premium feed and nutrition products. Growth is supported by government initiatives promoting sustainable agriculture, rising disposable incomes, and the increasing adoption of fortified feed and functional human nutrition products. Demand is particularly strong in high-income populations seeking premium animal feed and nutraceutical products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Alfalfa Protein Concentrate Market

- Roquette

- Groupe Soufflet

- DLF Seeds

- Sundown Naturals (Plant Protein Division)

- Frutarom (IFF)

- De Sangosse

- Alfalfa Monegros

- Green Plains

- Emsland Group

- Ingredion

- AGT Food and Ingredients

- Fenchem

- Scoular

- Herba Ingredients

- Danish Agro