China Baby Bodysuits Market Size & Outlook, 2025-2033

China Baby Bodysuits Market Insights

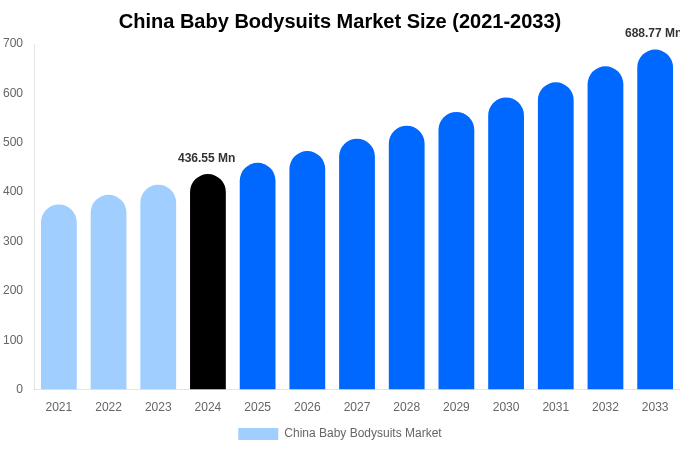

- As per Deep Market Insights insights, the China Baby Bodysuits Market stood at USD 436.55 Million in 2024 and is anticipated to grow to USD 688.77 Million by 2033.

- The China market is expected to advance at a CAGR of 5.25% from 2026 through 2033.

- In 2024, Short-sleeve bodysuits accounted for the highest share of the Product Type market size.

- During the forecast period, Wrap-style and kimono bodysuits is set to register the highest growth, making it the most lucrative Product Type segment.

Source: DMI Analysis Company Publications, Primary Interviews.

Other Key Findings

- China accounted for 8.56% of the global Baby Bodysuits Market size in 2024.

- By 2033, United States is expected to remain the top global market in terms of size.

- Within Asia Pacific, China is forecasted to dominate the regional Baby Bodysuits Market size by 2033.

- Australia will be the fastest-growing market in Asia Pacific, projected to achieve USD 90.91 Million by 2033.

Report Summary

| Report Scope | Details |

|---|---|

| Base Year for Study | 2024 |

| Study Period | 2021-2033 |

| Historical Period | 2021-2023 |

| Forecast Period | 2025-2033 |

| Market Size In 2024 | USD 436.55 Million |

| Market Size In 2033 | USD 688.77 Million |

| Largest segment | Short-sleeve bodysuits |

| Units | Revenue in USD Million |

| CAGR | 5.25% (2025-2033) |

| Segmnetation Covered | |

| Product Type |

|

| Material |

|

| Age Group |

|

| Design and Closure Style |

|

| End Use |

|

| Distribution Channel |

|

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

China Baby Bodysuits Market Product Type 2025-2033 (USD Million)

| Product Type | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Short-sleeve bodysuits | XX.x | XX.x | XX.x | 168.81 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Long-sleeve bodysuits | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Sleeveless and tank-style bodysuits | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Footed bodysuits | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Wrap-style and kimono bodysuits | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: DMI Analysis Company Publications, Primary Interviews.

China Baby Bodysuits Market Material 2025-2033 (USD Million)

| Material | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cotton | XX.x | XX.x | XX.x | 174.57 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Organic cotton | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Bamboo and eco-friendly fabrics | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Polyester and blended fabrics | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Performance and moisture-wicking materials | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: DMI Analysis Company Publications, Primary Interviews.

China Baby Bodysuits Market Age Group 2025-2033 (USD Million)

| Age Group | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Newborn (0–3 months) | XX.x | XX.x | XX.x | 182.91 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| 3–6 months | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| 6–12 months | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| 12–24 months | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: DMI Analysis Company Publications, Primary Interviews.

China Baby Bodysuits Market Design and Closure Style 2025-2033 (USD Million)

| Design and Closure Style | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Snap/button closure | XX.x | XX.x | XX.x | 217.35 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Zipper closure | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Pull-on (stretchable neck) | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Magnetic closure | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: DMI Analysis Company Publications, Primary Interviews.

China Baby Bodysuits Market End Use 2025-2033 (USD Million)

| End Use | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Daily wear | XX.x | XX.x | XX.x | 216.39 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Sleepwear | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Seasonal and festive wear | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Special occasion and premium gifting | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: DMI Analysis Company Publications, Primary Interviews.

China Baby Bodysuits Market Distribution Channel 2025-2033 (USD Million)

| Distribution Channel | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Baby specialty stores | XX.x | XX.x | XX.x | 183.78 | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Department and retail stores | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Online marketplaces | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Brand-owned e-commerce websites | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Subscription box and gifting platforms | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

| Total | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x | XX.x |

Source: DMI Analysis Company Publications, Primary Interviews.

Author :

Olivia Brooks

Olivia Brooks is a Market Research Analyst with more than 4 years of experience in the Consumer Goods and Services Industry. Her work focuses on consumer trend analysis, sustainability evaluation, and innovation research. Olivia’s studies help companies align with shifting consumer values and emerging retail models.

In-depth, exclusive market intelligence designed to accelerate your revenue.

Related Reports

Global

North America

United States

Canada

Europe

Germany

United Kingdom

France

Italy

Spain

Russia

Nordic

Benelux

Asia Pacific

China

India

Japan

Korea

Taiwan

Australia

Singapore

South East Asia

Middle East And Africa

United Arab Emirates

Saudi Arabia

South Africa

Egypt

Nigeria

Turkey

LATAM

Brazil

Mexico

Argentina

Colombia

Chile