Yeast Market Size

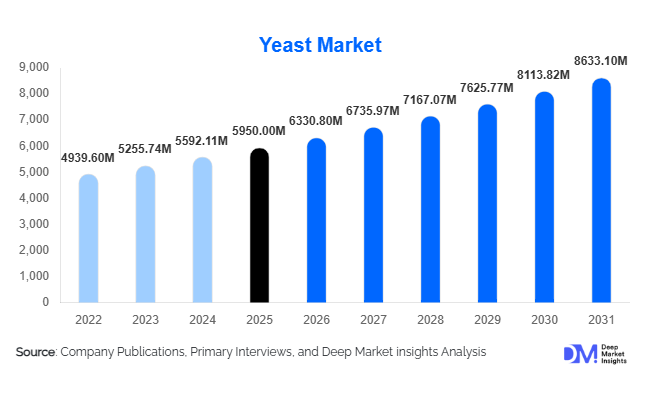

According to Deep Market Insights, the global yeast market size was valued at USD 5,950 million in 2025 and is projected to grow from USD 6,330.80 million in 2026 to reach USD 8,633.10 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The yeast market growth is primarily driven by rising global consumption of bakery products, increasing alcoholic beverage production, expanding demand for animal nutrition solutions, and the growing adoption of yeast in bioethanol, nutraceuticals, and pharmaceutical applications.

Key Market Insights

- Baker’s yeast remains the dominant product category, supported by rising bread and processed food consumption globally.

- Dry yeast leads by form due to longer shelf life, ease of transportation, and suitability for industrial-scale applications.

- Food & beverages account for the largest application share, driven by the bakery, brewing, and fermented food industries.

- Europe holds the largest regional share, supported by a strong baking culture and a mature brewing industry.

- Asia-Pacific is the fastest-growing region, fueled by population growth, expanding bakery capacity, and ethanol blending mandates.

- Technological advancements in strain optimization are improving fermentation efficiency and expanding specialty yeast applications.

What are the latest trends in the yeast market?

Rising Adoption of Specialty and Functional Yeast

Specialty yeast strains designed for targeted applications such as probiotics, nutraceuticals, and pharmaceuticals are gaining traction. Nutritional yeast enriched with B-complex vitamins and proteins is increasingly used in plant-based foods, dietary supplements, and functional beverages. This trend reflects broader consumer preference for clean-label, natural, and health-focused ingredients, positioning specialty yeast as a high-margin growth segment within the market.

Technological Innovation in Fermentation Processes

Yeast manufacturers are investing heavily in strain development, genetic optimization, and process automation to improve fermentation efficiency and yield consistency. Advanced fermentation technologies are enabling faster production cycles, higher alcohol tolerance for bioethanol yeast, and application-specific performance improvements. These innovations are particularly important for large-scale industrial fermentation and biofuel applications, where efficiency directly impacts profitability.

What are the key drivers in the yeast market?

Growth in Bakery and Processed Food Consumption

Rapid urbanization, changing dietary habits, and increasing consumption of packaged and convenience foods continue to drive global demand for bakery products. Baker’s yeast remains an essential ingredient for leavening, texture, and flavor development, making bakery expansion a core growth driver for the yeast market, especially in emerging economies.

Expansion of Bioethanol and Renewable Energy Programs

Government mandates for ethanol blending and renewable fuel adoption are significantly increasing demand for industrial yeast strains. Yeast plays a critical role in fermentation efficiency and alcohol yield, making high-performance strains essential for bioethanol producers. This driver is particularly strong in Asia-Pacific and Latin America.

What are the restraints for the global market?

Volatility in Raw Material Prices

Yeast production relies heavily on agricultural raw materials such as molasses and sugar. Fluctuations in crop yields, climate conditions, and commodity prices can impact production costs and profit margins, posing a key challenge for manufacturers.

Energy-Intensive Manufacturing Processes

Fermentation and drying processes are energy-intensive, making yeast producers sensitive to rising electricity and fuel costs. Smaller manufacturers with limited scale efficiencies are particularly vulnerable to margin pressure.

What are the key opportunities in the yeast industry?

Growth in Animal Nutrition and Feed Yeast

Feed yeast is increasingly adopted as a sustainable protein source in poultry, swine, and aquaculture industries. It improves gut health, immunity, and feed conversion ratios, while reducing dependence on antibiotic growth promoters. This creates strong growth opportunities amid tightening regulations on antibiotic use in animal farming.

Expansion of Functional Foods and Nutraceuticals

The rising global focus on immunity, gut health, and plant-based nutrition is driving demand for yeast-derived functional ingredients. Nutritional yeast and probiotic yeast strains offer significant opportunities for manufacturers to diversify into premium, high-margin segments.

Product Type Insights

Baker’s yeast dominates the global yeast market, accounting for approximately 45% of total revenue in 2025, driven primarily by its indispensable role in bread, rolls, pizza bases, and other baked goods consumed daily across both developed and emerging economies. The leading driver for this segment is the structural growth in industrial baking, supported by urbanization, rising consumption of packaged foods, and the expansion of quick-service restaurants and in-store bakeries. In addition, baker’s yeast benefits from high-volume repeat demand and relatively stable pricing, reinforcing its leadership position.

Brewer’s and wine yeast represent a significant secondary segment, supported by sustained global beer and wine production and the continued rise of craft brewing and premium alcoholic beverages. Demand in this segment is increasingly driven by application-specific yeast strains that improve flavor consistency, fermentation efficiency, and alcohol yield. Feed yeast is among the fastest-growing product categories, fueled by expanding global livestock and aquaculture production and rising demand for sustainable, protein-rich feed additives that enhance gut health and immunity. Meanwhile, specialty and industrial yeast segments are expanding rapidly, driven by bioethanol production, pharmaceutical fermentation, probiotics, and nutraceutical applications, where higher-margin, performance-driven yeast solutions are gaining prominence.

Application Insights

Food and beverage applications account for nearly 60% of global yeast demand, led by bakery, brewing, and fermented food products. The dominance of this segment is driven by yeast’s essential functional role in leavening, fermentation, flavor development, and texture enhancement, making substitution impractical at scale. Bakery applications remain the largest contributor, while brewing and wine fermentation provide stable, value-driven demand through both mass-market and premium alcoholic beverages.

Animal feed applications represent a steadily growing share as yeast-based additives gain wider acceptance in livestock and aquaculture nutrition. The key driver here is the shift toward antibiotic-free feed solutions, with yeast improving feed conversion efficiency, immunity, and digestive health. Industrial fermentation, including bioethanol production, is the fastest-growing application segment, supported by renewable energy mandates and ethanol blending requirements across major economies. Pharmaceutical and nutraceutical applications, although smaller in volume, contribute disproportionately to market value due to premium pricing, driven by the use of yeast in probiotics, vaccine development, and therapeutic protein production.

Distribution Channel Insights

Direct B2B sales dominate the yeast market, accounting for approximately 65% of total distribution, as large food manufacturers, breweries, animal feed producers, and biofuel companies rely on long-term supply contracts to ensure consistent quality, volume security, and pricing stability. The leading driver for this channel is the industrial-scale nature of yeast consumption, where uninterrupted supply is critical to production continuity.

Distributors and wholesalers play a vital role in serving small and medium-sized bakeries, regional breweries, and feed producers that lack the scale to procure directly from manufacturers. Meanwhile, online and specialty retail channels are emerging steadily, particularly for nutritional yeast and consumer-packaged products, supported by growing health awareness, e-commerce penetration, and direct-to-consumer marketing strategies adopted by yeast producers.

End-Use Industry Insights

The bakery and confectionery industry represents the largest end-use segment for yeast, driven by high-volume, daily consumption of bread and baked products, and the continued expansion of industrial baking facilities globally. Alcoholic beverages, particularly beer, form the second-largest end-use segment, supported by stable global beer consumption and growth in craft and specialty brewing.

Animal nutrition is the fastest-growing end-use industry, reflecting rising global meat and seafood demand and increasing adoption of yeast-based feed additives as sustainable protein and functional nutrition sources. Biofuels represent another high-growth end-use segment, as yeast is a critical input in ethanol fermentation processes. Healthcare and life sciences are emerging as high-value end-use industries, with yeast increasingly used in probiotics, vaccines, supplements, and biopharmaceutical manufacturing, supporting long-term value expansion for the overall market.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 32% of the global yeast market share in 2025, making it the largest regional market. Growth in this region is driven by a deeply entrenched baking culture, high per capita bread consumption, and mature brewing and wine industries. Germany, France, and the U.K. are key demand centers due to their strong industrial bakery presence and advanced fermentation capabilities. Additionally, Europe’s early adoption of bioethanol blending policies and strong regulatory support for sustainable food and feed additives continue to support stable yeast demand across both food and industrial applications.

Asia-Pacific

Asia-Pacific represents around 29% of the global market and is the fastest-growing regional market. Growth is driven by rapid population expansion, rising disposable incomes, and increasing consumption of baked and processed foods in China, India, and Southeast Asia. Expanding industrial bakery capacity, growing beer consumption, and government-backed ethanol blending programs are major demand drivers. Additionally, the rapid expansion of livestock and aquaculture production in the region is accelerating the adoption of feed yeast, positioning Asia-Pacific as the primary engine of future volume growth.

North America

North America accounts for approximately 21% of global yeast demand, supported by large-scale industrial baking, a well-established brewing industry, and strong biofuel production in the U.S. and Canada. Growth in this region is driven by continued demand for packaged bakery products, premium and craft beer trends, and sustained investment in bioethanol fermentation infrastructure. The region also benefits from advanced R&D capabilities and early adoption of specialty yeast in nutraceutical and pharmaceutical applications.

Latin America

Latin America holds about 10% of the global yeast market, with Brazil emerging as the dominant demand center. The primary growth driver in the region is Brazil’s large-scale bioethanol industry, where yeast is a critical fermentation input. In addition, rising meat consumption and expanding animal feed production across Brazil, Argentina, and Mexico are driving increased use of feed yeast, while gradual growth in industrial baking supports steady food-sector demand.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of the global market share. Growth is driven by rising bread consumption, population growth, and government-led food security initiatives aimed at increasing local food processing capacity. Expanding bakery infrastructure, particularly in North Africa and the Middle East, is boosting baker’s yeast demand, while the gradual development of animal feed and food manufacturing sectors is supporting long-term market expansion across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|