Women’s Watch Market Size

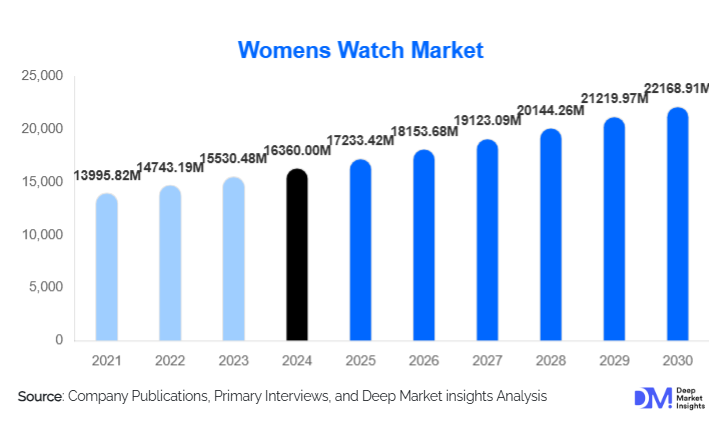

According to Deep Market Insights, the global women's watch market size was valued at USD 16,360.00 million in 2024 and is projected to grow from USD 17,233.42 million in 2025 to reach USD 22,168.91 million by 2030, expanding at a CAGR of 5.34% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of smartwatches, rising fashion-consciousness among women, and the growing demand for luxury and mid-range timepieces in emerging economies.

Key Market Insights

- Smartwatches and hybrid watches are gaining traction, as consumers increasingly prefer multifunctional devices that combine health tracking, connectivity, and style.

- Mid-range and premium watches dominate in terms of volume and value, driven by the balance of affordability, quality, and fashion appeal.

- Asia-Pacific is emerging as the fastest-growing region, led by rising disposable incomes and urbanization in China and India.

- North America and Europe maintain a steady demand for premium and luxury watches, with high brand awareness and technology adoption.

- E-commerce channels are transforming distribution, offering easy access to global brands and enabling personalized shopping experiences.

- Material innovation and sustainable production, including recycled metals and eco-friendly leather, are reshaping consumer preferences and brand positioning.

What are the latest trends in the women’s watch market?

Smartwatch and Hybrid Watch Adoption

The growing popularity of wearable technology is reshaping the women’s watch market. Smartwatches now offer features such as fitness tracking, heart rate monitoring, notifications, and mobile connectivity. Hybrid watches combine traditional analog aesthetics with smart functionalities, appealing to consumers seeking style without sacrificing technology. Customizable watch faces, interchangeable straps, and app ecosystems enhance personalization, attracting younger demographics. Rising interest in health and fitness among women has accelerated smartwatch adoption, making this segment a key driver of market growth globally.

Sustainable and Ethical Watch Production

Eco-conscious consumers increasingly prefer watches made from recycled metals, biodegradable plastics, and vegan leather. Brands adopting transparent sourcing practices, ethical labor policies, and environmentally friendly manufacturing processes are gaining consumer loyalty. Companies are also promoting “green” product lines, leveraging sustainability as a differentiator in competitive markets. This trend aligns with broader fashion and lifestyle movements and is particularly pronounced in Europe, North America, and urban APAC markets, where consumers are willing to pay a premium for eco-friendly and ethically produced watches.

What are the key drivers in the women’s watch market?

Rising Disposable Income and Fashion Awareness

Increasing purchasing power among women globally is fueling demand for mid-range, premium, and luxury watches. Urban populations in Asia-Pacific, North America, and Europe are driving fashion-oriented purchases, where watches are perceived as essential style accessories. Higher disposable income allows consumers to invest in premium designs, smart functionalities, and branded products. Social media influence and celebrity endorsements further accelerate demand for fashionable timepieces.

Technological Advancements in Wearables

Smartwatch innovations, including health monitoring, IoT connectivity, and app-based personalization, have significantly contributed to market growth. Consumers are increasingly seeking multifunctional watches that support fitness tracking, notifications, and lifestyle management. Integration with mobile apps, AI-driven insights, and improved battery life enhances product appeal and drives adoption among tech-savvy women across all age groups.

Fashion and Lifestyle Trends

Watches have evolved from functional devices to fashion statements, particularly among women aged 25–50 years. Trends in personalization, color, material, and limited-edition designs are shaping consumer preference. Urban millennials and Gen Z consumers increasingly view watches as a reflection of personal style and social status, contributing to growing demand across premium and mid-range segments.

What are the restraints for the global market?

High Price Sensitivity in Emerging Markets

In price-sensitive markets, consumers often prefer mid-range or budget watches, limiting the growth of luxury and premium segments. Despite rising disposable incomes, affordability constraints restrict the adoption of high-end watches in countries such as India, Brazil, and parts of Southeast Asia. Brands must balance pricing strategies to ensure accessibility without compromising brand perception.

Counterfeit and Unbranded Products

The prevalence of counterfeit and unbranded watches poses challenges to market growth. Fake products dilute brand value, undermine consumer trust, and reduce sales for legitimate manufacturers. Effective anti-counterfeiting measures, brand authentication technologies, and stringent regulatory enforcement are necessary to mitigate this challenge.

What are the key opportunities in the women’s watch industry?

Emerging Markets Expansion

Rising disposable incomes, urbanization, and fashion-consciousness in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Expanding retail and e-commerce presence in China, India, Brazil, and the UAE allows brands to tap into underserved markets. Regional marketing campaigns and localized product designs can enhance engagement and increase market share.

Integration of Health and Fitness Technology

With the surge in wellness awareness, integrating health and fitness tracking features in smartwatches offers strong revenue potential. Devices capable of monitoring activity levels, sleep patterns, heart rate, and stress management are increasingly preferred by women. This opportunity is particularly prominent in North America, Europe, and APAC, where health-conscious consumers value multifunctional products.

Sustainable and Ethical Product Lines

There is growing potential for eco-friendly and ethically produced watches. Consumers are willing to pay premiums for recycled materials, ethical labor sourcing, and carbon-neutral production. Brands that emphasize sustainability and corporate social responsibility can differentiate themselves, build loyalty, and penetrate environmentally conscious markets in Europe, North America, and urban APAC regions.

Product Type Insights

Smartwatches dominate the market with 28% share due to multifunctionality and health features. Analog watches remain popular in premium segments, particularly in Europe and North America, owing to classic aesthetics and brand heritage. Hybrid watches, combining analog design with smart features, are gaining traction in the Asia-Pacific and Middle East markets. This trend reflects consumer demand for fashion-conscious yet functional timepieces.

Material Insights

Stainless steel watches hold the largest market share at 35% globally, driven by durability, premium appeal, and fashion versatility. Leather watches dominate mid-range segments, while gold and precious metal watches are preferred in luxury segments. Ceramic and plastic materials are primarily used in budget and fashion watches for younger consumers seeking affordability and style variety.

Distribution Channel Insights

Offline retail accounts for 55% of sales, driven by consumer preference for in-store trials and premium brand experiences. Online retail is rapidly growing, facilitated by e-commerce platforms, direct-to-consumer websites, and digital marketing. The online channel is particularly important for mid-range and smartwatches, allowing global brands to expand their reach efficiently. Subscription-based services and D2C models are also emerging as innovative sales channels.

End-Use Insights

Fashion and personal accessory use dominate with 45% share, driven by urban, style-conscious consumers. Sports and fitness applications, including smartwatches, are the fastest-growing segment due to health awareness and wearable technology adoption. Professional and corporate use shows steady demand, particularly in North America and Europe. Export-driven demand is significant from Asia-Pacific to North America and Europe, contributing approximately USD 8.5 billion in 2024.

| By Product Type | By Material | By Price Range | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 28% of the market, with the USA leading due to high disposable income, smartwatch adoption, and fashion awareness. Canada follows with similar demand patterns. The market size in 2024 is approximately USD 9.1 billion. Premium and luxury watches remain popular, while smartwatches see strong adoption among health-conscious women.

Europe

Europe represents 25% of the global market, driven by Germany, the UK, and France. Luxury and premium watches dominate, reflecting mature fashion trends and brand loyalty. Estimated market size in 2024: USD 8.125 billion. Younger consumers drive growth in mid-range and smartwatch segments, influenced by social media and digital trends.

Asia-Pacific

APAC is the fastest-growing region (~12% CAGR), led by China and India. Rising urbanization, growing middle-class incomes, and fashion-conscious female consumers drive demand for mid-range and smartwatches. Japan and South Korea show steady growth, primarily in premium and luxury segments, while Australia focuses on mid-range and fitness-oriented watches.

Latin America

Brazil, Mexico, and Argentina are driving moderate growth. Demand is largely for mid-range watches among urban professionals, with increasing interest in smartwatches and fashion accessories. Export-driven purchases are expanding as brands introduce affordable digital channels.

Middle East & Africa

Luxury and fashion watches dominate in the UAE, Saudi Arabia, and South Africa. Urbanization, high disposable income, and fashion orientation are key drivers. Regional demand is complemented by intra-African exports of premium watches. Smartwatch adoption is gradually rising among tech-savvy populations in metropolitan areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|