Window Coverings Market Size

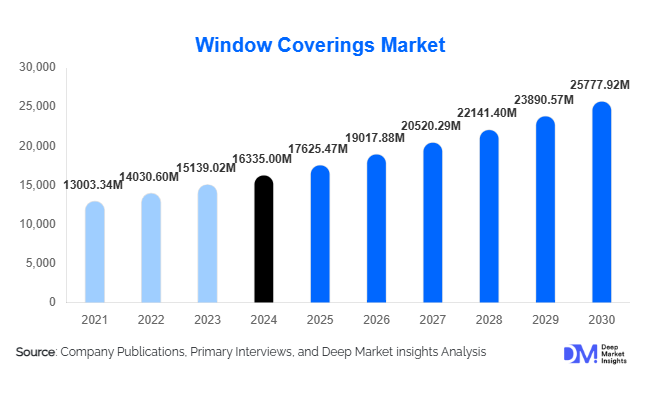

According to Deep Market Insights, the global window coverings market size was valued at USD 16,335.00 million in 2024 and is projected to grow from USD 17,625.47 million in 2025 to reach USD 25,777.92 million by 2030, expanding at a CAGR of 7.9% during the forecast period (2025–2030). The market growth is primarily driven by increasing urbanization, rising adoption of smart and automated solutions, growing awareness of energy-efficient home solutions, and the expansion of residential and commercial infrastructure worldwide.

Key Market Insights

- Automation and IoT integration are reshaping the market, with motorized blinds, smart shades, and app-controlled solutions increasingly preferred in residential and commercial spaces.

- Residential demand dominates the market, fueled by rising disposable income, home renovation trends, and the popularity of energy-efficient and aesthetic window coverings.

- Emerging markets in Asia-Pacific are witnessing rapid growth, driven by urbanization, rising middle-class income, and increased construction activity in countries like China, India, and Southeast Asia.

- Europe and North America remain key premium markets, with strong consumer interest in sustainable, thermal, and smart window covering solutions.

- Energy-efficient and sustainable materials such as thermal curtains, composite shutters, and eco-friendly fabrics are gaining traction globally due to environmental regulations and rising energy costs.

- E-commerce and online retail platforms are increasingly influencing purchase behavior, providing customization, easy delivery, and comparison options.

What are the latest trends in the window coverings market?

Smart and Automated Window Coverings

Motorized blinds, shades, and smart curtains are becoming standard in premium residential and commercial applications. Integration with home automation systems such as Alexa, Google Home, and IoT-enabled control systems allows users to manage light, privacy, and energy efficiency remotely. This trend is particularly strong in North America and Europe, where consumers are willing to invest in convenience and advanced technology. Increasing awareness of energy savings through automated shading solutions also contributes to adoption, while manufacturers are incorporating solar-powered motors and AI-based light control systems for smarter operations.

Sustainable and Energy-Efficient Solutions

Consumers and governments are increasingly prioritizing energy efficiency and eco-friendliness. Thermal curtains, insulated blinds, and recycled or composite materials are seeing rising demand. In Europe, strict energy-efficiency standards for buildings have made energy-saving window coverings essential, while in North America, homeowners seek products that reduce heating and cooling costs. Brands are launching eco-friendly, recyclable fabrics and hybrid materials, appealing to environmentally conscious consumers. This trend also aligns with retrofitting projects, where older buildings are upgraded with energy-efficient window coverings.

What are the key drivers in the window coverings market?

Urbanization and Residential Construction

Rapid urbanization in emerging markets is driving residential and commercial construction, particularly in China, India, and Southeast Asia. Modern apartments, offices, and hotels increasingly incorporate high-quality window coverings. Rising disposable income, growing middle-class households, and urban lifestyle trends are boosting demand for automated, aesthetic, and energy-efficient solutions.

Technological Advancements

Automation and smart integration are major growth drivers. Automated window blinds, IoT-enabled curtains, and app-controlled shades enhance user convenience, energy savings, and home aesthetics. Companies are increasingly investing in R&D to provide wireless controls, solar-powered motors, and AI-assisted light management, creating a premium market segment and differentiating their products from traditional manual options.

Focus on Energy Efficiency

Rising energy costs and sustainability awareness are fueling demand for energy-saving window coverings. Thermal curtains, cellular shades, and insulated blinds help maintain indoor temperature and reduce energy consumption. Government incentives and building codes in North America and Europe further encourage the adoption of energy-efficient window solutions.

What are the restraints for the global market?

High Initial Cost of Automated Solutions

Motorized and smart window coverings have higher upfront costs compared to manual options. Price-sensitive consumers in emerging economies often prefer low-cost solutions, limiting the adoption of advanced products despite long-term energy savings and convenience benefits.

Raw Material Volatility

Fluctuating prices of wood, aluminum, and fabric affect manufacturing costs, impacting product affordability and profit margins. Supply chain disruptions and import dependencies in certain regions further constrain growth, particularly in markets heavily reliant on imported materials.

What are the key opportunities in the window coverings market?

Emerging Markets Expansion

Rapid urbanization and growing middle-class populations in APAC, Latin America, and the Middle East are driving strong demand for modern and cost-effective window coverings. Manufacturers can capitalize on residential and commercial construction projects, targeting both automated and manual solutions.

Smart Home Integration

The increasing adoption of smart homes presents opportunities for IoT-integrated window coverings. Products that offer app control, AI-based lighting optimization, and solar-powered automation are in high demand. Premium residential and commercial projects in North America, Europe, and parts of APAC are particularly promising segments.

Energy-Efficient Solutions

Government incentives, sustainability mandates, and rising energy costs are promoting the adoption of thermal curtains, insulated blinds, and eco-friendly materials. This creates opportunities for both new entrants and established manufacturers to differentiate products and command premium pricing.

Product Type Insights

Blinds are the leading product type, capturing approximately 35% of the market in 2024 due to versatility, cost-effectiveness, and suitability for both residential and commercial applications. Venetian and roller blinds dominate, driven by customizable designs, light control, and ease of installation. Curtains and drapes hold a significant share as well, particularly in residential applications, where aesthetic appeal is crucial. Shutters and shades are growing steadily due to increasing preference for energy-efficient and durable solutions.

Material Insights

Fabric remains the most widely used material, representing about 38% of the market in 2024. Its aesthetic appeal, variety of textures, and compatibility with thermal and blackout applications drive its dominance. Wood and aluminum are preferred in premium and commercial segments, while vinyl and composite materials are popular in cost-sensitive or industrial applications.

Operation Type Insights

Manual window coverings continue to dominate globally with 52% market share in 2024 due to affordability and low maintenance. Motorized solutions are gaining traction in developed markets, while smart IoT-enabled products are capturing premium residential and commercial projects, particularly in North America and Europe.

Distribution Channel Insights

Offline retail channels hold the majority market share (55%) as consumers prefer physically inspecting products before purchase. E-commerce platforms are rapidly growing, offering convenience, customization, and direct-to-consumer sales. B2B channels, including interior design partnerships and project-based contracts, are also significant, especially in commercial segments.

End-Use Insights

The residential segment dominates with a 60% market share, driven by new housing projects, urbanization, and renovation trends. Commercial applications, including offices, hotels, and retail spaces, are growing steadily due to rising demand for energy-efficient and aesthetically pleasing solutions. Emerging end-use applications include healthcare, education, and co-working spaces, emphasizing privacy, light control, and energy savings. Export-driven demand from North America and Europe also supports growth, with Asia-Pacific manufacturers supplying premium window coverings globally.

| By Product Type | By Material | By Operation Type | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 28% of the market, with U.S. demand exceeding USD 6,500 million in 2024. The market is driven by high adoption of smart home solutions, energy-efficient products, and commercial infrastructure upgrades. Automated and premium window coverings are particularly popular in residential and hospitality sectors.

Europe

Europe holds 25% of the market, led by Germany, France, and the U.K. Demand is driven by energy efficiency standards, smart solutions, and high aesthetic preference. Germany alone represents USD 3,500 million in 2024. Europe is also an early adopter of sustainable and thermal window coverings, creating opportunities for premium segments.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of 7.5%, driven by China, India, and Southeast Asia. Rising urbanization, increasing disposable income, and construction activity fuel demand. Both manual and automated solutions are witnessing growth, with smart and energy-efficient products increasingly adopted in premium projects.

Middle East & Africa

MEA is growing steadily, led by GCC countries such as the UAE and Saudi Arabia. High-income populations and luxury real estate projects are driving demand for automated and aesthetic solutions. Intra-African adoption is also increasing with commercial and hospitality investments.

Latin America

LATAM is experiencing moderate growth, with Brazil and Mexico leading demand. Infrastructure expansion and hospitality projects are boosting adoption, particularly for durable and aesthetically appealing window coverings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Window Coverings Market

- Hunter Douglas

- Saint-Gobain

- Springs Window Fashions

- 3 Day Blinds

- IKEA

- Graber Blinds & Shades

- Norman Window Fashions

- Bali Blinds

- Levolor

- Lutron Electronics

- Alta Window Fashions

- Coulisse

- Luxaflex

- MechoShade Systems

- Velux

Recent Developments

- In March 2025, Hunter Douglas launched a new line of smart motorized blinds integrated with AI-based light control for premium residential projects in North America and Europe.

- In January 2025, Saint-Gobain introduced energy-efficient thermal curtains and eco-friendly composite shutters in Europe, targeting sustainable building mandates.

- In February 2025, Springs Window Fashions expanded its e-commerce platform to offer customized automated window solutions globally, enhancing direct-to-consumer reach.