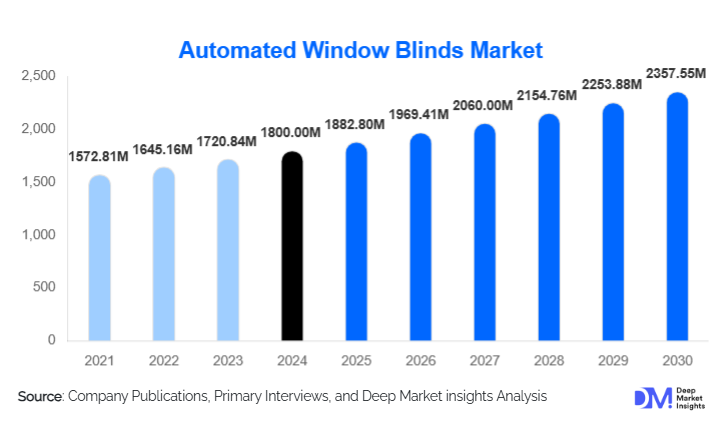

Automated Window Blinds Market Size

According to Deep Market Insights, the global automated window blinds market size was valued at USD 1,800 million in 2024 and is projected to grow from USD 1,882.8 million in 2025 to reach USD 2,357.55 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). This growth is being driven by increased adoption of smart-home systems, growing construction of green buildings, rising demand for energy-efficient shading solutions, and advancements in motor and IoT technologies.

Key Market Insights

- Smart-home integration is propelling the adoption of motorized and IoT-connected window blinds, as more homeowners seek convenience, voice control, and automated scheduling.

- Energy-saving potential is a critical value driver, especially in commercial and institutional buildings where automated shading contributes to reducing HVAC loads and optimizing lighting.

- North America holds a dominant share of the market, driven by a high base of smart-home adoption, rigorous energy standards, and advanced building automation.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, smart city projects, and increasing disposable income in markets such as China and India.

- Technology innovation is centered on IoT, AI, and solar motors, with companies developing self-learning shading systems and energy-harvesting motors for green buildings.

- Sustainable materials and low-noise motors are becoming increasingly important as customer preference shifts toward eco-friendly and quiet shading solutions.

What are the latest trends in the Automated Window Blinds Market?

AI-Enabled and Predictive Shading Systems

One of the most compelling trends in the automated window blinds market is the integration of artificial intelligence (AI). Modern systems can learn from a building’s occupancy, sunlight patterns, and temperature data to automatically adjust blinds for optimal comfort and energy efficiency. These predictive shading systems reduce reliance on manual input and can significantly lower heating, cooling, and lighting costs by dynamically responding to environmental conditions.

Energy-Harvesting and Solar-Powered Motorization

Solar-powered motorized blinds are increasingly popular, especially in retrofit scenarios and sustainable building projects. These blinds use small photovoltaic cells to recharge their internal batteries, eliminating the need for complex wiring and reducing power consumption from the mains. This not only simplifies installation but also aligns with the broader trend of green building and energy self-sufficiency.

Interoperability with Smart-Home Ecosystems

Automated blinds are being designed to work seamlessly with major smart-home platforms like Google Home, Amazon Alexa, Apple HomeKit, and Matter-based systems. As cross-protocol compatibility (Zigbee, Wi-Fi, Z-Wave, etc.) improves, these products are becoming more accessible to a wider consumer base. The interoperability trend helps blind systems become a native part of broader smart-home and smart-building ecosystems.

What are the key drivers in the Automated Window Blinds Market?

Smart-Home Proliferation and User Convenience

The rapid adoption of smart-home devices, voice assistants, hubs, and connected lighting has made motorized blinds a natural addition. Homeowners are increasingly favoring automation for convenience, energy savings, and integrated control through mobile apps. This trend is particularly strong in high-income regions where smart devices are already widespread.

Energy Efficiency & Sustainability Pressure

Automated blinds contribute significantly to reducing a building’s energy footprint. By regulating daylight and heat gain, they help to optimize HVAC usage. As governments implement stricter building codes and certification standards (e.g., LEED, BREEAM), automated shading becomes a vital component of energy-efficient buildings.

Advancements in Motor and Control Technologies

Improvements in motor technology, in battery life, noise reduction, and compactness make automated blinds more practical and affordable. Meanwhile, smart control systems (IoT, AI, voice) are lowering the barrier for adoption. These combined advances are making automated blinds more accessible for both retrofit and new-construction markets.

What are the restraints for the global market?

High Upfront Cost and Installation Complexity

Despite the benefits, automated window blinds involve significant up-front costs, motors, controllers, installation, and possibly integration with building systems. For retrofits, the need to run wiring or set up new control networks can deter adoption. These costs are still a barrier for cost-sensitive residential and small commercial users.

Fragmented Protocols and Interoperability Issues

The lack of universal standards for motor-control technology and smart-home protocols (Wi-Fi, Zigbee, Z-Wave, etc.) creates challenges for seamless integration. Customers may worry that their blinds will not work with existing systems, which inhibits widespread adoption. In addition, security concerns associated with connected devices can also slow down growth.

What are the key opportunities in the Automated Window Blinds Market?

Smart Building Integration and AI-Driven Shading

The convergence of building automation and shading presents a powerful opportunity. Automated blinds integrated into building management systems (BMS) with AI-driven optimization can reduce energy costs significantly while improving occupant comfort. Firms that develop predictive, self-learning solutions and tie them into broader building control systems stand to gain large-scale, high-value contracts.

Expansion into Emerging Markets via Affordable & Retrofit Solutions

Emerging markets such as India, China, Southeast Asia, and Latin America are urbanizing rapidly and rolling out smart city infrastructure. There is strong potential for motorized and IoT-connected blinds, especially in mid- to high-end housing and commercial projects. New entrants can differentiate themselves by offering cost-effective, solar- or battery-operated blinds tailored to local market needs.

Eco-Friendly & Energy-Neutral Product Development

Sustainability is a growing theme globally. Solar-powered motors, low-energy controllers, recyclable materials, and quiet, long-life motors are increasingly in demand. Manufacturers that can combine energy harvesting, smart automation, and eco-materials will be well placed to serve both residential and institutional green-building markets.

Product Type Insights

Motorized horizontal (Venetian / slatted) blinds dominate due to their versatility, ease of control, and aesthetic compatibility with both modern and traditional interiors. Roll-up or roller blinds are also gaining strong traction, particularly for large window spans and commercial applications, because of their simplicity, sleek design, and energy-optimization potential. Cellular (honeycomb) motorized blinds are emerging as a sustainable and energy-efficient option, particularly in green building projects, due to their insulating properties.

Application Insights

In the commercial sector, offices remain the largest application for automated window blinds, driven by building-automation initiatives, glare reduction, and energy savings. The hospitality industry (hotels, resorts) is a rapidly growing sub-application, using motorized blinds to enhance guest experience and efficiency. On the residential side, smart homes are increasingly integrating automated shading for convenience, privacy, and energy control. Emerging uses are visible in public infrastructure (airports, schools) and in mission-critical industrial facilities (data centers), where precise daylight management is critical.

Distribution Channel Insights

Direct B2B sales remain the dominant distribution method, particularly for commercial and institutional buyers who require large-scale blind systems integrated into building automation platforms. For homeowners, online channels (e-commerce, D2C) are rapidly gaining traction, offering configurators, remote control options, and smart shading bundles. Specialist shading and smart-home installers act as key offline partners, particularly for retrofit projects. In addition, system integrators and smart-building contractors are becoming important sales channels.

Customer Type Insights

Large commercial customers, such as property developers, facility managers, and hoteliers, are major buyers of motorized shading systems. Upscale residential customers with smart homes or luxury new-builds value programmable and voice-controlled blinds. Retrofits of existing homes are being carried out by technology-enthusiasts and sustainability-conscious homeowners. System integrators and smart-home installers also drive demand by bundling automated blinds with lighting, HVAC, security, and other building-automation components.

| By Product Type | By Technology | By Control Mechanism | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the leading region for automated window blinds, particularly in the U.S., where smart-home density is high, and building automation is well-established. Commercial buildings, luxury homes, and retrofit markets all contribute strongly. The region’s energy regulation and building-code requirements also drive shading automation.

Europe

Europe (Germany, UK, France, Nordic countries) sees robust demand driven by energy-efficiency regulations and green building standards. Retrofitting old buildings and offices is a major driver, along with rising consumer willingness to pay for smart and automated home products.

Asia-Pacific

Asia-Pacific is the fastest-growing region. China, India, Japan, Australia, and Southeast Asia are driving demand with large-scale residential construction, smart-city programs, and increasing smart-home adoption. Solar-powered blinds and cost-efficient motorization are popular due to both cost sensitivity and sustainability focus.

Middle East & Africa

The Middle East (UAE, Saudi Arabia) is seeing rising demand for automated shading in luxury real estate, offices, and hospitality, while in Africa, countries like South Africa and Kenya are gradually adopting motorized blinds, especially in commercial and institutional infrastructure.

Latin America

In Latin America, Brazil, Mexico, and Chile are emerging as important markets. Demand is driven by urbanization, rising income levels, and a growing interest in smart-home and green-building solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Automated Window Blinds Market

- Hunter Douglas

- Somfy Systems

- Lutron Electronics

- Graber

- MechoShade Systems

- NORMAN Window Fashions

- Springs Window Fashions

- BCM Controls

- VELUX

- Crestron Electronics

- Griesser AG

- Habitat Architectural Products

- Luxaflex

- Geiger

- Rolling Center

Recent Developments

- In January 2025, Somfy Systems launched a new AI-driven shading controller that learns from occupant behavior and weather forecasts to optimize blind movement.

- In March 2025, Hunter Douglas introduced a solar-powered motor kit that can be retrofitted to existing roller blinds, expanding access to energy-harvesting automation.

- In July 2025, Lutron Electronics announced a partnership with a major smart home platform provider to integrate its motorized shades with voice assistants and Matter protocol compliance.