Walnut Ingredients Market Size

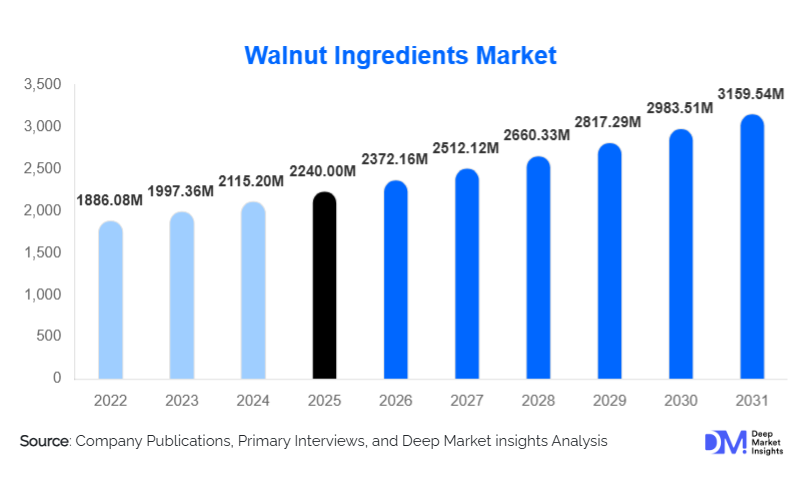

According to Deep Market Insights, the global walnut ingredients market size was valued at USD 2,240.00 million in 2025 and is projected to grow from USD 2,372.16 million in 2026 to reach USD 3,159.54 million by 2031, expanding at a CAGR of 5.9% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer demand for functional and plant-based foods, increasing adoption of walnut-derived oils and flours in personal care and nutraceutical products, and technological innovations in processing that enhance the nutritional and functional value of walnut ingredients.

Key Market Insights

- Walnut kernels remain the largest product segment, widely used across bakery, snacks, and plant-based applications due to their nutritional and functional benefits.

- Processed forms such as walnut flours and powders are rapidly gaining traction, driven by growing demand for easy-to-use, clean-label, and functional ingredients in food and beverage products.

- North America dominates the market, accounting for 35–38% of global demand, driven by health-conscious consumers and advanced food processing infrastructure.

- Asia Pacific is the fastest-growing region, fueled by rising health awareness, expanding middle-class populations, and investments in local walnut processing facilities.

- Europe maintains a significant market share, with countries like Germany and France favoring organic and nutrient-rich ingredients in bakery, snacks, and plant-based foods.

- Technological innovations, including cold-press extraction, micro-milling, and standardized fractionation, are enhancing product quality, shelf-life, and functional applications.

What are the latest trends in the walnut ingredients market?

Rising Demand for Functional Foods and Nutraceuticals

Manufacturers are increasingly incorporating walnut ingredients into functional foods, protein-rich snacks, and nutraceuticals. Walnut-derived components such as omega-3-rich oils, polyphenol extracts, and protein flours are marketed for heart health, cognitive benefits, and anti-inflammatory properties. This trend aligns with consumer preferences for health-promoting, plant-based products and is driving innovation in formulation and product diversification across multiple industries.

Integration into Natural Cosmetics and Personal Care

Walnut oils and walnut shell powders are gaining popularity in skincare and haircare products due to their emollient, antioxidant, and exfoliating properties. Cosmetic brands are adopting biodegradable walnut shell powders as sustainable alternatives to microplastics, while cold-pressed walnut oils are utilized in premium lotions, serums, and hair treatments. Certification and traceability, such as organic and non-GMO labels, further enhance market adoption in personal care segments.

What are the key drivers in the walnut ingredients market?

Growing Health and Wellness Consciousness

Consumer focus on heart health, cognitive function, and overall wellness is driving demand for nutrient-rich walnut ingredients. Products enriched with walnut kernels, oils, and flours are increasingly used in bakery, snacks, plant-based beverages, and dietary supplements. This has made walnut ingredients a preferred choice for functional and clean-label products.

Expansion of Plant-Based and Clean-Label Products

Walnut flours and protein concentrates are widely integrated into plant-based milk, meat alternatives, and high-protein snacks. The growing clean-label movement encourages the use of natural walnut derivatives without chemical additives, enhancing both product functionality and consumer appeal.

Advances in Processing Technology

Innovations such as cold-press extraction, micro-milling, and fractionation are improving the functionality, stability, and shelf-life of walnut ingredients. These advancements support broader applications across food, nutraceuticals, and personal care industries while facilitating premium pricing opportunities.

What are the restraints for the global market?

Raw Material Supply and Price Volatility

Walnut crops are highly sensitive to climatic conditions, which can create seasonal supply shortages and fluctuating prices. Such volatility affects manufacturing costs, particularly for small-scale processors without diversified sourcing or hedging mechanisms.

Competition from Lower-Cost Alternatives

Walnut ingredients are often priced higher than other nut and seed-based ingredients, limiting adoption in price-sensitive segments. Cost-driven substitution with almonds, peanuts, or sunflower-based ingredients may constrain market penetration in developing regions.

What are the key opportunities in the walnut ingredients market?

Functional Food and Nutraceutical Expansion

There is a growing opportunity to integrate walnut ingredients into functional foods and dietary supplements. Products emphasizing heart, brain, and anti-inflammatory benefits can capture premium pricing while meeting rising consumer demand for science-backed health claims. This allows both new and existing participants to create value-added formulations such as protein bars, omega-3 beverages, and cognitive health capsules.

Natural Cosmetic Applications

Increasing demand for natural and sustainable personal care products presents opportunities for cold-pressed walnut oils and walnut shell powders. Botanical formulations, organic certifications, and sustainable sourcing enhance adoption, enabling higher margins and brand differentiation in skincare, haircare, and exfoliating products.

Regional Growth in Emerging Markets

Asia Pacific, particularly China and India, represents a fast-growing market for walnut ingredients due to urbanization, rising health awareness, and expanding food processing infrastructure. Local production facilities and strategic supply chains allow manufacturers to tap into regional demand efficiently while overcoming logistics and freshness challenges.

Product Type Insights

Walnut kernels dominate the product segment, accounting for 48% of the global market in 2025. Their versatility and high nutritional value make them preferred in bakery, snack, and plant-based applications. Walnut oils and flours are also gaining ground due to functional applications in food and personal care. Cold-pressed oils, defatted flours, and extracts are commanding premium prices owing to their bioactive content and clean-label positioning.

Application Insights

The food industry represents the largest application, capturing nearly 49% of demand. Bakery, snacks, and plant-based beverages drive growth, while functional foods and nutraceuticals are emerging segments. Personal care and cosmetics are also rapidly expanding, particularly for natural oils and exfoliating walnut shell powders. Export-driven demand to North America and Europe strengthens the market, with processed walnut ingredients increasingly preferred for consistency and functionality.

Distribution Channel Insights

Direct B2B supply to manufacturers is the primary distribution channel, followed by retail, e-commerce, and specialty health stores. Online platforms are gaining importance due to convenience, traceability, and digital marketing support. Large-scale contracts with bakery, snack, and personal care brands ensure volume stability and recurring revenue streams for suppliers.

End-Use Insights

Food manufacturers lead consumption, particularly in bakery, snacks, and plant-based products. Personal care and nutraceutical companies are emerging end-users, adopting walnut oils, flours, and extracts for premium and functional offerings. Export-oriented demand from North America and Europe supports growth for Asia Pacific and Latin American producers.

| By Product Type | By Form | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35–38% of the market, with the U.S. leading demand due to high health awareness and mature food processing infrastructure. Consumers favor functional foods and clean-label products incorporating walnut kernels, oils, and flours.

Europe

Europe holds a significant share, particularly Germany, France, and the U.K. Demand is driven by organic, nutrient-rich, and sustainable ingredients. Consumers prefer clean-label bakery, snack, and plant-based applications.

Asia Pacific

Asia Pacific is the fastest-growing region, fueled by China and India. Rising middle-class income, urbanization, and increasing health consciousness are driving adoption in functional foods, nutraceuticals, and personal care. Local processing investments are enhancing supply chains and supporting regional demand.

Latin America

Brazil and Mexico are leading markets, with growth supported by increasing premium food and snack consumption. Export of walnut ingredients to North America and Europe contributes to regional expansion.

Middle East & Africa

Demand is nascent but growing in high-income Middle Eastern countries and African markets. Africa remains the core production hub, with tourism and local consumption driving limited regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Walnut Ingredients Market

- Olam International

- ADM (Archer Daniels Midland)

- Hammons

- Poindexter Nut Company

- Anderson International Corp.

- Jabsons Foods

- Morada Nut Company

- Grower Direct Nut Co.

- Diamond Foods

- Del Monte Foods

- Bergin Fruit & Nut

- Mariani Nut Company

- Kashmir Walnut Group

- Sacramento Valley Walnut Growers

- Growers' Nut Company