Vitamin C Gummies Market Size

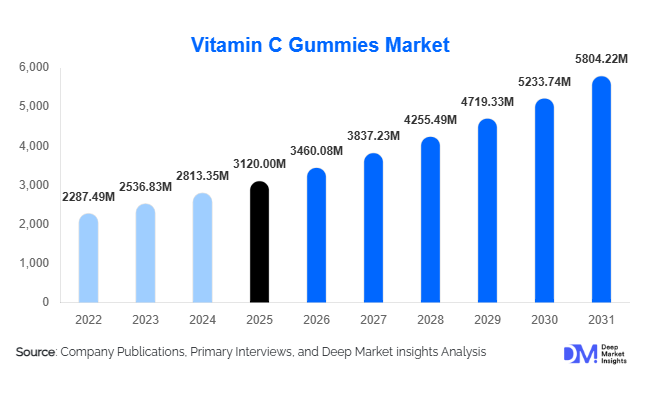

According to Deep Market Insights,the global vitamin C gummies market size was valued at USD 3,120 million in 2025 and is projected to grow from USD 3,460.08 million in 2026 to reach USD 5,804.22 million by 2031, expanding at a CAGR of 10.9% during the forecast period (2026–2031). The market growth is primarily driven by rising preventive healthcare awareness, increasing preference for chewable and palatable supplement formats, and expanding online retail penetration. Growing demand for immunity-boosting products, combined with innovations in sugar-free, vegan, and clean-label formulations, continues to position vitamin C gummies as a mainstream dietary supplement category across developed and emerging economies.

Key Market Insights

- Immunity support remains the dominant application, accounting for over 50% of total demand, supported by sustained post-pandemic consumer focus on preventive health.

- Adults aged 19–59 years represent the largest consumer group, contributing nearly half of total market revenue due to daily wellness supplementation trends.

- Online retail channels account for more than one-third of global sales, driven by subscription-based models and D2C supplement brands.

- North America dominates the global market, supported by high dietary supplement penetration and strong brand presence.

- Asia-Pacific is the fastest-growing region, led by India and China, driven by rising middle-class income and health awareness.

- Sugar-free and plant-based gummies are rapidly gaining share, reflecting evolving consumer preferences toward clean-label products.

What are the latest trends in the vitamin C gummies market?

Sugar-Free and Clean-Label Formulations

Manufacturers are increasingly introducing sugar-free, low-calorie, and naturally sweetened vitamin C gummies to address concerns around sugar consumption and metabolic health. The use of stevia, monk fruit extract, and tapioca-based syrups is replacing traditional glucose syrups in premium product lines. Additionally, pectin-based vegan gummies are replacing gelatin to cater to vegetarian and flexitarian consumers. Clean-label positioning, non-GMO certifications, and organic sourcing are enhancing brand differentiation, particularly in North America and Europe. This shift allows manufacturers to command premium pricing while aligning with evolving dietary preferences.

Functional Blends and Multi-Vitamin Integration

Vitamin C gummies are increasingly formulated with additional functional ingredients such as zinc, vitamin D, elderberry extract, probiotics, and collagen. These blended formulations target specific health outcomes, including immune resilience, skin radiance, and gut health. The trend toward multifunctional supplements is expanding average selling prices and encouraging repeat purchases. Personalized supplement packs and AI-driven health assessment tools integrated into e-commerce platforms are further strengthening consumer engagement and lifetime value.

What are the key drivers in the vitamin C gummies market?

Rising Preventive Healthcare Awareness

Consumers globally are prioritizing preventive healthcare strategies, with vitamin C recognized as a key antioxidant supporting immune defense and collagen synthesis. Growing awareness regarding micronutrient deficiencies, particularly in urban populations, is fueling sustained demand. The global dietary supplements industry’s steady expansion provides a strong foundation for gummy-based product growth.

Improved Consumer Compliance Through Gummy Formats

Traditional tablets and capsules often face adherence challenges, especially among children and elderly populations. Gummies offer improved taste, convenience, and ease of consumption, leading to higher daily compliance rates. This format innovation has expanded the addressable consumer base and driven higher repeat purchase frequency.

What are the restraints for the global market?

Sugar Content and Regulatory Scrutiny

Despite rising demand, conventional vitamin C gummies contain added sugars, which may conflict with broader public health campaigns aimed at reducing sugar intake. Regulatory frameworks in certain regions are tightening labeling standards and advertising claims, potentially affecting product positioning.

Raw Material Price Volatility

The global supply chain for ascorbic acid, largely concentrated in Asia, is susceptible to price fluctuations. Variations in pectin and natural extract costs also impact manufacturing margins. Smaller manufacturers may face cost pressures during raw material inflation cycles, influencing retail pricing strategies.

What are the key opportunities in the vitamin C gummies industry?

Expansion in Emerging Economies

Rapid urbanization and rising disposable incomes in India, Indonesia, Brazil, and Mexico present strong growth opportunities. Government-led nutrition awareness campaigns and expanding pharmacy chains are increasing supplement accessibility. Localized flavors and affordable SKU strategies can unlock new consumer segments.

Subscription-Based and D2C Models

Digital-first supplement brands are leveraging subscription services to ensure recurring revenue streams. Personalized vitamin packs and data-driven health recommendations enhance customer retention. Online sales channels already represent approximately 34% of global revenue and are expected to expand further during the forecast period.

Source Type Insights

Synthetic ascorbic acid dominates the global vitamin C gummies market, accounting for nearly 72% of total revenue in 2025. The segment’s leadership is primarily attributed to its cost efficiency, large-scale manufacturing feasibility, consistent purity levels, and longer shelf stability compared to plant-derived alternatives. Bulk production capabilities and standardized potency make synthetic sources highly suitable for mass-market and private-label formulations, supporting widespread global distribution. The leading position of this segment is further strengthened by its compatibility with medium- and high-strength dosage formats, which are increasingly demanded in immunity and sports nutrition applications. Meanwhile, natural-source vitamin C derived from acerola cherry, amla, and citrus extracts is witnessing rapid growth in premium and clean-label product lines. Rising consumer preference for plant-based, non-GMO, and minimally processed ingredients is accelerating demand for naturally sourced formulations, particularly in developed economies where willingness to pay higher prices for transparency and sustainability is strong.

Consumer Age Group Insights

Adults aged 19–59 years represent the largest consumer group, accounting for approximately 48% of total market share. The dominance of this segment is driven by strong adoption of daily supplementation routines focused on immune resilience, skin health, energy metabolism, and overall preventive healthcare. Busy lifestyles, rising stress levels, and increased awareness of micronutrient deficiencies are reinforcing regular vitamin C intake among working-age populations. Children form a significant secondary segment, supported by the superior taste, chewability, and compliance advantages of gummy formulations compared to tablets and syrups. Pediatric supplementation is particularly influenced by parental focus on immunity and seasonal illness prevention. The geriatric population is experiencing steady growth in demand due to ease-of-consumption benefits, swallowing difficulties associated with traditional dosage forms, and growing emphasis on healthy aging and antioxidant support.

Dosage Strength Insights

Medium-strength gummies containing 126–500 mg per serving lead the market with an estimated 55% revenue share. This segment’s leadership is driven by its alignment with recommended daily intake guidelines while maintaining a safety profile suitable for long-term use. Consumers perceive medium-strength formulations as offering an optimal balance between efficacy and risk mitigation, making them ideal for routine immunity and wellness supplementation. These products are widely distributed across both online and offline channels, further reinforcing their dominance. High-strength formulations are gaining momentum, particularly among fitness enthusiasts, athletes, and wellness-focused consumers seeking enhanced antioxidant protection and recovery support. Low-dose products continue to serve pediatric and maintenance-focused segments, ensuring comprehensive portfolio diversification for manufacturers.

Distribution Channel Insights

Online retail leads global distribution, capturing nearly 34% of total market share. The growth of this channel is driven by expanding direct-to-consumer (D2C) brands, subscription-based supplement models, and the rapid penetration of e-commerce marketplaces. Digital platforms enable detailed product comparisons, ingredient transparency, customer reviews, and targeted marketing, which collectively enhance consumer confidence and repeat purchases. Pharmacies and supermarkets remain critical offline channels, particularly in emerging markets where brand trust, pharmacist recommendations, and physical product verification significantly influence buying decisions. Brick-and-mortar presence also supports impulse purchases and bundled wellness promotions, sustaining omnichannel growth strategies.

End-Use Application Insights

Immunity support dominates the market, accounting for approximately 52% of global demand. The leading position of this segment is supported by sustained post-pandemic awareness regarding immune resilience and preventive health management. Vitamin C’s established role in supporting immune cell function and reducing oxidative stress continues to drive high consumer trust. General wellness supplementation follows as a broad application category encompassing daily nutritional support. Skin health applications are expanding steadily due to vitamin C’s role in collagen synthesis and antioxidant protection, fueling demand within beauty-from-within product lines. Sports and active nutrition represents the fastest-growing application segment, supported by rising global gym memberships, endurance sports participation, and consumer interest in recovery optimization.

| By Source Type | By Consumer Age Group | By Dosage Strength | By Distribution Channel | By Nature | By End-Use Application |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market share in 2025, making it the largest regional market. The United States leads regional demand due to high dietary supplement penetration, advanced retail infrastructure, and strong presence of established nutraceutical brands. Growth is supported by rising preventive healthcare spending, widespread adoption of gummy dosage formats, and robust D2C brand ecosystems leveraging digital marketing and influencer-driven campaigns. Canada contributes steadily through pharmacy-dominated sales channels and growing demand for clean-label and natural formulations. Increasing focus on immune resilience and functional nutrition continues to reinforce regional expansion.

Asia-Pacific

Asia-Pacific holds nearly 29% of global revenue and represents the fastest-growing regional market, with a CAGR exceeding 12%. China plays a dual role as both a leading producer of ascorbic acid and a rapidly expanding consumer market, benefiting from strong manufacturing capabilities and export competitiveness. India is emerging as the fastest-growing consumer base, with annual growth rates surpassing 14%, supported by rising middle-class income, expanding e-commerce penetration, and increasing awareness of preventive healthcare. Urbanization, growing pediatric supplementation demand, and government initiatives promoting nutritional health further accelerate regional growth. Southeast Asian markets are also witnessing expanding retail access and rising demand for convenient dosage formats.

Europe

Europe represents approximately 22% of the global market, led by Germany, the United Kingdom, and France. Regional growth is driven by strong regulatory frameworks ensuring product quality and safety, which enhance consumer trust in supplementation. Clean-label demand, organic certification trends, and preference for plant-based ingredients are accelerating premiumization across Western Europe. Aging demographics and increasing adoption of preventive healthcare practices further contribute to sustained demand. Innovation in sugar-reduced and vegan gummy formulations is particularly prominent in this region.

Latin America

Latin America accounts for about 7% of global market share, with Brazil and Mexico leading consumption. Regional growth is supported by rising health awareness, expanding pharmacy networks, and increasing availability of imported and locally manufactured supplements. Economic stabilization in key markets and growing middle-class purchasing power are improving access to functional nutrition products. The popularity of immunity-focused products during seasonal illness cycles continues to drive incremental demand.

Middle East & Africa

The Middle East & Africa region represents approximately 8% of global demand. The United Arab Emirates and Saudi Arabia are key high-income markets characterized by strong retail infrastructure, premium supplement adoption, and high per-capita health expenditure. In sub-Saharan Africa, South Africa leads supplement consumption, supported by expanding pharmacy chains and increasing consumer awareness regarding micronutrient deficiencies. Urbanization, growing expatriate populations, and rising focus on preventive healthcare are collectively contributing to steady regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vitamin C Gummies Market

- Amway Corp.

- Bayer AG

- Church & Dwight Co., Inc.

- Haleon plc

- Nestlé Health Science

- Nature’s Way Products LLC

- Herbaland Naturals Inc.

- SmartyPants Vitamins

- Olly Public Benefit Corporation

- Pharmavite LLC

- Garden of Life LLC

- Jamieson Wellness Inc.

- Blackmores Limited

- Swisse Wellness Pty Ltd

- GNC Holdings LLC