Vitamin and Mineral Premix Market Size

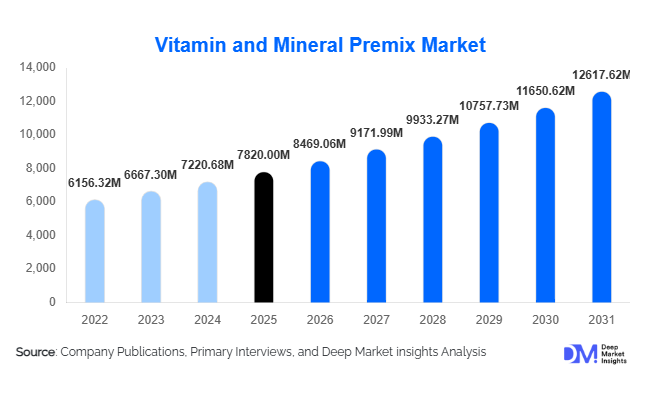

According to Deep Market Insights,the global vitamin and mineral premix market size was valued at USD 7,820 million in 2025 and is projected to grow from USD 8,469.06 million in 2026 to reach USD 12,617.62 million by 2031, expanding at a CAGR of 8.3% during the forecast period (2026–2031). Market growth is primarily driven by increasing global demand for fortified foods, rapid expansion of the dietary supplements industry, rising animal protein consumption, and government-led micronutrient fortification initiatives across emerging economies.

Key Market Insights

- Combination vitamin-mineral premixes dominate the market, accounting for nearly 42% of global revenue in 2025 due to multifunctional health positioning.

- Powder premixes hold over 63% market share, supported by ease of blending, longer shelf life, and cost efficiency.

- Asia Pacific leads global demand, contributing approximately 34% of 2025 market revenue, driven by China and India.

- Human nutrition applications account for nearly 55% of total market share, with dietary supplements as the fastest-growing sub-segment.

- Top five companies collectively control around 48% of the global market, indicating moderate consolidation.

- Water-soluble vitamins such as vitamin C and B-complex are the most consumed micronutrients globally, particularly in immunity-focused formulations.

What are the latest trends in the vitamin and mineral premix market?

Shift Toward Personalized and Functional Nutrition

Demand is increasingly shifting from standardized fortification toward customized premix solutions tailored to specific consumer health goals such as immunity enhancement, metabolic support, bone health, and cognitive function. Nutraceutical brands are partnering with premix manufacturers to develop application-specific blends for gummies, ready-to-drink beverages, plant-based dairy alternatives, and sports nutrition powders. Microencapsulation and coating technologies are improving nutrient stability and taste masking, enabling higher inclusion rates without compromising sensory quality.

Expansion of Fortified Staple Food Programs

Government-mandated fortification of rice, wheat flour, edible oils, and dairy products across Asia and Africa is expanding institutional demand for premixes. Public health initiatives targeting anemia, vitamin A deficiency, and iodine deficiency are creating long-term procurement contracts for premix manufacturers. Compliance with international food safety standards and traceability requirements has become a critical differentiator among suppliers.

What are the key drivers in the vitamin and mineral premix market?

Rising Preventive Healthcare Awareness

Consumers globally are prioritizing immunity and preventive wellness, boosting demand for fortified foods and dietary supplements. Post-pandemic behavioral shifts have accelerated intake of vitamin C, vitamin D, zinc, and iron blends. This structural change in consumer behavior continues to support consistent growth in premix demand across human nutrition industries.

Growth in Animal Nutrition and Protein Consumption

Expanding poultry, aquaculture, and pet nutrition industries—particularly in Asia Pacific and Latin America—are driving mineral and vitamin premix demand for feed optimization. Feed efficiency, improved animal health, and reduced antibiotic reliance are key objectives pushing livestock producers toward high-performance premixes.

What are the restraints for the global market?

Raw Material Price Volatility

Vitamin A, D, and E raw materials are highly sensitive to production fluctuations in China and Europe. Periodic supply disruptions lead to price spikes, impacting margins and long-term contracts for premix manufacturers.

Regulatory and Compliance Complexity

Varying fortification limits, labeling laws, and technical standards across regions increase compliance costs and create operational challenges for multinational suppliers. Frequent updates to nutrient inclusion guidelines add further complexity.

What are the key opportunities in the vitamin and mineral premix industry?

Government-Led Nutritional Fortification Programs

Large-scale public nutrition programs in India, Southeast Asia, and Africa offer stable, high-volume demand for iron, vitamin A, and iodine premixes. Suppliers aligned with public procurement standards can secure multi-year contracts.

Premium and Customized Nutraceutical Blends

Rising demand for personalized supplements presents opportunities for premium-priced customized premixes. Companies investing in R&D, AI-driven formulation systems, and encapsulation technologies can capture higher-margin segments.

Formulation Type Insights

Vitamin-mineral combination premixes lead the global market, accounting for approximately 42% of total revenue in 2025. The leadership of this segment is primarily driven by its ability to deliver comprehensive nutritional solutions in a single formulation, making it highly suitable for multifunctional applications across fortified foods, beverages, dietary supplements, and clinical nutrition products. Manufacturers increasingly prefer combination premixes to simplify production processes, ensure uniform nutrient distribution, reduce formulation complexity, and enhance regulatory compliance across multiple geographies. Standalone vitamin premixes account for around 33% of total revenue, supported by rising demand for targeted immunity, bone health, and energy-support formulations. Mineral premixes contribute nearly 20% of market revenue, largely driven by strong demand from the animal feed industry, where precise mineral supplementation is critical for improving livestock productivity, feed efficiency, and overall animal health outcomes.

Nutrient Type Insights

Water-soluble vitamin premixes dominate the nutrient segment with nearly 31% market share, supported by strong global consumption of vitamin C and B-complex formulations in immunity-boosting, energy-enhancing, and functional beverage applications. Their high compatibility with beverages, dairy products, and dietary supplements enhances their commercial viability. The leading driver for this segment is the increasing consumer focus on preventive healthcare and daily micronutrient supplementation, particularly in urban populations. Trace mineral premixes represent approximately 24% of total revenue, particularly in livestock nutrition, fortified staple foods, and functional beverages. Growing awareness of micronutrient deficiencies such as iron, zinc, and iodine deficiency across developing economies further accelerates the adoption of trace mineral fortification programs.

Physical Form Insights

Powder premixes hold the largest share at 63% of the global market, favored for their cost efficiency, extended shelf stability, ease of transportation, and compatibility with dry blending processes in large-scale food and feed manufacturing. The primary growth driver for powder formulations is their flexibility in formulation customization and large-batch industrial processing. Liquid premixes account for nearly 22% of the market and are primarily used in beverage, pharmaceutical, and specialized nutrition applications where rapid solubility and uniform dispersion are required. Liquid forms are gaining traction in ready-to-drink fortified beverages and pediatric nutrition solutions due to their enhanced bioavailability and ease of administration.

Application Insights

Food and beverage fortification accounts for approximately 38% of total market share, driven by government-supported staple food fortification programs targeting deficiencies in iron, vitamin A, vitamin D, and folic acid. The leading growth driver in this segment is the increasing implementation of mandatory fortification policies across emerging economies to combat malnutrition and hidden hunger. Dietary supplements contribute nearly 34% of total revenue, supported by rising consumer awareness regarding immunity, preventive healthcare, and personalized nutrition trends. Animal nutrition applications account for around 24% of the market, driven by the intensification of livestock production systems, growing global meat consumption, and the need to enhance feed conversion efficiency and animal health performance.

End-Use Industry Insights

The human nutrition industry dominates the market, generating nearly 55% of global market revenue in 2026, valued at approximately USD 4.5 billion. Growth in this segment is supported by expanding nutraceutical industries, increasing disposable incomes, urbanization, and rising demand for functional and fortified food products. The animal nutrition industry follows, valued at approximately USD 2.9 billion and growing at nearly 9% CAGR, driven by commercial livestock farming expansion, aquaculture development, and export-oriented meat production. The pharmaceutical sector remains a niche but stable segment, supported by increasing demand for medical nutrition, therapeutic supplementation, and hospital-based nutrition formulations, particularly in aging populations and chronic disease management.

| By Formulation Type | By Application | By Physical Form | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia Pacific

Asia Pacific leads the global market with 34% share in 2025, driven primarily by large-scale production capacities, expanding population bases, and government-led fortification initiatives. China remains a major global producer and exporter of vitamins, benefiting from strong manufacturing infrastructure and supply chain integration. India is witnessing the fastest regional growth at approximately 9.5% CAGR due to expanding fortification mandates in staple foods such as rice and wheat flour, rising dietary supplement consumption, growing middle-class income levels, and increasing awareness regarding preventive healthcare. Rapid urbanization and growth in functional food demand further accelerate regional expansion.

North America

North America accounts for nearly 27% of global revenue, with the United States contributing over 80% of regional demand. Market growth is driven by a well-established nutraceutical industry, high consumer spending on wellness products, strong regulatory frameworks supporting fortified foods, and increasing adoption of personalized nutrition solutions. Rising prevalence of lifestyle-related disorders and proactive consumer attitudes toward daily supplementation continue to strengthen demand for customized vitamin and mineral premixes.

Europe

Europe holds approximately 24% of the global market share, led by Germany, France, and the Netherlands. The region’s growth is supported by regulatory-driven fortification standards, advanced functional food markets, and strong research and development capabilities in nutritional science. Increasing demand for clean-label, traceable, and scientifically validated nutritional products further enhances the adoption of high-quality premix solutions. Additionally, aging demographics across Western Europe are contributing to higher demand for bone health, immunity, and clinical nutrition formulations.

Latin America

Latin America demonstrates steady growth, with Brazil dominating regional demand due to its expanding poultry and livestock production sectors. Export-driven meat industries are stimulating feed premix consumption, particularly for mineral and trace element formulations that enhance productivity and meet international quality standards. Government-backed food fortification programs and improving healthcare awareness across countries such as Mexico and Argentina are further supporting regional market expansion.

Middle East & Africa

The Middle East & Africa region is the fastest-growing market, expanding at nearly 10% CAGR, supported by staple food fortification initiatives aimed at addressing widespread micronutrient deficiencies. Rising population growth, improving healthcare infrastructure, and increasing government partnerships with international health organizations are accelerating premix adoption. Growing awareness regarding maternal and child nutrition, particularly in Sub-Saharan Africa and parts of the Middle East, is further strengthening demand for vitamin and mineral premixes in both fortified foods and humanitarian nutrition programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vitamin and Mineral Premix Market

- DSM-Firmenich

- BASF SE

- Cargill Incorporated

- Archer Daniels Midland Company

- Glanbia plc

- SternVitamin GmbH & Co. KG

- Corbion N.V.

- Hexagon Nutrition

- Nutreco N.V.

- Wright Enrichment Inc.

- Burkmann Industries

- Vitablend Nederland B.V.

- Sudeep Nutrition Pvt Ltd

- Farbest Brands

- Prinova Group LLC