Vital Wheat Gluten Bulk Market Size

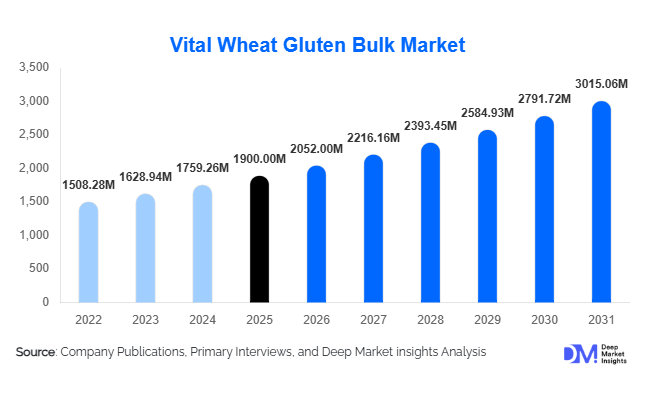

According to Deep Market Insights, the global vital wheat gluten bulk market size was valued at USD 1,900 million in 2025 and is projected to grow from USD 2,052.00 million in 2026 to reach USD 3,015.06 million by 2031, expanding at a CAGR of 8.0% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for high-protein food ingredients, rapid expansion of plant-based meat production, increasing industrial bakery output, and growing adoption of functional proteins in aquafeed and pet food formulations.

Key Market Insights

- Food-grade vital wheat gluten dominates the market, accounting for nearly 68% of total demand, supported by large-scale bakery and plant-based meat production.

- Bakery & confectionery remains the leading application, contributing approximately 45% of global consumption due to gluten’s dough-strengthening properties.

- Asia Pacific leads the global market, holding nearly 38% share in 2025, driven by strong demand from China and India.

- Direct bulk industrial supply accounts for over 75% of total sales, reflecting long-term B2B procurement contracts.

- Animal nutrition applications are growing at over 8.5% CAGR, particularly in aquaculture-intensive countries.

- Industrial uses in bio-based adhesives and biodegradable materials are emerging as high-growth niche segments.

What are the latest trends in the vital wheat gluten bulk market?

Acceleration of Plant-Based Protein Manufacturing

The expansion of plant-based meat and hybrid protein formulations is significantly boosting demand for vital wheat gluten as a functional protein binder and texturizer. High-moisture extrusion technologies are enabling manufacturers to replicate fibrous meat textures more effectively, making gluten an indispensable ingredient. Major food processors are entering long-term supply agreements to ensure price stability amid rising wheat volatility. Emerging markets in Southeast Asia and Latin America are witnessing new production facilities for meat substitutes, further expanding bulk gluten demand. This trend is reshaping procurement strategies, with companies prioritizing protein purity, traceability, and sustainability certifications.

Industrialization of Bakery Production in Emerging Markets

Urbanization and organized retail expansion are driving industrial bread and packaged baked goods production, particularly in Asia and Africa. Vital wheat gluten is increasingly used to standardize flour performance, improve dough elasticity, and enhance shelf stability. As automated baking lines become widespread, the need for consistent protein content in flour blends has increased. Bulk gluten supplementation ensures quality uniformity, making it critical for large-scale operations. Governments promoting food security and protein fortification are also indirectly stimulating gluten usage in staple foods.

What are the key drivers in the vital wheat gluten bulk market?

Rising Demand for High-Protein Foods

Consumers worldwide are prioritizing protein-rich diets, fueling demand for fortified bakery goods, snacks, and meat substitutes. Vital wheat gluten offers a cost-effective, plant-based protein solution with functional elasticity benefits, making it highly attractive to food manufacturers. The increasing popularity of flexitarian and vegetarian diets further supports sustained growth.

Expansion of Aquaculture and Pet Food Industries

Feed-grade vital wheat gluten is widely used as a binder and protein enhancer in aquafeed and premium pet food formulations. Rising seafood consumption and aquaculture expansion in Asia Pacific are accelerating demand. The ingredient improves pellet durability and protein digestibility, making it essential for feed efficiency optimization.

What are the restraints for the global market?

Raw Material Price Volatility

Wheat price fluctuations due to climate variability, geopolitical disruptions, and export restrictions significantly impact production costs. Sudden spikes in raw material prices can compress margins and disrupt long-term supply contracts.

Gluten Sensitivity and Regulatory Scrutiny

Increasing awareness of gluten intolerance and celiac disease in developed markets has encouraged gluten-free reformulations in certain product categories. While industrial and feed demand remain stable, this trend may moderate growth in specific consumer-facing food segments.

What are the key opportunities in the vital wheat gluten bulk industry?

Protein Fortification in Developing Economies

Governments focusing on nutritional security are promoting protein enrichment in staple foods. Bulk gluten suppliers can collaborate with industrial bakeries and institutional food programs to enhance protein content in cost-sensitive markets across Africa and South Asia.

Industrial Bio-Based Applications

Growing sustainability regulations are encouraging the development of biodegradable adhesives, paper coatings, and bio-based plastics. Vital wheat gluten’s binding properties make it suitable for eco-friendly industrial formulations, opening new revenue streams beyond food and feed sectors.

Grade Insights

Food-grade vital wheat gluten leads the global market, accounting for approximately 68% of total market share in 2025. Its dominance is primarily driven by its critical functional properties, including superior elasticity, water absorption capacity, dough strengthening capability, and protein enrichment potential. The leading segment driver for food-grade gluten is the expanding demand for high-protein bakery products and plant-based meat alternatives, where gluten plays a structural and texturizing role. Increasing consumer preference for fortified foods, clean-label protein ingredients, and improved baking performance further reinforces its leadership. The segment also benefits from rising industrial bread production, convenience food demand, and innovation in meat analog formulations.

Feed-grade gluten represents nearly 24% of the global market and is largely driven by its high protein content and digestibility in aquaculture, poultry, and pet food applications. Growing global demand for animal protein, expansion of aquaculture farming, and rising premium pet food consumption are strengthening segment performance. Industrial-grade gluten holds a smaller but steadily expanding share of approximately 8%, primarily used in adhesives, paper processing, biodegradable materials, and specialty coatings. Increasing interest in bio-based and sustainable industrial inputs is supporting above-average growth in this segment.

Application Insights

Bakery and confectionery applications account for around 45% of the total market share, making it the leading application segment. The primary driver for this segment is the expanding industrial bread and baked goods production worldwide, where vital wheat gluten enhances dough stability, improves texture, and increases loaf volume. Growing demand for packaged baked goods, frozen dough products, and high-protein bakery formulations further accelerates growth. Rapid urbanization, changing dietary patterns, and the proliferation of quick-service restaurants continue to strengthen this segment’s dominance.

Meat and seafood processing, including plant-based meat analogues, contributes nearly 28% of market demand. The rapid rise of alternative protein products and flexitarian diets has significantly boosted gluten usage as a texturizing and binding agent. Animal feed and pet food applications account for about 22%, supported by aquaculture expansion and increasing premiumization in pet nutrition. Industrial uses comprise roughly 5% of the market but are expanding at above-average growth rates due to growing adoption in eco-friendly adhesives and biodegradable material formulations.

Distribution Channel Insights

Direct bulk industrial supply dominates the distribution landscape with nearly 78% market share, reflecting long-term procurement contracts between large food processors, feed manufacturers, and gluten producers. The leading driver for this channel is the operational efficiency and cost advantage associated with large-volume sourcing, ensuring consistent quality and stable supply chains. Vertical integration strategies and strategic supplier agreements further strengthen this channel’s position. Ingredient distributors and traders account for the remaining share, primarily serving small and mid-sized manufacturers that require flexible order volumes and diversified sourcing options.

End-Use Industry Insights

The food processing industry represents approximately 70% of global demand and is projected to exceed USD 1,400 million in value by 2026. The leading driver for this segment is the global expansion of processed and convenience foods, along with increasing protein fortification across bakery, snacks, and plant-based categories. Rising demand for texture optimization and shelf-life enhancement in industrial food production further supports segment growth.

The animal nutrition industry contributes around 22% of global consumption, driven by high-protein feed requirements in aquaculture, poultry, and specialty pet food products. Industrial manufacturing accounts for nearly 8% of total demand and is experiencing rapid growth due to rising interest in bio-based materials and sustainable industrial applications. Plant-based meat production and aquaculture remain among the fastest-growing end-use sectors, positively influencing overall market expansion and encouraging product innovation.

| By Grade | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia Pacific

Asia Pacific leads the global vital wheat gluten market with nearly 38% share in 2025. Regional growth is primarily driven by expanding bakery consumption, rapid urbanization, and increasing protein fortification in processed foods. China dominates regional consumption due to its extensive bakery industry, large-scale noodle production, and strong aquafeed manufacturing base. Government support for domestic food processing capacity and rising middle-class demand for packaged foods further strengthen market performance. India is the fastest-growing country in the region, expanding at close to 10% CAGR, driven by growing packaged food demand, quick-service restaurant expansion, and protein enrichment initiatives. Japan and South Korea maintain stable demand supported by premium bakery products, high-quality processed foods, and advanced food manufacturing technologies.

North America

North America accounts for around 27% of global demand, supported by advanced food processing infrastructure and strong consumer demand for high-protein and plant-based products. The United States leads the region, driven by the rapid expansion of plant-based meat production, industrial bakery operations, and protein-enriched snack categories. Rising health consciousness and established alternative protein brands continue to stimulate demand. Canada contributes through strong wheat production capacity and export-oriented gluten processing, enhancing regional supply chain resilience and supporting both domestic consumption and international trade.

Europe

Europe holds approximately 24% of the global market share, with Germany, France, and the Netherlands serving as key consumption and production hubs. The region benefits from well-established bakery traditions, premium bread consumption, and strong regulatory frameworks that favor high-quality food ingredients. Export-oriented gluten manufacturing and increasing demand for clean-label and plant-based foods further drive regional growth. Sustainable production practices and innovation in meat substitutes are also supporting steady market expansion across Western and Central Europe.

Latin America

Latin America accounts for nearly 6% of the global market. Regional growth is supported by the expansion of processed food manufacturing, increasing urbanization, and rising protein consumption trends. Brazil and Mexico are the primary contributors, driven by growing industrial bakery sectors and improving feed production capacity. Expanding regional exports and investments in local food processing infrastructure are gradually strengthening market penetration.

Middle East & Africa

The Middle East and Africa represent about 5% of global demand, with growth supported by rising food security initiatives and increasing reliance on imported wheat-based ingredients. Saudi Arabia, the United Arab Emirates, and South Africa lead regional consumption due to expanding bakery industries and government-backed food processing investments. Growing urban populations, modernization of retail channels, and increased demand for packaged bread and processed foods are key drivers contributing to steady regional market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vital Wheat Gluten Bulk Market

- Cargill Incorporated

- Archer Daniels Midland Company

- Tereos Group

- Manildra Group

- Roquette Frères

- CropEnergies AG

- MGP Ingredients Inc.

- Loryma GmbH

- Permolex Ltd.

- Anhui Ante Food Co., Ltd.

- Henan Tianguan Group

- Glico Nutrition Co., Ltd.

- Sedamyl

- Pioneer Industries Limited

- White Energy Co.