Vita Gummy Vitamins Market Size

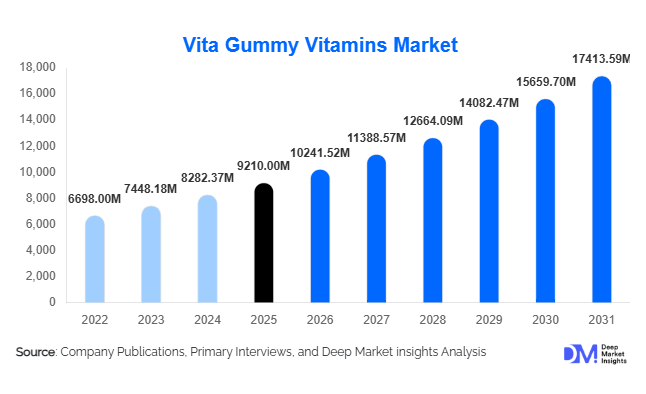

According to Deep Market Insights,the global vita gummy vitamins market size was valued at USD 9,210 million in 2025 and is projected to grow from USD 10,241.52 million in 2026 to reach USD 17,413.59 million by 2031, expanding at a CAGR of 11.2% during the forecast period (2026–2031). The vita gummy vitamins market growth is primarily driven by rising preventive healthcare awareness, increasing preference for convenient and palatable supplement formats, and rapid expansion of online nutraceutical distribution channels.

Vita gummy vitamins have evolved beyond children’s supplements to become a mainstream delivery format for multivitamins, immunity boosters, beauty supplements, digestive health, and condition-specific formulations. Adult consumers now represent the dominant demand segment, fueled by lifestyle deficiencies, immunity concerns, and wellness-oriented consumption habits. Innovation in sugar-free, vegan, and clean-label gummies is further accelerating premiumization across developed and emerging markets. Strong R&D investments, flavor diversification, and subscription-based digital sales models are reshaping global competitive dynamics.

Key Market Insights

- Adult-focused multivitamin gummies dominate global demand, accounting for the largest share of total revenue due to preventive healthcare trends.

- Online retail is the fastest-growing distribution channel, supported by D2C brands, subscription models, and influencer-driven marketing.

- North America leads the global market, driven by high supplement penetration and strong brand awareness.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class income and expanding nutraceutical awareness in China and India.

- Vegan and pectin-based gummies are gaining traction as consumers shift toward plant-based and clean-label formulations.

- Premium and condition-specific formulations are expanding rapidly, improving margins and increasing average selling prices.

What are the latest trends in the vita gummy vitamins market?

Personalized and Condition-Specific Nutrition

Consumers are increasingly seeking targeted formulations addressing immunity, sleep, stress, hair & skin health, digestive balance, and prenatal care. Brands are introducing AI-driven assessments and subscription platforms that tailor vitamin blends to individual health profiles. Personalized gummies command higher margins and foster brand loyalty, particularly in North America and Europe. This trend is also strengthening D2C models, where recurring monthly delivery programs ensure consistent revenue streams.

Clean-Label and Sugar-Free Innovations

Health-conscious consumers are scrutinizing sugar content in gummy formulations. As a result, manufacturers are reformulating products with natural sweeteners, reduced sugar content, and organic-certified ingredients. Pectin-based vegan gummies are rapidly replacing gelatin-based options in premium segments. Transparent labeling, allergen-free claims, and non-GMO certifications are becoming critical purchasing drivers, especially in developed markets with strict regulatory oversight.

What are the key drivers in the vita gummy vitamins market?

Rising Preventive Healthcare Awareness

Consumers globally are prioritizing immunity, general wellness, and nutritional supplementation to counter lifestyle-related deficiencies. Increasing healthcare costs are encouraging self-care practices, driving consistent demand for daily vitamin consumption across adults and elderly populations.

Convenience and Higher Compliance Rates

Compared to tablets and capsules, gummies offer superior taste and ease of consumption. This improves adherence among children and older consumers who struggle with pill swallowing. The enhanced sensory experience is a strong driver for repeat purchases.

Digital Commerce and Influencer Marketing

E-commerce platforms and social media endorsements are reshaping consumer buying patterns. Online channels now represent nearly 29% of the 2025 global market, enabling global brand reach and subscription-based recurring sales models.

What are the restraints for the global market?

Sugar Content and Caloric Concerns

Growing awareness around sugar intake poses challenges to traditional gummy formulations. Reformulation with sugar alternatives increases production complexity and cost.

Regulatory and Labeling Compliance

Stringent dietary supplement regulations across regions require compliance with ingredient disclosure, dosage limits, and health claims. Regulatory inconsistencies increase operational costs for multinational players.

What are the key opportunities in the vita gummy vitamins industry?

Emerging Market Expansion

Rapid urbanization and income growth in Asia-Pacific, Latin America, and the Middle East present substantial opportunities. Countries such as China, India, Brazil, and Saudi Arabia are witnessing rising demand for OTC nutraceuticals, driven by expanding pharmacy retail chains and digital health awareness.

Premium and Vegan Portfolio Diversification

Premium pricing strategies centered on organic, vegan, and sugar-free formulations are expanding margins. Consumers are willing to pay higher prices for clean-label certifications and condition-specific blends, creating space for innovation-led differentiation.

Product Type Insights

Multivitamin gummies dominate the global market, accounting for approximately 34% of the 2025 market share. The leadership of this segment is primarily driven by consumer preference for comprehensive daily supplementation in a convenient, single-format product that eliminates the need for multiple SKUs. Increasing awareness of micronutrient deficiencies, coupled with growing interest in preventive healthcare, continues to reinforce demand for broad-spectrum formulations containing vitamins A, B-complex, C, D, and E. The appeal of multivitamin gummies lies in their taste, ease of consumption, and suitability for both first-time supplement users and experienced consumers seeking simplified wellness routines. Functional gummies targeting immunity, beauty, digestive health, and sleep represent the fastest-growing sub-segments, supported by rising demand for targeted health benefits and condition-specific supplementation.

Consumer Group Insights

Adults aged 20–50 years represent the largest consumer group, contributing nearly 41% of the 2025 market. The dominance of this segment is driven by increasing work-related stress, sedentary lifestyles, irregular dietary habits, and heightened awareness of nutritional gaps. Urbanization and growing participation in fitness and wellness activities further support sustained adult consumption. This demographic also demonstrates higher purchasing power and stronger engagement with online retail platforms, influencing repeat purchases and subscription-based buying behavior. Meanwhile, geriatric demand is rising steadily due to a greater focus on bone density, cardiovascular support, immunity enhancement, and overall vitality. Pediatric demand remains stable, supported by parental preference for palatable dosage formats that improve compliance compared to traditional tablets or syrups.

Distribution Channel Insights

Online retail holds around 29% of the 2025 market share and is expanding rapidly due to subscription models, direct-to-consumer strategies, influencer marketing, and enhanced digital brand visibility. The leading driver for this segment is the convenience of doorstep delivery combined with access to a wide variety of premium and niche brands. Digital platforms enable detailed product comparisons, consumer reviews, and personalized recommendations, strengthening consumer confidence. Pharmacies and drug stores remain critical distribution channels in Europe and Latin America, where pharmacist recommendations significantly influence purchasing decisions. Supermarkets and hypermarkets maintain a strong presence in North America due to established shelf visibility, impulse buying behavior, and trusted retail infrastructure.

Formulation Insights

Gelatin-based gummies account for approximately 62% of the 2025 global market due to cost efficiency, established manufacturing infrastructure, and favorable texture stability. The primary driver behind this segment’s dominance is large-scale production feasibility and well-developed supply chains that ensure competitive pricing. However, plant-based formulations are growing at double-digit rates, particularly in premium and vegan product categories. Rising consumer preference for clean-label, non-GMO, allergen-free, and ethically sourced ingredients is accelerating demand for pectin-based and other plant-derived alternatives, especially in developed markets with strong vegan and vegetarian populations.

Price Tier Insights

The premium segment holds nearly 38% of global revenue, driven by clean-label positioning, organic ingredients, clinically backed formulations, and targeted health claims. The leading growth driver for this tier is consumer willingness to pay higher prices for transparency, quality assurance, and advanced functional benefits. Premium brands often leverage sugar-free formulations, added botanicals, adaptogens, and personalized nutrition concepts to differentiate themselves. Super-premium products are emerging in developed markets with high disposable incomes, where personalization, sustainable packaging, and science-driven branding create strong value propositions.

| By Product Type | By Consumer Group | By Distribution Channel | By Formulation | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 38% of the 2025 global market share, with the United States alone contributing nearly 31%. The regional market is driven by high dietary supplement penetration, strong consumer awareness regarding preventive healthcare, and advanced e-commerce ecosystems. The U.S. market exceeds USD 2.8 billion in 2025 and continues to expand through premiumization, personalized nutrition trends, and growing demand for functional gummies addressing immunity, sleep, and stress management. Strong retail infrastructure, aggressive product innovation, celebrity endorsements, and widespread adoption of subscription-based wellness models further reinforce regional dominance. Canada also contributes steadily, supported by regulatory clarity and increasing plant-based product adoption.

Europe

Europe accounts for nearly 27% of the global market, led by Germany, the United Kingdom, and France. Regional growth is primarily supported by stringent clean-label regulations, high consumer trust in regulated nutraceutical products, and a strong shift toward plant-based and sugar-reduced formulations. Increasing aging populations across Western Europe are driving demand for bone health and immunity-support products, while sustainability-focused packaging initiatives are influencing brand positioning. Eastern Europe is witnessing gradual expansion due to improving retail penetration and rising middle-class disposable income.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 13% CAGR. China and India serve as key growth engines, supported by rising disposable incomes, rapid urbanization, expanding e-commerce penetration, and growing awareness of nutraceutical benefits. Preventive healthcare adoption has accelerated significantly, particularly after recent global health crises, strengthening demand for immunity and multivitamin gummies. Japan and South Korea maintain stable demand for high-quality, scientifically formulated supplements, with consumers favoring premium and innovative functional products. The region’s large population base and increasing health-conscious middle class continue to create long-term growth opportunities.

Latin America

Brazil and Mexico dominate regional demand, supported by expanding pharmacy retail networks, improving healthcare awareness, and increasing middle-class health expenditure. Urban consumers are driving growth through rising adoption of convenient supplement formats, while local manufacturing expansion is gradually reducing dependency on imports. Growth is further supported by strong pharmacist influence and increasing availability of international premium brands in metropolitan markets.

Middle East & Africa

The United Arab Emirates and Saudi Arabia are emerging as high-growth markets due to strong purchasing power, expanding modern retail infrastructure, and increasing focus on preventive healthcare. Demand across the region remains largely import-driven, with premium international brands commanding significant shelf presence. Rising lifestyle-related health concerns, growing expatriate populations, and government initiatives promoting wellness awareness are contributing to steady regional expansion. South Africa also represents a developing opportunity, supported by improving retail penetration and rising consumer health consciousness.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vita Gummy Vitamins Market

- Church & Dwight Co., Inc.

- Bayer AG

- Nestlé S.A.

- Unilever PLC

- Haleon plc

- Nature’s Way Products LLC

- SmartyPants Vitamins

- OLLY Public Benefit Corporation

- Hero Nutritionals LLC

- Jamieson Wellness Inc.

- Pharmavite LLC

- GSK plc

- Amway Corp.

- Blackmores Limited

- Herbaland Naturals Inc.