Virtual Reality Puzzle Games Market Size

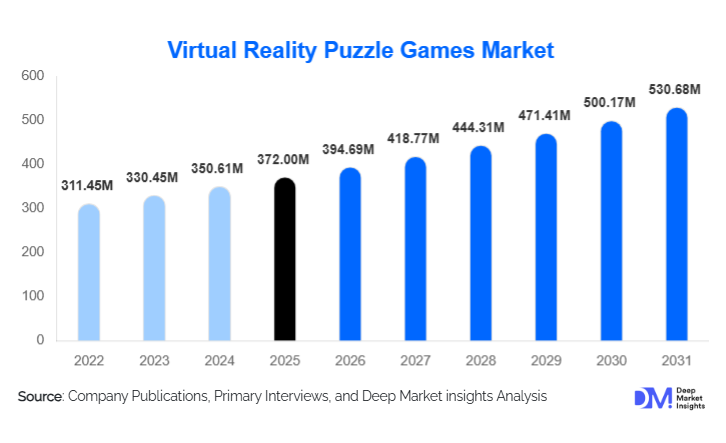

According to Deep Market Insights, the global virtual reality puzzle games market size was valued at USD 372.00 million in 2024 and is projected to grow from USD 394.69 million in 2025 to reach USD 530.68 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The virtual reality puzzle games market growth is driven by rapid adoption of standalone VR headsets, increasing consumer preference for immersive and cognitively engaging gameplay, and expanding use of VR puzzle experiences across education, healthcare, and enterprise training environments.

Key Market Insights

- Standalone VR headsets dominate the market, accounting for the largest share due to ease of access, declining hardware costs, and strong app-store ecosystems.

- Puzzle-based VR content attracts a broader demographic, including casual gamers, older users, and non-traditional gaming audiences.

- North America leads global demand, supported by high VR headset penetration, strong consumer spending, and a mature developer ecosystem.

- Asia-Pacific is the fastest-growing region, driven by China, Japan, and South Korea, with growth exceeding 20% CAGR.

- Education and cognitive wellness applications are expanding rapidly, transforming VR puzzle games into tools for learning and therapy.

- AI-driven adaptive puzzles and procedural content generation are reshaping gameplay depth and replay value.

What are the latest trends in the virtual reality puzzle games market?

AI-Driven Adaptive Puzzle Design

Artificial intelligence is increasingly being integrated into VR puzzle games to create adaptive gameplay experiences. AI algorithms analyze player behavior, cognitive patterns, and progression speed to dynamically adjust puzzle complexity and game flow. This enhances user engagement, reduces frustration, and extends average playtime. Procedural puzzle generation powered by AI is also gaining traction, allowing developers to deliver fresh content without proportionally increasing development costs. These advancements are particularly beneficial for subscription-based and freemium monetization models, where long-term engagement is critical.

Expansion Beyond Entertainment into Education and Healthcare

VR puzzle games are moving beyond pure entertainment into education, cognitive training, and mental health applications. Educational institutions are using immersive puzzle environments to enhance spatial reasoning, logic development, and STEM learning outcomes. In healthcare, VR puzzle games are being adopted for neurological rehabilitation, memory improvement, and attention training. This diversification is reducing revenue cyclicality and positioning VR puzzle games as functional digital tools rather than discretionary entertainment alone.

What are the key drivers in the virtual reality puzzle games market?

Growth of Standalone VR Hardware Ecosystems

The rapid adoption of standalone VR headsets has significantly lowered entry barriers for consumers. Devices that do not require high-end PCs or consoles have expanded the addressable user base, directly boosting demand for accessible VR puzzle games. Strong integration between hardware and content ecosystems has also improved discoverability and monetization.

Broad Demographic Appeal and Lower Motion Sickness Risk

Compared to action-intensive VR titles, puzzle games offer slower-paced, stationary experiences that reduce motion sickness. This makes them suitable for older users, first-time VR adopters, and institutional use. The inclusive nature of puzzle gameplay has expanded the market beyond traditional gamers.

What are the restraints for the global market?

Limited VR Hardware Penetration in Emerging Economies

Despite falling prices, VR hardware adoption remains limited in many developing regions. High upfront device costs and limited local content availability restrict market expansion in price-sensitive markets.

High Development Costs for Premium VR Content

Creating high-quality VR puzzle games requires specialized skills, advanced engines, and extensive testing. Smaller developers face challenges in scaling production, which can limit innovation and content diversity.

What are the key opportunities in the virtual reality puzzle games industry?

Institutional Adoption in Education and Corporate Training

Educational institutions and enterprises represent high-growth opportunities for VR puzzle games. Long-term licensing contracts, recurring revenue, and lower customer acquisition costs make this segment attractive for developers seeking stable income streams.

Location-Based VR Puzzle Experiences in Emerging Markets

VR arcades and experiential entertainment centers are expanding rapidly across Asia-Pacific, the Middle East, and Latin America. Puzzle-based VR games are well-suited for these venues due to shorter session lengths, lower hardware strain, and group participation potential.

Platform Type Insights

Standalone VR headset games dominate the market, accounting for approximately 42% of total revenue in 2024. Their leadership is primarily driven by ease of adoption, affordable pricing compared to PC-tethered systems, and strong integration with VR app stores that streamline content delivery. The popularity of all-in-one devices like Meta Quest and Pico headsets has further boosted consumption, particularly among casual gamers and educational users. PC-based VR puzzle games follow, benefiting from high-end visual fidelity, complex puzzle mechanics, and immersive performance, which appeal to hardcore VR enthusiasts. Console-based VR titles maintain steady demand via well-established ecosystems like PlayStation VR, with cross-title compatibility and loyal gamer communities supporting consistent adoption. Mobile VR puzzle games, while smaller in share, are growing rapidly due to accessibility, low hardware cost, and casual gaming trends, especially in emerging markets where standalone or tethered devices are less prevalent.

Monetization Model Insights

Premium one-time purchase games lead the market with around 38% share, reflecting strong consumer willingness to pay for complete, ad-free experiences and high-quality gameplay. Subscription-based models are gaining traction, particularly in education and cognitive training applications, where recurring revenue aligns with institutional licensing and long-term engagement. Freemium and ad-supported models are expanding among casual and mobile VR users, fueled by broad smartphone adoption and the rise of short-session puzzle experiences. Developers are increasingly using hybrid monetization strategies to capture multiple user segments while maximizing revenue from both casual and core players.

End-Use Application Insights

Entertainment and gaming remain the largest application segment, accounting for approximately 61% of market demand. This dominance is fueled by growing VR headset penetration, consumer demand for immersive puzzle gameplay, and the popularity of casual and mid-core VR content. Education and healthcare are the fastest-growing segments, each recording growth above 22% CAGR, as institutions and healthcare providers adopt VR puzzle games for STEM education, cognitive training, and mental wellness. Corporate training and location-based entertainment are emerging applications, supported by gamified team-building exercises, VR arcades, and experiential centers, contributing incremental demand and revenue diversification opportunities for developers.

Distribution Channel Insights

VR app stores such as Meta Store, SteamVR, and PlayStation Store dominate distribution due to centralized ecosystems, easy content discovery, and seamless payment integration. Direct developer platforms and enterprise licensing channels are expanding, particularly in educational and corporate segments, where bulk licensing, tailored content, and support services are key drivers. Additionally, emerging B2B models, such as VR puzzle solutions for therapy centers and cognitive rehabilitation programs, are creating new revenue channels beyond traditional consumer sales.

Age Group Insights

Adults aged 18–35 represent the largest user segment, driven by early VR adoption, gaming familiarity, and interest in immersive, interactive content. Users aged 36–50 are a rapidly growing demographic, attracted by cognitive engagement and casual puzzle gameplay that balance entertainment with mental stimulation. Older users above 50 are increasingly adopting VR puzzle games for mental wellness, memory enhancement, and therapeutic applications, creating opportunities for specialized puzzle content and healthcare partnerships.

| By Platform Type | By Monetization Model | By End-Use Application | By Distribution Channel | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of the global market, led by the United States with nearly 28% share. Growth is supported by high consumer spending, mature VR infrastructure, and strong content development ecosystems. Drivers include the rapid adoption of standalone VR headsets, the wide availability of premium puzzle titles, and increasing integration of VR in education and corporate training programs. Government initiatives promoting digital learning and innovation hubs further stimulate demand for VR puzzle content across institutions and enterprises.

Asia-Pacific

Asia-Pacific holds around 29% market share and is the fastest-growing region. Major contributors include China, Japan, and South Korea. Growth is driven by domestic VR hardware production, rising gaming culture, and strong government support for digital entertainment and educational initiatives. The expanding middle-class consumer base, increasing adoption of mobile and standalone VR devices, and thriving VR arcade networks are fueling regional demand. In China, policies supporting edtech and gamified learning accelerate VR puzzle game adoption in schools, while Japan and South Korea show high consumer uptake for immersive entertainment and cognitive training applications.

Europe

Europe represents roughly 22% of global demand, led by the UK, Germany, and France. Drivers include high VR penetration, strong interest in educational and cultural VR applications, and institutional adoption in schools and cognitive health programs. The market is further boosted by innovative VR developers and tech-forward consumers who favor premium and subscription-based puzzle games. Government-backed digital education projects and rising demand for interactive learning tools provide consistent growth opportunities.

Latin America

Latin America accounts for a smaller share but is witnessing rising adoption in Brazil and Mexico, supported by expanding VR arcade networks, improving digital infrastructure, and growing consumer awareness. Affluent consumers are increasingly investing in standalone and mobile VR devices, while gaming cafes and experiential centers provide access to broader demographics. Growth drivers include urbanization, improving internet infrastructure, and increased youth engagement with gaming and VR technology.

Middle East & Africa

The Middle East is emerging as a growth market, led by the UAE and Saudi Arabia, supported by high-income populations, investment in digital entertainment, and VR-focused government initiatives. Demand is driven by luxury and experiential adoption, with VR puzzle games being integrated into leisure centers, corporate training, and education programs. Africa remains nascent but shows potential through educational and institutional VR initiatives, particularly in South Africa and Kenya, where digital literacy programs and VR labs are driving initial adoption. Regional growth is expected to accelerate as access to standalone VR hardware and localized content increases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Virtual Reality Puzzle Games Market

- Meta Platforms

- Sony Interactive Entertainment

- Valve Corporation

- Ubisoft

- Resolution Games

- Vertigo Games

- nDreams

- Fast Travel Games

- Survios

- Owlchemy Labs