Global Vegetable Oil Market Size

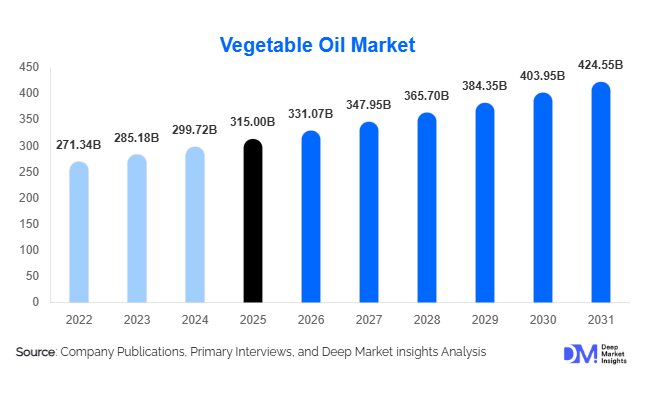

According to Deep Market Insights,the global vegetable oil market size was valued at USD 315 billion in 2025 and is projected to grow from USD 331.07 billion in 2026 to reach USD 424.55 billion by 2031, expanding at a CAGR of 5.1% during the forecast period (2026–2031). The vegetable oil market growth is primarily driven by rising food processing demand, increasing use in biofuels and industrial applications, and a growing preference for sustainable and specialty oils across households and commercial sectors.

Key Market Insights

- Palm oil remains the dominant oil type globally, accounting for approximately 33% of the total market in 2025 due to high yield, low cost, and versatile industrial and food applications.

- Conventional vegetable oils dominate consumption, comprising nearly 92% of the market, while organic and specialty oils are emerging in premium segments.

- Refined (RBD) vegetable oils hold the largest processing share, with 78% of the market, driven by long shelf life, neutral taste, and suitability for food manufacturing.

- Food & beverage processing is the largest end-use segment, contributing roughly 62% of global demand in 2025, supported by packaged foods, snacks, and bakery sectors.

- B2B distribution channels dominate, with 68% share, reflecting bulk procurement by manufacturers, biofuel producers, and industrial users.

- Asia-Pacific is the largest regional market, with China and India collectively accounting for over 30% of global consumption, while Africa is the fastest-growing region with a CAGR of 6.5%.

What are the latest trends in the vegetable oil market?

Sustainable and Certified Vegetable Oils

Producers are increasingly shifting toward sustainably sourced and certified oils, including RSPO-certified palm oil and traceable soybean and sunflower oils. Consumers, governments, and multinational corporations are emphasizing low-carbon and ESG-compliant sourcing, creating opportunities for premium pricing. Traceability systems, blockchain-enabled supply chains, and sustainable farming practices are becoming central to competitive differentiation.

Functional and Specialty Oils Gaining Popularity

Consumer preference for health-conscious products is driving growth in cold-pressed, organic, high-oleic, and cholesterol-lowering oils. Oils such as rice bran, specialty sunflower, and non-GMO canola are expanding rapidly, particularly in North America and Europe. This trend is accelerating R&D investments and branded offerings, creating higher-margin opportunities for manufacturers.

What are the key drivers in the vegetable oil market?

Growth of Global Food Processing Industry

Rising urbanization and dual-income households are driving demand for processed foods, bakery products, snacks, and ready-to-eat meals. Vegetable oils serve as a critical ingredient in these products, providing both functional and sensory properties. Countries like India, China, and Brazil are seeing strong growth in packaged food sectors, directly fueling oil consumption.

Population Growth and Rising Calorie Intake

Developing economies, including India, Indonesia, Nigeria, and Bangladesh, are witnessing higher per capita consumption of edible oils due to dietary transitions and income growth. Vegetable oils, being the most affordable source of dietary fat, remain the primary choice for households and small-scale food businesses.

Industrial Demand for Biofuels and Oleochemicals

Vegetable oils are increasingly utilized as feedstock for biodiesel, renewable diesel, soaps, detergents, lubricants, and surfactants. Policy mandates like the EU RED III and U.S. Renewable Fuel Standard are bolstering demand, providing manufacturers with stable offtake and growth opportunities.

What are the restraints for the global vegetable oil market?

Raw Material Price Volatility

Prices of soybean, palm fruit, and sunflower seeds are highly sensitive to weather conditions, geopolitical tensions, and energy prices. Such fluctuations directly affect production costs and profitability for oil refiners and manufacturers.

Regulatory and Sustainability Pressure

Environmental concerns, particularly around deforestation for palm oil cultivation, have led to stricter trade and sustainability regulations. Compliance costs and reputational risks can be substantial, especially for smaller producers operating in high-demand export markets.

What are the key opportunities in the vegetable oil industry?

Expansion in Biofuels and Renewable Energy Applications

The renewable energy sector offers significant growth potential for vegetable oil producers. Biodiesel and sustainable aviation fuels (SAF) use oils such as soybean and palm as feedstock. Government mandates in Europe, Asia, and North America are creating structured, long-term demand, enabling investment in integrated refining and processing capacities.

Premiumization and Functional Oil Innovation

Consumer focus on health, wellness, and clean-label products drives demand for cold-pressed, organic, and specialty oils. Functional oils with added health benefits, such as omega fatty acids and antioxidants, are increasingly penetrating developed markets, offering higher margins and brand differentiation opportunities.

Untapped Emerging Markets

Regions like Africa and South Asia exhibit per capita consumption below global averages. Strategic investments in local refining, packaging, and distribution can unlock sustained volume growth, particularly in household consumption and small-scale food processing sectors.

Product Type Insights

Palm oil dominates the global vegetable oil market due to cost efficiency, high yield, and versatility. Soybean oil and sunflower oil are expanding rapidly in regions with strong processed food industries. Specialty oils like rice bran, coconut, and high-oleic sunflower oils are emerging segments in premium and health-focused markets, offering higher margins.

Application Insights

Food and beverage processing remains the largest application, followed by biofuels and industrial uses. Growing applications in cosmetics, personal care, and nutraceuticals are creating niche opportunities. Export-driven industrial demand, particularly from Europe and North America, supports consistent growth across multiple oil types.

Distribution Channel Insights

B2B channels dominate global sales, with bulk procurement by food manufacturers and industrial users. Modern trade, traditional retail, and online direct-to-consumer platforms are increasingly important for specialty and packaged oils. Digital platforms and traceability certifications are enhancing transparency and consumer trust in premium oils.

End-Use Insights

The food and beverage sector remains the largest consumer of vegetable oils. Biofuel and oleochemical applications are the fastest-growing end-use segments, reflecting policy-driven adoption. Cosmetics and personal care are emerging as niche, high-value applications. Household consumption continues to grow in Asia-Pacific, Africa, and Latin America, driving long-term volume expansion.

| By Oil Type | By Nature | By Processing Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 16% of the global market, led by the U.S., where soybean oil dominates due to domestic production and biofuel usage. Rising health awareness supports growth in specialty oils. The region benefits from strong food processing industries and infrastructure for both domestic and export distribution.

Europe

Europe holds around 18% market share, with Germany, France, and the Netherlands as key demand centers. Sustainable sourcing, functional oils, and biodiesel feedstock are primary growth drivers. Specialty and organic oils are growing rapidly in Western Europe, supporting higher margins.

Asia-Pacific

Asia-Pacific is the largest regional market at 48% share, with China and India together contributing over 30% of global demand. Urbanization, rising incomes, and expanding food processing sectors are key growth factors. Palm oil and soybean oil dominate consumption, while specialty and organic oils are emerging.

Latin America

Latin America accounts for 10% of global demand, with Brazil and Argentina as major consumers. Soybean and palm oils are widely used in both household and industrial applications. Emerging interest in specialty oils is observed among premium consumers.

Middle East & Africa

Middle East & Africa represents 8% of the global market, with Nigeria, Egypt, and Saudi Arabia as primary consumers. Africa is the fastest-growing region with a CAGR of 6.5%, driven by increasing household consumption and food processing industries. Intra-African trade and exports to Europe further support market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Vegetable Oil Market

- Wilmar International

- Cargill

- ADM

- Bunge

- Olam Group

- Sime Darby Plantation

- Musim Mas Group

- IOI Corporation

- Louis Dreyfus Company

- Marico

- EFKO Group

- Fuji Oil Holdings

- Richardson International

- Conagra Brands

- Grupo Los Grobo