Upcycled Vegetable Snacks Market Size

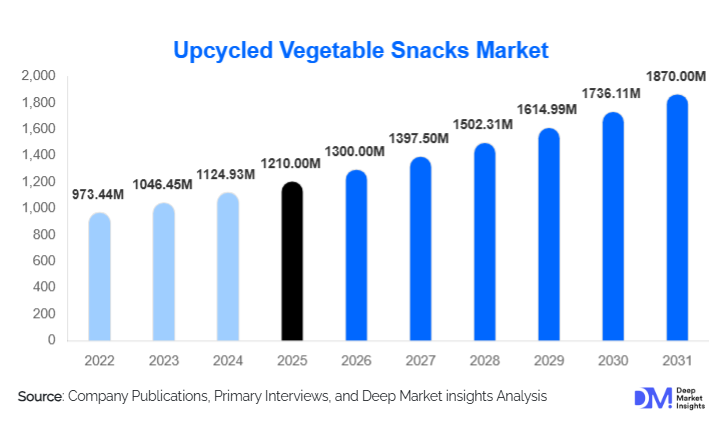

According to Deep Market Insights, the global upcycled vegetable snacks market size was valued at USD 1,210 million in 2025 and is projected to grow from USD 1,300 million in 2026 to reach USD 1,870 million by 2031, expanding at a CAGR of 7.5% during the forecast period (2026–2031). The market growth is primarily driven by increasing consumer demand for sustainable and nutritious snacks, regulatory incentives for food waste reduction, and technological innovations in processing and packaging that improve both quality and shelf life.

Key Market Insights

- Root vegetables such as carrots, beetroot, and sweet potato dominate the source segment, accounting for 28% of the market in 2025 due to abundant supply and high consumer acceptance.

- Chips and crisps are the leading snack format, representing 34% of global market share, favored for taste familiarity and ease of retail adoption.

- Baked processing technology leads, capturing 46% of the market, as it aligns with health-conscious, clean-label preferences.

- North America holds the largest regional market share, driven by high consumer awareness, robust retail distribution, and strong e-commerce penetration.

- Asia-Pacific is the fastest-growing region, with India and China experiencing rapid growth due to rising health consciousness and expanding modern retail infrastructure.

- Verified upcycled certification and sustainability labeling are increasingly important, driving premium pricing and consumer trust.

What are the latest trends in the upcycled vegetable snacks market?

Function-Focused & Health-Oriented Snacks

Manufacturers are increasingly incorporating functional ingredients such as high protein, fiber, and micronutrients into upcycled snacks, enhancing their health appeal. This trend is expanding the target audience from environmentally conscious consumers to mainstream health-focused buyers. Clean-label certifications and low-sodium formulations are also gaining prominence, providing differentiation in competitive retail environments. Products now often highlight nutritional content alongside sustainability messaging to maximize consumer appeal.

Sustainable & Eco-Friendly Packaging

Packaging innovations, including recyclable, compostable, and mono-material solutions, are being widely adopted. Brands are emphasizing traceability and impact metrics, such as the amount of food waste diverted, on packaging. These innovations not only reduce environmental footprint but also strengthen brand positioning, especially among younger, eco-conscious consumers. Retailers are supporting these initiatives by offering dedicated sustainable product sections and online visibility for environmentally responsible SKUs.

What are the key drivers in the upcycled vegetable snacks market?

Rising Consumer Preference for Sustainability

Consumers are increasingly motivated to purchase products that reduce food waste and have a smaller environmental footprint. Upcycled vegetable snacks satisfy this demand by using surplus or imperfect vegetables, delivering both nutrition and a reduced carbon impact. Millennials and Gen Z, in particular, are driving this trend, seeking products that align with personal values on sustainability and health.

Regulatory Incentives for Food Waste Reduction

Governments in North America, Europe, and the Asia-Pacific are promoting circular economy practices through food waste regulations, tax incentives, and institutional procurement policies favoring upcycled products. Compliance with these regulations not only helps brands reduce operational risks but also opens opportunities in institutional, retail, and foodservice channels.

Technological Advancements in Processing

Innovations such as vacuum frying, air-drying, and hybrid baking improve snack texture, taste, and shelf life while preserving nutrients. Advanced technologies allow large-scale production with consistent quality, reducing reliance on seasonal variability and improving profitability. Digital traceability systems are also enhancing trust among consumers and retailers by verifying upcycled content.

What are the restraints for the global market?

Raw Material Supply Volatility

The availability of surplus or imperfect vegetables fluctuates seasonally, leading to inconsistent raw material supply and cost pressures. High moisture content vegetables are particularly challenging due to rapid spoilage, requiring efficient logistics and processing to maintain quality.

Premium Pricing Relative to Conventional Snacks

Upcycled vegetable snacks generally carry higher prices due to processing, certification, and packaging costs. Price sensitivity in emerging markets can limit widespread adoption unless brands leverage scale, cost efficiencies, or strategic retail partnerships to narrow the price gap.

What are the key opportunities in the upcycled vegetable snacks industry?

Integration with the Functional Food Segment

There is strong growth potential for upcycled vegetable snacks with added functional benefits such as protein enrichment, fiber, or micronutrients. Targeting health-conscious consumers allows brands to expand beyond sustainability-focused buyers and justify premium pricing. Collaborations with juice, bakery, or cereal manufacturers also create new product lines and revenue streams.

Expansion in Emerging Markets

Asia-Pacific, particularly India and China, offers significant growth opportunities due to rising health awareness, urbanization, and retail modernization. Local flavor adaptations and cost-effective manufacturing provide a competitive advantage for both new entrants and established players in these regions.

Technological Innovation and Digital Traceability

Investment in processing technologies and digital traceability systems ensures product quality, safety, and verified upcycled claims. Blockchain-enabled verification and impact labeling enhance consumer trust and support premium positioning. Digital channels and e-commerce provide direct-to-consumer access, subscription services, and personalized offerings that accelerate adoption.

Product Type Insights

Chips and crisps dominate the upcycled vegetable snacks market, accounting for the largest share due to their strong taste familiarity, widespread consumer acceptance, and compatibility with existing snacking habits. The dominance of this segment is further driven by flexible packaging formats, such as single-serve, family packs, and on-the-go SKUs, which enable penetration across supermarkets, convenience stores, and e-commerce platforms. From a manufacturing perspective, chips and crisps allow efficient utilization of surplus root vegetables such as carrots, beetroot, and sweet potatoes, ensuring stable raw material availability and cost optimization.

Functional snack bars and vegetable-based puffs are emerging as high-growth sub-segments, particularly in health-oriented, premium, and specialty retail channels. These products integrate upcycled vegetables with added protein, fiber, or micronutrients, expanding their appeal beyond sustainability-focused consumers to performance-oriented and wellness-driven buyers. Products with verified upcycled certification and eco-labeling are gaining disproportionate traction, as transparency and measurable environmental impact increasingly influence purchasing decisions across global markets.

Application Insights

Retail consumption remains the primary application segment, driving the majority of global demand as consumers seek convenient, nutritious, and sustainable snacking solutions. Urban lifestyles, rising health awareness, and increased preference for packaged snacks with transparent ingredient sourcing have strengthened retail adoption. Supermarkets and online retailers are increasingly allocating dedicated shelf space to upcycled and sustainable snack categories, accelerating mainstream penetration.

Online subscriptions and direct-to-consumer e-commerce platforms represent one of the fastest-growing application areas. Curated snack boxes emphasizing sustainability, functional nutrition, and traceable sourcing are driving repeat purchases and higher customer lifetime value. Additionally, export-driven demand is rising, particularly from North America and Europe into Asia-Pacific and Middle East markets, where premium imported upcycled snacks are perceived as high-quality and aspirational products. This cross-border demand supports global revenue diversification and scale efficiencies for leading manufacturers.

Distribution Channel Insights

Supermarkets and hypermarkets remain the dominant distribution channels, capturing the largest volume share due to their extensive reach, strong consumer trust, and ability to support large-scale product launches. Leading retailers increasingly prioritize sustainable and clean-label offerings, positioning upcycled vegetable snacks within health and wellness aisles to maximize visibility and impulse purchases.

E-commerce and subscription-based models are experiencing rapid growth, driven by convenience, transparent product information, and personalized recommendations. These channels are particularly effective for niche and premium upcycled snack brands, allowing direct consumer engagement, storytelling around sustainability impact, and faster geographic expansion without heavy reliance on traditional retail infrastructure.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest market for upcycled vegetable snacks, led by the United States and Canada. Regional dominance is driven by high consumer awareness of sustainability, strong demand for clean-label and plant-based foods, and well-established retail and e-commerce infrastructure. Regulatory focus on food waste reduction, combined with widespread adoption of upcycled certification, further accelerates market growth. The presence of leading innovators, strong private-label participation, and advanced processing technologies also supports continuous product innovation and premium adoption.

Europe

Europe accounts for approximately 28–30% of the global market, with the UK, Germany, and France leading demand. Growth is driven by stringent food waste regulations, strong sustainability mandates, and high consumer willingness to pay for environmentally responsible products. Organized retail penetration and government-backed circular economy initiatives encourage manufacturers to adopt upcycled ingredients. Younger demographics, particularly in Western Europe, are accelerating growth through preference for ethical consumption, plant-based diets, and digitally enabled shopping channels.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with India and China at the forefront. Rapid urbanization, rising disposable incomes, expanding middle-class populations, and increasing health consciousness are key growth drivers. Retail modernization and the expansion of e-commerce platforms enable wider product accessibility, while localized flavor profiles improve consumer acceptance. Additionally, government initiatives targeting food security and waste reduction are creating favorable conditions for upcycled food adoption. The region’s CAGR exceeds the global average, reflecting early-stage penetration and strong long-term demand potential.

Latin America

Latin America is an emerging growth region, with Brazil, Argentina, and Mexico showing increasing adoption. Growth is driven by affluent urban consumers seeking healthier and premium snack alternatives, alongside the gradual expansion of modern retail formats. While domestic production remains limited, outbound exports from North America and Europe supplement supply and introduce global brands to local markets. Increasing awareness of sustainability and nutrition is expected to support steady market expansion over the forecast period.

Middle East & Africa

Africa serves as a key source of raw material supply due to agricultural production, while regional consumption is gradually increasing in urban centers. The Middle East, led by the UAE and Saudi Arabia, represents a high-value consumer market driven by premium food demand, strong import reliance, and growing interest in health and wellness products. High disposable incomes, expanding modern retail infrastructure, and sustainability-focused government initiatives are supporting adoption. Intra-regional trade and premium imports continue to drive growth across both regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Upcycled Vegetable Snacks Industry

- Mondelez International Inc.

- Del Monte Pacific

- Imperfect Foods

- The Ugly Company

- RIND Snacks

- Outcast Foods

- Planetarians

- THEO’s Plant-Based

- Bake Me Healthy

- Cascara Foods

- Confetti Snacks

- Growers Garden

- Matriark Foods

- Pulp Pantry

- Spare Snacks