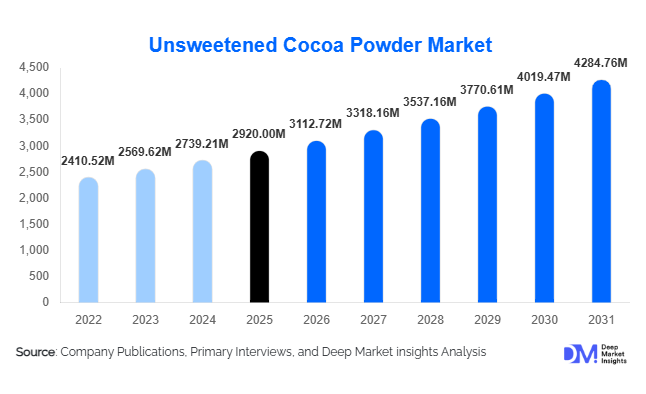

Unsweetened Cocoa Powder Market Size

According to Deep Market Insights, the global unsweetened cocoa powder market size was valued at USD 2,920 million in 2025 and is projected to grow from USD 3,112.72 million in 2026 to reach USD 4,284.76 million by 2031, expanding at a CAGR of 6.6% during the forecast period (2026–2031). Market growth is primarily driven by rising demand from the global food and beverage industry, increasing adoption of low-sugar and clean-label ingredients, and the expanding use of cocoa powder in functional foods, nutraceuticals, and personal care formulations.

Key Market Insights

- Unsweetened cocoa powder remains a critical ingredient across bakery, confectionery, and beverage manufacturing due to its flavor intensity and formulation flexibility.

- Dutch-processed cocoa powder dominates global demand, supported by its smoother taste profile and wide industrial acceptance.

- Europe leads global consumption, driven by advanced chocolate manufacturing hubs in Germany, the Netherlands, and Belgium.

- Asia-Pacific is the fastest-growing region, fueled by expanding bakery, dairy dessert, and ready-to-drink beverage industries.

- Rising demand for organic and ethically certified cocoa is reshaping sourcing strategies and premium product positioning.

- Raw material price volatility remains a key risk factor influencing pricing and profitability across the value chain.

What are the latest trends in the unsweetened cocoa powder market?

Shift Toward Clean-Label and Sugar-Reduced Formulations

Food manufacturers are increasingly reformulating products to reduce sugar content while preserving taste, driving higher usage of unsweetened cocoa powder. Its natural flavor strength allows producers to maintain sensory appeal without added sweeteners or artificial flavorings. This trend is particularly strong in bakery mixes, breakfast cereals, plant-based beverages, and dairy alternatives. As regulatory scrutiny around sugar consumption intensifies, unsweetened cocoa powder is emerging as a preferred natural ingredient across multiple product categories.

Growing Adoption in Functional Foods and Nutraceuticals

Unsweetened cocoa powder is gaining traction beyond traditional food applications due to its antioxidant and flavonoid content. Manufacturers of protein powders, meal replacements, and functional beverages are increasingly incorporating cocoa powder for both nutritional and flavor benefits. This trend is supported by rising consumer awareness of cocoa’s cardiovascular and cognitive health properties, positioning the ingredient as both indulgent and health-aligned.

What are the key drivers in the unsweetened cocoa powder market?

Expansion of the Global Bakery and Confectionery Industry

The steady expansion of bakery and confectionery production globally remains a primary growth driver. Unsweetened cocoa powder is extensively used in cakes, cookies, fillings, coatings, and chocolate-flavored products. Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth in packaged baked goods, directly boosting cocoa powder demand.

Rising Demand for Natural and Sustainable Ingredients

Consumers are increasingly prioritizing transparency, sustainability, and ethical sourcing. This has encouraged manufacturers to invest in traceable and certified cocoa powder supply chains. Unsweetened cocoa powder aligns well with clean-label trends, supporting long-term demand growth across premium and mass-market segments.

What are the restraints for the global market?

Volatility in Cocoa Bean Prices

Cocoa bean supply disruptions caused by climate variability, aging plantations, and geopolitical challenges in West Africa significantly impact raw material prices. These fluctuations compress margins for processors and can lead to pricing instability for end users, posing a key challenge to market participants.

Regulatory and Compliance Pressures

Strict regulations related to pesticide residues, heavy metals, and sustainability reporting increase compliance costs, particularly for small and mid-sized producers. Meeting diverse regional standards adds complexity to global operations and can slow market entry.

What are the key opportunities in the unsweetened cocoa powder industry?

Growth in Organic and Ethically Certified Cocoa Powder

Demand for organic, fair-trade, and single-origin cocoa powder is rising rapidly, especially in Europe and North America. These segments offer higher margins and long-term supply contracts, presenting attractive opportunities for producers willing to invest in certification and traceability.

Asia-Pacific Processing and Localization Opportunities

Rapid growth in food manufacturing across China, India, and Southeast Asia is creating opportunities for localized cocoa powder processing facilities. Establishing regional production reduces logistics costs and improves supply chain resilience for global manufacturers.

Product Type Insights

Dutch-processed unsweetened cocoa powder holds the largest market share globally, primarily due to its mild flavor, darker color, and broad applicability in bakery and beverage formulations. The alkalization process enhances solubility and reduces acidity, making it ideal for mass-market chocolate products, cocoa-based drinks, and processed foods. Natural (non-alkalized) cocoa powder continues to see strong demand in niche and health-focused segments, especially in products requiring higher acidity or antioxidant retention, such as specialty baked goods, smoothies, and functional foods. Among fat content categories, medium-fat cocoa powder (12–20%) leads the market, offering an optimal balance between flavor intensity, texture, and processing performance, which makes it the preferred choice for industrial applications in confectionery and bakery. This dominance is driven by its versatility, cost-effectiveness, and ability to deliver consistent product quality, particularly in high-volume manufacturing environments.

End-Use Industry Insights

The food and beverage manufacturing sector is the largest end-use segment, accounting for over 40% of total demand for unsweetened cocoa powder. Its growth is driven by increasing global consumption of chocolate-flavored products, bakery items, and beverage mixes. Bakery and confectionery applications follow closely, benefitting from the ongoing expansion of packaged food and convenience-oriented products in both mature and emerging markets. Notably, the nutraceutical and functional food segment is the fastest-growing end-use segment, expanding at a CAGR exceeding 8%. This growth is fueled by rising consumer awareness of cocoa's health benefits, including antioxidant properties, cardiovascular support, and mental well-being. Manufacturers are increasingly incorporating cocoa powder into protein powders, meal replacements, functional beverages, and health-focused snacks, creating new high-margin opportunities and driving product innovation.

Distribution Channel Insights

Direct B2B supply contracts dominate the market, accounting for more than half of global sales, as large-scale food manufacturers and multinational brands secure long-term agreements with cocoa powder producers to ensure stable supply and consistent quality. Ingredient distributors play a crucial role in serving small and mid-sized manufacturers, offering flexibility in order volume and access to specialty grades. Meanwhile, retail and e-commerce channels are expanding steadily, particularly for organic, single-origin, and specialty cocoa powders targeting health-conscious consumers and premium product segments. The growth in e-commerce is further accelerated by the increasing demand for direct-to-consumer delivery of small-batch and high-quality cocoa powders, catering to artisanal bakers and specialty food enthusiasts.

| By Product Type | By End-Use Industry | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 34% of the global unsweetened cocoa powder market, led by Germany, the Netherlands, Belgium, and France. The region’s dominance is supported by a highly developed chocolate manufacturing ecosystem, a strong presence of multinational confectionery companies, and robust demand for certified and sustainable cocoa products. Drivers for growth include high consumer preference for premium and specialty cocoa, stringent food safety and quality regulations, and an increasing focus on organic and fair-trade cocoa, which commands premium pricing and encourages innovation in product offerings.

North America

North America holds around 26% of the market, with the United States representing the largest share. Market growth is supported by large-scale bakery, beverage mix, and functional food manufacturing industries. Key drivers include rising demand for clean-label, low-sugar, and high-antioxidant formulations, increasing consumption of cocoa-based snacks and beverages, and innovations in ready-to-drink and powdered drink mixes. Consumer preference for premium and ethically sourced cocoa products also fuels adoption, along with supportive distribution infrastructure and well-established B2B supply networks.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at nearly 8% CAGR, with China and India as key markets. Drivers include rising packaged food consumption, growing urbanization, and increasing disposable income among middle-class consumers. The expanding bakery and confectionery sector, combined with higher chocolate penetration in emerging markets, creates strong industrial demand. Additionally, local processing facilities and foreign direct investments are improving supply chain efficiency, making premium cocoa powder more accessible to regional food manufacturers. Health-conscious trends and increasing adoption of functional foods further accelerate growth in this region.

Latin America

Latin America accounts for a smaller but steadily growing share of the global market, with Brazil and Mexico leading demand. Market growth is primarily driven by domestic confectionery production and export-oriented food manufacturing. Regional drivers include rising per capita chocolate consumption, expansion of packaged food manufacturing, and growing investment in value-added cocoa processing to supply both domestic and international markets. Increasing interest in organic and single-origin cocoa powder also presents niche opportunities for local and global players.

Middle East & Africa

The Middle East & Africa region plays a dual role as a major cocoa-producing hub and a growing consumer market. Demand is increasing in the UAE, South Africa, and other Gulf countries, driven by rising chocolate consumption, growing foodservice and bakery sectors, and increasing urbanization. West Africa remains central to global cocoa production, supplying raw material for global cocoa powder processing. Regional growth is further supported by government initiatives to modernize agricultural practices, improve supply chain infrastructure, and promote value addition in cocoa processing, while rising health-conscious consumer behavior encourages adoption of cocoa-based functional products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|