UHT Milk Market Size

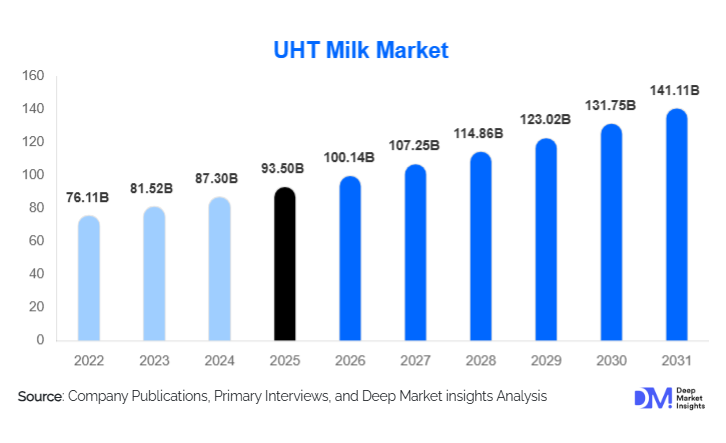

According to Deep Market Insights, the global UHT milk market size was valued at USD 93.50 billion in 2025 and is projected to grow from USD 100.14 billion in 2026 to reach USD 141.11 billion by 2031, expanding at a CAGR of 7.1% during the forecast period (2026–2031). The UHT milk market growth is driven by rising urbanization, increasing demand for shelf-stable dairy products, expansion of institutional nutrition programs, and growing penetration of modern retail and e-commerce grocery platforms. UHT milk’s extended shelf life, reduced cold-chain dependency, and suitability for export markets make it a critical component of global dairy supply chains.

Key Market Insights

- Asia-Pacific dominates the global UHT milk market, accounting for over 43% of total demand, driven by China and India.

- Full-cream UHT milk remains the leading fat-content segment, particularly in emerging economies with high caloric consumption preferences.

- Carton-based aseptic packaging accounts for nearly 78% of sales, supported by sustainability, cost efficiency, and long shelf life.

- Institutional and foodservice demand is growing at over 8% CAGR, outpacing household consumption growth.

- Fortified and functional UHT milk is the fastest-growing product type, supported by health and wellness trends.

- Export-driven demand from Africa and the Middle East is strengthening global trade flows.

What are the latest trends in the UHT milk market?

Growth of Fortified and Functional UHT Milk

Consumers are increasingly seeking nutritionally enhanced dairy products, driving demand for fortified and functional UHT milk. Products enriched with calcium, vitamins A and D, high protein content, and lactose-free formulations are gaining strong traction across Europe, North America, and urban Asia. This segment commands premium pricing and is expanding rapidly within school nutrition programs, elderly care, and fitness-oriented consumer groups. Manufacturers are investing in R&D to differentiate products through targeted health benefits, improving margins, and brand positioning.

Sustainability and Packaging Innovation

Sustainability has become a defining trend in the UHT milk market. Dairy companies are transitioning toward recyclable, bio-based, and lightweight carton packaging to reduce environmental impact. Energy-efficient UHT processing lines and water-saving technologies are being deployed to meet regulatory and retailer sustainability requirements. These initiatives are particularly prominent in Europe, where eco-labeling and carbon footprint disclosures increasingly influence purchasing decisions.

What are the key drivers in the UHT milk market?

Urbanization and Lifestyle Convenience

Rapid urbanization and changing consumer lifestyles are key growth drivers for the UHT milk market. Urban consumers value convenience, reduced shopping frequency, and long shelf life, making UHT milk a preferred alternative to fresh milk. This trend is especially strong in Asia-Pacific, Latin America, and Africa, where cold-chain infrastructure remains uneven.

Expansion of Institutional Nutrition Programs

Government-led nutrition initiatives, including school feeding programs, defense supplies, hospitals, and disaster relief operations, are significantly boosting UHT milk demand. These programs favor UHT milk due to its safety, consistent quality, and long storage life. Public procurement contracts provide volume stability and predictable revenue streams for manufacturers.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in raw milk prices, driven by feed costs, climate variability, and energy prices, pose a key restraint for the UHT milk market. These factors impact procurement costs and compress margins, particularly for price-sensitive markets in emerging economies.

Consumer Preference for Fresh Milk in Developed Markets

In parts of North America and Western Europe, consumers still perceive fresh milk as superior in taste and nutrition, limiting UHT milk penetration. Overcoming this perception requires sustained marketing investments and product innovation.

What are the key opportunities in the UHT milk industry?

Export-Oriented Growth in Emerging Regions

Africa and the Middle East are increasingly reliant on imported dairy products due to limited domestic production. UHT milk’s long shelf life makes it ideal for export-driven growth, creating opportunities for producers in Europe, New Zealand, and Latin America to secure long-term supply contracts.

Technology and Automation in Dairy Processing

Investments in automated UHT processing, digital quality control, and energy-efficient equipment are enabling manufacturers to scale production while reducing operational costs. Adoption of Industry 4.0 technologies is improving yield consistency and traceability, strengthening competitiveness.

Product Type Insights

Plain UHT milk continues to dominate the global market, accounting for approximately 62% of 2024 revenue. This dominance is largely driven by its staple role in household consumption and institutional programs, such as schools, hospitals, and government nutrition initiatives, which favor the affordability, safety, and long shelf life of plain UHT milk. In contrast, fortified and functional UHT milk represents the fastest-growing segment, expanding at over 9% CAGR. Growth in this segment is fueled by rising health awareness, increasing demand for protein-enriched, calcium-fortified, and lactose-free options, and the proliferation of fitness-oriented and aging populations across North America, Europe, and Asia-Pacific. Flavored UHT milk remains a niche but steadily expanding category, particularly popular among children, adolescents, and young urban consumers, driven by taste preference and lifestyle adoption.

Fat Content Insights

Full-cream UHT milk leads globally with a 54% market share, particularly in Asia, Africa, and the Middle East, where higher caloric intake is culturally preferred, and consumer awareness of the nutritional benefits of full-fat dairy products is strong. Semi-skimmed and skimmed variants are increasingly popular in Europe and North America, supported by weight-management, heart-health, and cholesterol-conscious consumer trends. The growing availability of semi-skimmed and skimmed UHT milk in modern retail and e-commerce platforms is further driving adoption in health-conscious urban populations.

Packaging Insights

Carton-based aseptic packs dominate the global UHT milk market, accounting for nearly 78% of sales. These packs are preferred for their long shelf life, cost efficiency, ease of transportation, and sustainability credentials. Plastic bottles are mainly adopted for premium, single-serve, or ready-to-drink UHT milk formats, catering to convenience-focused consumers in urban areas. Flexible pouches remain limited to select price-sensitive markets, where affordability and ease of disposal are key considerations. Innovations in recyclable and eco-friendly packaging are increasingly shaping purchasing decisions, particularly in Europe and North America.

Distribution Channel Insights

Supermarkets and hypermarkets account for 46% of global UHT milk sales, benefiting from wide product assortments, private-label options, and established cold-chain infrastructure. Institutional and B2B channels represent approximately 28% of demand, driven by contracts with schools, hospitals, hotels, and catering businesses. Online grocery platforms are the fastest-growing distribution channel, fueled by urbanization, e-commerce adoption, and subscription-based delivery models that cater to convenience-seeking consumers. Direct-to-consumer platforms are also expanding, supported by digital marketing and social media engagement to target health-conscious urban buyers.

End-Use Insights

Household consumption remains the largest end-use segment, accounting for around 60% of total global demand. Foodservice, institutional nutrition, and food processing segments are witnessing robust growth, exceeding 8% CAGR. Drivers include the recovery of tourism and hospitality sectors post-pandemic, expansion of urban catering services, and export-oriented food processing industries in Latin America, Asia-Pacific, and the Middle East. The food processing segment increasingly relies on UHT milk for bakery, confectionery, ready-to-drink beverages, and dairy-based ingredient applications, due to its consistent quality, extended shelf life, and reduced spoilage risk.

| By Product Type | By Fat Content | By Packaging Type | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global UHT milk market with a 43% share in 2024. China alone contributes nearly 18% of global demand, supported by extensive school milk programs, rapid urbanization, and rising middle-class consumption. India, Indonesia, and Thailand are significant growth markets, driven by population growth, increasing per capita milk consumption, and the expansion of modern retail and e-commerce distribution channels. The leading driver for UHT milk growth in the region is the increasing adoption of functional and fortified milk, reflecting rising health awareness, urban lifestyle shifts, and government-led nutrition initiatives.

Europe

Europe accounts for approximately 27% of the market, led by Germany, France, Spain, and Italy. Southern Europe exhibits near-universal adoption of UHT milk, whereas Northern Europe focuses on premium and functional variants. Growth is supported by rising consumer preference for lactose-free and fortified products, coupled with stringent food safety and quality standards. The key drivers in Europe include the strong health-conscious consumer base, growth in functional milk adoption, and widespread modern retail penetration that facilitates access to premium UHT products.

Latin America

Latin America holds a 16% market share, with Brazil and Mexico as major consumers due to warm climates, long distribution networks, and high urban population concentrations. Regional growth is driven by increasing household consumption, expanding supermarket penetration, and the rising popularity of fortified and functional milk for school and institutional nutrition programs. The leading growth driver is the adoption of UHT milk as a practical alternative to fresh milk, which requires refrigeration that may be limited in remote or underserved regions.

Middle East & Africa

The Middle East & Africa region accounts for 9% of global demand and is the fastest-growing region, with a CAGR exceeding 8.5%. Growth is primarily driven by import dependency due to limited domestic milk production, rising population, and increasing urbanization. The adoption of UHT milk in institutional nutrition programs, such as schools, hospitals, and government welfare initiatives, is a key growth driver. Additionally, rising health awareness, preference for fortified products, and expansion of modern retail and e-commerce channels are accelerating market penetration.

North America

North America represents approximately 5% of the global UHT milk market, with growth concentrated in lactose-free, fortified, and functional milk segments. Consumers increasingly prioritize convenience, long shelf life, and health-oriented products. The region’s growth is supported by widespread awareness of nutrition benefits, strong institutional demand, and the expansion of online grocery platforms that facilitate direct-to-consumer delivery.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the UHT Milk Market

- Lactalis Group

- Nestlé

- Danone

- FrieslandCampina

- Arla Foods

- Fonterra

- Yili Group

- Mengniu Dairy

- Saputo

- Amul

- Savencia

- DMK Group

- Bright Dairy

- Meiji Holdings

- Almarai