Tyrosinase Food Market Size

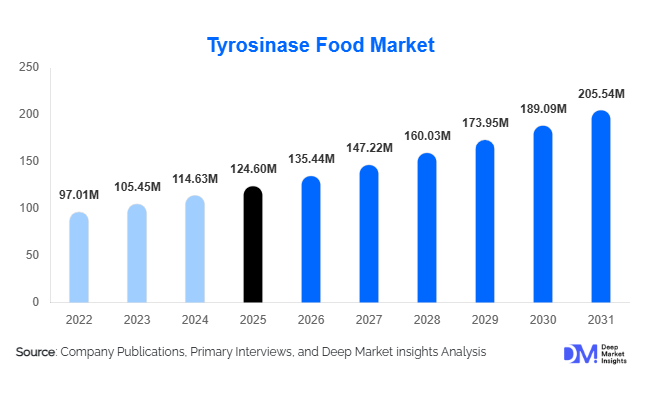

According to Deep Market Insights, the global tyrosinase food market size was valued at USD 124.6 million in 2025 and is projected to grow from USD 135.44 million in 2026 to reach USD 205.54 million by 2031, expanding at a CAGR of 8.7% during the forecast period (2026–2031). The tyrosinase food market growth is primarily driven by the rising adoption of enzyme-based food processing aids, increasing preference for clean-label and naturally processed foods, and advancements in microbial fermentation technologies that enable consistent and scalable enzyme production.

Key Market Insights

- Microbial tyrosinase dominates the market due to superior scalability, regulatory acceptance, and cost efficiency compared to plant- and animal-derived alternatives.

- Powdered enzyme formats lead adoption, supported by longer shelf life, easier transportation, and compatibility with dry food formulations.

- Bakery and confectionery applications account for the largest share, driven by demand for natural browning control, texture enhancement, and visual appeal.

- Asia-Pacific leads global consumption, supported by expanding food processing capacity in China, India, and Southeast Asia.

- Medium-activity tyrosinase is most widely used, balancing performance efficiency and cost-effectiveness for industrial-scale applications.

- Technological innovation in enzyme engineering is improving thermal stability and expanding application potential across high-temperature food processes.

What are the latest trends in the tyrosinase food market?

Growing Adoption of Clean-Label Enzymatic Processing

Food manufacturers are increasingly replacing synthetic additives with enzymatic solutions to meet clean-label and regulatory requirements. Tyrosinase is gaining traction as a natural processing aid that improves color stability, flavor development, and protein cross-linking without appearing on final ingredient labels in many regions. This trend is particularly strong in Europe and North America, where regulatory scrutiny and consumer awareness around artificial additives are accelerating enzyme adoption. Manufacturers are positioning tyrosinase as a sustainability-enabling ingredient that reduces chemical usage while improving product consistency.

Advancements in Microbial Fermentation and Enzyme Stability

Recent advances in microbial strain optimization, fermentation efficiency, and purification techniques have significantly improved tyrosinase yield and activity stability. High-performance variants with improved heat tolerance are enabling usage in baked goods, processed dairy, and ready-to-eat foods. These developments are expanding the addressable market and allowing enzyme suppliers to offer application-specific formulations, supporting premium pricing and long-term supplier partnerships.

What are the key drivers in the tyrosinase food market?

Rising Demand for Natural Food Processing Aids

The global shift toward natural and minimally processed foods is a major driver for tyrosinase adoption. Food processors are increasingly prioritizing enzymatic solutions that improve quality attributes while supporting clean-label positioning. Tyrosinase enables controlled oxidation reactions that enhance food appearance and texture, making it a preferred alternative to chemical oxidizers in bakery, dairy, and beverage applications.

Expansion of Global Processed Food Production

Rapid growth in processed and convenience food consumption, particularly in Asia-Pacific, is accelerating demand for specialty food enzymes. Tyrosinase supports large-scale food production by improving uniformity, shelf appeal, and sensory characteristics. Rising urbanization, changing dietary habits, and export-oriented food manufacturing are reinforcing this demand across emerging economies.

What are the restraints for the global market?

Technical Complexity and Limited Awareness

Effective tyrosinase application requires precise control of dosage, temperature, and processing conditions. Limited technical expertise among small and mid-sized food processors can restrict adoption, particularly in price-sensitive markets. Inadequate awareness of enzyme benefits further slows penetration outside established industrial users.

Cost Sensitivity and Production Volatility

Tyrosinase production relies on controlled fermentation processes and purification technologies, making it sensitive to energy costs and raw material price fluctuations. Margin pressure may arise for suppliers competing on price rather than performance differentiation, particularly in emerging markets.

What are the key opportunities in the tyrosinase food industry?

Emerging Market Food Processing Expansion

Emerging economies such as India, Vietnam, Indonesia, and Brazil are investing heavily in food processing infrastructure. Localized enzyme manufacturing and application-specific tyrosinase solutions present significant opportunities for both global players and regional entrants seeking to reduce import dependency and capture domestic demand.

Integration into Functional and High-Protein Foods

The growing functional food and sports nutrition markets offer new application avenues for tyrosinase. Its role in protein cross-linking supports texture optimization in high-protein formulations, plant-based foods, and medical nutrition products, expanding demand beyond traditional food processing segments.

Source Insights

Microbial tyrosinase dominates the global tyrosinase food market, accounting for approximately 68% of total market share in 2025. This leadership is primarily driven by its scalable fermentation-based production, consistent enzymatic activity, and cost efficiency compared to alternative sources. Additionally, microbial tyrosinase benefits from broad regulatory acceptance across major food-producing regions, making it the preferred choice for large-scale food processing applications.

Plant-derived tyrosinase holds a comparatively smaller share and is largely utilized in niche and specialty food applications, particularly where clean-label positioning and plant-based sourcing are prioritized. However, challenges related to lower yield and variability in enzyme activity limit its wider adoption. Animal-derived tyrosinase continues to decline in market presence due to higher production costs, ethical concerns, and stringent regulatory restrictions, especially in Europe and North America.

Form Insights

Powdered tyrosinase remains the leading form segment, capturing nearly 62% of the global market share in 2025. The segment’s dominance is driven by its extended shelf life, ease of storage and transportation, and high compatibility with dry food formulations such as bakery mixes, seasoning blends, and processed food premixes. Its stability under varying temperature conditions further supports widespread adoption by industrial food manufacturers.

Liquid tyrosinase is witnessing steady growth, particularly in beverage, dairy, and liquid food processing applications. The key growth driver for this segment is its rapid solubility and uniform dispersion, which enables precise enzyme activity control during processing. Rising demand for ready-to-drink beverages and fermented dairy products is expected to accelerate adoption of liquid formulations over the forecast period.

Application Insights

Food color enhancement and enzymatic browning control represent the largest application segment, accounting for approximately 34% of global demand. Growth in this segment is primarily driven by the increasing shift toward natural food processing solutions and the replacement of synthetic additives with enzyme-based alternatives in fruits, vegetables, bakery products, and processed foods.

Protein cross-linking and texture improvement applications are expanding steadily, supported by rising demand for improved mouthfeel, elasticity, and structural stability in bakery, dairy, and processed food products. This application segment is further benefiting from the growth of plant-based and alternative protein foods, where tyrosinase enhances texture and binding without synthetic ingredients.

End-Use Industry Insights

The bakery and confectionery segment leads the market, accounting for nearly 29% of total market share. The primary driver for this segment is the growing demand for natural browning control, texture enhancement, and visual appeal in baked goods, pastries, and confectionery products. Industrial bakeries increasingly rely on tyrosinase to ensure consistency and product quality at scale.

Dairy, beverages, and processed foods collectively represent a significant portion of demand, driven by innovation in fermented products, flavored dairy, and premium beverages. Meanwhile, nutraceuticals and functional foods are emerging as the fastest-growing end-use segment, supported by rising consumer awareness of functional ingredients, enzyme-based processing, and clean-label nutrition.

| By Source | By Form | By Activity Level | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global tyrosinase food market with approximately 38% share in 2025. Regional growth is driven by large-scale food manufacturing capacity, rapid urbanization, and increasing consumption of processed and convenience foods. China leads demand due to its extensive food processing infrastructure and strong domestic enzyme production capabilities.

India is the fastest-growing market in the region, registering a CAGR exceeding 10%, supported by expansion of the food processing sector, rising investments under government-led manufacturing initiatives, and growing adoption of enzymatic solutions among mid-sized food producers.

Europe

Europe accounts for nearly 27% of global demand, led by Germany, France, and the Netherlands. Growth in the region is strongly supported by strict clean-label and food safety regulations, which favor enzyme-based processing aids over chemical additives. Additionally, Europe’s advanced food technology ecosystem and high penetration of premium bakery and dairy products ensure consistent demand for tyrosinase.

North America

North America holds approximately 22% market share, driven by strong demand from the premium bakery segment, dairy product innovation, and the expanding functional food and beverage industry. The United States leads regional consumption, supported by high R&D investments, adoption of advanced food processing technologies, and consumer preference for clean-label and naturally processed foods.

Latin America

Latin America represents a steadily growing market, led by Brazil and Mexico. Regional growth is driven by increasing exports of processed foods, modernization of food processing facilities, and gradual adoption of enzyme-based processing aids to improve product quality and shelf life. Rising urban populations and changing dietary habits further support market expansion.

Middle East & Africa

The Middle East & Africa region holds a smaller but expanding share of the global market. Growth is primarily driven by rising food imports, growth of premium and packaged food manufacturing, and increasing investments in food processing infrastructure. The UAE and South Africa are emerging as key demand centers due to their roles as regional food trade hubs and growing focus on value-added food production.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tyrosinase Food Market

- Novozymes A/S

- DSM-Firmenich

- BASF SE

- Amano Enzyme Inc.

- Kerry Group

- AB Enzymes

- Chr. Hansen Holding

- DuPont Nutrition & Biosciences

- Advanced Enzyme Technologies

- Biocatalysts Ltd

- Jiangsu Boli Bioproducts

- Sunson Industry Group

- Enzyme Development Corporation

- Aumgene Biosciences

- Creative Enzymes