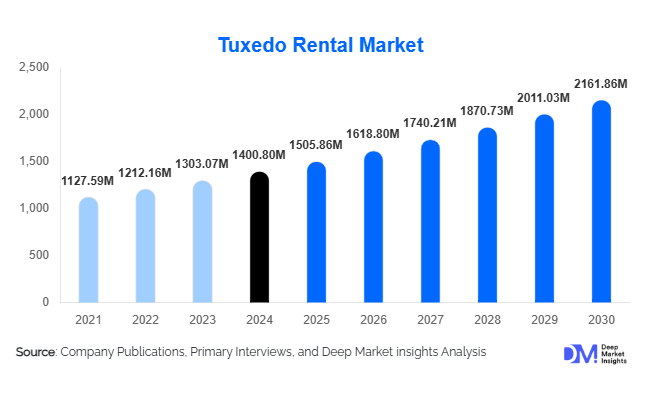

Tuxedo Rental Market Size

According to Deep Market Insights, the global tuxedo rental market size was valued at USD 1,400.80 million in 2024 and is projected to grow from USD 1,505.86 million in 2025 to reach USD 2,161.86 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The tuxedo rental market growth is primarily driven by the rebound of global social events, rising preference for cost-effective formalwear, growing sustainability awareness, and increasing adoption of online and hybrid rental platforms.

Key Market Insights

- Wedding and engagement events remain the largest demand driver, accounting for the highest rental volumes globally.

- Short-term rentals (1–3 days) dominate, reflecting the event-centric nature of tuxedo usage.

- North America leads the global market, supported by strong prom culture, weddings, and corporate events.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and Western-style weddings.

- Mid-range pricing tiers account for the largest share, balancing affordability with quality and brand appeal.

- Digital platforms and virtual fitting technologies are reshaping customer acquisition and retention strategies.

What are the latest trends in the tuxedo rental market?

Digital and Hybrid Rental Models Expanding Rapidly

The tuxedo rental industry is increasingly shifting toward digital-first and hybrid business models. Online booking platforms, virtual sizing tools, and home delivery services are improving customer convenience while reducing dependency on physical retail footprints. Hybrid models, combining online reservations with in-store fittings, are becoming the preferred approach for premium and mid-range rentals, enabling higher conversion rates and lower return volumes. The integration of AI-based size recommendation engines and mobile-friendly platforms is particularly appealing to younger demographics.

Sustainability and Circular Fashion Adoption

Sustainability is emerging as a major trend in the tuxedo rental market. Consumers are increasingly aware of textile waste and overconsumption, making rental an attractive alternative to ownership. Leading providers are investing in eco-friendly cleaning processes, recycled fabrics, and extended garment lifecycle management. Marketing tuxedo rental as a circular fashion solution is strengthening brand positioning, particularly among millennials and Gen Z consumers who prioritize environmental responsibility.

What are the key drivers in the tuxedo rental market?

Recovery and Growth of the Global Event Economy

The resurgence of weddings, corporate galas, award ceremonies, and social gatherings following pandemic-related disruptions has significantly boosted tuxedo rental demand. Destination weddings, luxury hospitality events, and entertainment industry functions are generating consistent short-term rental requirements, particularly in North America, Europe, and emerging Asian markets.

Cost Efficiency Compared to Ownership

Purchasing a tuxedo involves high upfront costs and limited usage frequency, making rental a more economical option for most consumers. Rental prices typically represent a fraction of ownership costs while offering access to premium brands and contemporary styles. This cost advantage is a key driver among young professionals, students, and first-time formalwear users.

Rising Acceptance of Rental-Based Consumption

The broader acceptance of rental and subscription models across fashion and lifestyle categories is positively influencing tuxedo rentals. Consumers are increasingly comfortable renting high-value apparel for occasional use, supported by improved hygiene standards, quality assurance, and flexible rental policies.

What are the restraints for the global market?

Fit, Quality, and Hygiene Concerns

Despite advancements in sizing technology, concerns related to improper fit, garment wear-and-tear, and hygiene persist among some consumers. These perceptions are more pronounced in premium segments, where expectations for customization and quality are higher. Addressing these issues requires continuous investment in inventory management and garment refurbishment.

High Inventory and Maintenance Costs

Tuxedo rental businesses require substantial capital investment in inventory, cleaning infrastructure, logistics, and storage. Seasonal demand fluctuations can lead to underutilized inventory during off-peak periods, exerting pressure on operating margins, particularly for smaller and regional players.

What are the key opportunities in the tuxedo rental industry?

Expansion into Emerging Markets

Emerging economies in the Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Rising middle-class populations, increasing exposure to Western formalwear, and growth in luxury hospitality and corporate events are creating new demand pools. Localization of designs and pricing strategies can further accelerate adoption.

Technology-Enabled Personalization

Investments in AI-driven sizing, virtual try-ons, and data analytics present opportunities to improve customer satisfaction while reducing return rates. Personalized style recommendations and event-specific bundles can enhance average order values and customer loyalty.

Product Type Insights

Mid-range tuxedo rentals dominate the market, accounting for approximately 44% of global revenue in 2024. This segment appeals to consumers seeking a balance between affordability and premium aesthetics. Premium and luxury tuxedo rentals cater to high-income customers and account for around 31% of the market, driven by weddings, entertainment events, and luxury hospitality. Economy rentals represent the remaining share, primarily serving students and budget-conscious consumers for proms and graduations.

Application Insights

Wedding and engagement events represent the largest application segment, contributing nearly 38% of total market revenue in 2024. Proms and graduation ceremonies form the second-largest application, particularly in North America. Corporate and black-tie business events continue to generate steady demand, while entertainment and red-carpet events drive premium and bespoke rentals.

Distribution Channel Insights

Offline specialty rental stores continue to hold a significant share due to fitting requirements and immediate service needs. However, online and hybrid channels are the fastest-growing, supported by digital convenience, broader geographic reach, and improved logistics. Brand-owned platforms are increasingly outperforming third-party marketplaces in customer retention and profitability.

Customer Type Insights

Individual consumers (B2C) account for approximately 72% of the market, driven by personal event participation. Institutional clients, including hotels, cruise lines, event management firms, and entertainment studios, represent a growing B2B segment, benefiting from bulk rentals and recurring demand.

| By Occasion Type | By Customer Type | By Rental Duration | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 41% of the global tuxedo rental market in 2024. The United States dominates regional demand, supported by a well-established prom culture, high wedding spending, and a strong calendar of corporate and black-tie events. The presence of large rental chains, omnichannel booking models, and wide style availability further strengthens market penetration. Canada contributes consistent demand, driven by formal social occasions and business events across major urban centers.

Europe

Europe represents around 26% of the global market, led by the U.K., Germany, France, and Italy. Demand is underpinned by long-standing formalwear traditions, frequent corporate functions, and high participation in weddings and cultural events. Sustainability awareness and cost-conscious consumer behavior are accelerating the shift toward rental models, particularly among younger demographics in Western Europe.

Asia-Pacific

Asia-Pacific holds approximately 21% market share and is the fastest-growing region, expanding at over 8% CAGR. China and India are key contributors, supported by rapid urbanization, rising disposable incomes, and increasing adoption of Western-style formal attire for weddings and premium events. Growth is also reinforced by expanding luxury hospitality, destination weddings, and greater access to organized rental platforms in metropolitan areas.

Latin America

Latin America accounts for about 7% of the market, with Brazil and Mexico leading regional demand. Urban weddings, social celebrations, and formal gatherings continue to drive rental usage, particularly in major cities where affordability and convenience support tuxedo rental over ownership.

Middle East & Africa

The Middle East & Africa region represents roughly 5% of global revenue. The UAE and Saudi Arabia anchor demand through high-end weddings, corporate events, and luxury hospitality-led functions. South Africa remains a regional hub for formalwear rentals, supported by business events, private celebrations, and established retail infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tuxedo Rental Market

- Men’s Wearhouse

- The Black Tux

- Generation Tux

- Moss Bros Group

- Jim’s Formal Wear

- Formalwear International

- Turo’s Tux

- Leonard Formalwear

- SuitShop

- Perry Ellis International

- StudioSuits

- Masterhand Group

- Alain Dupetit

- Dresscode Group

- Bridegroom’s Wear