Corporate Event Market Size

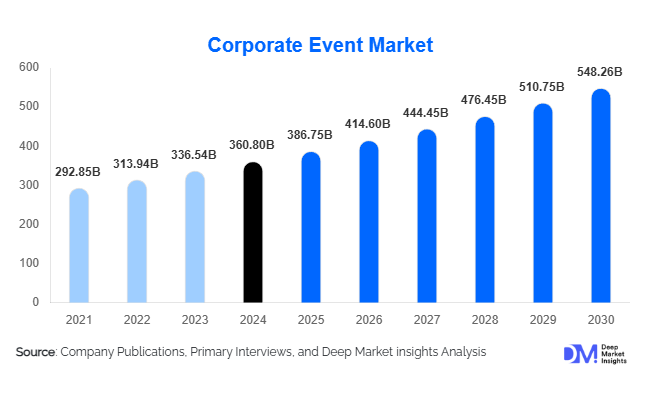

According to Deep Market Insights, the global corporate event market size was valued at USD 360.8 billion in 2024 and is projected to grow from USD 386.75 billion in 2025 to reach USD 548.26 billion by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The corporate event market growth is primarily driven by the increasing adoption of hybrid and virtual event formats, expansion of MICE infrastructure globally, rising corporate spending on employee engagement and brand-experiential programs, and growing demand from emerging markets such as Asia-Pacific and the Middle East.

Key Market Insights

- Hybrid and virtual events are reshaping the industry, allowing companies to reach wider audiences while optimizing costs and improving sustainability outcomes.

- Large enterprises dominate spending, but SMEs and government organisations are increasingly investing in corporate events for marketing, stakeholder engagement, and employee retention.

- North America remains the largest regional market, led by the U.S., due to mature corporate infrastructure, high corporate travel budgets, and widespread adoption of event technologies.

- Asia-Pacific is the fastest-growing region, with China, India, and Japan leading demand due to rising corporate budgets, government MICE initiatives, and rapid urbanization.

- Technological integration, including AI-powered analytics, immersive AR/VR experiences, mobile event platforms, and virtual networking tools, is increasingly central to event strategy.

- Information technology, financial services, and automotive sectors are leading verticals driving the market through frequent product launches, global conferences, and partner engagement programs.

What are the latest trends in the corporate event market?

Hybrid and Digital Event Integration

Corporate events are increasingly combining physical and digital formats to enhance reach, flexibility, and ROI. Hybrid events enable companies to connect with global stakeholders who cannot attend in person, while virtual platforms facilitate data-driven insights on attendee engagement. The adoption of AI-driven matchmaking, live polling, virtual networking lounges, and on-demand content allows organisations to track outcomes and refine engagement strategies. This shift is particularly beneficial for SMEs and multinational companies seeking cost-efficient ways to scale events across multiple regions.

Data-Driven Personalisation and Analytics

Organisers are leveraging data analytics and AI to personalise attendee experiences, optimise content delivery, and measure event success. Insights on attendee behaviour, engagement levels, and preferences allow companies to fine-tune marketing and internal communication strategies. Event platforms now incorporate dashboards for real-time metrics, post-event reporting, and ROI measurement, enhancing the strategic value of corporate gatherings. Additionally, immersive technologies such as AR/VR and gamified experiences are being integrated to boost engagement and create differentiated experiences.

What are the key drivers in the corporate event market?

Increasing Corporate Spending on Engagement and Branding

Companies recognize the strategic value of events in employee engagement, talent retention, and customer relationship management. High budgets are being allocated for leadership conferences, product launches, town halls, and incentive programs. Brand-experiential events, where customers and partners engage with products and services interactively, are increasingly preferred. Large-scale conferences and seminars remain dominant, particularly among IT, finance, and automotive companies, which frequently host global events requiring significant investments.

Government and Infrastructure Support

Government initiatives promoting MICE tourism, such as investment in convention centres and airport connectivity, are enabling corporate event growth in emerging economies. Regions like India, China, and the UAE are actively upgrading infrastructure to attract multinational conferences, incentive travel programs, and trade shows. These initiatives enhance the feasibility of regional and international events while creating new opportunities for event service providers and technology platforms.

What are the restraints for the global market?

High Operational Costs and Logistical Complexity

Planning and executing corporate events involve substantial costs, including venue hire, travel, accommodation, AV technology, catering, and security. These expenses create barriers for smaller enterprises and may lead to budget constraints or postponements. Logistical complexity, especially for global or multi-city events, further challenges event organisers in achieving consistent quality and ROI.

Security and Data Privacy Concerns

As virtual and hybrid events become more prevalent, companies face risks associated with cybersecurity, data privacy, and online platform reliability. Attendee information, live-streaming content, and sensitive corporate data require robust protection measures. Inadequate safeguards can affect brand reputation and limit the adoption of digital formats, creating hurdles for market expansion.

What are the key opportunities in the corporate event market?

Expansion in Emerging Markets

Asia-Pacific and the Middle East are witnessing rapid growth in corporate events due to rising corporate budgets, government support, and increased urbanisation. Cities like Mumbai, Shanghai, Dubai, and Singapore are becoming major hubs for conferences, product launches, and incentive travel programs. Event service providers and technology platforms that target these emerging markets can capture a large portion of new demand by offering cost-effective and innovative solutions.

Adoption of Technology-Driven Event Services

AI, AR/VR, immersive experiences, and event analytics tools present significant opportunities for differentiation and value creation. Service providers can offer end-to-end digital solutions, including personalised content delivery, attendee engagement tracking, and post-event analytics, enabling companies to maximize ROI. The demand for data-rich, measurable, and interactive experiences is increasing across all industries, creating a premium segment for technology-integrated events.

Hybrid and Micro-Event Strategies

Smaller-scale, regional, or micro-events are emerging as effective alternatives to large, centralized gatherings. These formats reduce costs, enable higher participation, and improve flexibility, particularly for SMEs and government organizations. Providers can specialise in managing multiple concurrent micro-events, integrating local experiences with global brand standards, and combining physical and virtual participation, expanding opportunities in both developed and emerging regions.

Event Type Insights

By Event Type, the corporate event market is segmented into Internal/Employee Events, Sales & Marketing Events, Investor & Financial Events, Industry/Trade Events, Partner & Supplier Events, and Executive/Strategic Retreats.

Among these, Sales & Marketing Events hold a dominant share due to their vital role in driving brand visibility, lead generation, and product promotion across industries. Internal/Employee Events are also gaining traction as organizations emphasize team engagement and corporate culture. Meanwhile, Industry/Trade Events continue to grow steadily with the expansion of global B2B networking opportunities. Investor & Financial Events are expected to see consistent growth, supported by increased investor relations activities. Executive/Strategic Retreats and Partner & Supplier Events are niche but crucial segments, catering to leadership collaboration and strategic alliances.

Delivery Mode Insights

Based on delivery mode, the market is categorized into Physical Events, Hybrid Events, and Virtual Events.

Physical Events currently dominate due to the strong preference for in-person networking and immersive brand experiences. However, Hybrid Events are growing at the fastest rate as they combine physical and digital engagement, offering flexibility and wider reach. Virtual Events remain relevant, especially for cost-efficient gatherings and global audiences, supported by advancements in event technology and virtual conferencing tools.

Service Type Insights

By service type, the market includes Event Planning & Management, Technology & AV Solutions, Logistics & Production Services, and Catering & Hospitality Services.

Event Planning & Management represents the largest share, as organizations increasingly outsource complete event coordination to specialized service providers. Technology & AV Solutions are expected to grow rapidly, driven by innovations in virtual platforms, interactive content, and digital engagement tools. Logistics & Production Services remain essential for operational execution, while Catering & Hospitality Services continue to play a critical role in enhancing on-site attendee experiences.

End-User Insights

The end-user segmentation includes IT & Telecom, Finance & Banking, Automotive, Healthcare & Pharmaceuticals, and Manufacturing & Industrial.

The IT & Telecom sector leads the market due to frequent product launches, tech conferences, and global summits. Finance & Banking follows closely, with a focus on investor meetings, financial conferences, and corporate communication events. The Automotive industry utilizes events for product showcases, dealer meets, and brand activations. Healthcare & Pharmaceuticals show robust growth, supported by medical conferences, training sessions, and product awareness programs. Meanwhile, the Manufacturing & Industrial sector is leveraging trade fairs and exhibitions to highlight technological advancements and strengthen B2B relationships.

| By Event Type | By Delivery Mode | By Service Type | By End-User Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market (35% share), led by the U.S., due to mature event infrastructure, high corporate budgets, and rapid adoption of hybrid technologies. Key growth drivers include strong demand for experiential marketing, premium production values, and sophisticated ROI measurement through pipeline tracking, retention metrics, and NPS. Canada contributes to growth primarily via business conferences, incentive programs, and regional trade shows. Organizations in this region are increasingly leveraging data-driven event tools, immersive technologies, and cross-industry networking events to optimize engagement and efficiency.

Europe

Europe accounts for 32% of the market, with the U.K., Germany, and France leading demand. Growth is driven by corporate headquarters concentration, strong sustainability and ESG expectations, and stringent data/privacy regulations that influence event design and attendee tracking. Companies are favoring regional hubs, hybrid and green events, and multi-lingual strategies to navigate fragmented markets. Rising adoption of eco-friendly venues, carbon reporting for events, and compliance-focused digital platforms further support growth, while regional economic stability allows steady corporate spending on conferences, trade shows, and strategic retreats.

Asia-Pacific

Asia-Pacific is the fastest-growing region (16.5% CAGR), accounting for 21-22% of the market in 2024. China, India, and Japan lead demand, driven by rising corporate budgets, large-scale regional expansions, government MICE initiatives, and rapid urbanization. Key drivers include appetite for in-person events, mobile-first engagement platforms, and hybrid event adoption. Price sensitivity in certain markets encourages innovative, cost-efficient event solutions, while technology adoption supports immersive experiences and measurable ROI. Emerging Tier-2 cities are also creating new hubs for trade shows and corporate conferences.

Latin America

Latin America (8-10% share) is growing moderately, driven by Brazil, Argentina, and Mexico. The primary growth driver is the rising demand for trade shows, roadshows, and regional corporate gatherings as markets open up. Cost-sensitive buyers still value in-person relationship-building, encouraging hybrid models that combine affordability with high engagement. Infrastructure and venue quality improvements in major cities further enable larger corporate events, enhancing ROI and international participation.

Middle East & Africa

MEA (6-8% share) is emerging rapidly, supported by investment in destination events, luxury hospitality, and government-driven mega-projects. UAE, Saudi Arabia, and South Africa are key markets benefiting from high-margin, small-scale elite events and international conferences. Drivers include the premium demand for bespoke experiences, high-value incentive programs, and luxury hospitality integration. While political and regulatory variability can impact cross-border attendance, government initiatives and strategic mega-projects create significant opportunities for global event organizers and high-end service providers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Corporate Event Market

- Informa plc

- BCD Group

- Cvent Inc.

- Freeman Company

- Maritz Holdings, Inc.

- ITA Group

- Access Destination Services, LLC

- Reed Exhibitions

- Merlin Entertainments plc

- SMG Manifest LLC

- BI Worldwide

- 360 Destination Group

- CWT Meetings & Events

- Creative Group, Inc.

- BCD Travel Services B.V.

Recent Developments

- In March 2025, Cvent Inc. launched a new AI-powered virtual event platform to enhance attendee engagement and analytics.

- In January 2025, Informa plc expanded its presence in Asia-Pacific, acquiring two regional event management firms to strengthen hybrid event capabilities.

- In February 2025, BCD Group introduced a sustainability-focused corporate event service, integrating carbon offset programs and eco-friendly venue partnerships.