Global Tropical Fruits Market Size

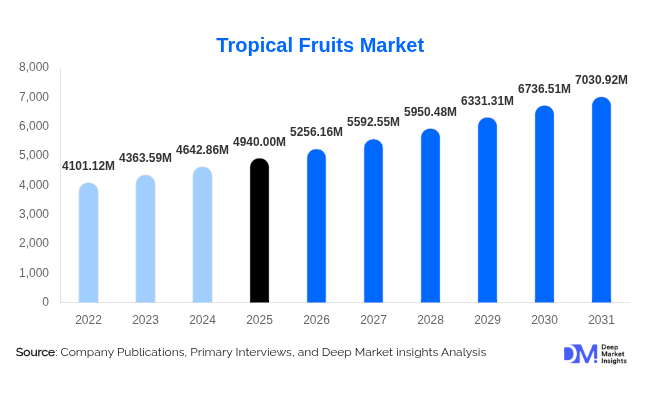

According to Deep Market Insights, the global tropical fruits market size was valued at USD 4,940.00 million in 2025 and is projected to grow from USD 5,256.16 million in 2026 to reach USD 7,030.92 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The market growth is primarily driven by rising global consumption of fresh and healthy foods, increasing penetration of tropical fruits into non-native regions through international trade, and growing industrial usage of tropical fruits in food processing, beverages, nutraceuticals, and cosmetics.

Key Market Insights

- Fresh tropical fruits dominate global consumption, accounting for over 60% of total market value due to strong household demand.

- Bananas remain the single largest fruit segment, contributing nearly 38% of global tropical fruit revenues.

- Asia-Pacific leads global production and consumption, supported by large populations, favorable climates, and expanding domestic demand.

- North America and Europe are import-driven markets, relying heavily on Latin America and Asia for year-round supply.

- Organic tropical fruits are growing at nearly twice the market CAGR, driven by premium pricing and health-conscious consumers.

- Cold-chain and logistics advancements are significantly reducing post-harvest losses and improving export quality.

What are the latest trends in the tropical fruits market?

Rising Demand for Organic and Sustainably Sourced Fruits

Consumers are increasingly prioritizing organic and sustainably produced tropical fruits, particularly in North America and Europe. Organic bananas, mangoes, avocados, and pineapples are witnessing strong demand growth as buyers seek pesticide-free produce with transparent sourcing. Retailers are expanding private-label organic fruit offerings, while producers are investing in certification, traceability systems, and regenerative farming practices. Sustainability credentials are also becoming a key differentiator in export markets, allowing suppliers to command higher margins and secure long-term retail contracts.

Expansion of Value-Added Tropical Fruit Products

The market is witnessing rapid growth in value-added forms such as frozen fruits, purees, pulps, dried fruits, and concentrates. These formats are increasingly used in smoothies, dairy alternatives, bakery fillings, confectionery, and ready-to-drink beverages. Technological improvements in freezing and dehydration are preserving flavor and nutritional content, making processed tropical fruits more appealing to both consumers and industrial buyers. This trend is reducing reliance on fresh fruit pricing cycles and creating stable demand channels for producers.

What are the key drivers in the tropical fruits market?

Global Shift Toward Healthier Diets

Rising awareness of nutrition and preventive health is a major driver of tropical fruit consumption. Fruits such as mangoes, papayas, pineapples, and guavas are rich in vitamins, antioxidants, and dietary fiber, making them popular choices in daily diets. Post-pandemic health consciousness has further accelerated demand, particularly in urban populations and developed markets.

Growth in International Trade and Retail Penetration

Advancements in refrigerated transport, controlled-atmosphere storage, and ripening technologies have enabled tropical fruits to reach distant markets with consistent quality. Organized retail expansion, especially supermarkets and hypermarkets, has improved availability and affordability, driving higher per-capita consumption in non-producing regions.

What are the restraints for the global market?

Climate Volatility and Agricultural Risks

Tropical fruit cultivation is highly sensitive to weather variability, pests, and diseases. Climate change-related events such as droughts, floods, and hurricanes can disrupt supply, impact yields, and cause price volatility. These risks pose challenges to long-term production stability.

Post-Harvest Losses and Infrastructure Gaps

Inadequate cold storage, fragmented logistics, and limited processing capacity in developing producing countries result in significant post-harvest losses, sometimes exceeding 20%. These inefficiencies reduce profitability and export competitiveness.

What are the key opportunities in the tropical fruits industry?

Functional Foods and Nutraceutical Applications

Tropical fruit extracts and derivatives are increasingly used in immunity-boosting supplements, digestive enzymes, and functional beverages. As the global nutraceutical industry continues to expand, tropical fruits offer high-growth opportunities beyond fresh consumption.

Emerging Import Markets and Trade Liberalization

Rising incomes and modern retail growth in Eastern Europe, the Middle East, and East Asia are unlocking new demand for imported tropical fruits. Improved trade agreements and investments in port and cold-chain infrastructure are enabling producers to access these high-value markets.

Fruit Type Insights

Bananas dominate the global tropical fruits market, accounting for approximately 38% of total market value in 2025 due to affordability, year-round availability, and widespread consumption. Mangoes and pineapples follow as key segments, supported by both fresh consumption and processing demand. Avocados represent one of the fastest-growing segments, driven by strong demand in North America and Europe for healthy fats and premium produce.

Product Form Insights

Fresh whole fruits represent about 62% of total market value, reflecting strong household demand. However, frozen and processed forms are growing rapidly, supported by foodservice, beverage, and industrial applications. Dried and dehydrated tropical fruits are gaining popularity as healthy snack alternatives.

End-Use Insights

Household consumption accounts for nearly 58% of total demand, making it the largest end-use segment. The food processing and beverage industries are the fastest-growing end users, expanding at over 6.5% CAGR, driven by demand for fruit-based ingredients in packaged foods, smoothies, and functional drinks. Cosmetics and nutraceutical applications are emerging as high-margin niche segments.

Distribution Channel Insights

Supermarkets and hypermarkets dominate distribution with approximately 45% market share, supported by organized retail expansion and global sourcing capabilities. Online retail and direct-to-consumer channels are growing rapidly, particularly for premium and organic fruits. Foodservice and wholesale export channels remain critical for volume-driven sales.

| By Fruit Type | By Product Form | By Nature | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global tropical fruits market with approximately 42% share in 2025. India, China, Thailand, Indonesia, and the Philippines are major producers and consumers. China is the fastest-growing country market, expanding at over 7% CAGR, driven by rising imports and premium fruit demand.

Latin America

Latin America accounts for around 23% of global market value and is the world’s largest export hub. Ecuador, Brazil, Mexico, and Costa Rica dominate banana, pineapple, and mango exports, supplying North America and Europe.

North America

North America represents about 17% of global demand, led by the United States, which alone accounts for nearly 11% of global tropical fruit imports. Demand is driven by year-round consumption, health trends, and strong retail penetration.

Europe

Europe holds approximately 14% market share, with Germany, the U.K., France, and the Netherlands as key markets. The Netherlands serves as a major re-export hub for tropical fruits across the continent.

Middle East & Africa

The Middle East and Africa collectively account for about 4% of global demand. The UAE and Saudi Arabia are emerging as high-growth import markets, while Africa remains a key production base for global exports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Tropical Fruits Market

- Chiquita Brands International

- Dole plc

- Fresh Del Monte Produce

- Del Monte Pacific Limited

- Fyffes plc

- Compagnie Fruitière

- Unifrutti Group

- Total Produce plc

- Grupo Noboa

- Reybanpac

- AgroAmerica

- Banabay

- Lapanday Foods Corporation

- Keelings International

- Earth University Foundation (Commercial Arm)