Treehouse Glamping Market Size

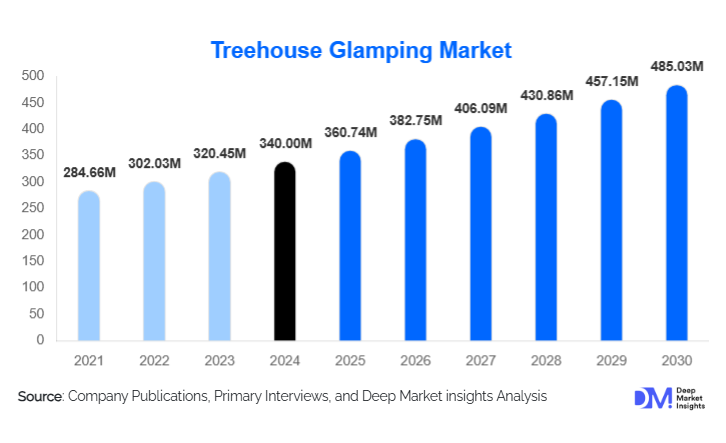

According to Deep Market Insights, the global treehouse glamping market size was valued at USD 340.00 million in 2024 and is projected to grow from USD 360.74 million in 2025 to reach USD 485.03 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The growth of the treehouse glamping market is fueled by rising consumer demand for immersive nature experiences, increasing adoption of sustainable tourism models, and the expansion of luxury treehouse accommodations that offer hotel-grade comfort in forested environments.

Key Market Insights

- Experiential and nature-immersive travel is reshaping global tourism demand, positioning treehouse glamping as a preferred alternative to traditional resort stays.

- Luxury treehouse accommodations are expanding worldwide, offering amenities such as en-suite bathrooms, climate control, and premium interiors targeted at affluent travelers.

- Europe accounts for the largest regional share of the treehouse glamping market in 2024, driven by a mature eco-tourism culture and strong domestic travel demand.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class incomes, regional tourism growth, and increasing government support for eco-friendly lodging.

- Technology adoption is accelerating, with operators integrating digital booking systems, immersive virtual tours, and personalized experience platforms.

- Younger travelers (18–32 years) represent the dominant customer demographic, accounting for nearly half of global treehouse glamping stays in 2024.

What are the latest trends in the treehouse glamping market?

Sustainable & Eco-Integrated Treehouse Designs

Treehouse glamping operators are increasingly adopting sustainable design philosophies that minimize environmental impact. This includes using reclaimed wood, renewable energy systems, rainwater harvesting, and low-impact foundation designs that protect surrounding ecosystems. Many resorts integrate sustainability education, carbon-offset programs, and guided eco-tours into their offerings, appealing to environmentally conscious travelers. The emphasis on sustainability not only supports brand differentiation but also aligns with government incentives promoting eco-tourism in regions such as Europe and the Asia-Pacific. As eco-awareness grows globally, treehouse glamping is emerging as a highly sustainable alternative to traditional resort development.

Technology-Enabled Guest Experiences

Technology is reshaping how travelers discover and engage with treehouse glamping destinations. Virtual reality previews help guests visualize forest canopy accommodations before booking, while digital concierge systems allow seamless check-in, tailored itinerary planning, and personalized add-on experiences. Mobile apps offering curated nature trails, wellness activities, and local cultural content enrich the guest experience. For operators, technology enables dynamic pricing, efficient booking management, and enhanced safety monitoring for treehouse structures. The rising expectations of digital-native travelers, particularly millennials and Gen Z, are accelerating tech integration across glamping destinations worldwide.

What are the key drivers in the treehouse glamping market?

Growing Preference for Experience-Centric Travel

Global travelers increasingly prefer unique, experience-driven accommodations over standardized hotel stays. Treehouse glamping offers an immersive blend of comfort, adventure, and natural beauty, making it attractive to couples, families, and younger adventurers. This shift in traveler behavior is especially strong among 18–32-year-olds, who account for 45–48% of total market demand in 2024. The desire for Instagram-worthy, memory-rich travel experiences continues to drive market expansion.

Rising Demand for Sustainable & Wellness Tourism

The global rise in nature-based wellness travel, including mindfulness retreats, digital detox programs, and forest therapy, has enhanced the appeal of treehouse glamping. The inherent proximity to nature supports mental wellness, stress relief, and low-impact tourism. Resorts that integrate wellness amenities such as yoga decks, meditation pods, and organic cuisine are capturing growing interest among health-conscious travelers. As sustainability becomes central to travel choices, treehouse glamping aligns perfectly with eco-friendly tourism values.

Expansion of Premium & Luxury Treehouse Experiences

There has been a surge in investment toward high-end treehouses featuring boutique interiors, private decks, spas, and premium hospitality services. Luxury treehouses account for 35–40% of global revenues in 2024, making them the fastest-growing tier. Affluent travelers increasingly seek secluded, exclusive experiences, and luxury treehouse glamping satisfies this demand while offering strong profit margins for operators.

What are the restraints for the global market?

High Construction & Maintenance Costs

Treehouse structures require specialized engineering, safety reinforcements, and continuous maintenance, making them more expensive to build compared to tents, cabins, or pods. Material costs, site preparation, and regulatory compliance contribute to high upfront investment. These financial barriers limit market entry and slow expansion for smaller operators.

Seasonal Demand and Regulatory Constraints

Many treehouse glamping sites rely on favorable weather conditions, resulting in seasonal revenue patterns. Additionally, strict environmental regulations and zoning laws often restrict construction in woodland or protected areas. Navigating these regulations increases project timelines and costs, limiting growth opportunities in certain regions.

What are the key opportunities in the treehouse glamping industry?

Wellness-Retreat and Eco-Healing Experiences

The global wellness tourism boom presents a substantial opportunity for treehouse glamping operators to integrate healing-focused experiences. Treehouse resorts offering yoga sessions, forest bathing, mindfulness retreats, hot springs access, and organic culinary programs can cater to a fast-growing wellness traveler segment. This hybrid model increases visitor stay duration and supports higher per-night pricing.

Emerging Market Expansion Across Asia-Pacific & LATAM

Countries such as India, Indonesia, Vietnam, Brazil, and Costa Rica possess vast natural landscapes ideal for treehouse glamping development. Rapid urbanization, rising disposable incomes, and government eco-tourism initiatives make these markets highly attractive. First-mover operators can secure strategic sites and build strong brand loyalty as regional demand for unique nature experiences accelerates.

Technology-Led Personalization & Smart Treehouse Concepts

There is a significant opportunity for operators to differentiate through technology, smart lighting, automated temperature control, digital guest services, and AI-driven personalization. Tech-enabled nature experiences appeal strongly to Gen Z and millennial travelers. Integrating AR-guided trails, drone-based nature tours, or interactive forest education programs can create additional revenue streams and boost guest engagement.

Product Type Insights

Luxury treehouse glamping leads the market with the largest revenue share, driven by affluent travelers seeking exclusive, comfort-oriented experiences in natural settings. Luxury offerings often include en-suite bathrooms, private decks, spas, and premium furnishings. Mid-range treehouses appeal to families and young couples, offering a balance between affordability and comfort. Basic or rustic treehouses attract adventure travelers and budget-conscious guests who prioritize nature immersion over amenities. Across segments, premiumization is a strong trend, with operators adding upgraded facilities to boost occupancy and average daily rates.

Application Insights

Leisure and holiday travel remains the dominant application, accounting for 60–65% of total market demand. Nature enthusiasts, couples, and families drive this segment. Wellness retreats represent a rapidly expanding application as travelers seek restorative stays focused on mental and physical well-being. Event-based stays, including intimate weddings, corporate off-sites, and family gatherings, are growing steadily, supported by the appeal of secluded scenic venues. Adventure and eco-tourism also contribute significantly, particularly in forested regions, national parks, and wildlife corridors.

Distribution Channel Insights

Offline bookings dominate the treehouse glamping market, representing 55–60% of total reservations in 2024. Many travelers prefer direct communication with hosts for customized packages and local guidance. However, online bookings are growing rapidly, driven by the rise of glamping platforms, enhanced D2C websites, and integration of virtual tours. Social media and influencer promotions strongly influence booking decisions among younger demographics, accelerating digital adoption.

Traveler Type Insights

Couples and romantic travelers represent a high-value segment, especially in luxury and mid-range treehouses designed for privacy and scenic immersion. Group travelers, including families and friends, drive demand for multi-unit treehouse clusters. Solo travelers, particularly wellness and adventure seekers, contribute to weekday occupancy. Youth travelers (18–32 years) remain the largest segment overall, shaped by digital booking habits and a preference for memorable, nature-centric experiences.

Age Group Insights

The 18–32 age group accounts for the highest share, about 45–48% of global market demand, driven by a preference for unique, Instagrammable experiences. Travelers aged 33–50 years are significant contributors to luxury treehouse bookings due to higher disposable incomes. Older travelers in the 51–65 and 65+ brackets show growing interest in wellness-oriented and comfort-driven stays, favoring premium treehouses with accessibility features and guided nature activities.

| By Accommodation Type | By Application | By Traveler Type | By Booking Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is one of the largest regions for treehouse glamping, supported by strong domestic travel demand, road-trip culture, and widespread interest in national park experiences. The U.S. holds the majority share, driven by rising demand for nature retreats and wellness-focused stays. Canada contributes through forest-rich provinces that support scenic treehouse accommodations.

Europe

Europe leads the global market with a 28–30% share in 2024, supported by a mature eco-tourism ecosystem and high domestic travel volumes. The U.K., Germany, and France are leading contributors, benefiting from forested landscapes, sustainable tourism policies, and widespread acceptance of glamping as a premium leisure activity.

Asia-Pacific

APAC is the fastest-growing region, driven by rapidly expanding middle-class populations and increasing interest in nature-immersive travel. India, China, Indonesia, and Thailand offer strong development potential due to diverse natural landscapes and government-backed eco-tourism initiatives. Australia and Japan represent mature markets with consistent demand.

Latin America

LATAM holds a modest but growing share, with countries such as Costa Rica, Brazil, and Peru offering ideal forest environments. Eco-tourism growth and increased marketing of nature-based accommodations are helping expand regional demand.

Middle East & Africa

MEA shows emerging potential, particularly in forested African nations and mountainous regions. While climate constraints limit broader adoption, niche opportunities exist in eco-lodges and high-end retreat markets. Regional tourism authorities are exploring sustainable resort models to diversify travel offerings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Treehouse Glamping Industry

- Collective Retreats

- Under Canvas

- Huttopia

- Treehouse Point

- Getaway

- Canopy & Stars

- Backland

- Outland Camps

- Banyan Tree Group (Eco-Stay Division)

- Inkaterra

- Elephant Hills

- Wild Canvas

- EcoCamp Patagonia

- PurePods

Recent Developments

- In March 2025, Collective Retreats announced the launch of new luxury treehouse units integrating solar microgrids and water recycling technology to reduce environmental impact.

- In February 2025, Under Canvas revealed its expansion plan into three new forest destinations across the U.S., introducing elevated treehouse suites with panoramic canopy views.

- In January 2025, Huttopia introduced a smart-treehouse prototype featuring automated climate control, AR nature education modules, and digital concierge services.