Wellness Tourism Market Size

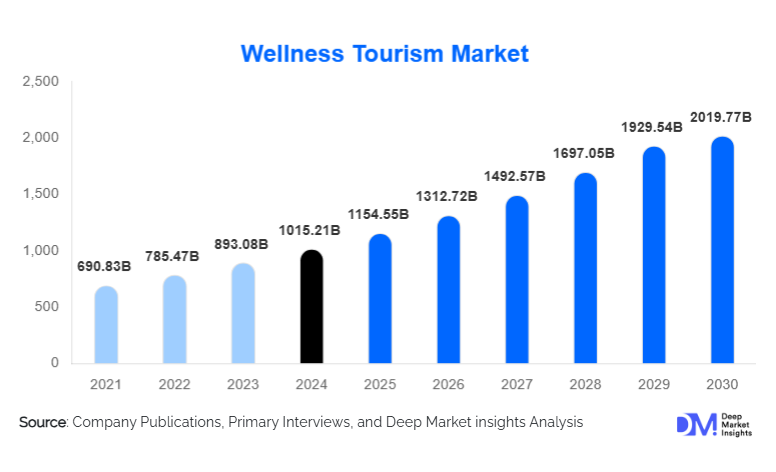

According to Deep Market Insights, the global wellness tourism market size was valued at USD 1,015.21 billion in 2024 and is projected to grow from USD 1,154.55 billion in 2025 to reach USD 2,019.77 billion by 2030, expanding at a CAGR of 13.7% during the forecast period (2025–2030). The wellness tourism market growth is primarily driven by rising global prioritization of preventive healthcare, escalating demand for holistic wellness experiences, and the rapid expansion of integrated medical-wellness travel models across major destinations.

Key Market Insights

- Preventive-health and lifestyle-oriented travel is replacing traditional leisure tourism, as consumers increasingly prioritize stress management, longevity, and holistic well-being.

- Luxury wellness resorts and medical-wellness campuses are expanding globally, offering diagnostics, spa therapies, integrative medicine, and personalized healing programs.

- North America leads global spending on wellness travel, driven by high disposable income and an established premium spa and retreat ecosystem.

- Asia-Pacific is the fastest-growing wellness tourism region, supported by government-backed medical tourism initiatives and the popularity of Ayurveda, TCM, and integrative therapies.

- Digital wellness technologies, including wearables, telehealth, and AI personalization, are redefining wellness experiences before, during, and after travel.

- Domestic wellness travel continues to dominate volume, as travelers seek short-stay retreats, mental health weekends, and accessible wellness getaways.

What are the latest trends in the wellness tourism market?

Holistic & Preventive Wellness Experiences Are Becoming Mainstream

Wellness tourism is increasingly centered on preventive care, longevity programs, mental well-being, and lifestyle transformation. Resorts now offer structured diagnostic programs, sleep therapy, metabolic health tracking, and integrative medicine services. Travelers seek evidence-based results rather than leisure-only experiences, pushing operators to elevate medical partnerships, practitioner credentials, and outcome-driven programs. Governments promoting medical value travel are aligning with wellness resorts to create accredited “healing corridors,” merging medical precision with restorative tourism offerings.

Technology-Enabled Personalized Wellness Journeys

Wearable devices, biometric monitoring, AI-guided health assessments, and tele-wellness platforms are increasingly integrated into wellness travel packages. From pre-trip virtual consultations to app-guided mindfulness, technology enhances personalization and long-term engagement. Resorts are incorporating continuous glucose monitoring (CGM), genetic testing, sleep analytics, and digital detox packages. Post-stay telehealth and subscription wellness programs are also gaining adoption, allowing brands to build long-term customer relationships and significantly increase lifetime value.

What are the key drivers in the wellness tourism market?

Rising Global Prioritization of Health & Preventive Care

Consumers are shifting from reactive healthcare to preventive wellness, driving demand for structured retreats, diagnostics, detox programs, and mental health getaways. Aging populations in major economies, alongside rising chronic lifestyle diseases, are accelerating wellness-focused travel as a means of proactive health management. This trend has strengthened the premium tier, where travelers invest heavily in programs that promise measurable outcomes and sustained well-being.

Hospitality Industry Transformation Toward Integrated Wellness

Global hotel chains and boutique operators have incorporated wellness as a core business strategy. Investments in wellness floors, medical partnerships, in-house clinics, and specialized signature therapies are reshaping hospitality value propositions. Integrated offerings, combining spa, fitness, nutrition, and medical support, allow operators to command higher ADRs and improve occupancy year-round. The evolution toward “wellness-first resorts” is a cornerstone of current market expansion.

What are the restraints for the global market?

High Capital and Operational Costs

Building wellness resorts, medical campuses, thermal spas, and retreats requires substantial investment in facilities, specialized equipment, and practitioner talent. Skilled therapists, nutritionists, and medical professionals significantly increase operational costs. Inflation in service labor and imported wellness products further constrains margins, making wellness tourism more accessible to higher-income travelers while limiting mass adoption.

Regulatory Inconsistencies & Quality Assurance Challenges

The global wellness sector lacks uniform regulations, leading to variations in practitioner qualifications, treatment standards, and medical credibility. Inconsistent oversight exposes travelers to misinformation and can damage destination reputations when adverse events occur. Harmonizing certification systems and enforcing quality benchmarks remains a major challenge for industry expansion.

What are the key opportunities in the wellness tourism industry?

Medical–Wellness Integration for High-Value Travelers

Blending medical travel with wellness recovery programs creates comprehensive, outcomes-driven experiences. Cardiac rehabilitation, orthopedic recovery, fertility treatments, diagnostics, and chronic care programs are being bundled with restorative spa and lifestyle regimens. This high-margin opportunity is particularly strong in APAC and the Middle East, where governments are promoting medical value travel (MVT) and investing in accredited international facilities.

Destination Development & Government-Supported Wellness Hubs

Governments are investing in wellness corridors, thermal parks, and preventive health tourism clusters as part of national tourism diversification strategies. Infrastructure expansion, visa facilitation, AYUSH promotion, and wellness certification programs are enabling new destinations to compete globally. This creates opportunities for operators, developers, and healthcare providers to establish integrated campuses and premium wellness enclaves.

Product Type Insights

Spa & relaxation tourism dominates the market, accounting for an estimated 30% share in 2024, driven by wide availability, strong brand penetration, and adoption across all travel budgets. Destination spas and premium wellness resorts deliver high-value experiences with specialized therapies and premium amenities. Medical wellness and integrative healing programs are among the fastest-growing product categories, fueled by demand for diagnostics, longevity programs, and rehabilitation. Yoga, meditation, and mindfulness retreats continue to attract younger and wellness-centric demographics, while thermal and hot spring tourism remains strong in Europe and Asia due to long-standing cultural preferences.

Application Insights

Mental well-being, relaxation, and stress relief are the largest applications within wellness tourism, representing nearly 36% of total demand. Travelers increasingly seek programs for burnout recovery, sleep enhancement, emotional detoxification, and digital detox. Preventive health screenings and metabolic wellness programs are expanding rapidly due to rising lifestyle diseases. Fitness and active wellness experiences, such as boot camps, hiking retreats, and endurance wellness tours, are popular among millennials. Medical rehabilitation and post-treatment recovery packages also contribute strongly to demand, especially in APAC and Latin America.

Distribution Channel Insights

Direct bookings account for approximately 45% of the market, driven by the need for customization, health screenings, and personalized pre-stay communication. Wellness resorts’ own websites, loyalty programs, and tele-consultation platforms enhance direct engagement. Online travel agencies (OTAs) are expanding wellness verticals, making packaged retreats more discoverable. Specialist wellness travel agencies curate premium experiences for affluent clients. Corporate wellness travel channels are also growing, driven by employee well-being programs, leadership retreats, and health incentive travel.

Traveler Type Insights

Affluent leisure travelers and high-net-worth individuals (HNWIs) represent the largest spenders, contributing an estimated 40% of market revenue. Their preference for luxury wellness resorts, medical diagnostics, and long-stay healing programs significantly influences pricing and investment patterns. Group travelers, including corporate teams, wellness clubs, and retreat groups, drive volume in short-stay programs. Solo travelers, including digital nomads, are increasingly choosing wellness sabbaticals and flexible stay packages. Families are emerging as a strong segment, opting for multi-generational wellness experiences focusing on nutrition, fitness, and mental health.

Age Group Insights

Travelers aged 31–50 years constitute the largest segment, valuing wellness-first vacations that balance relaxation, fitness, and preventive care. Young adults aged 18–30 drive demand for yoga retreats, adventure wellness, and budget-friendly experiences, frequently booking via digital channels. Older adults aged 51–70 contribute significantly to medical wellness, longevity programs, and rehabilitation stays. The 65+ segment, though smaller, generates high revenue due to demand for safety-focused, medically supervised wellness travel packages.

| By Service / Product Type | By Travel Type | By Accommodation Type | By Price Tier | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for an estimated 32% of global wellness tourism spending in 2024. The U.S. leads due to high disposable income, sophisticated spa infrastructure, and rapid adoption of integrative medicine and mental wellness retreats. Corporate wellness travel and short-stay mindfulness retreats are growing rapidly.

Europe

Europe holds a strong 28% share, supported by historical spa culture, thermal tourism, and government-backed preventive health programs. Germany, France, the U.K., and Spain dominate outbound and domestic wellness spending. Naturthermal spas and medical wellness clinics remain core attractions, while sustainable wellness retreats are gaining traction among younger demographics.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing around 23% of the market. India, Thailand, China, Japan, and Indonesia lead growth through Ayurveda, TCM therapies, yoga retreats, and medical tourism. Governmental support for “Heal in India,” Thailand’s medical tourism infrastructure, and Bali’s retreat culture make APAC a global wellness hub.

Latin America

Latin America contributes approximately 6% of global spending, with Mexico, Brazil, and Argentina emerging as key destinations for integrative wellness, detox retreats, and medical recovery packages. Mexico also attracts substantial inbound wellness-motivated medical travel from the U.S. and Canada.

Middle East & Africa

With an estimated 11% share, this region is rapidly expanding through luxury wellness resorts, desert healing retreats, and UAE/Saudi investments in medical tourism. Africa’s wellness offerings, such as thermal springs, nature-based retreats, and safari-wellness hybrids, are increasingly marketed to global travelers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Wellness Tourism Market

- Marriott International

- Hilton Worldwide Holdings

- Hyatt Hotels Corporation

- InterContinental Hotels Group (IHG)

- Accor S.A.

- Four Seasons Hotels and Resorts

- Mandarin Oriental Hotel Group

- Minor International (Anantara, Avani)

- Banyan Tree Holdings

- Aman Group

- Canyon Ranch

- Chiva-Som

- Oetker Collection

- Vana Retreats

- Meliá Hotels International

Recent Developments

- In March 2025, several leading hotel chains expanded wellness-specific property portfolios across APAC, integrating medical diagnostics and longevity clinics into resort facilities.

- In February 2025, India and Thailand announced new bilateral agreements to promote medical value travel (MVT), enhancing visa facilitation and accreditation pathways for international patients.

- In January 2025, luxury wellness brands introduced AI-driven personalization platforms, enabling biometric-based program design for guests before arrival.