Towel Rack Market Size

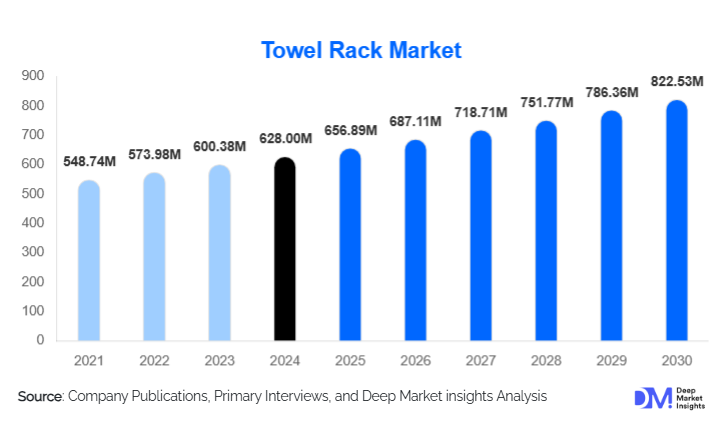

According to Deep Market Insights, the global towel rack market size was valued at USD 628 million in 2024 and is projected to grow from USD 656.89 million in 2025 to reach USD 822.53 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). The market growth is primarily driven by the rise in residential and commercial renovation activities, increasing luxury bathroom upgrades, and growing adoption of smart and heated towel racks across hospitality, healthcare, and wellness sectors.

Key Market Insights

- Smart and heated towel racks dominate demand, backed by growing integration of home automation and energy-efficient heating technologies.

- Residential sector contributes over 52% of total demand due to rising home remodeling, aesthetic advancements, and premium bathroom installations.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, real estate development, and cost-effective manufacturing exports.

- North America leads in smart towel rack adoption due to strong penetration of IoT-based luxury bathroom fittings.

- Stainless steel remains the most preferred material, holding approximately 41% market share due to durability, hygiene, and aesthetic appeal.

- Online distribution channels are expanding rapidly, accounting for 28% of total sales as customers shift toward e-commerce and B2B sourcing platforms.

What are the latest trends in the towel rack market?

Smart and IoT-Enabled Heating Technology

Connected towel racks with programmable timers, temperature sensors, WiFi, and app-based controls are gaining traction in premium households and commercial establishments. These products integrate seamlessly with smart home ecosystems such as Alexa, Google Home, and Apple HomeKit. Manufacturers are exploring remote control functionality, energy efficiency optimization, and voice-command compatibility, appealing to tech-savvy consumers. Smart heated towel racks not only provide comfort and hygiene advantages but also prevent mold formation by ensuring controlled drying cycles.

Shift Toward Sustainable and Recyclable Materials

Consumers are increasingly opting for towel racks made using stainless steel 316 grade, bamboo, aluminum composites, and recycled metals due to their corrosion resistance, environmental friendliness, and longer lifecycle. Manufacturers in Europe and Australia are introducing FSC-certified wood and recyclable metals to cater to eco-conscious buyers. The premium hospitality sector is also adopting antimicrobial coated towel racks in wellness centers, healthcare facilities, and spas to support hygiene compliance and sustainability standards.

What are the key drivers in the towel rack market?

Growing Bathroom Renovation and Smart Home Integration

The rise in smart home adoption and consumer preference for premium bathroom aesthetics are major demand drivers. In the U.S. alone, more than 60% of renovated homes in 2023 included upgraded bathroom fixtures, with heated towel racks gaining traction in luxury segments. Smart and electric models are valued for their utility, hygiene, and visual appeal, making them popular in residential upgrades and boutique hotels.

Rising Hospitality & Wellness Infrastructure Development

Increased construction of hotels, spas, resorts, senior care facilities, and fitness centers across Asia-Pacific, Middle East, and Europe has resulted in higher demand for commercial-grade stainless steel racks. These sectors prioritize hygiene, sustainability, and comfort, making heated racks crucial for providing a premium guest experience. Rapid tourism infrastructure expansion in UAE, Thailand, Indonesia, and Saudi Arabia is significantly driving volume adoption.

What are the restraints for the global market?

High Material Cost and Profitability Pressure

Volatility in prices of key raw materials such as stainless steel, brass, and aluminum impacts manufacturing costs, limiting price competitiveness, especially in emerging markets. Premium heated and smart racks require complex assembly and electrical safety compliance, adding to cost challenges for manufacturers.

Fragmented Design Choices and Low Product Differentiation

Basic, non-heated towel racks face commoditization, leading to intense price competition. The presence of low-cost imports restricts margins for established brands, especially in regions with high DIY (do-it-yourself) adoption such as the U.S., UK, and Australia.

What are the key opportunities in the towel rack industry?

Smart Infrastructure Expansion and Real Estate Integration

With governments investing heavily in urban housing developments and commercial real estate projects in India, China, UAE, and Egypt, manufacturers have opportunities to collaborate directly with architects and developers. Smart city projects increasingly incorporate energy-efficient bathroom fittings, creating bulk demand for hardwired and recessed towel racks.

Growing Commercial Demand in Healthcare and Wellness Facilities

Hospitals, luxury clinics, physiotherapy centers, and senior living facilities are adopting antibacterial, heated towel racks to maintain hygiene and comfort. The healthcare segment is expected to grow at over 8% annually, offering long-term contract opportunities for bulk suppliers and OEMs.

Product Type Insights

Electric heated towel racks lead the market, holding 38% share in 2024 due to their increasing adoption in luxury homes, hotels, healthcare, and spas. Hydronic and electric plug-in variants are popular in European wellness spaces and premium residential installations. Non-heated racks such as wall-mounted and over-the-door racks continue to cater to budget, retail, and DIY-focused markets, especially in the U.S., Canada, and Germany.

Material Insights

Stainless steel dominates with 41% share in 2024 owing to corrosion resistance, durability, and premium finish. Aluminum and brass show rising momentum in mid-range and custom-designed residential applications, while bamboo and wood-based designs are gaining attention in eco-luxury hospitality spaces.

Distribution Channel Insights

Online platforms, including manufacturer websites, e-commerce marketplaces, and B2B procurement portals, account for 28% of sales and are gaining traction due to customizable ordering, design previews, and international shipping. Retail specialty stores and home improvement centers remain dominant in the mid-range non-heated rack segment.

End-Use Insights

The residential sector represents 52% of the global market due to renovations, smart home adoption, and premium upgrades in urban multi-family homes and villas. The hospitality sector holds approximately 24%, led by demand from hotels, resorts, spas, and vacation rentals. Healthcare and wellness facilities are expected to be the fastest-growing end-use during 2025–2030 with an estimated CAGR of 8.2%.

| Product Type | Material | End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 28% market share, led by the United States, which accounts for 21% alone. High renovation spending, smart home penetration, and adoption of energy-regulated heated towel racks drive demand in the region.

Europe

Europe holds 24% market share, supported by strong demand in Germany, the UK, Italy, and France. Hydronic heating towel racks are highly popular in European wellness infrastructure, supported by energy efficiency regulations and hygiene standards.

Asia-Pacific

Asia-Pacific is the fastest-growing market with a projected CAGR of 8.4% during 2025–2030. China (11% share), India, Japan, and South Korea lead the region with expanding residential construction, commercial real estate investments, and export-based manufacturing.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are major contributors to demand, driven by luxury hotel expansion, spa culture, and real estate growth in wellness tourism-focused destinations.

Latin America

Brazil, Mexico, and Argentina represent emerging markets with moderate expansion in wellness-focused residential and hospitality infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The market is moderately concentrated, with the top five companies, Kohler, Zehnder Group, Roca Group, WarmlyYours, and Amba Products, holding nearly 32% of global market share in 2024, primarily in premium and smart towel rack categories.

Key Players in the Towel Rack Market

- Kohler Co.

- Zehnder Group

- Roca Group

- WarmlyYours

- Amba Products

- Vogue UK

- Jeeves Heated Towel Rails

- Moen Incorporated

- Purmo Group

- Hudson Reed

- Häfele GmbH

- Vola A/S

- Myson

- Devon & Devon

- Jeeves

Recent Developments

- In April 2024, Zehnder Group launched a new series of energy-efficient hydronic heated towel racks designed for premium hospitality applications.

- In February 2024, Kohler Co. announced an expansion in smart bathroom products with app-controlled towel warming racks integrated with Alexa and Google Home.

- In January 2025, WarmlyYours introduced antimicrobial-coated stainless steel racks designed for hospitals, spas, and healthcare facilities.