Swimsuit Market Size

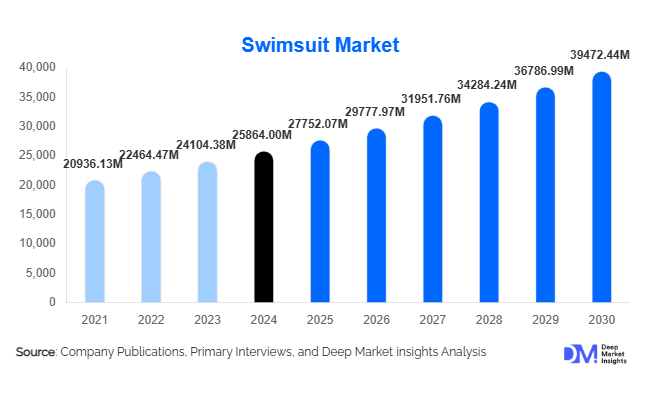

According to Deep Market Insights, the global swimsuit market size was valued at USD 25,864.00 million in 2024 and is projected to grow from USD 27,752.07 million in 2025 to reach USD 39,472.44 million by 2030, expanding at a CAGR of 7.30% during the forecast period (2025–2030). The swimsuit market growth is primarily driven by the rising popularity of beach and resort tourism, increasing engagement in swimming and water-based fitness activities, and strong consumer demand for fashionable, inclusive, and sustainable swimwear across global markets.

Key Market Insights

- Sustainable and eco-friendly swimsuits made from recycled fabrics are gaining rapid traction among environmentally conscious consumers.

- Women’s swimwear dominates global demand, especially the two-piece/bikini category, supported by high fashion influence and strong social media engagement.

- E-commerce is the fastest-growing distribution channel, driven by D2C brands, influencer marketing, and AI-based fit recommendation tools.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, lifestyle changes, and the expansion of beach tourism.

- North America leads demand for premium, performance, and athleisure swimwear due to a strong fitness culture and higher spending capacity.

- Technological innovations, including UV-protective fabrics, chlorine-resistant materials, and 3D body-scanning fit-tech, are reshaping product development.

What are the latest trends in the Swimsuit Market?

Sustainability & Recycled Swimwear Leading Global Demand

The swimsuit market is experiencing a significant shift toward sustainability, with brands increasingly adopting recycled fibers such as regenerated nylon, ocean plastics, and eco-friendly spandex. Consumers are more aware of textile waste, prompting demand for longer-lasting, environmentally responsible swimwear. As this shift grows, related training gear such as swimming fins is also seeing interest in sustainable materials, reinforcing a broader move toward eco-friendly aquatic products. Several swimwear labels now integrate closed-loop manufacturing models, biodegradable packaging, and zero-waste cutting techniques to appeal to eco-conscious shoppers. This trend is amplified by younger demographics prioritizing sustainability, compelling both legacy brands and D2C startups to expand their green swimwear collections.

Technology-Enhanced Swimwear Shopping & Fit Solutions

Technological integration is transforming swimwear purchasing behavior, especially online. Virtual try-ons, AI-powered size recommendation engines, and 3D body scanning help shoppers find the right fit, critical in a category where fit concerns often deter online purchases. Advanced fabrics such as quick-dry textiles, UV-shield materials, anti-odor treatments, and chlorine-resistant fibers are elevating product performance. Social commerce, influencer-driven campaigns, and AR-based beachwear previews are further enhancing digital engagement, making swimwear one of the fastest-growing apparel categories in e-commerce.

What are the key drivers in the Swimsuit Market?

Rising Global Tourism & Beach Vacation Culture

Growth in international and domestic tourism, especially beach, cruise, and resort travel, continues to fuel swimsuit demand globally. As more travelers prioritize tropical destinations and water-based leisure, swimsuit purchases rise both pre-travel and at destinations. Coastal tourism expansion in Southeast Asia, the Caribbean, and Mediterranean nations further accelerates this trend.

Increasing Participation in Fitness Swimming & Water Sports

Swimming has become one of the most popular fitness activities due to its accessibility and low-impact nature. Rising memberships in aquatic fitness clubs, water aerobics programs, and recreational swimming centers are creating sustained demand for performance swimwear. Water sports such as surfing, paddleboarding, diving, and snorkeling are also growing, boosting purchases of rash guards, wetsuits, and sport-specific swimwear.

Fashion Cycles, Social Media Influence & Body Positivity Movement

Trend-driven designs, frequent style refresh cycles, and influencer-led culture have transformed swimsuits into fashion statements. The rise of body positivity and inclusive sizing movements has widened the consumer base, encouraging more diverse demographics to purchase swimwear confidently. Seasonal lookbooks, celebrity collaborations, and viral social media trends continue driving sales momentum globally.

What are the restraints for the global market?

Seasonality & Climate Dependency

Swimsuit sales remain highly seasonal in colder regions, causing uneven annual revenue patterns and inventory challenges. Winter months lead to sharp demand drops, except in tropical climates or for hotel/resort retail outlets. This seasonal nature limits consistent growth across certain markets.

Intense Price Competition, Especially from Fast-Fashion Producers

The proliferation of low-cost swimwear from fast-fashion brands and Asian manufacturers creates significant price pressure. These players frequently release budget-friendly collections with rapid turnaround times, challenging mid-range and premium brands. This competitive environment compresses margins and raises customer expectations for trend-driven designs at lower prices.

What are the key opportunities in the Swimsuit Industry?

Premium Wellness & Performance Swimwear Expansion

The intersection of wellness tourism and swimwear is creating opportunities for high-performance, comfort-focused, and health-oriented products. Compression swimsuits, anti-chafe designs, thermal swim gear, and UV-protection swimwear appeal to fitness swimmers and wellness travelers. Premium swimwear that blends functionality with aesthetic appeal is expected to see significant growth, especially in North America and Europe.

Modest & Inclusive Swimwear for Diverse Global Demographics

Modest swimwear, such as swim dresses, long-sleeve suits, and burkinis, represents a rapidly expanding segment, especially in the Middle East, Southeast Asia, and parts of Europe. Inclusive sizing and adaptive swimwear for people with disabilities are additional opportunity areas. Brands that offer culturally aligned designs and multi-body-type collections can capture long-term loyalty across global customer bases.

Product Type Insights

Women’s two-piece swimsuits dominate the market with approximately 46% share, driven by strong fashion cycles, social-media influence, and high replacement frequencies. One-piece suits and modest swimwear are gaining traction among women seeking comfort and coverage. Men’s swim trunks and board shorts remain the preferred category for male consumers, while rash guards grow steadily due to water sports participation. Kids’ swimwear is expanding in line with family travel growth and rising participation in swimming lessons.

Application Insights

Leisure and vacation swimwear represent the largest application segment globally, supported by beach tourism, resort stays, and cruise travel. Fitness swimming and water aerobics are expanding rapidly as health-conscious consumers adopt swimming as a primary exercise. Competitive swimming uses specialized high-performance suits built from compression and hydrodynamic fabrics, representing a smaller but well-established niche. Athleisure-inspired swimwear, designed for poolside lounging and lifestyle use, is becoming a lucrative category among younger consumers.

Distribution Channel Insights

Online retail channels, including e-commerce marketplaces, brand-owned D2C websites, and social commerce platforms, are gaining dominance due to convenience, wider assortments, and fit-assist technologies. However, offline retail (department stores, specialty swimwear stores, and sports retailers) continues to command a sizable share, especially for consumers who prefer trying garments before purchase. Subscription-based swimwear boxes and influencer-led capsule drops are emerging as innovative engagement channels.

End-User Insights

Women constitute the largest end-user segment, followed by men and children. Female consumers drive premium and fashion-forward swimwear demand. Men’s swimwear is growing steadily, supported by water sports and fitness trends. Kids’ swimwear sees strong demand from vacationing families and growing interest in early swimming education programs.

| By Product Type | By Material | By End User | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains one of the largest swimsuit markets, contributing roughly a 31% share of global revenue. The region’s strong fitness culture, high travel expenditure, and preference for performance and designer swimwear drive growth. Online shopping penetration is high, with D2C swimwear brands gaining strong traction.

Europe

Europe represents around 22% share and benefits from Mediterranean tourism and a strong preference for sustainable fashion. Italy, Spain, France, and Germany are major consumers. European buyers show high interest in recycled swimwear, modish designs, and premium craftsmanship.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a 7–8% CAGR, supported by rising middle-class income, travel culture, and youth-driven fashion adoption. China, India, Indonesia, Japan, and Australia are key contributors. The growing popularity of swimming lessons and water parks further supports regional demand.

Latin America

Warm climates, vibrant beach cultures, and evolving fashion trends in Brazil, Mexico, and Argentina are propelling swimsuit sales. Local brands and international labels are both strengthening their footing in the region.

Middle East & Africa

The region is experiencing steady growth due to tourism in the UAE, Qatar, and Saudi Arabia. Demand for modest swimwear is particularly strong, opening opportunities for specialized product lines.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|