Sustainable Tourism Market Size

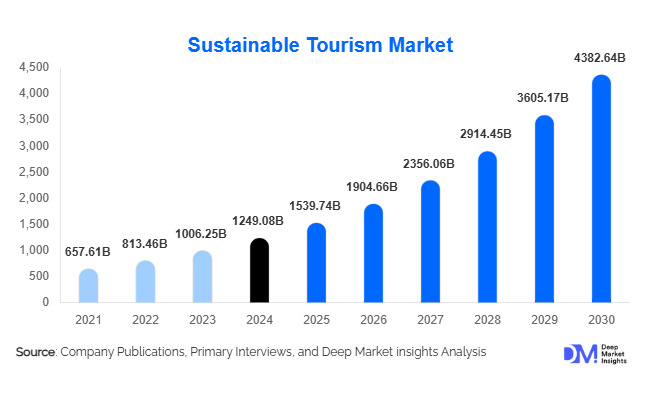

According to Deep Market Insights, the global sustainable tourism market size was valued at USD 1,249.08 billion in 2024 and is projected to grow from USD 1,539.74 billion in 2025 to reach USD 4,382.64 billion by 2030, expanding at a CAGR of 23.27% during the forecast period (2025–2030). This strong market growth is driven by surging consumer demand for eco-friendly travel experiences, government-led sustainability mandates, and rising investment in low-impact tourism infrastructure across the globe. As travelers increasingly prioritize environmental responsibility, ethical tourism models, and community-integrated experiences, the sustainable tourism industry continues to evolve from a niche segment into a mainstream global travel movement.

Key Market Insights

- Sustainable tourism is rapidly shifting toward regenerative and low-impact travel experiences, emphasizing environmental preservation and community benefit.

- Eco-lodges and green-certified hotels are expanding worldwide, driven by traveler preference for transparent, verifiable sustainability practices.

- Europe dominates the sustainable tourism market due to strong regulatory frameworks, carbon-reduction policies, and high traveler adoption of eco-friendly tourism.

- Asia-Pacific is the fastest-growing region, supported by government investments, rising middle-class income, and large-scale cultural tourism programs.

- Digital transformation, including carbon calculators, sustainability ratings, and AI-enabled eco-trip planners, is reshaping traveler decision-making.

- Millennials and Gen Z represent nearly half of global sustainable travel spending, signaling long-term structural growth in demand.

What are the latest trends in the sustainable tourism market?

Community-Driven & Regenerative Tourism Expanding Rapidly

Community-led tourism is gaining traction as travelers seek experiences that meaningfully support local livelihoods. Regenerative tourism models, focused on restoring ecosystems, empowering communities, and building cultural resilience, are becoming mainstream offerings. Experiences increasingly include heritage preservation programs, cultural immersion workshops, and community-hosted eco-stays that return economic value directly to local populations. Governments and NGOs are forming partnerships with villages and rural regions to develop sustainable tourism projects that balance environmental conservation with social upliftment. As a result, regenerative tourism is emerging as one of the strongest differentiators for destinations seeking to reduce overtourism and maximize long-term ecological stability.

Technology-Enabled Sustainable Travel Experiences

Digital innovation is accelerating the adoption of sustainable tourism. Online platforms now integrate sustainability scores, carbon calculators, and blockchain-based verification of eco-certifications, enabling transparency and reducing greenwashing. AI-powered itinerary planners optimize travel routes for minimal carbon emissions, while AR/VR experiences allow travelers to preview destinations, reducing unnecessary physical trips. Apps that highlight eco-conscious choices, such as low-impact accommodations, renewable-energy-powered transport, or local conservation volunteering, are becoming major travel tools. Smart hotels, IoT-driven energy management, and automated waste reduction systems are further enhancing the sustainability of both accommodations and travel operations.

What are the key drivers in the sustainable tourism market?

Shift Toward Ethical, Experiential, and Environmentally Conscious Travel

Travelers worldwide are leaning toward meaningful, purpose-driven travel that minimizes environmental harm. Rising awareness of climate change and biodiversity loss has led consumers to prioritize eco-friendly accommodations, wildlife-safe adventures, and carbon-neutral transport. This behavioral shift is especially pronounced among Millennials and Gen Z, who are willing to pay premiums for sustainability-focused travel experiences. As sustainability becomes embedded in consumer identity, demand for green-certified travel continues to surge.

Government Policies & Regulatory Push for Sustainable Travel

Governments across Europe, Asia-Pacific, and the Americas are implementing policies to promote low-impact tourism, including emission caps, eco-certification standards, and conservation-linked tourism programs. Public funding is increasingly directed toward renewable-energy tourism infrastructure, waste management systems, and heritage site protection. International initiatives positioning tourism as a key pillar of climate action are further accelerating the transition toward sustainable tourism models globally.

What are the restraints for the global market?

High Costs of Sustainable Infrastructure & Certifications

Implementing sustainable practices remains expensive for many tourism operators. Renewable energy systems, eco-friendly construction materials, waste treatment facilities, and global certification fees significantly increase capital costs. Small and medium-sized operators often struggle to allocate resources for such upgrades, slowing adoption in price-sensitive regions.

Lack of Standardized Metrics & Greenwashing Risks

The absence of universal sustainability standards leads to inconsistent certifications and confusion for travelers. This gap makes it difficult to compare sustainable offerings and increases the prevalence of greenwashing, undermining consumer trust. Without unified frameworks, transparent evaluation of sustainability claims remains a challenge, hindering global market cohesion.

What are the key opportunities in the sustainable tourism industry?

Eco-Infrastructure Development & Renewable-Powered Tourism

Massive opportunities exist in developing renewable-energy-powered hotels, low-impact transport modes, and carbon-neutral tourism zones. Governments are expanding incentives for solar-powered resorts, eco-ports, sustainable airports, EV-based city tours, and climate-resilient attractions. These infrastructure upgrades create long-term competitive advantages for destinations positioning themselves as sustainability leaders.

Cultural, Heritage & Rural Tourism Expansion

Growing interest in authentic cultural experiences creates significant opportunities for rural communities. Community homestays, indigenous-led tourism, and artisan-focused cultural routes allow regions to diversify income while preserving heritage. Rural development programs across Asia-Pacific, Africa, and Latin America are integrating tourism with craft preservation, agricultural tourism, and cultural storytelling, unlocking new revenue streams.

Product / Tourism Type Insights

Eco-tourism dominates the market, contributing approximately 35% of global 2024 revenue. Its leadership comes from heightened consumer preference for nature-based, conservation-linked travel experiences. This segment includes national park explorations, wildlife conservation tours, and outdoor adventure activities designed to minimize environmental harm. Green tourism and cultural tourism follow closely, with rising adoption among travelers seeking immersive experiences that combine sustainability with education and cultural exchange.

Application Insights

Sustainable tourism applications include eco-lodging, cultural immersion, volunteer tourism, conservation activities, and wellness-focused nature retreats. Leisure travel accounts for nearly 60% of the application share, supported by growing demand for regenerative and nature-based recreational travel. Educational tourism and voluntourism are expanding quickly as institutions incorporate sustainability into academic programs. Business travel is increasingly adopting carbon-neutral corporate travel initiatives, contributing to steady growth across the sustainable tourism application spectrum.

Distribution Channel Insights

OTAs lead with nearly 50% of total bookings, owing to transparent sustainability filters, peer review systems, and digital convenience. Direct hotel bookings are rising as eco-hotels improve digital presence through interactive sites and loyalty programs. Travel agencies specializing in eco-friendly experiences continue to expand, especially in Europe, where sustainable certifications drive consumer choice. Subscription-based travel platforms and digital sustainability passports are emerging as new distribution innovations.

Traveler Type Insights

Family travelers represent 45% of total sustainable tourism revenue, driven by demand for educational, safe, and value-rich eco-stays. Millennials and Gen Z solo travelers are propelling growth in budget-friendly eco-adventures and conservation volunteering. Couples and honeymooners increasingly prefer eco-luxury resorts offering wellness and nature-immersive experiences, contributing significantly to the premium segment.

Age Group Insights

Millennials (26–40) account for 48% of the global sustainable tourism market, making them the most influential demographic. Their strong environmental values, digital research habits, and willingness to pay for eco-certified products fuel market expansion. Gen Z drives budget and adventure sustainable tourism growth, while older age groups (50+) dominate high-end wellness retreats and heritage travel.

| By Tour Type | By Traveler Type | By Booking Channel | By Service Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a substantial share of global sustainable tourism spending, supported by high disposable incomes and a strong interest in eco-luxury travel. The U.S. and Canada invest heavily in protected area tourism, renewable-powered resorts, and conservation-linked travel. About 22% of the global 2024 market share comes from this region.

Europe

Europe dominates with 31% of the 2024 market share, driven by stringent sustainability regulations, carbon-neutral tourism programs, and highly eco-conscious travelers. Countries including Germany, France, the U.K., and the Nordic nations lead the adoption of sustainable accommodations and low-impact transport systems.

Asia-Pacific

APAC is the fastest-growing region, expanding above 22% CAGR. China, India, Indonesia, Japan, and Australia drive regional momentum. Rising middle-class affluence, cultural tourism flows, and government investments in eco-destinations support strong long-term growth.

Latin America

LATAM shows steady growth with emerging sustainable tourism circuits in Costa Rica, Brazil, Peru, and Chile. Costa Rica remains a global leader in eco-tourism certifications, while Brazil’s biodiversity hotspots attract nature enthusiasts.

Middle East & Africa

MEA is home to some of the world’s most biodiversity-rich sustainable tourism regions. African nations are developing community-based tourism models, while Gulf countries integrate sustainability into mega-tourism projects. South Africa, Kenya, Namibia, and the UAE lead regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sustainable Tourism Market

- Intrepid Travel

- TUI Group (Sustainable Travel Division)

- G Adventures

- Airbnb (Sustainability Programs)

- Ecotourism Australia Certified Operators

- Responsible Travel

- Hilton (Green Hotels Portfolio)

- Marriott International (Sustainability Certified Properties)

- Wilderness Safaris (Eco-Lodge Division)

- Ker & Downey

- Natural Habitat Adventures

- Explora Travel

- Six Senses Resorts

- Aman Resorts

- Ecolodges Indonesia