Sustainable Athleisure Market Size

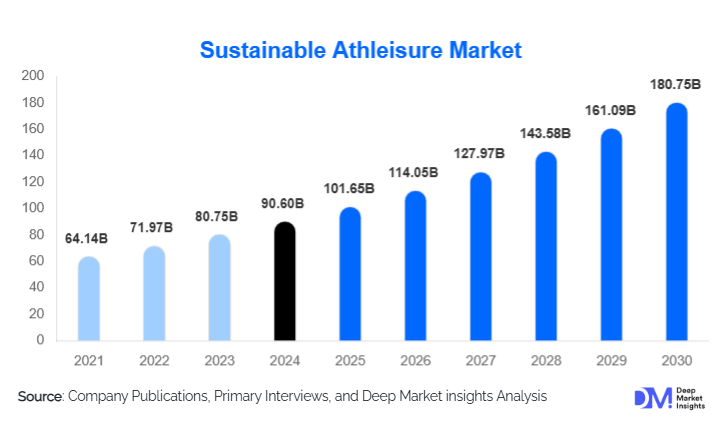

According to Deep Market Insights, the global sustainable athleisure market size was valued at USD 90.60 billion in 2024 and is projected to grow from USD 101.65 billion in 2025 to reach USD 180.75 billion by 2030, expanding at a CAGR of 12.2% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness of environmental sustainability, increasing adoption of eco-friendly and performance-oriented apparel, and the rapid expansion of online and direct-to-consumer channels, facilitating global reach.

Key Market Insights

- Sustainable athleisure is increasingly integrating eco-friendly materials, including recycled polyester, organic cotton, and bio-based fabrics, attracting environmentally conscious consumers seeking functional yet responsible apparel.

- Women’s apparel dominates the segment, reflecting higher fashion awareness and willingness to invest in eco-conscious products.

- Online retail channels are leading sales globally, with direct-to-consumer platforms and marketplaces providing extensive visibility and transparency on sustainability credentials.

- Asia Pacific is the fastest-growing region, driven by rising disposable incomes, urban fitness culture, and increasing adoption of sustainable lifestyle products.

- North America holds the largest market share due to strong environmental consciousness, high purchasing power, and mature athleisure adoption.

- Technological integration in sustainable materials and digital marketing is enhancing product performance, consumer engagement, and traceability in supply chains.

What are the latest trends in the sustainable athleisure market?

Eco-Friendly Material Innovations

Brands are increasingly adopting recycled polyester, organic cotton, biodegradable fabrics, and high-performance sustainable blends to meet consumer demand for eco-conscious apparel. Innovations in textile technology now allow sustainable fabrics to match the performance of conventional materials, making them suitable for both activewear and casual use. Circular manufacturing practices and zero-waste cutting techniques are also being integrated, reducing environmental impact and enhancing brand credibility among eco-conscious consumers.

Direct-to-Consumer and Digital Retail Growth

Online sales channels are rapidly transforming sustainable athleisure distribution. D2C e-commerce platforms allow brands to showcase transparency in sourcing, offer customized products, and create engaging digital experiences. Social commerce, influencer collaborations, and interactive apps are further boosting consumer awareness and loyalty. This trend enables emerging sustainable brands to scale globally without heavy reliance on physical retail infrastructure, making the market more accessible to both startups and established players.

What are the key drivers in the sustainable athleisure market?

Rising Consumer Environmental Awareness

Consumers increasingly prioritize products with low environmental impact, including apparel made from recycled, organic, and bio-based materials. Millennials and Gen Z, in particular, are willing to pay a premium for sustainability, boosting demand for eco-conscious athleisure offerings. Brands that demonstrate genuine commitment to sustainability benefit from higher engagement and long-term loyalty.

Integration of Fitness and Lifestyle

The global shift toward active lifestyles is expanding the use of athleisure beyond gyms, creating demand for versatile, comfortable, and performance-driven apparel suitable for daily wear. As urban populations increasingly prioritize wellness and physical activity, sustainable athleisure becomes a preferred choice for consumers seeking environmentally responsible yet functional clothing.

Rapid Online and Global Distribution

Expansion of e-commerce platforms, marketplaces, and social media marketing channels allows sustainable athleisure brands to reach consumers worldwide. Direct-to-consumer models enable smaller brands to scale efficiently while providing consumers with transparent sourcing and sustainability information, further strengthening demand growth.

What are the restraints for the global market?

Higher Production Costs

Eco-friendly materials and sustainable manufacturing practices often involve higher costs than conventional methods, leading to increased retail prices. This price differential can limit adoption in price-sensitive markets and pose challenges for brands attempting to balance affordability with sustainability.

Supply Chain Complexity

Ensuring authenticity, traceability, and compliance in sustainable sourcing adds operational complexity. Fragmented supply chains, certification requirements, and verification processes increase costs and barriers to entry for emerging players in the sustainable athleisure market.

What are the key opportunities in the sustainable athleisure market?

Next-Gen Sustainable Materials

Opportunities exist in developing bio-based, biodegradable, and recycled fabrics that reduce environmental impact without compromising performance. Companies investing in material R&D can differentiate themselves and access both environmentally conscious consumers and mainstream athleisure buyers.

Emerging Markets Growth

Regions such as Southeast Asia, Latin America, and Africa show growing adoption of fitness culture and eco-conscious consumerism. Affordable, sustainable athleisure offerings in these markets present significant growth potential, especially through e-commerce and localized manufacturing to reduce supply chain carbon footprint.

Digital & Community-Driven Retail Expansion

The rise of online platforms, social commerce, and community-based brand engagement creates opportunities for niche players to scale globally. Personalized products, storytelling around sustainability, and loyalty programs enhance consumer retention while promoting eco-conscious lifestyles.

Product Type Insights

Shirts and tops dominate the sustainable athleisure market, representing approximately 25% of the total market share in 2024. This segment leads globally due to its universal consumer appeal, high frequency of purchase, and versatility across both athletic and casual wear use cases. Sustainable shirts and tops are comparatively easier to manufacture using recycled polyester, organic cotton, and blended sustainable fabrics, allowing brands to scale production while maintaining affordability. Additionally, these products serve as entry-level sustainable offerings, making them highly attractive to first-time eco-conscious consumers.

Pants and leggings represent the fastest-growing product sub-segment, particularly within the women’s category. The surge in yoga participation, home workouts, and lifestyle athleisure usage has significantly boosted demand for sustainable leggings made with stretchable recycled fibers and moisture-wicking eco-blends. Performance durability combined with sustainability credentials has positioned leggings as a premium growth driver, especially in urban and fitness-focused markets.

Consumer Demographic Insights

Women’s athleisure leads the sustainable athleisure market with an estimated 55–60% share of total demand in 2024. This dominance is driven by higher fashion consciousness, greater alignment with sustainability values, and stronger purchasing intent for ethically produced apparel. Women consumers are also more receptive to innovation in fabric technology, fit, and design, encouraging brands to prioritize sustainable collections targeted at this segment.

The men’s segment continues to expand steadily as awareness of sustainable fashion grows among male consumers, particularly in performance training wear and casual athleisure. Meanwhile, the youth and children’s segment is gaining momentum, supported by parental preference for eco-friendly clothing, school sports participation, and the increasing influence of sustainability education. Together, these segments are expected to contribute meaningfully to long-term volume growth.

Distribution Channel Insights

Online retail channels account for approximately 45–50% of the global sustainable athleisure market share, making them the leading distribution channel worldwide. Growth is driven by the convenience of digital shopping, broader product availability, and the ability of brands to clearly communicate sustainability credentials, certifications, and supply chain transparency. Direct-to-consumer platforms allow brands to engage customers through storytelling, customization, and loyalty programs while maintaining higher margins.

Offline channels, including specialty sportswear stores, department stores, and brand-owned flagship outlets, continue to play a complementary role, particularly in regions with strong brand recognition and high foot traffic. Physical retail remains critical for product trials, fit validation, and premium brand positioning, especially within the luxury and performance-focused sustainable athleisure segments.

Pricing Tier Insights

Mass sustainable athleisure dominates the market, accounting for approximately 60–65% of total market share. This segment benefits from increasing availability of affordable, sustainable materials and improved manufacturing efficiencies, enabling brands to offer eco-friendly products at competitive price points. Mass-market offerings are particularly successful in driving volume adoption across emerging economies and price-sensitive consumer groups.

Premium and luxury sustainable athleisure segments, while smaller in absolute share, are witnessing faster CAGR growth. This acceleration is driven by brand differentiation, superior fabric innovation, advanced performance features, and strong alignment with sustainability-conscious high-income consumers. These segments also benefit from higher margins and stronger brand loyalty.

| By Product Type | By Consumer Demographic | By Distribution Channel | By Pricing Tier | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global sustainable athleisure market, accounting for approximately 33–35% of total demand. The United States leads the region, supported by high consumer awareness of sustainability, high disposable incomes, and a deeply entrenched fitness and wellness culture. Growth is further driven by the widespread adoption of direct-to-consumer brands, robust e-commerce infrastructure, and increasing regulatory focus on sustainable manufacturing and labeling. Urban lifestyles, hybrid work culture, and year-round athleisure usage continue to reinforce demand across both mass and premium segments.

Europe

Europe represents a mature and highly sustainability-driven market, with strong adoption across the U.K., Germany, France, and Nordic countries. Growth in the region is fueled by stringent environmental regulations, strong consumer preference for ethical fashion, and early adoption of circular economy principles. European consumers actively seek certified sustainable apparel, supporting demand for organic, recycled, and low-impact athleisure products. Well-established retail networks and cross-border e-commerce further strengthen regional market penetration.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market for sustainable athleisure, led by China, India, Japan, and South Korea. Rapid urbanization, rising middle-class incomes, and increasing participation in fitness and recreational sports are key growth drivers. The region also benefits from expanding e-commerce ecosystems, mobile-first consumers, and social-media-driven fashion trends. Additionally, Asia-Pacific serves as a major manufacturing hub, enabling faster adoption of sustainable production practices and cost-efficient scaling of eco-friendly athleisure products.

Latin America

Latin America is an emerging market for sustainable athleisure, with Brazil, Mexico, and Argentina leading regional demand. Growth is driven by expanding urban populations, increasing health awareness, and rising exposure to global athleisure brands through digital platforms. While price sensitivity remains a challenge, the availability of mass sustainable athleisure and regional manufacturing capabilities presents long-term growth opportunities. E-commerce penetration and influencer-driven marketing are playing a critical role in accelerating adoption.

Middle East & Africa

The Middle East is experiencing steady growth, led by the UAE, Saudi Arabia, and Qatar, supported by high-income populations, a strong preference for premium lifestyle products, and an increasing focus on health and wellness. Government-led initiatives promoting sports participation and sustainability further support market expansion. Africa, while currently smaller in consumption, offers significant production and sourcing opportunities due to growing awareness of sustainable apparel, availability of raw materials, and increasing investment in ethical manufacturing practices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|