Athleisure Products Market Size

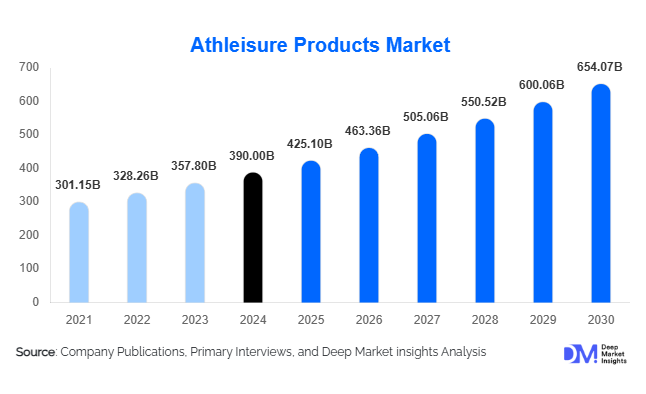

According to Deep Market Insights, the global athleisure products market was valued at USD 390 billion in 2024 and is projected to grow from USD 425.10 billion in 2025 to reach USD 654.07 billion by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). Market growth is primarily driven by the rising adoption of fitness-oriented lifestyles, the increasing preference for versatile, comfort-driven apparel, and the blurring boundary between sportswear and everyday fashion. The market continues to benefit from e-commerce expansion, fabric innovation, and strong demand across both developed and emerging economies.

Key Market Insights

- Women’s athleisure dominates global demand, accounting for over half of 2024 sales, fueled by the popularity of leggings, yoga pants, and sports bras for both exercise and daily wear.

- Asia-Pacific is the fastest-growing regional market, driven by rising disposable incomes, expanding middle-class populations, and urban lifestyle shifts in China, India, and Southeast Asia.

- Mass athleisure holds around 65% of the total market share due to its affordability and widespread accessibility across global retail channels.

- Online and direct-to-consumer (D2C) channels now account for nearly 40% of sales, reflecting the accelerating digitalization of apparel retail.

- Sustainable and eco-friendly fabrics, including recycled polyester, bamboo blends, and organic cotton, are emerging as key differentiators in premium segments.

- North America remains the largest regional market, holding approximately 38% of the 2024 global share, followed by Europe and Asia-Pacific.

Latest Market Trends

Fashion–Fitness Convergence Accelerating

The fusion of athletic performance and fashion design has become the defining feature of the athleisure industry. Consumers increasingly seek apparel that transitions seamlessly from the gym to casual social settings, pushing brands to deliver multifunctional and stylish products. This convergence is visible in capsule collections, luxury-brand collaborations, and the adoption of minimalist yet functional designs suitable for hybrid lifestyles. The integration of stretch, breathability, and sweat-resistant fabrics in aesthetically versatile silhouettes is propelling the category’s expansion across both premium and mass-market segments.

Sustainability and Material Innovation

Eco-friendly manufacturing is transforming the athleisure supply chain. Brands are investing in recycled fibers, waterless dyeing, and biodegradable textiles to meet growing consumer and regulatory expectations for sustainability. Startups and established players alike are leveraging advanced materials such as plant-based elastane, bamboo viscose, and bio-nylon. Circular fashion initiatives, recycling, re-commerce, and rental models are also gaining traction. This emphasis on sustainability not only enhances brand perception but also enables companies to command higher margins in the premium segment.

Omnichannel and Digital Transformation

The proliferation of online retail and direct-to-consumer models is reshaping global distribution. Leading athleisure brands are integrating AI-driven personalization, virtual try-ons, and influencer-based marketing to enhance digital engagement. Social media platforms, fitness apps, and community-driven marketing strategies have emerged as crucial demand accelerators. Meanwhile, brick-and-mortar stores are evolving into experiential hubs, combining retail with wellness events and product customization zones to create immersive brand ecosystems.

Athleisure Products Market Drivers

Growing Health and Fitness Awareness

The increasing global emphasis on wellness, fitness, and active living is a primary growth driver. Consumers now prioritize comfort and flexibility in their clothing as gym culture, yoga, pilates, and outdoor activities become mainstream. Athleisure’s versatility aligns perfectly with these habits, fueling consistent demand across demographics and geographies.

Hybrid Lifestyle and Work-from-Home Influence

The post-pandemic hybrid work culture has redefined wardrobe preferences, leading to a surge in demand for versatile apparel that blends comfort and style. Consumers prefer garments that transition effortlessly between professional, social, and fitness settings. This trend has significantly boosted sales of soft, stretchable, and breathable athleisure products for everyday wear.

Digital Commerce and Brand Engagement

The rapid expansion of online retail and influencer marketing has revolutionized the athleisure industry. Global players are using AI analytics and digital supply-chain platforms to forecast demand, reduce inventory cycles, and personalize offerings. The D2C model enables brands to maintain stronger control over pricing, margins, and customer relationships, further amplifying profitability and brand loyalty.

Market Restraints

Intense Competition and Price Pressures

The market is highly fragmented, with global giants competing alongside niche labels and fast-fashion retailers. While this fosters innovation, it also drives significant price competition. Maintaining profitability in the mass segment is challenging, forcing brands to balance design differentiation and cost efficiency.

Rising Raw Material and Supply Chain Costs

Volatility in the prices of key materials, polyester, cotton, nylon, and elastane, along with logistics disruptions and rising labor costs, has increased production expenses. The push for sustainable manufacturing adds further cost complexity. Supply-chain optimization and nearshoring strategies are therefore becoming critical for margin stability.

Athleisure Products Market Opportunities

Emerging Market Expansion

Emerging economies in the Asia-Pacific, Latin America, and Africa represent major untapped opportunities. Rapid urbanization, rising incomes, and increasing health consciousness are driving apparel modernization. Localized product design, affordable pricing, and region-specific marketing campaigns can unlock substantial new revenue streams for global players.

Smart and Functional Apparel Integration

Technology integration within fabrics such as moisture sensors, thermal regulation, and compression technology is reshaping the category. Smart athleisure that tracks body performance and health indicators is transitioning from niche to mainstream, enabling brands to command premium pricing and attract tech-savvy consumers.

Omnichannel and Experiential Retail Growth

Brands that integrate digital commerce with immersive retail experiences are expected to outperform competitors. Flagship stores combining community events, fitness workshops, and wellness cafés are enhancing customer engagement. Seamless online-to-offline experiences will remain a defining success factor across global markets.

Product Type Insights

Leggings, yoga pants, and tights represent the leading product category, accounting for nearly 23% of global revenue in 2024. Their popularity is driven by functionality, comfort, and stylistic versatility that appeal to both fitness enthusiasts and casual users. Hoodies, joggers, and sports bras follow as core growth drivers, with innovations in fit, fabric, and design enhancing consumer retention across genders and age groups.

Category Insights

Mass athleisure dominates the market with a 65% share in 2024, driven by widespread affordability and global retail penetration. The premium athleisure segment is expanding rapidly, particularly in North America and Europe, as consumers show a willingness to pay more for sustainable and designer collaborations. Eco-friendly athleisure is an emerging niche expected to capture double-digit growth through 2030.

End-User Insights

Women’s athleisure leads with about 52% of total market share in 2024, reflecting strong adoption of yoga, fitness, and casual performance wear. Men’s athleisure is growing quickly, especially in urban centers where comfort-based office and travel wear are gaining acceptance. The children’s and unisex categories present promising growth opportunities as family-oriented and inclusive fashion trends expand.

Distribution Channel Insights

Online retail and D2C platforms have become central to market expansion, accounting for roughly 40% of 2024 sales. E-commerce growth is supported by enhanced digital marketing, influencer collaborations, and loyalty programs. Physical stores, however, continue to drive premium brand experiences and impulse purchases through curated displays and experiential merchandising.

| By Product Type | By Material | By End User | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, holding around 38% of the global share in 2024. The U.S. dominates due to high consumer spending, fitness culture, and strong brand presence. Continued innovation in sustainable fabrics and premium lines supports steady growth at approximately 7–8% CAGR.

Europe

Europe commands roughly 20% market share, with the U.K., Germany, and France leading adoption. Sustainable and premium athleisure collections are especially popular, reflecting European consumers’ emphasis on ethical and quality apparel. Growth remains stable with the increasing penetration of designer collaborations.

Asia-Pacific

Asia-Pacific holds about 25% of global revenue in 2024 and is the fastest-growing region at 10–12% CAGR. China and India drive regional expansion through urbanization, increasing disposable incomes, and lifestyle evolution. Domestic manufacturing capabilities also support export-led growth, particularly in performance apparel and private-label production.

Latin America

Latin America accounts for 8–10% of the global market. Brazil and Mexico lead regional consumption, driven by growing middle-class participation in sports and casual wear trends. Local brands are emerging, and cross-border e-commerce is expanding access to international athleisure labels.

Middle East & Africa

The Middle East & Africa region represents about 5–7% of the global share in 2024. Rapid retail modernization in GCC nations, coupled with rising youth populations and fitness awareness, supports double-digit growth. Africa’s domestic manufacturing is also improving, creating new export and retail opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Athleisure Products Market

- Nike, Inc.

- Adidas AG

- Lululemon Athletica Inc.

- Under Armor, Inc.

- PUMA SE

- VF Corporation

- ASICS Corporation

- New Balance Athletics, Inc.

- Columbia Sportswear Company

- Anta Sports Products Limited

- Decathlon S.A.

- Skechers USA, Inc.

- Gymshark Limited

- Fila Holdings Corporation

- Sun & Sand Sports LLC

Recent Developments

- In June 2025, Lululemon launched its first AI-powered “Studio Mirror Fit” line, integrating digital workout analytics with apparel fit feedback to enhance personalized performance wear.

- In May 2025, Nike announced a USD 200 million investment to expand sustainable textile production facilities in Vietnam and Indonesia to support its eco-athleisure range.

- In March 2025, Adidas introduced a fully recyclable “Loop” collection under its sustainability initiative, targeting circular fashion adoption across global markets.