Sucralose Market Size

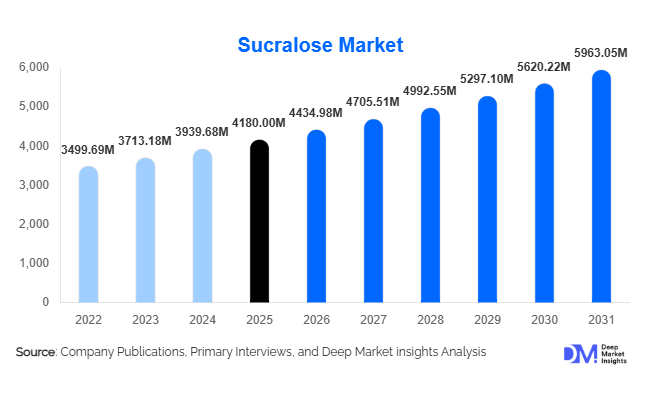

According to Deep Market Insights, the global sucralose market size was valued at USD 4,180 million in 2025 and is projected to grow from USD 4,434.98 million in 2026 to reach USD 5,963.05 million by 2031, expanding at a CAGR of 6.1% during the forecast period (2025–2031). Market growth is primarily driven by increasing global sugar-reduction initiatives, rising prevalence of diabetes and obesity, and the expanding use of high-intensity sweeteners in beverages, pharmaceuticals, and nutraceuticals. Sucralose, being approximately 600 times sweeter than sugar and highly stable under heat and varied pH conditions, continues to be widely adopted across processed foods and carbonated beverage formulations.

Key Market Insights

- Beverage applications dominate global demand, accounting for over 41% of total consumption in 2025 due to large-scale reformulations in zero-calorie soft drinks.

- Asia-Pacific leads global production and consumption, contributing nearly 38% of the total market share, supported by strong manufacturing capacity in China.

- Food & beverage manufacturing remains the largest end-use industry, representing approximately 63% of overall demand.

- Direct B2B sales channels dominate distribution, accounting for 57% of market share as multinational buyers secure long-term supply contracts.

- Powdered sucralose remains the preferred form, capturing nearly 68% of the total market share due to ease of blending and bulk handling efficiency.

- Rising pharmaceutical and nutraceutical adoption is accelerating demand in syrups, chewables, and dietary supplements.

What are the latest trends in the sucralose market?

Expansion of Zero-Calorie Beverage Reformulations

Global beverage manufacturers are increasingly reformulating carbonated soft drinks, energy beverages, and flavored waters using sucralose to comply with sugar tax regulations and front-of-pack labeling standards. Large beverage brands in North America and Europe are transitioning from high-fructose corn syrup to blended sweetener systems incorporating sucralose for cost efficiency and taste stability. Emerging markets in Asia-Pacific and Latin America are also witnessing increased penetration of low-sugar beverages, driving incremental demand. This trend is supported by rising consumer awareness of calorie intake and the long-term health implications of sugar consumption.

Technological Advancements in Production Efficiency

Manufacturers are investing in improved chlorination processes, automation, and purification technologies to reduce production costs and enhance purity levels beyond 98%. Energy-efficient manufacturing systems and wastewater treatment innovations are lowering environmental footprints while improving operating margins. Technological integration is also supporting the development of sucralose blends with natural sweeteners such as stevia, improving taste profiles and expanding application possibilities in bakery and dairy products.

What are the key drivers in the sucralose market?

Rising Prevalence of Diabetes and Obesity

Growing health concerns worldwide have prompted consumers to shift toward low-calorie and sugar-free alternatives. Sucralose offers a non-glycemic solution, making it suitable for diabetic-friendly food and beverage products. Governments are also promoting sugar reduction policies, further strengthening demand.

Growth in Functional and Nutraceutical Products

The rapid expansion of protein supplements, vitamin syrups, and chewable tablets has increased the use of sucralose as a stable sweetening agent. The nutraceutical industry is growing at 8–9% annually, directly contributing to incremental sucralose consumption globally.

What are the restraints for the global market?

Competition from Natural Sweeteners

Stevia and monk fruit extracts are gaining popularity due to consumer preference for natural ingredients. While sucralose remains cost-effective and stable, shifting perceptions toward clean-label products may limit premium growth opportunities.

Raw Material and Energy Price Volatility

Sucralose production is energy-intensive and dependent on sugar derivatives. Fluctuations in feedstock prices and energy costs can impact profit margins, particularly for small-scale manufacturers without vertical integration.

What are the key opportunities in the sucralose industry?

Emerging Asia-Pacific Consumption Growth

Countries such as China, India, Indonesia, and Vietnam are experiencing rising processed food and beverage production. Establishing localized manufacturing facilities in these markets can reduce logistics costs and strengthen supply chain resilience.

Hybrid Sweetener Formulations

Blending sucralose with natural sweeteners to enhance taste and reduce aftertaste presents significant innovation potential. This strategy enables manufacturers to tap into clean-label trends while retaining cost advantages.

Form Insights

Powdered sucralose dominates the global market, accounting for approximately 68% of the total revenue share in 2025. Its leadership is primarily driven by operational efficiency in large-scale food and beverage manufacturing. Powdered form ensures ease of blending in dry beverage mixes, bakery premixes, dairy powders, and pharmaceutical excipients. The stability of powdered sucralose under high-temperature processing conditions, including baking and pasteurization, further strengthens its adoption. Additionally, bulk transportation and storage advantages make it the preferred choice for multinational ingredient buyers seeking cost optimization and longer shelf life.

Granular sucralose holds a moderate share, largely concentrated in tabletop sweetener applications and retail consumer packaging. Growth in this segment is supported by rising at-home consumption of low-calorie sweeteners and increasing diabetic-friendly product demand. Meanwhile, liquid sucralose is gaining traction in beverage manufacturing, particularly for carbonated drinks and ready-to-drink (RTD) formulations. Its precise dosing capability, superior solubility, and compatibility with automated bottling systems make it highly attractive for high-volume beverage production lines.

Application Insights

Beverages remain the leading application segment, accounting for nearly 41% of total global demand in 2025. This dominance is driven by aggressive reformulation of carbonated soft drinks, energy drinks, flavored waters, and low-calorie juices in response to sugar taxes and calorie-labeling mandates across North America, Europe, and parts of Latin America. Beverage manufacturers prefer sucralose due to its clean sweetness profile, thermal stability, and compatibility with acidic formulations.

Food products, including bakery, confectionery, and dairy, represent the second-largest application segment, supported by demand for reduced-sugar snacks and functional dairy products. Pharmaceutical applications contribute approximately 15% of total demand, driven by expanding production of pediatric syrups, chewable tablets, and oral suspensions. The nutraceutical segment is the fastest growing, expanding at 8–9% CAGR, fueled by global growth in protein supplements, vitamin gummies, and wellness-oriented products.

Distribution Channel Insights

Direct B2B sales dominate the sucralose market with a 57% share in 2025, as multinational food, beverage, and pharmaceutical companies secure long-term procurement contracts to ensure supply consistency and pricing stability. Large-volume industrial buyers prefer direct sourcing to maintain quality control and regulatory compliance.

Ingredient distributors play a vital intermediary role, particularly in emerging markets across Asia-Pacific, Latin America, and the Middle East, where regional logistics and regulatory complexities require localized expertise. Retail channels, including supermarkets and e-commerce platforms, primarily serve tabletop sweetener consumers, with online sales expanding due to rising health-conscious purchasing behavior.

End-Use Industry Insights

The food and beverage manufacturing sector leads the market, accounting for approximately USD 2,630 million in 2025, supported by steady 6% annual growth in processed and packaged foods globally. Key drivers include sugar reformulation mandates, rising consumption of diet beverages, and expansion of functional food categories.

The pharmaceutical sector represents nearly USD 620 million in 2025, benefiting from increasing global OTC drug production and pediatric formulations requiring non-glycemic sweeteners. Nutraceuticals represent the fastest-growing end-use industry, supported by expanding sports nutrition, weight management supplements, and diabetic-friendly health products. Export-driven demand remains a defining characteristic of the market, with China accounting for over 70% of global sucralose export volumes, supplying North America and Europe.

| By Form | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 38% of the global market share in 2025 and remains the fastest-growing region with an estimated CAGR of 7.5%. China dominates global production capacity and export volumes, benefiting from large-scale manufacturing infrastructure, cost-efficient labor, and integrated supply chains. Domestic demand in China is also rising due to expansion in the beverage and dairy industries.

India is emerging as a high-growth market, driven by increasing urbanization, rising diabetes prevalence, and the expansion of pharmaceutical manufacturing. Southeast Asian countries such as Indonesia and Vietnam are witnessing rapid growth in processed food and soft drink production, further strengthening regional demand. Favorable government manufacturing initiatives and export-oriented policies continue to position the Asia-Pacific as the global production hub.

North America

North America accounts for 27% of global demand, with the United States contributing nearly 22% individually. Regional growth is driven by strong sugar reduction policies, consumer awareness regarding obesity, and widespread reformulation of beverages and packaged foods. Major beverage brands headquartered in the U.S. continue to adopt sucralose in zero-calorie product lines. Canada is also contributing to demand growth through clean-label reformulations and functional beverage expansion. Advanced food processing infrastructure and stable regulatory approvals from authorities such as the FDA support sustained adoption.

Europe

Europe represents approximately 23% of the global market share. Germany, the United Kingdom, and France lead regional demand due to strict sugar taxation frameworks and mandatory nutritional labeling standards. European consumers exhibit a strong preference for reduced-sugar and diabetic-friendly products, accelerating food manufacturer reformulations. Eastern European countries are experiencing gradual growth due to expanding processed food industries. Regulatory alignment under EFSA guidelines ensures consistent quality standards, supporting long-term market stability.

Latin America

Latin America holds around 7% of the global market share, with Brazil and Mexico leading consumption. Growth is primarily driven by sugar tax implementation in Mexico and expansion of beverage manufacturing in Brazil. The increasing middle-class population and growing demand for low-calorie soft drinks are strengthening regional uptake. Argentina and Chile are also witnessing gradual adoption due to rising health awareness and improved distribution networks.

Middle East & Africa

The Middle East & Africa account for nearly 5% of global demand. The UAE and Saudi Arabia are key consumption hubs due to strong import reliance and expanding beverage industries. Rising lifestyle diseases and increasing government focus on public health are encouraging reduced-sugar product penetration. South Africa leads Sub-Saharan Africa in pharmaceutical and beverage manufacturing, contributing to steady regional demand growth. Improving trade connectivity and expanding retail infrastructure are expected to support gradual market expansion in the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sucralose Market

- JK Sucralose Inc.

- Tate & Lyle PLC

- Niutang Chemical Ltd.

- Techno Sucralose Co. Ltd.

- Anhui Jinhe Industrial Co., Ltd.

- Guangdong Food Industry Institute

- Nantong Changhai Food Additive Co., Ltd.

- Hebei Hanlin Biotechnology Co., Ltd.

- Shandong Kanbo Biochemical Technology Co., Ltd.

- Unitech Sweet Co. Ltd.

- Zhejiang Synose Tech Co., Ltd.

- HYET Sweet

- Vitasweet Co. Ltd.

- Sanxinyuan Food Industry Co, Ltd.

- Foodchem International Corporation