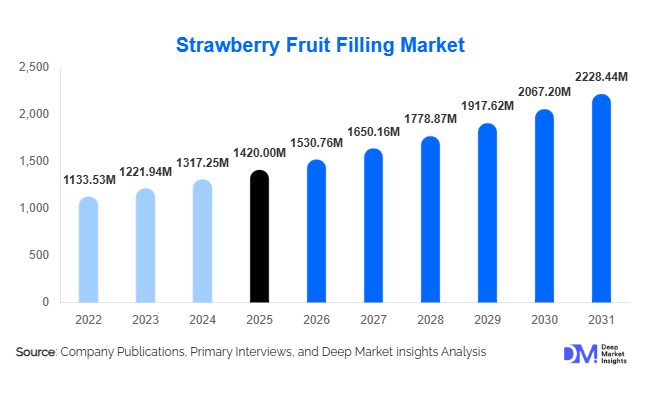

Strawberry Fruit Filling Market Size

According to Deep Market Insights, the global strawberry fruit filling market size was valued at USD 1,420 million in 2025 and is projected to grow from USD 1,530.76 million in 2026 to reach USD 2,228.44 million by 2031, expanding at a CAGR of 7.8% during the forecast period (2026–2031). The strawberry fruit filling market growth is primarily driven by increasing global consumption of bakery and dairy products, rising preference for fruit-based ingredients over synthetic flavorings, and growing demand for clean-label and high-fruit-content formulations across developed and emerging economies.

Key Market Insights

- Bakery applications dominate global demand, accounting for nearly 48% of total consumption in 2025, driven by strong sales of cakes, donuts, and pastries.

- B2B industrial sales represent over 60% of the market, as large-scale bakeries and dairy processors procure fruit fillings in bulk packaging formats.

- Europe holds the largest regional share (around 30%), supported by strong fruit processing infrastructure and high per capita bakery consumption.

- Asia-Pacific is the fastest-growing region, expanding at over 9% CAGR due to urbanization and Western-style food adoption in China and India.

- Clean-label and organic variants are gaining traction, particularly in North America and Western Europe.

- Aseptic and shelf-stable processing technologies are improving distribution efficiency and export potential.

What are the latest trends in the strawberry fruit filling market?

Clean-Label and High-Fruit Content Formulations

Manufacturers are increasingly shifting toward high-fruit-content (≥60%) formulations with reduced sugar and minimal preservatives. Food brands are reformulating products to align with clean-label positioning, eliminating artificial colors and flavors. Premium bakeries and yogurt brands are marketing “real fruit” fillings to appeal to health-conscious consumers. Organic-certified strawberry fillings are also expanding shelf presence in retail channels, supported by traceable sourcing and non-GMO certifications. This trend is reshaping procurement strategies, with industrial buyers demanding transparent ingredient declarations and natural stabilizers.

Technological Advancements in Aseptic Processing

Advanced aseptic packaging and pasteurization technologies are extending shelf life without compromising texture or flavor. Aseptic bags-in-box and bulk drums are increasingly used for export markets, reducing spoilage and logistics costs. Automation in fruit preparation lines, including controlled sugar infusion and viscosity optimization systems, is improving product consistency. Smart manufacturing and temperature-controlled supply chains are enabling producers to serve geographically distant markets more efficiently, particularly in Asia and the Middle East.

What are the key drivers in the strawberry fruit filling market?

Expansion of the Global Bakery Industry

The global industrial bakery industry, valued at over USD 500 billion, continues to grow steadily at 5–6% annually. Increasing consumption of filled pastries, cakes, and snack products directly fuels demand for strawberry fillings. Rapid QSR and café chain expansion across Asia-Pacific and Latin America further strengthens B2B procurement volumes.

Growth of the Yogurt and Dairy Dessert Segment

Flavored yogurts and layered dairy desserts are major application areas. With the global yogurt market expanding at approximately 6–7% CAGR, fruit preparations remain critical for flavor differentiation. Strawberry continues to be the most popular fruit flavor globally due to universal taste acceptance and vibrant color appeal.

What are the restraints for the global market?

Volatility in Raw Strawberry Prices

Climate variability, seasonal harvest cycles, and supply chain disruptions significantly affect strawberry prices. This directly impacts production costs and compresses manufacturer margins, particularly for high-fruit-content variants.

Cold Chain and Shelf-Life Constraints

In emerging markets, inadequate cold storage infrastructure can restrict distribution efficiency. Fruit fillings require strict quality control and temperature management to prevent microbial spoilage.

What are the key opportunities in the strawberry fruit filling industry?

Emerging Market Manufacturing Hubs

Countries such as India, Indonesia, and Vietnam are investing in food processing infrastructure under initiatives like “Make in India.” Local production facilities can reduce import dependence and improve price competitiveness. Rising disposable incomes in these regions create sustained long-term demand for fruit-based bakery products.

Plant-Based and Functional Food Integration

Strawberry fillings are increasingly incorporated into plant-based yogurts, protein bars, and fortified snacks. The expansion of vegan and functional food markets presents new application opportunities. Manufacturers can differentiate through fiber-enriched, reduced-sugar, or vitamin-fortified fruit fillings tailored to health-focused brands.

Product Type Insights

Conventional strawberry fruit filling dominates the global market, accounting for approximately 52% of the global market share in 2025. The segment’s leadership is primarily driven by its cost-effectiveness, consistent texture, standardized sweetness levels, and long-standing acceptance among industrial food manufacturers. Large-scale bakeries and dairy processors prefer conventional variants due to their stable supply, predictable performance during baking and freezing, and compatibility with automated production lines. In addition, conventional fillings offer extended shelf life and ease of storage, which further strengthens their commercial viability.

Organic and high-fruit-content variants are witnessing faster growth, supported by rising consumer awareness regarding clean-label ingredients and natural formulations. However, these premium offerings remain comparatively niche due to higher raw material costs and limited price elasticity in mass-market applications. Meanwhile, sugar-free and no-added-sugar strawberry fillings are expanding steadily, driven by regulatory pressure on sugar reduction, growing health consciousness, and increasing demand from diabetic and weight-management consumers. Reformulation strategies and the use of alternative sweeteners are enhancing product innovation within this segment.

Application Insights

Bakery applications lead the market with nearly 48% share of total revenue in 2025, making it the largest application segment. The dominance of this segment is driven by the widespread use of strawberry fillings in cakes, donuts, croissants, pastries, tarts, and pies, where flavor consistency, heat stability, and visual appeal are critical. Rapid growth in artisanal bakeries, in-store supermarket bakeries, and quick-service restaurant dessert menus continues to stimulate demand. Additionally, the expansion of premium and customized baked goods in urban markets supports sustained segment growth.

Dairy and frozen desserts represent the second-largest segment, supported by increasing consumption of fruit-on-the-bottom yogurts, cheesecakes, ice creams, and flavored milk products. Manufacturers favor strawberry fillings due to their strong consumer familiarity and vibrant color profile. Confectionery and beverage applications are emerging growth areas, particularly in ready-to-drink smoothies, milkshakes, filled chocolates, cereal bars, and layered desserts. Product diversification and hybrid dessert innovations are further broadening the application scope.

Distribution Channel Insights

B2B direct sales account for approximately 61% of total revenue, reflecting the dominance of industrial buyers such as commercial bakeries, dairy processors, and food manufacturing companies. Long-term procurement contracts, bulk purchasing advantages, and customized formulation requirements strengthen the position of direct sales in the market. Manufacturers often provide technical support and tailored viscosity or fruit-content specifications to large clients, reinforcing channel loyalty.

Foodservice distributors play an important role in supplying cafés, hotels, catering companies, and quick-service chains with ready-to-use fruit fillings. Retail channels, including supermarkets, hypermarkets, and online grocery platforms, are steadily expanding their presence, particularly for consumer-sized jars, pouches, and squeeze packs. Growth in home baking trends and e-commerce grocery penetration is contributing to higher retail sales volumes.

Packaging Insights

Industrial pails and drums dominate the packaging segment with nearly 58% share in 2025, primarily due to bulk procurement by food manufacturers. The leadership of this segment is driven by operational efficiency, cost optimization, and ease of integration into large-scale production systems. These formats minimize handling costs and reduce packaging waste per unit volume, making them ideal for industrial applications.

Aseptic bags-in-box packaging is gaining traction, particularly in export-oriented trade, as it enhances shelf stability and reduces contamination risks during long-distance transportation. In the retail segment, glass jars and squeeze bottles are witnessing growth, especially in premium and home-baking categories. Attractive packaging design, resealability, and convenience features are influencing purchasing decisions in consumer markets.

| By Product Type | By Form | By Application | By Distribution Channel | By Packaging Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of global demand in 2025, with the United States leading regional consumption due to its well-established bakery chains, yogurt manufacturers, and processed dessert industry. Regional growth is driven by increasing demand for clean-label products, reformulation initiatives to reduce sugar content, and rising popularity of premium fruit-based desserts. Strong cold-chain infrastructure and advanced food processing capabilities further support market expansion. Additionally, innovation in plant-based dairy alternatives incorporating fruit fillings is creating new growth avenues.

Europe

Europe holds the largest share at 30% of the global market, supported by strong bakery traditions and high per capita consumption of fruit-based desserts. Countries such as Germany, France, Italy, and Poland are key consumers. Poland’s position as a major strawberry producer strengthens regional supply chains, ensuring raw material availability and competitive pricing. Growth drivers in Europe include increasing preference for organic fruit fillings, stringent quality standards promoting high-fruit-content products, and strong demand from artisanal bakeries. Sustainable sourcing and eco-friendly packaging initiatives are also shaping regional market dynamics.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR exceeding 9%. China and India are major demand centers, driven by rapid urbanization, rising disposable incomes, and increasing adoption of Western-style bakery and dairy products. The expansion of modern retail infrastructure and international café chains further accelerates consumption. Japan and South Korea maintain steady premium demand, supported by innovation in convenience desserts and high-quality confectionery products. Growing investments in food processing facilities and domestic fruit cultivation are strengthening regional production capacity.

Latin America

Latin America is witnessing steady growth, with Brazil and Mexico emerging as leading markets. Expansion of the organized bakery sector, rising consumption of packaged desserts, and growth in domestic food processing industries are key drivers. Increasing penetration of supermarket chains and improvements in cold storage logistics are enhancing product availability. Additionally, local strawberry cultivation in certain areas supports partial regional supply, reducing import dependency.

Middle East & Africa

The Middle East & Africa region demonstrates gradual growth, with the UAE and Saudi Arabia serving as major import-driven markets due to expanding hospitality and tourism sectors. Rising demand for premium desserts in hotels, cafés, and quick-service restaurants supports market expansion. Limited domestic strawberry production increases reliance on European suppliers, while growing investments in food manufacturing infrastructure are gradually strengthening regional processing capabilities. Urbanization and increasing consumer preference for Western-style bakery products continue to create growth opportunities across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Strawberry Fruit Filling Market

- Agrana Beteiligungs-AG

- Döhler Group

- Zentis GmbH & Co. KG

- Frulact

- Puratos Group

- SVZ International

- Hero Group

- Kerry Group

- Ingredion Incorporated

- Andros Group