Stone Fruit Market Size

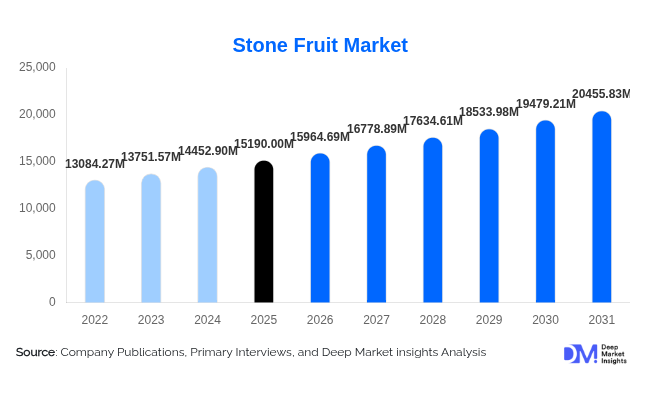

According to Deep Market Insights, the global stone fruit market size was valued at USD 15,190.00 million in 2025 and is projected to grow from USD 15,964.69 million in 2026 to reach USD 20,455.83 million by 2031, expanding at a CAGR of 5.1% during the forecast period (2026–2031). The stone fruit market growth is primarily driven by rising global consumption of fresh fruits, increasing health awareness among consumers, expanding cold-chain and export infrastructure, and the growing penetration of premium and organic fruit varieties across developed and emerging economies.

Key Market Insights

- Fresh stone fruits dominate global consumption, accounting for over two-thirds of total market value due to daily household usage and preference for minimally processed foods.

- Asia-Pacific leads global production and consumption, with China alone contributing over one-fifth of total demand.

- Premium cherries and nectarines are the fastest value-growing fruit types, driven by export demand from East Asia and the Middle East.

- Modern retail channels dominate distribution, supported by cold storage expansion, better packaging, and branding of fresh produce.

- Organic and sustainably grown stone fruits are gaining traction, growing at nearly twice the pace of conventional farming.

- Counter-seasonal trade from the Southern Hemisphere plays a critical role in stabilizing year-round global supply.

What are the latest trends in the stone fruit market?

Premiumization and Export-Grade Fruit Expansion

The stone fruit market is witnessing a strong shift toward premium and export-grade produce, particularly cherries, nectarines, and specialty plum varieties. Export-oriented growers are investing heavily in varietal licensing, orchard modernization, and advanced post-harvest technologies to meet strict quality standards in high-value markets such as China, Japan, South Korea, and the Gulf countries. Premium stone fruits often command price premiums of 30–60% compared to domestic-grade produce, making them a key driver of revenue growth despite lower volume shares.

Rising Adoption of Cold-Chain and Post-Harvest Technologies

Advancements in controlled-atmosphere storage, precision grading, and temperature-monitored logistics are significantly reducing post-harvest losses and extending shelf life. These technologies are enabling long-distance exports and improving price realization for growers. Automated sorting lines, AI-based defect detection, and digital traceability systems are increasingly adopted by large producers, especially in Europe, North America, and export hubs such as Chile and South Africa.

What are the key drivers in the stone fruit market?

Growing Health and Nutrition Awareness

Stone fruits are rich in antioxidants, vitamins, and dietary fiber, aligning well with global trends toward healthier eating habits. Increasing awareness of the role of fruits in immunity, digestive health, and disease prevention has driven higher per-capita fruit consumption, particularly in urban areas. This trend has been reinforced by dietary guidelines and public health campaigns promoting fresh produce consumption.

Expansion of Global Fresh Fruit Trade

The globalization of fruit trade has been a major growth driver for the stone fruit market. Southern Hemisphere producers such as Chile, Australia, Argentina, and South Africa supply stone fruits to Northern Hemisphere markets during off-seasons, ensuring year-round availability. Trade agreements, improved port infrastructure, and advancements in cold-chain logistics have significantly expanded export volumes over the past decade.

Modern Retail and E-Commerce Growth

The rapid expansion of supermarkets, hypermarkets, and online grocery platforms has increased accessibility to high-quality stone fruits. Organized retail offers better handling, packaging, and pricing transparency, which enhances consumer confidence and drives repeat purchases. E-commerce platforms, in particular, are gaining importance in urban Asia and North America, supporting premium and organic fruit sales.

What are the restraints for the global market?

Climate Sensitivity and Production Volatility

Stone fruit cultivation is highly sensitive to climatic conditions such as frost, drought, and extreme heat. Climate variability can significantly impact yields, fruit quality, and supply consistency, leading to price volatility. Unexpected weather events continue to pose a major risk to growers and exporters, especially in regions with limited irrigation or frost protection infrastructure.

High Post-Harvest Losses and Logistics Costs

Despite technological improvements, stone fruits remain highly perishable, with post-harvest losses ranging between 15% and 25% in developing regions. Rising costs of refrigerated transport, labor, and energy further compress margins, particularly for exporters serving distant markets.

What are the key opportunities in the stone fruit market?

Organic and Sustainable Stone Fruit Production

Organic stone fruits currently account for less than 10% of global supply, yet demand is growing rapidly in North America and Europe. Consumers are increasingly willing to pay premiums for residue-free and environmentally responsible produce. Transitioning to certified organic or integrated pest management systems presents a significant opportunity for growers to enhance profitability and secure long-term retail partnerships.

Value-Added Processing and Functional Applications

Stone fruits are increasingly used in frozen fruit mixes, bakery fillings, baby food, smoothies, and nutraceutical products. Investments in freezing, drying, puree concentration, and bioactive compound extraction allow producers to diversify revenue streams and reduce reliance on fresh market pricing, while meeting demand from fast-growing food processing and functional food industries.

Fruit Type Insights

Peaches dominate the global stone fruit market, accounting for approximately 34% of total market value in 2025, driven by widespread cultivation, affordability, and high fresh consumption. Plums and nectarines collectively represent around 30% of the market, supported by strong demand in Europe and Asia. Cherries, while smaller in volume, are the fastest-growing in value terms due to premium pricing and export demand. Apricots hold a niche but stable share, particularly in Mediterranean and Central Asian regions.

Product Form Insights

Fresh stone fruits account for nearly 68% of global market value, reflecting strong consumer preference for fresh produce. Processed forms such as frozen, canned, and dried fruits collectively make up the remaining share, with frozen stone fruits experiencing the fastest growth due to rising demand from bakeries, dairy manufacturers, and foodservice operators.

End-Use Insights

Household consumption represents approximately 61% of total demand, supported by daily dietary use. The food and beverage processing industry is the fastest-growing end-use segment, driven by expanding applications in yogurts, desserts, baked goods, and functional beverages. Nutraceutical and baby food applications are emerging as high-growth niches, particularly in developed markets.

| By Fruit Type | By Product Form | By Cultivation Method | By Distribution Channel | By End Use | By Price Tier |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global stone fruit market with an estimated 38% share in 2025. China dominates both production and consumption, accounting for over 22% of global demand. India, Japan, and South Korea are key growth markets, driven by rising disposable incomes and expanding modern retail infrastructure.

Europe

Europe holds approximately 27% of the global market, led by Spain, Italy, France, and Turkey. The region is a major exporter of plums, cherries, and apricots, benefiting from advanced orchard management and strong export linkages.

North America

North America accounts for around 18% of global demand, with the United States being a major consumer of premium peaches, nectarines, and cherries. Demand for organic and sustainably grown stone fruits is particularly strong in this region.

Latin America

Latin America represents roughly 11% of the market and plays a critical role as an export hub. Chile is the leading exporter, supplying cherries, plums, and nectarines to Asia and North America during counter-seasonal periods.

Middle East & Africa

The Middle East & Africa account for about 6% of global demand. The Middle East is a high-value import market, while South Africa is a key exporter supporting global supply chains.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stone Fruit Market

- The Wonderful Company

- Del Monte Fresh Produce

- Sun World International

- Dole plc

- Frutura

- Prima Group

- Camposol

- Dutoit Group

- Greenyard Group

- San Miguel Global

- AgroFresh

- Fruitmasters

- NatureSweet

- Zespri Group

- Chiquita Brands International