Stevia Market Size

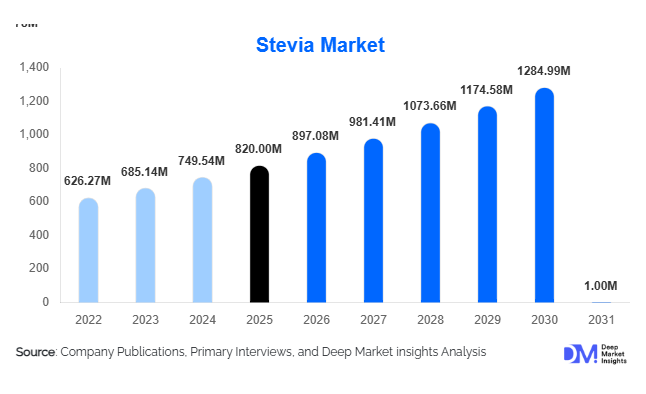

According to Deep Market Insights, the global stevia market size was valued at USD 820 million in 2025 and is projected to grow from USD 897.08 million in 2026 to reach USD 1,405.78 million by 2031, expanding at a CAGR of 9.4% during the forecast period (2026–2031). The stevia market growth is primarily driven by rising global sugar reduction initiatives, increasing diabetes and obesity prevalence, and growing consumer preference for plant-based, zero-calorie sweeteners. As regulatory authorities across North America and Europe continue to support sugar reformulation programs, food and beverage manufacturers are accelerating the integration of steviol glycosides into mainstream product portfolios. Advancements in fermentation-based production technologies, particularly for high-purity glycosides such as Reb M and Reb D, are improving taste profiles and enabling wider application across beverages, dairy, bakery, and nutraceutical products.

Key Market Insights

- Beverages account for over 55% of total stevia demand, driven by the reformulation of carbonated soft drinks and functional beverages.

- High-purity Reb A remains the dominant glycoside, holding approximately 42% market share in 2025.

- Leaf extraction technology leads production, representing nearly 64% of global output, though fermentation-based methods are growing rapidly.

- Asia-Pacific dominates the global market, accounting for about 32% of total revenue in 2025.

- B2B distribution channels control nearly 70% of sales, as stevia is primarily sold to food and beverage processors.

- The top five companies hold approximately 58% market share, reflecting moderate consolidation in the industry.

What are the latest trends in the stevia market?

Shift Toward Fermentation-Derived Glycosides

The market is witnessing a strong shift toward fermentation-based production of steviol glycosides, particularly Reb M and Reb D. Unlike traditional leaf extraction, fermentation enables consistent quality, improved taste, and scalable production. Biotechnology advancements are reducing bitterness while improving sweetness equivalence to sugar, allowing higher substitution rates in beverages. Major ingredient suppliers are investing in precision fermentation facilities to meet growing demand from global beverage brands seeking clean-label and cost-efficient sugar alternatives.

Expansion of Clean-Label and Natural Reformulation

Food and beverage companies are increasingly reformulating products to eliminate artificial sweeteners such as aspartame and sucralose. Stevia’s plant-based origin positions it as a preferred alternative in clean-label product launches. Demand is particularly strong in flavored waters, ready-to-drink teas, dairy desserts, and protein beverages. Retail brands are also launching private-label stevia blends, further increasing penetration in household tabletop sweeteners.

What are the key drivers in the stevia market?

Global Sugar Reduction Policies

More than 45 countries have introduced sugar taxes or reformulation targets, compelling manufacturers to reduce sugar content. Stevia offers a zero-calorie solution without raising glycemic index levels, making it a preferred choice in regulatory-driven markets such as the U.K., Mexico, and the United States. These policies are directly accelerating B2B demand.

Rising Prevalence of Diabetes and Obesity

With over 530 million adults living with diabetes globally, the demand for low-calorie and diabetic-friendly products is expanding. Stevia’s natural positioning and zero-glycemic impact support its integration across beverages, nutraceuticals, and pharmaceutical formulations. Health-conscious consumers are increasingly opting for products labeled “no added sugar” or “naturally sweetened.”

What are the restraints for the global market?

Taste and Aftertaste Challenges

Despite technological improvements, lower-purity stevia extracts may produce bitterness or lingering aftertaste. This limits adoption in premium beverage formulations and requires blending strategies, increasing production costs.

Raw Material Supply Concentration

Stevia leaf cultivation is heavily concentrated in China and parts of South America. Climatic risks, trade barriers, or agricultural disruptions can impact supply stability and pricing, posing challenges for manufacturers dependent on leaf extraction processes.

What are the key opportunities in the stevia industry?

Emerging Market Penetration

Asia-Pacific and Latin America present high-growth opportunities due to rising middle-class populations and expanding functional beverage markets. Countries such as India, Indonesia, and Brazil are witnessing strong uptake of sugar substitutes. Establishing regional extraction and blending facilities can lower logistics costs and strengthen supply chains.

Nutraceutical and Functional Food Integration

The global nutraceutical market, growing at over 8% annually, presents strong integration opportunities for stevia in protein powders, meal replacements, and dietary supplements. Clean-label demand and fitness-driven consumption trends are likely to drive double-digit growth in this sub-segment.

Product Type Insights

Stevia extracts dominate the global market, accounting for approximately 48% share in 2025, driven primarily by rising demand for high-purity steviol glycosides (≥95%) in beverage reformulation programs. Leading glycosides such as Reb A, Reb M, and Reb D are preferred by multinational beverage manufacturers due to improved sweetness profiles and reduced bitterness compared to earlier-generation extracts. The dominance of extracts is supported by large-scale industrial adoption, standardized quality specifications, and compatibility with carbonated soft drinks, flavored waters, and functional beverages. Additionally, fermentation-derived high-purity extracts are gaining momentum, further reinforcing this segment’s leadership.

Stevia blends are witnessing steady growth, particularly in retail tabletop formats, where manufacturers combine stevia with erythritol or monk fruit to optimize taste and mouthfeel. Liquid stevia concentrates are expanding in pharmaceutical syrups, nutraceutical tonics, and liquid dietary supplements due to ease of solubility and dosage precision. Powdered and granular stevia formats remain widely used in bakery and confectionery applications, offering formulation stability under high temperatures. Whole leaf stevia continues to represent a niche segment, primarily catering to natural health consumers and herbal product markets.

Application Insights

Beverages remain the leading application, contributing nearly 55% of total revenue in 2025, primarily driven by global sugar reduction mandates and reformulation initiatives. Carbonated soft drinks, energy drinks, flavored waters, and ready-to-drink teas are the largest adopters, as manufacturers seek zero-calorie sweetening solutions without compromising taste. The beverage segment’s dominance is reinforced by long-term supply agreements between ingredient suppliers and multinational beverage brands.

Dairy and frozen desserts are emerging as strong secondary segments, supported by growing demand for reduced-sugar yogurts, flavored milk, and ice creams. Bakery and confectionery manufacturers increasingly incorporate stevia to achieve calorie reduction targets while maintaining sweetness intensity. Nutraceuticals and dietary supplements represent the fastest-growing application segment, expanding at over 11% CAGR, driven by protein powders, meal replacements, and functional health beverages that prioritize clean-label positioning.

Distribution Channel Insights

B2B sales dominate the market with approximately 70% share in 2025, reflecting stevia’s primary role as an ingredient supplied directly to food and beverage manufacturers. The growth of this segment is fueled by bulk procurement contracts, large-scale beverage reformulation programs, and expanding functional food production. Ingredient suppliers maintain long-term partnerships with global consumer brands, ensuring consistent revenue streams.

Retail distribution through supermarkets and hypermarkets is expanding steadily, particularly for tabletop sweeteners and blended stevia products. Online channels are witnessing accelerated growth, supported by direct-to-consumer nutraceutical brands and subscription-based health platforms. Digital platforms enable product comparison, ingredient transparency, and clean-label marketing, strengthening consumer engagement.

End-Use Industry Insights

The food and beverage industry accounts for approximately 75% of total stevia demand, underpinned by global sugar reformulation programs and increasing consumer preference for low-calorie products. The scale and purchasing power of multinational beverage and packaged food companies solidify this segment’s dominance. The nutraceutical industry is the fastest-growing end-use sector, supported by expanding global demand for functional nutrition and fitness products. Pharmaceutical applications maintain stable growth, particularly in diabetic formulations, cough syrups, and chewable tablets, where sugar-free labeling is critical. Personal care applications, including toothpaste, mouthwash, and herbal oral care products, are emerging as niche but promising segments due to stevia’s natural origin and sweetness properties.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global stevia market with approximately 32% share in 2025, driven by its dual role as the largest production and consumption hub. China dominates production and export volumes, accounting for over 60% of global stevia extract exports, supported by established agricultural cultivation, cost-efficient extraction infrastructure, and strong export networks. Domestic demand in China is growing due to expanding functional beverage consumption and government-backed health awareness campaigns.

India represents the fastest-growing market in the region, expanding at over 12% CAGR, fueled by rising diabetes prevalence, increasing middle-class health consciousness, and rapid growth in low-sugar beverages. Japan and South Korea demonstrate mature demand supported by established regulatory approvals and long-standing acceptance of stevia in processed foods. Regional growth is further strengthened by government support for agricultural diversification and biotechnology investments in fermentation-based glycosides.

North America

North America holds nearly 28% of global market share, with the United States accounting for roughly 80% of regional demand. Growth in this region is primarily driven by aggressive sugar reduction initiatives, high obesity and diabetes rates, and widespread clean-label consumer preference. Major beverage manufacturers headquartered in the U.S. are actively reformulating product portfolios using stevia to comply with public health guidelines.

The region also benefits from strong biotechnology investments, enabling the expansion of fermentation-based glycoside production. Canada contributes a steady demand through health-conscious retail consumers and expanding nutraceutical manufacturing. The U.S. remains the largest global importer of stevia extracts, reinforcing North America’s demand-driven market structure.

Europe

Europe represents approximately 24% of the global market, supported by robust sugar taxation policies and strict regulatory frameworks promoting healthier food formulations. The U.K., Germany, and France lead adoption due to structured sugar reduction programs and high consumer awareness of natural sweeteners. The European Food Safety Authority (EFSA) approvals provide regulatory clarity, fostering stable market growth. Demand in Europe is further driven by expanding private-label product launches and the strong presence of functional dairy and beverage brands. Clean-label positioning and consumer preference for plant-based ingredients reinforce steady regional expansion.

Latin America

Latin America accounts for around 10% of global demand, supported by both production and consumption growth. Brazil and Paraguay are major cultivation and processing hubs due to favorable climatic conditions. Mexico drives regional consumption, largely due to sugar tax implementation and beverage reformulation mandates. Rising urbanization, expanding middle-class populations, and increasing awareness of diabetes management are contributing to regional growth. Export-driven demand from Paraguay further strengthens Latin America’s strategic position in global supply chains.

Middle East & Africa

The Middle East & Africa region holds approximately 6% share in 2025, with gradual but steady growth. The UAE and Saudi Arabia are key demand centers due to high per capita beverage consumption and government-led health initiatives targeting sugar reduction. South Africa leads demand within Sub-Saharan Africa, supported by urban retail expansion and increasing adoption of sugar-free beverages. Regional growth is driven by rising disposable income, growing diabetic populations, and increasing availability of imported stevia-based tabletop sweeteners. Although still emerging, improved distribution networks and expanding modern retail infrastructure are expected to accelerate adoption over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stevia Market

- Cargill

- Ingredion Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland (ADM)

- PureCircle Limited

- DSM-Firmenich

- Sweegen

- GLG Life Tech Corporation

- Sunwin Stevia International

- Zhucheng Haotian Pharma

- Morita Kagaku Kogyo Co., Ltd.

- Pyure Brands LLC

- S&W Seed Company

- Stevia Corp

- Evolva Holding SA