Starter Culture Market Size

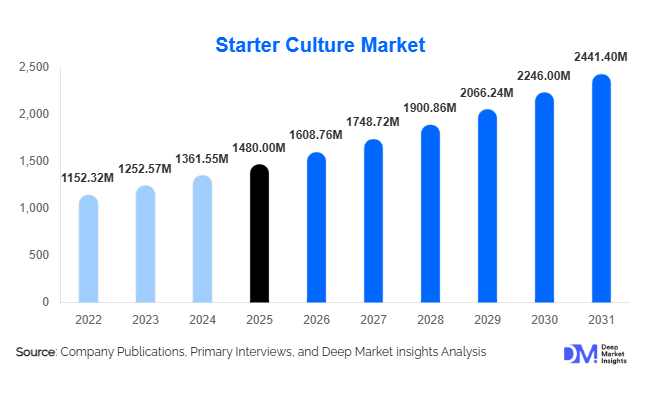

According to Deep Market Insights, the global starter culture market size was valued at USD 1,480 million in 2025 and is projected to grow from USD 1,608.76 million in 2026 to reach approximately USD 2,441.40 million by 2031, expanding at a CAGR of 8.7% during the forecast period (2026–2031). The starter culture market growth is primarily driven by the rising consumption of fermented foods, increasing demand for clean-label and natural food ingredients, and growing awareness of probiotic and gut-health benefits among global consumers.

Key Market Insights

- Bacterial starter cultures dominate the global market, supported by their extensive use in dairy fermentation, particularly cheese and yogurt production.

- Dairy applications account for the largest share of global starter culture demand, driven by consistent consumption growth across both developed and emerging economies.

- Europe leads global consumption due to strong fermentation traditions, advanced food processing infrastructure, and strict quality standards.

- Asia-Pacific is the fastest-growing regional market, fueled by rising dairy intake, urbanization, and government support for food processing industries.

- Freeze-dried starter cultures are the preferred form globally, owing to their long shelf life, storage stability, and ease of transportation.

- Technological advancements in strain customization are reshaping product innovation and enabling application-specific cultures.

What are the latest trends in the starter culture market?

Rising Demand for Probiotic and Functional Starter Cultures

The starter culture market is witnessing a strong shift toward probiotic and functional strains designed to deliver targeted health benefits. Consumers increasingly associate fermented foods with digestive health, immunity, and overall wellness, driving manufacturers to integrate clinically supported strains into dairy, beverages, and functional food formulations. This trend has accelerated innovation in strain selection, with companies developing cultures that offer enhanced survivability, stability, and sensory performance. Functional starter cultures are also being used to reduce sugar, improve texture, and extend shelf life, making them highly attractive to food manufacturers focused on clean-label positioning.

Precision Fermentation and Strain Customization

Advancements in microbial genomics, bioinformatics, and fermentation technology are enabling precision-engineered starter cultures. Manufacturers are increasingly offering application-specific cultures optimized for fermentation speed, flavor development, and consistency. Precision fermentation allows food processors to reduce batch variability and improve yield efficiency, particularly in large-scale dairy and beverage production. The integration of AI-driven fermentation control systems and digital monitoring tools is further enhancing process optimization and accelerating adoption among industrial manufacturers.

What are the key drivers in the starter culture market?

Growth in Fermented Food Consumption

Global consumption of fermented foods such as cheese, yogurt, sourdough bread, and fermented beverages continues to rise, supported by changing dietary habits and increased preference for natural food preservation methods. Starter cultures are essential for achieving consistent fermentation outcomes, making them indispensable across industrial and artisanal food production. Expanding urban populations and westernization of diets in Asia-Pacific and Latin America are further strengthening this demand.

Health and Wellness-Oriented Consumer Preferences

Consumers are increasingly prioritizing foods that support gut health and immunity, driving strong demand for probiotic-rich products. Starter cultures enable manufacturers to enhance functional properties while maintaining clean-label claims. Scientific validation of probiotic benefits has improved consumer confidence, supporting premium pricing and higher adoption across multiple food categories.

What are the restraints for the global market?

High R&D and Production Costs

The development of advanced starter cultures requires significant investment in microbiology research, controlled fermentation facilities, and cold-chain logistics. These high costs can limit adoption among small and medium-scale food producers, particularly in developing regions. Strain preservation and regulatory testing further add to operational expenses.

Regulatory and Compliance Challenges

Approval processes for microbial strains vary across regions, with stringent regulations in Europe and North America. Compliance with food safety standards, labeling requirements, and novel strain approvals can delay commercialization and increase time-to-market for new products.

What are the key opportunities in the starter culture industry?

Expansion of Plant-Based and Alternative Foods

The rapid growth of plant-based dairy alternatives presents a major opportunity for starter culture manufacturers. Cultures are increasingly used to improve flavor, texture, and digestibility of plant-based yogurts, cheeses, and beverages. Customized strains for non-dairy substrates are expected to unlock new revenue streams and expand market penetration.

Emerging Market Industrialization

Asia-Pacific, Latin America, and parts of Africa are witnessing strong investments in food processing infrastructure. Government initiatives such as Make in India and Made in China 2025 are encouraging domestic production of fermented foods, indirectly boosting demand for starter cultures. These regions offer long-term growth potential for global suppliers.

Microbial Type Insights

Bacterial starter cultures account for approximately 62% of the global starter culture market share in 2025, making them the dominant microbial type worldwide. This leadership is primarily driven by their extensive and indispensable role in dairy fermentation, where consistency, safety, and predictable acidification are critical. Lactic acid bacteria (LAB) remain the most widely used bacterial cultures due to their proven safety profile, regulatory acceptance, and ability to enhance flavor, texture, and shelf life across a wide range of dairy products, including cheese, yogurt, and cultured creams. Their compatibility with large-scale industrial processing and standardized fermentation systems further reinforces their dominance.

Yeast starter cultures represent a steadily expanding segment, driven by growing demand from the bakery and alcoholic beverage industries. The global rise of craft beer, premium wine, and artisanal baked goods has increased the need for yeast strains that offer flavor differentiation, fermentation efficiency, and aroma complexity. Meanwhile, mold starter cultures remain a niche but strategically important segment, particularly in specialty and traditional cheese varieties. Mold cultures such as those used in blue, bloomy-rind, and surface-ripened cheeses continue to see stable demand in premium dairy markets, especially in Europe, where traditional cheese-making practices are deeply embedded.

Application Insights

Dairy applications represent nearly 48% of total global starter culture demand, maintaining their position as the leading application segment in 2025. This dominance is driven by consistently high consumption of cheese and yogurt across both developed and emerging economies, coupled with the need for controlled fermentation, standardized quality, and extended shelf life. Continuous innovation in dairy products, such as high-protein yogurts, low-sugar formulations, and premium cheese varieties, has further increased reliance on advanced starter cultures.

Alcoholic beverages, including beer and wine, form the second-largest application segment, supported by the global expansion of craft brewing, premium wines, and specialty alcoholic beverages. Starter cultures are increasingly used to improve fermentation efficiency, flavor complexity, and batch consistency, particularly among small and mid-sized producers. Functional foods and non-alcoholic fermented beverages represent the fastest-growing application areas, expanding at double-digit growth rates. Rising consumer focus on gut health, immunity, and clean-label nutrition is driving demand for fermented beverages, probiotic shots, and cultured plant-based drinks, significantly boosting starter culture adoption beyond traditional food categories.

End-Use Industry Insights

Industrial food and beverage manufacturers account for approximately 70% of global starter culture consumption, reflecting their reliance on scalable, standardized, and high-performance fermentation solutions. Large manufacturers prioritize starter cultures that deliver consistent results, reduced batch variability, and compatibility with automated processing lines. Long-term supply contracts and co-development partnerships between culture producers and multinational food companies further strengthen this segment’s dominance.

Artisanal and small-scale producers represent a smaller but high-value segment, particularly in Europe and North America. Demand in this segment is driven by consumer preference for traditional, region-specific, and premium fermented products. Artisanal producers increasingly adopt specialized starter cultures to preserve authenticity while ensuring food safety and regulatory compliance, supporting steady growth in this premium niche.

| By Microbial Type | By Application | By End-Use Industry | By Form |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe holds approximately 34% of the global starter culture market share in 2025, making it the largest regional market. Germany, France, Italy, and the Netherlands are the key contributors, supported by long-established dairy traditions and a strong culture of fermented food consumption. Advanced fermentation technologies, high per-capita cheese and yogurt consumption, and strict food quality and safety standards drive sustained demand for high-quality starter cultures. Additionally, Europe’s strong focus on clean-label products and protected designation of origin (PDO) foods encourages the use of specialized and premium starter cultures, reinforcing regional market leadership.

North America

North America accounts for nearly 27% of global starter culture demand, led by the United States and Canada. Regional growth is driven by rising consumption of probiotic foods, clean-label dairy products, and functional beverages. The rapid expansion of the craft beer, specialty cheese, and fermented food segments has increased demand for customized and high-performance starter cultures. Strong R&D capabilities, early adoption of fermentation innovations, and high consumer awareness of gut health further support market growth across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of over 10.5%. China, India, and Japan are the primary growth engines, supported by rapid urbanization, rising disposable incomes, and increasing adoption of Western dietary patterns. Government-backed food processing initiatives, expanding cold-chain infrastructure, and growing domestic dairy production are accelerating starter culture demand. In addition, rising awareness of probiotic health benefits and increasing consumption of fermented beverages are driving strong uptake across both traditional and modern food categories.

Latin America

Latin America represents a steadily growing market, led by Brazil and Mexico. Growth is supported by increasing dairy consumption, expanding middle-class populations, and the modernization of food manufacturing facilities. Multinational dairy and beverage companies are expanding production capacity in the region, driving demand for standardized starter cultures. Additionally, rising interest in yogurt, cheese, and fermented drinks is contributing to gradual but consistent market expansion.

Middle East & Africa

The Middle East & Africa starter culture market is emerging gradually, supported by growing dairy production in South Africa, Saudi Arabia, and the UAE. Increasing investments in food processing infrastructure, rising imports of starter cultures, and expanding consumption of yogurt and fermented dairy products are key growth drivers. In the Middle East, high reliance on imported food ingredients and premium dairy consumption support demand, while in Africa, urbanization and improving cold-chain logistics are creating long-term growth opportunities for starter culture suppliers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Starter Culture Market

- Chr. Hansen

- DSM-Firmenich

- IFF (Danisco)

- Kerry Group

- Lallemand

- Lesaffre

- Sacco System

- Angel Yeast

- CSK Food Enrichment

- BioGaia