Stabilizers for High-Protein Yogurt Market Size

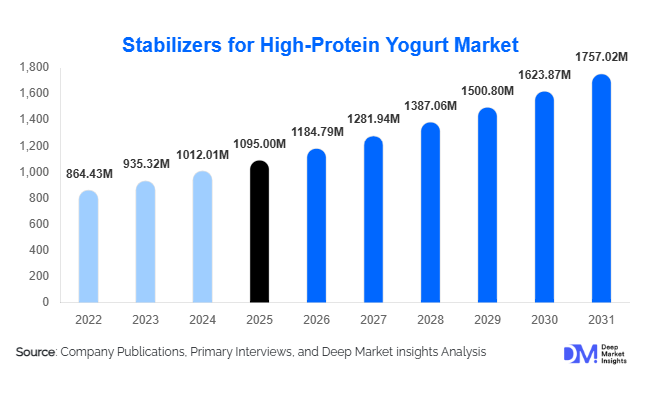

According to Deep Market Insights,the global stabilizers for high-protein yogurt market size was valued at USD 1,095 million in 2025 and is projected to grow from USD 1,184.79 million in 2026 to reach USD 1,757.02 million by 2031, expanding at a CAGR of 8.2% during the forecast period (2026–2031). The market growth is primarily driven by rising global demand for protein-enriched dairy products, increasing consumption of Greek yogurt and drinkable protein yogurts, and continuous product innovation aimed at improving texture, mouthfeel, and shelf stability in high-protein formulations.

Key Market Insights

- Pectin remains the leading stabilizer type, accounting for nearly 24% of the 2025 market share due to strong compatibility with acidic dairy systems and clean-label positioning.

- Plant-based stabilizers dominate the market, contributing approximately 58% of global revenue, reflecting consumer preference for natural and vegan-friendly ingredients.

- North America leads the global market, holding around 34% share in 2025, supported by high Greek yogurt penetration and protein-focused dietary trends.

- Asia-Pacific is the fastest-growing region, projected to expand at over 9% CAGR through 2031, driven by rising middle-class consumption in China and India.

- Powdered stabilizers account for more than 70% of total sales, owing to ease of transportation, longer shelf life, and better processing compatibility.

- Customized blended stabilizer systems are gaining traction, particularly in yogurts with protein levels above 20%, addressing challenges such as syneresis and chalky texture.

What are the latest trends in the stabilizers for high-protein yogurt market?

Clean-Label and Plant-Based Reformulation

Clean-label demand continues to reshape the stabilizers landscape. Dairy brands are increasingly reformulating products to replace synthetic additives with plant-derived hydrocolloids such as pectin, guar gum, and locust bean gum. Consumers are scrutinizing ingredient lists, pushing manufacturers toward simplified formulations and natural positioning. This trend is particularly strong in Europe and North America, where regulatory scrutiny and consumer advocacy have influenced labeling standards. Ingredient suppliers are responding by launching minimally processed, traceable stabilizer systems that align with sustainability goals and plant-based dietary preferences.

High-Protein (>20%) Yogurt Innovation

The emergence of ultra-high-protein yogurt formulations exceeding 20% protein content is creating demand for advanced stabilizer blends. High protein concentrations often cause phase separation, graininess, and reduced viscosity. Manufacturers are investing in multifunctional stabilizer systems that improve protein-water interactions, enhance creaminess, and maintain structural integrity during shelf life. This trend is closely linked to sports nutrition and weight management applications, where consumers seek maximum protein density without compromising sensory quality.

What are the key drivers in the stabilizers for high-protein yogurt market?

Growth of Protein-Enriched Dairy Consumption

Global yogurt consumption exceeds USD 110 billion annually, with protein-fortified variants accounting for a rapidly expanding share. Greek yogurt alone contributes over 45% of high-protein yogurt sales in developed markets. As consumers increasingly prioritize satiety, muscle recovery, and metabolic health, demand for stabilizers that maintain texture in protein-rich matrices continues to rise.

Expansion of Functional and Sports Nutrition Dairy

The sports nutrition segment is growing at double-digit rates in several regions, driving innovation in drinkable yogurt and fortified dairy beverages. Stabilizers play a critical role in ensuring viscosity control and preventing protein sedimentation during storage and distribution. This has increased reliance on customized hydrocolloid blends tailored for high-shear and heat-treated processing environments.

Premiumization and Product Differentiation

Dairy brands are differentiating offerings through lactose-free, low-sugar, and fortified variants. These modifications alter protein interactions and water-binding capacity, necessitating advanced stabilizer solutions. Premium yogurt positioning allows manufacturers to absorb higher ingredient costs, supporting value growth in the stabilizers segment.

What are the restraints for the global market?

Raw Material Price Volatility

Seaweed-derived carrageenan and citrus-based pectin face supply fluctuations due to climate variability and agricultural uncertainties. Rising input costs directly impact stabilizer pricing, compressing margins for dairy processors and ingredient suppliers.

Regulatory and Consumer Scrutiny

Certain stabilizers, particularly carrageenan, face periodic regulatory reviews and consumer skepticism. Reformulation pressures may limit usage volumes in specific regions, compelling manufacturers to invest in alternative clean-label solutions.

What are the key opportunities in the stabilizers for high-protein yogurt industry?

Emerging Market Penetration

Asia-Pacific and Latin America offer significant whitespace opportunities. Penetration of high-protein yogurt remains below 20% of total yogurt consumption in many emerging economies. Rising disposable income, urbanization, and Western dietary influences are expected to expand demand for protein-enriched dairy products, creating downstream growth for stabilizer suppliers.

Customized Blended Stabilizer Systems

Ingredient suppliers offering application-specific blends tailored to individual dairy processors are gaining long-term supply contracts. These systems optimize texture, water retention, and shelf life while reducing overall formulation complexity. Technological integration, including AI-driven formulation modeling, further enhances competitive differentiation.

Ingredient Type Insights

Pectin leads the global high-protein yogurt stabilizers market with approximately 24% share in 2025, primarily driven by its superior functionality in acidic dairy environments and strong clean-label positioning. Its ability to stabilize casein proteins, prevent syneresis, and deliver a smooth mouthfeel in high-protein formulations makes it the preferred choice among manufacturers targeting premium and label-friendly yogurt products. The leading segment driver for pectin is its compatibility with low-sugar and high-protein formulations, where protein destabilization risks are higher and clean-label ingredients are increasingly prioritized by consumers and retailers. Modified starch and carrageenan follow closely, supported by their cost efficiency, strong water-binding capacity, and viscosity enhancement performance in large-scale production systems. Carrageenan, in particular, remains critical in protein suspension systems due to its interaction with dairy proteins. Blended stabilizer systems are witnessing the fastest growth, especially in drinkable and ultra-high-protein yogurt applications, as they combine hydrocolloids and texturizers to deliver multifunctional performance including protein suspension, creaminess enhancement, and shelf-life extension.

Source Insights

Plant-based stabilizers dominate the market with nearly 58% share in 2025, reflecting growing global demand for natural, vegan-compatible, and clean-label ingredients. The leading driver for this segment is the increasing consumer shift toward plant-forward and sustainable ingredient sourcing, which aligns with regulatory transparency trends across major dairy-consuming markets. Seaweed-derived stabilizers such as carrageenan account for a substantial portion of plant-based demand due to their cost-effectiveness, scalability, and proven protein-stabilizing properties in dairy matrices. Fruit-derived pectin continues to gain preference in premium and organic yogurt categories. Meanwhile, microbial fermentation-derived stabilizers including xanthan gum are gaining traction owing to their consistent quality, controlled production conditions, and reliable rheological performance. Their scalability and stability under varying pH and temperature conditions make them particularly attractive for multinational dairy processors seeking standardized global formulations.

Form Insights

Powdered stabilizers account for over 72% of total sales in 2025, making them the dominant form segment. The leading driver for powdered formats is their superior storage stability, ease of transportation, cost efficiency, and compatibility with automated dry blending systems used in industrial yogurt manufacturing. Powdered formats allow precise dosing, improved dispersion when pre-blended, and extended shelf life, which is critical for global supply chains. Liquid stabilizer systems serve specialized applications requiring rapid hydration, reduced dust generation, and uniform dispersion in high-speed processing environments. Although smaller in market share, liquid systems are gaining attention among manufacturers optimizing continuous production lines and minimizing mixing times.

Protein Concentration Compatibility Insights

The 15–20% protein yogurt segment holds approximately 46% share of the 2025 market, representing the largest compatibility category. The primary driver of this segment is the balance it offers between strong nutritional claims and manageable formulation complexity. At this protein range, stabilizers effectively control viscosity, prevent phase separation, and maintain spoonable texture without excessive formulation costs. Yogurts exceeding 20% protein content represent the fastest-growing subsegment, fueled by sports nutrition trends, active lifestyle adoption, and demand for satiety-focused dairy snacks. These high-protein systems require advanced stabilizer blends to manage increased protein-protein interactions, making them a key growth opportunity for multifunctional hydrocolloid solutions.

End-Use Insights

High-protein yogurt manufacturing remains the primary end-use industry, expanding at an annual rate of 7–9% as consumers increasingly prioritize protein-enriched diets. The leading growth driver in this segment is rising demand for functional dairy products positioned for muscle recovery, weight management, and balanced nutrition. Drinkable yogurt and fortified dairy beverages are the fastest-growing subsegments, expanding above 10% CAGR due to convenience-driven consumption patterns and on-the-go nutrition trends. Export-oriented production from countries such as the United States, Germany, France, and New Zealand further strengthens stabilizer demand, particularly in private-label and premium yogurt categories requiring consistent texture during extended distribution cycles. Emerging applications include frozen high-protein yogurt desserts and protein-enriched children’s dairy snacks, where stabilizers play a critical role in freeze-thaw stability and sensory optimization.

| By Ingredient Type | By Source | By Form | By Protein Concentration Compatibility | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market in 2025, with the United States representing the dominant contributor, followed by Canada. Regional growth is driven by high per capita Greek yogurt consumption, strong sports nutrition adoption, and widespread consumer acceptance of protein-enriched foods. The expansion of private-label premium yogurt offerings and continuous innovation in lactose-free and clean-label dairy products further accelerate stabilizer demand. Advanced dairy processing infrastructure and high R&D investments among ingredient manufacturers support rapid commercialization of multifunctional stabilizer systems. Canada contributes significantly through growth in lactose-free, organic, and natural yogurt innovation aligned with evolving labeling standards.

Europe

Europe holds around 30% market share, led by Germany, France, and the United Kingdom. Regional growth is primarily driven by stringent labeling regulations, clean-label reformulation initiatives, and strong consumer preference for natural and plant-derived ingredients. Demand for premium yogurt varieties, including high-protein skyr-style and strained yogurts, sustains stabilizer adoption. Additionally, established dairy export markets and a mature retail infrastructure support consistent product innovation. Sustainability initiatives and reduced additive usage policies further encourage the adoption of plant-based hydrocolloids and optimized stabilizer blends.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at over 9% CAGR through 2031. China represents the largest growth engine, followed by India and Japan. Rapid urbanization, rising disposable incomes, westernization of dietary patterns, and expanding cold-chain infrastructure significantly drive demand for premium and high-protein dairy products. Multinational dairy brands are investing heavily in product localization and protein fortification strategies to capture health-conscious urban consumers. Increasing awareness of digestive health and functional nutrition further accelerates stabilizer demand in drinkable and spoonable yogurt formats across the region.

Latin America

Latin America contributes approximately 8% of global revenue, with Brazil and Mexico leading regional consumption. Market growth is supported by expanding dairy processing capacity, modernization of retail distribution channels, and increasing consumer awareness regarding protein-rich diets. Economic stabilization in key markets and rising penetration of value-added yogurt products contribute to gradual demand expansion. Regional manufacturers are increasingly incorporating stabilizer blends to enhance product consistency under variable storage conditions.

Middle East & Africa

The Middle East & Africa region holds nearly 6% market share, led by the United Arab Emirates and South Africa. Growth is supported by rising dairy imports, expanding domestic yogurt production facilities, and increasing demand for fortified dairy products among urban populations. Government initiatives to strengthen local food manufacturing and reduce import dependency further stimulate stabilizer consumption. The growing young population and rising awareness of protein-enriched diets are expected to create sustained long-term growth opportunities across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stabilizers for High-Protein Yogurt Market

- Cargill Incorporated

- Ingredion Incorporated

- IFF (DuPont)

- CP Kelco

- DSM-Firmenich

- Kerry Group

- Tate & Lyle PLC

- Ashland Global

- Palsgaard A/S

- Fufeng Group

- Nexira

- Hydrosol GmbH

- Glanbia Nutritionals

- Fiberstar Inc.

- Darling Ingredients